Whether it's skyrocketing or plummeting, Wall Street has never stopped snapping up Bitcoin.

On January 10, the U.S. Securities and Exchange Commission approved 11 Bitcoin ETFs, including BlackRock. Before the approval, in the past six months since the approval signal was released, Bitcoin has risen from a minimum of nearly $27,000 to a maximum of nearly $49,000, a total increase of nearly 162%, leading the list of rising crypto assets.

After the approval, Bitcoin plummeted twice in a row. One time was on January 13, when Bitcoin fell below $42,000, with an intraday drop of more than 7%. Another time was in the early morning of January 23, when Bitcoin fell below $40,000, falling more than 3% within the day.

Bitcoin's skyrocketing rise and fall itself seems to have never stopped Wall Street financial giants from frantically buying up Bitcoin.

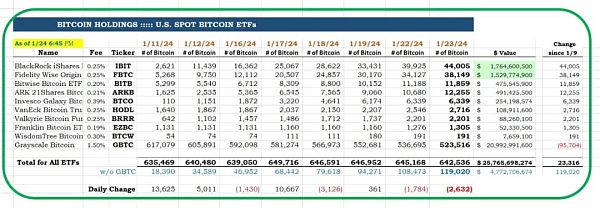

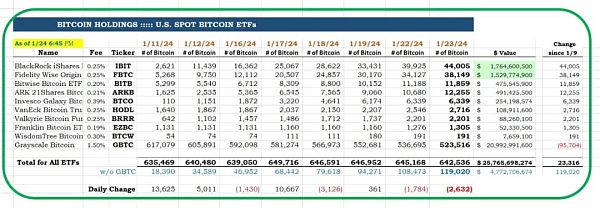

According to the latest statistics from CC15Capital, starting from January 9, within 8 trading days of the launch of the Bitcoin ETF, 10 companies including BlackRock Bitcoin spot ETF institutions have purchased a total of 119,020 Bitcoins, worth approximately US$4.7 billion. This does not include the 523,516 Bitcoins currently held by Grayscale GBTC, worth approximately more than 20 billion. Since January 10, after the US Securities Regulatory Commission approved the Bitcoin spot ETF including BlackRock, Grayscale GBTC has been in a redemption state.

According to Eric Balchunas, a senior ETF analyst at Bloomberg who has been tracking Bitcoin ETFs, as of January 24, GBTC fund outflows were "only" $425 million, which is the lowest level since the first day the ETF was launched, and there seems to be more Downtrend. Still, that's a pretty big number.

The key to the problem is to find the key issues. Wall Street financial giants including BlackRock frantically purchased 119,020 Bitcoins in just 8 days. You must know that MicroStrategy, another listed software company on Wall Street, took 300 days to acquire 100,000 Bitcoins. Wall Street financial giants including BlackRock used 1/38 of the time it took MicroStrategy to grab as many Bitcoins as MicroStrategy, or even more than the number of Bitcoins held by MicroStrategy.

It seems to be an undoubted fact that the future of Bitcoin belongs to Wall Street. After all, as long as the Bitcoin ETF exists for trading on Nasdaq and the New York Stock Exchange for one day, financial giants including BlackRock will never stop snapping up Bitcoin.

Among the 119,020 Bitcoins, BlackRock undoubtedly bore the brunt, with reserves of 44,005 Bitcoins, worth approximately 1.765 billion. When Carbon Chain Value wrote the article "BlackRock Explosion" on January 17, the number of BlackRock coins held at that time was 11,500. After 7 days, the number of coins held increased to 44,005.

Followed by Fidelity Investments, with reserves of 38,149 Bitcoins worth approximately US$1.53 billion.

Bitwise reserves 11,859 Bitcoins, worth approximately US$475 million.

ARK Capital ARK reserves 12,255 Bitcoins, