EthCC7 was recently held in Brussels, and the organizer invited Ethereum founder Vitalik to give a keynote speech.

It is worth noting that 2024 is the 10th anniversary of Ethereum IC0. After Vitalik's speech, the three former core founders of Ethereum, Vitalik Buterin, Joseph Lubin and Gavin Wood, took a group photo together again to commemorate.

This article is the keynote speech of Ethereum founder Vitalik at EthCC7 recently, compiled by Golden Finance 0xxz.

Topic of Speech

Strengthening L1:Optimizing Ethereum to become a highly reliable, trustworthy and permissionless Layer 2 base layer

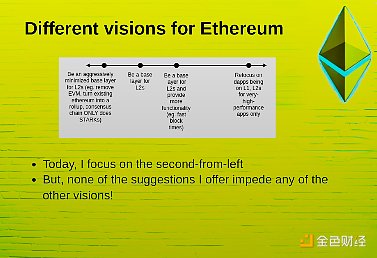

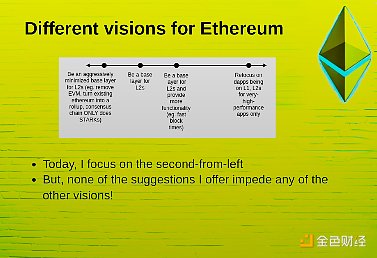

Ethereum Vision Spectrum

I think there's a spectrum of possible different roles that the Ethereum base layer might play in the ecosystem over the next five to ten years. You can think of it as a spectrum from left to right.

On the left side of the spectrum, it basically tries to be a very minimalist base layer that basically just acts as a proof validator for all L2s. Maybe also provides the ability to transfer ETH between different L2s. But other than that, that's basically it.

On the right side of the spectrum, basically refocusing on dApps running primarily on L1, with L2 only used for some very specific and high-performance transactions.

In the middle of the spectrum there are some interesting options. I put Ethereum as a base layer for L2 second from the left. On the far left I put an extreme version, the extreme version is that we completely abandon the execution client part of Ethereum, only keep the consensus part, add some zero-knowledge proof validators, and basically turn the entire execution layer into a Rollup as well.

I mean the very extreme options are on the left, and on the right it can be a base layer, but also try to provide more functionality to L2. One idea in this direction is to further reduce Ethereum's swap time, which is currently 12 seconds, maybe down to 2-4 seconds. The purpose of this is to actually make basic rollups viable as the main way L2 operates. So right now, if you want L2 to have a top user experience, you need to have your own pre-confirmation, which means either a centralized sorter or your own decentralized sorter. If their consensus speeds increase, then L2 will no longer need to do this. If you really want to enhance the scalability of L1, then the need for L2 will also decrease.

So, it's a spectrum. At the moment I'm mainly focused on the left second version, but the things I'm suggesting here also apply to other visions, and the suggestions here don't actually hinder other visions. This is something I think is very important.

Ethereum's robustness advantage

A big advantage of Ethereum is that it has a large and relatively decentralized staking ecosystem.

The left side of the above picture is the hashrate chart of all Bitcoin mining pools, and the right side is the Ethereum staker chart.

The distribution of Bitcoin hashrate is not very good at present. Two mining pools together account for more than 50% of the hashrate, and four mining pools together account for more than 75%.

And Ethereum is actually in a better position than the chart shows because the second largest grey portion is actually unidentified, which means it could be a combination of many people, and there could even be a lot of independent stakers in it. And the blue portion, Lido, is actually a weird, loosely coordinated structure of 37 different validators. So, Ethereum actually has a relatively decentralized staking ecosystem that's doing pretty well.

There's a lot of improvements we can make in this area, but I think there's still value in recognizing this. This is one of the unique advantages that we can really build on top of.

Ethereum's robustness advantages also include:

Having a multi-client ecosystem:There are Geth execution clients and non-Geth execution clients, and the proportion of non-Geth execution clients even exceeds that of Geth execution clients. A similar situation also occurs in consensus client systems;

International community:People in many different countries, including projects, L2, teams, etc.

Multi-centered knowledge ecosystem:There is the Ethereum Foundation, there are client teams, and even teams like Paradigm's Reth have been increasing their leadership in open source recently;

A culture that values these attributes

So, the Ethereum ecosystem as a base layer already has these very strong advantages. I think this is a very valuable thing and should not be given up easily. I would even say that there are clear steps that can be taken to further advance these advantages and even make up for our weaknesses.

Where does Ethereum L1 fall short of high standards and how can it be improved?

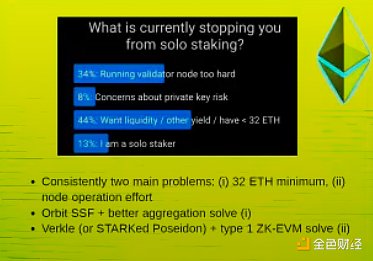

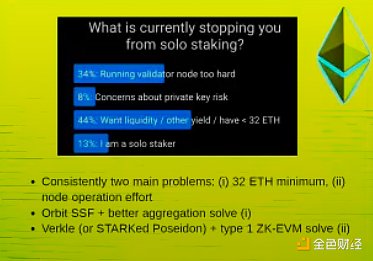

This is a poll I did on Farcaster about half a year ago: If you are not doing Solo staking, what is stopping you from doing Solo staking?

I can repeat this question in this venue, who is doing Solo staking? If you're not doing Solo staking, who of you thinks the 32 ETH threshold is the biggest barrier, who thinks it's too hard to run a node is the biggest barrier, who thinks the biggest barrier is not being able to stake your ETH in DeFi protocols at the same time? Who thinks the biggest barrier is the fear of having to put your private keys on a running node that makes it more vulnerable to theft?

As you can see, the top two barriers that are agreed upon are: the 32 ETH minimum requirement and the difficulty of node operation. It's always important to recognize this.

A lot of times when we start to dig into how to maximize how people can double-use their collateral in DeFi protocols, we find that a large number of people don't even use DeFi protocols at all. So let's focus on the main issues and what we can do to try to solve them.

Start with running a validator node, or, in other words, starting with the 32 ETH threshold. Actually, these two issues are related because they are both a function of the number of validators in Ethereum Proof of Stake.

Today we have about 1 million validator entities, each with 32 ETH on deposit, so if the minimum requirement was changed to 4 ETH, then we would have 8 million or maybe more than 8 million, maybe 9 million or 10 million validators. If we want to reduce to 100,000 validators, then the minimum requirement might have to go up to around 300 ETH.

So, it's a trade-off. Ethereum has historically tried to be in the middle of that trade-off. But if we can find any way to improve it, then we have extra statistical points that we can choose to use to reduce the minimum requirement, or to make it easier to run a node.

In fact, right now I think that aggregate signatures are not even the main difficulty of running a node. In the beginning, we may focus more on reducing the minimum requirement, but eventually it will be both.

So, there are two technologies that can improve both aspects.

One technique is to allow staking or allow finality without requiring every validator to sign. Basically, you need some kind of random sampling, randomly sampling enough nodes to achieve significant economic security.

Right now, I think we have far more than enough economic security. The cost of doing a 51% attack, in terms of the amount of ETH that is slashed, is one-third of 32 million ETH, which is about 11 million ETH. Who would spend 11 million ETH to destroy the Ethereum blockchain? Not even the US government.

These sampling techniques are similar to if you have a house, if the front door is protected by four layers of steel plates, but the window is just a shoddy glass that someone can easily break with a baseball bat. I think Ethereum is like this to some extent, if you want to do a 51% attack, you have to lose 11 million ETH. But in fact, there are many other ways to attack the protocol, and we really should strengthen these protections more. So instead, if you have a subset of validators doing finality, then the protocol is still secure enough and you can really improve the level of decentralization.

The second technique is better signature aggregation. You can do some advanced stuff like Starks, instead of supporting 30,000 signatures per slot, eventually we might be able to support more signatures. That's the first part.

The second part is making it easier to run a node.

The first step is history expiration, and there's actually a lot of progress on that with EIP-4444.

The second step is stateless clients. Verkle has been around for a long time, and another possible option is to do a binary hash tree like Poseidon, with Stark-friendly hash functions. Once you have that, in order to validate Ethereum blocks, you no longer need a hard drive. Later on, you can also add a Type 1 ZKVM that can Stark-validate the entire Ethereum block, so you can validate arbitrarily large Ethereum blocks by downloading data, even data availability sampling data, and then you only need to verify one proof.

If you do this, it will become much easier to run a node. If you have stateless clients, one very annoying thing currently is that if you want to change your hardware or software setup, usually you either need to start from scratch and lose a day, or you need to do something very dangerous and put your keys in two places, which will be slahed. If we have stateless clients, you no longer need to do this.

You can simply start a new standalone client, shut down the old one, move the keys over, and start the new one. You only lose one epoch.

Once you have ZKVM, the hardware requirements are basically reduced to almost zero.

So, the 32 ETH threshold and the difficulty of running a node, both of these problems can be solved technically. I think there are a lot of other benefits to doing this, and it will really improve our ability to increase people's ability to stake individually, and it will give us a better ecosystem for individual staking, and it will avoid the risk of staking centralization.

There are other challenges with proof of stake, such as risks associated with liquid staking, risks associated with MEV. These are also important issues that need to continue to be considered. Our researchers are thinking about these.

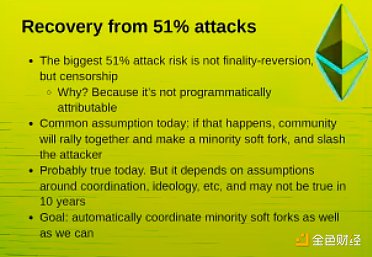

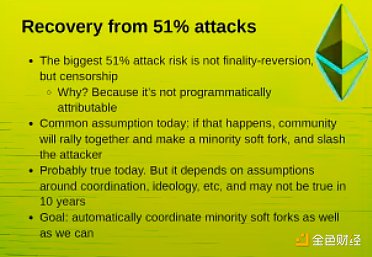

Recovering from a 51% attack

I really started to think seriously and rigorously. It's surprising that many people don't think about this topic at all and just treat it as a black box.

What would happen if there was a 51% attack?

Ethereum could be 51% attacked, Bitcoin could be 51% attacked, a government could be 51% attacked, like buying off 51% of the politicians.

One problem is that you don't want to rely on prevention alone, you want to have a recovery plan as well.

A common misconception is that people think 51% attacks are about reversing finality. People focus on this because this is something that Satoshi Nakamoto emphasized in the white paper. You can double spend, after I bought my private jet, I 51% attack, get my Bitcoin back, and I can keep my private jet and fly around.

Actually more realistic attacks might involve deposits on exchanges and things like breaking DeFi protocols.

But reversals are actually not the worst thing. The biggest risk we should worry about is actually censorship. 51% of the nodes stop accepting blocks from the other 49% of the nodes or any nodes that try to include a certain type of transaction.

Why is this the biggest risk? Because finality reversals have slashes, there is immediate on-chain verifiable evidence that at least a third of the nodes did something very, very wrong and they were punished.

Where in a censorship attack, it's not programmatically attributable, there's no immediate programmatic evidence to say which people did something bad. Now, if you're an online node, if you want to see that a certain transaction wasn't included within 100 blocks, but, we haven't even written software to do that kind of check,

Another challenge with censorship is that if someone wants to attack, they can do it, and they start by delaying transactions and blocks they don't like for 30 seconds, and then delay it for a minute, and then delay it for two minutes, and you don't even have consensus on when to respond.

So, I say, actually censorship is the greater risk.

There's an argument in blockchain culture that if an attack happens, the community will come together, and they'll obviously do a minority soft fork and cut the attacker.

That may be true today, but that relies on a lot of assumptions about coordination, ideology, all kinds of other things, and it's unclear how true that will be in 10 years. So what a lot of other blockchain communities are starting to do is they're saying, well we have things like censorship, we have these inherently more unattributable bugs. So we have to rely on social consensus. So let's just rely on social consensus and proudly admit that we're going to use it to solve our problems.

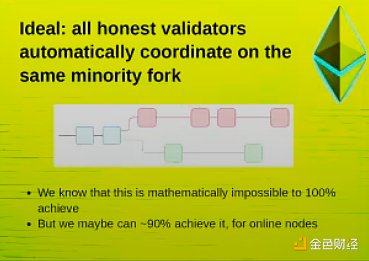

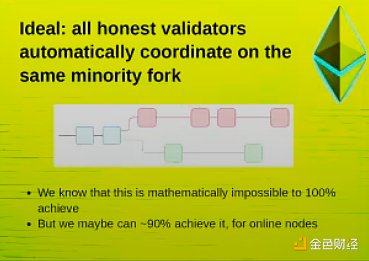

I'm actually advocating for going in the opposite direction. We know that it's mathematically impossible to fully coordinate an automated response and automatically fork a majority attacker who's doing censorship. But we can get as close as we can.

You can create a fork that, based on some assumptions about network conditions, actually brings at least a majority of the nodes online. The argument I'm trying to get across here is that what we actually want is to try to make the response to a 51% attack as automated as possible.

If you're a validator, then your node should be running software that automatically forks the majority chain if it detects that a transaction is being censored or that some validator is being censored, and all the honest nodes will automatically coordinate on the same minority soft fork because of the code they're running.

Of course, there is again the mathematical impossibility result, at least anyone who is offline at the time will not be able to tell who is right and who is wrong.

There are a lot of limits, but the closer you get to that goal, the less work social consensus needs to do.

If you imagine what a 51% attack would actually look like. It wouldn't be like this, where all of a sudden at some point in time, Lido, Coinbase, and Kraken would publish a blog post at 5:46 that basically said, hey guys, we're doing censorship now.

What would actually happen is that you would see a social media war at the same time, you would see all sorts of other attacks at the same time. If in fact a 51% attack did happen, by the way, I mean, we shouldn't assume that Lido, Coinbase, and Kraken are going to be in power in 10 years. The Ethereum ecosystem is going to become more and more mainstream, and it needs to be very resilient to that. We want the social layer to be as lightly burdened as possible, which means we need the technical layer to at least come up with a clear winning candidate, and if they want to fork off a chain that's being censored, they should rally around a minority soft fork.

I'm advocating that we do more research and come up with a very specific proposal.

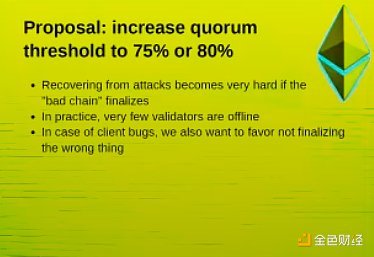

Proposal: Raise the Quorum threshold to 75% or 80%

I think it is possible to raise the Quorum threshold from today's two-thirds to around 75% or 80%.

The basic argument is that if a malicious chain, such as a censored chain, attacks, recovery becomes very, very difficult. However, on the other hand, if you increase the proportion of Quorum, what is the risk? If the Quorum is 80%, then instead of 34% of the nodes being offline to stop finality, 21% of the nodes being offline can stop finality.

It's risky. Let's see what this looks like in practice? From what I've seen, I think we've only had one incident where finality was down for about an hour due to more than a third of the nodes being offline. And then, have there been any incidents where 20% to 33% of the nodes were offline? I think at most once, at least zero. Because in practice, very few validators are offline, I actually think that the risk of doing this is pretty low. The benefit is basically that the threshold that an attacker needs to hit is greatly increased, and the range of scenarios where the chain goes into safe mode in the event of a client vulnerability is greatly increased, so people can really collaborate to figure out what the problem is.

If the threshold for Quorum goes from 67% to 80%, then the value of a minority client, or the value that a minority client can provide, really starts to increase, let's say the percentage that a client needs to hit goes from 67% to 80%.

Other censorship concerns

Other censorship concerns, either inclusion lists or some kind of alternative to inclusion lists. So, the whole multi-parallel proposer thing, if it works, might even become a replacement for inclusion lists. You need, either account abstraction, you need some kind of in-protocol account abstraction.

The reason you need it is, because right now, smart contract wallets don't really benefit from inclusion lists. Smart contract wallets don't really benefit from any kind of protocol-level censorship resistance guarantees.

If there is an in-protocol account abstraction, then they benefit. So, there are a lot of things, actually a lot of these things have value in both the L2-centric vision and the L1-centric vision.

I think of the different ideas that I talked about, about half of them are probably specifically for Ethereum focused on L2, but the other half are basically, for L2 as a user of Ethereum's base layer and L1, or, like, directly for user-facing applications as a user.

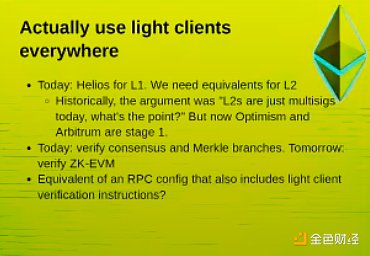

Use light clients everywhere

In a lot of ways, the way we interact with the space is kind of sad, we're decentralized, we're trustless, who in this room is running a light client on his computer that verifies consensus? Very few. Who uses Ethereum by trusting Infura's browser wallet? In five years, I'd like to see the number of hands raised reversed. I'd like to see wallets that don't trust Infura for anything. We need to integrate light clients.

Infura can continue to provide data. I mean, if you don't need to trust Infura, that's actually good for Infura because it makes it easier for them to build and deploy infrastructure, but we have tools that can remove the trust requirement.

What we can do is, we can have a system where the end user runs something like the Helios light client. It should actually run directly in the browser and verify the Ethereum consensus directly. If he wants to verify something on the chain, like interact with the chain, then you just verify the Merkle proof directly.

If you do that, you actually get a level of trustlessness in your interaction with Ethereum. This is for L1. In addition, we need an equivalent solution for L2.

On the L1 chain, there are block headers, there is state, there is a synchronization committee, and there is consensus. If you verify the consensus, if you know what the block header is, you can walk the Merkle branch and see what the state is. So how do we provide light client security guarantees for L2s. The state root of L2 is there, if it's the base Rollup, there is a smart contract, and that smart contract stores the block headers of L2. Or if you have preconfirmations, then you have a smart contract that stores who the preconfirmers are, so you determine who the preconfirmers are, and then you listen for a two-thirds subset of their signatures.

So once you have the Ethereum block headers, there's a fairly simple chain of trust, hashes, Merkle branches, and signatures that you can verify, and you can get light client verification. The same is true for any L2.

I've brought this up to people in the past, and a lot of times the reaction is, oh my god, that's interesting, but what's the point? A lot of L2s are multisig. Why don't we trust multisigs to verify multisigs?

Fortunately, as of last year, that's actually no longer true. Optimism and Arbitrum are in Phase 1 Rollup, which means they actually have proof systems running on-chain, and there's a security committee that can cover them if there are vulnerabilities, but the security committee needs to pass a very high voting threshold, like 75% of 8 people, and Arbitrum will increase that to 15 people. So, in the case of Optimism and Arbitrum, they're not just multisig, they have actual proof systems, and those proof systems actually work, at least with majority power in deciding which chain is right or wrong.

The EVM goes even further, I believe it doesn't even have a security committee, so it's completely trustless. We're really starting to move forward on that, and I know a lot of other L2s are moving forward on that as well. So L2 is more than just multisig, so the concept of light clients for L2 is actually starting to make sense.

Today we can already validate Merkle branches, just by writing code. Tomorrow we'll also be able to validate ZKVM, so you can fully validate Ethereum and L2 in your browser wallet.

Who wants to be a trustless Ethereum user in a browser wallet? Great. Who would rather be a trustless Ethereum user on their phone? From a Raspberry Pi? From a smartwatch? From the space station? We'll get to that, too. So what we need is the equivalent of an RPC configuration that contains not only which servers you're talking to, but also the actual light client validation instructions. That's something we can work towards.

Anti-Quantum Strategy

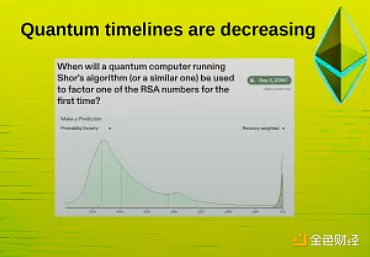

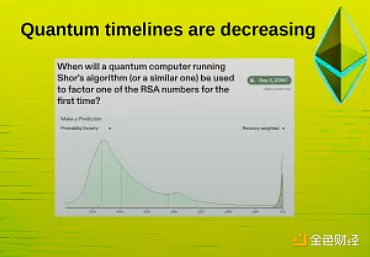

The time for quantum computing to arrive is decreasing. Metaculous believes that quantum computers will arrive in the early 2030s, and some believe it will be earlier.

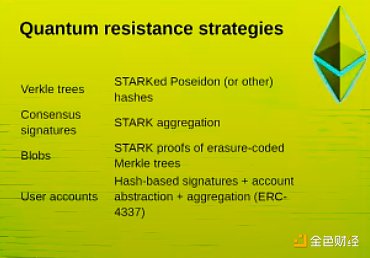

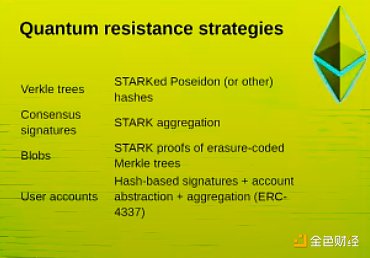

So we need an anti-quantum strategy. We do have an anti-quantum strategy. There are four parts of Ethereum that are vulnerable to quantum computing, and each part has a natural replacement.

A quantum-resistant alternative to Verkle Tree is Starked Poseidon Hash, or if we want to be more conservative, we can use Blake consensus signatures. We currently use BLS aggregate signatures, which can be replaced with Stark aggregate signatures. Blob uses KZG, and can use separate encoding Merkle tree Stark proofs. User accounts currently use ECDSA SECP256K1, which can be replaced with hash-based signatures and account abstraction and aggregation, smart contract wallet ERC 4337, etc.

Once you have these, users can set their own signature algorithms, basically using hash-based signatures. I think we really need to start thinking about actually building hash-based signatures so that user wallets can be easily upgraded to hash-based signatures.

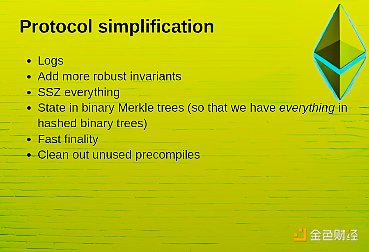

Protocol Simplification

If you want a strong base layer, the protocol needs to be simple. It shouldn't have 73 random hooks and some backward compatibility that exists because of some random stupid idea that some random person named Vitalik came up with in 2014.

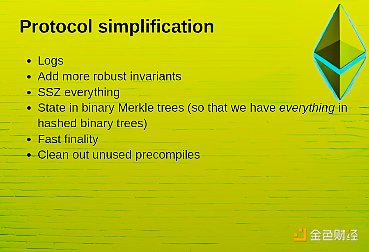

So it's valuable to try to really simplify and start to really eliminate technical debt. Logs are currently based on bloom filters, they don't work very well and they're not fast enough, so there needs to be improvements to Log that add stronger immutability, which we've already done on the stateless side, basically limiting the amount of state access per block.

Ethereum is currently an incredible combination of RLP, SSZ, and API. Ideally we should only use SSZ, but at least get rid of RLP, state, and binary Merkle trees. Once you have a binary Merkle tree, all Ethereum is on the binary Merkle tree.

Fast finality, Single Slot Finality (SSF), clean up unused precompilers, such as the ModX precompiler, which often causes consensus errors. It would be great if we could remove it and replace it with high-performance solidity code.

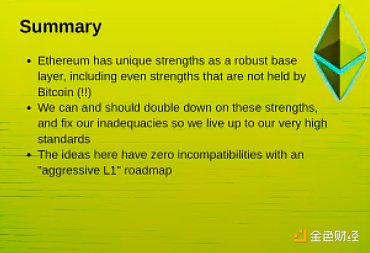

Summary

As a strong base layer, Ethereum has very unique advantages, including some advantages that Bitcoin does not have, such as consensus decentralization, such as significant research on 51% attack recovery, etc.

I think it is necessary to really strengthen these advantages. At the same time, recognize and correct our shortcomings and make sure we meet very high standards. These ideas are fully compatible with the aggressive L1 roadmap.

One of the things I am most satisfied with about Ethereum, especially the core development process, is that our ability to work in parallel has greatly improved. This is a strong point, and we can actually work on a lot of things in parallel. So caring about these topics does not actually affect the ability to improve the L1 and L2 ecosystems. For example, improving the L1 EVM to make it easier to do cryptography. It's currently too expensive to verify Poseidon hashes in the EVM. 384-bit cryptography is also too expensive.

So there are some ideas above EOF, such as SIMD opcodes, EVM max, etc. There is an opportunity to attach this high-performance coprocessor to the EVM. This is better for Layer 2 because they can verify proofs more cheaply, and it is also better for Layer 1 applications because privacy protocols such as zk SNARKs are cheaper.

Who has used privacy protocols? Who wants to use privacy protocols and pay 40 fees instead of 80 fees? More people. The second group can use it on Layer 2, and Layer 1 can get significant cost savings.

Ethereum's "Big Three" reunited

2024 is the 10th anniversary of Ethereum IC0. The 2024 EthCC invited all three of the former Ethereum core founders, Vitalik Buterin, Joseph Lubin, and Gavin Wood, to attend.

After Vitalik’s speech, they were invited to take a group photo:

The Big Three shook hands again

YouQuan

YouQuan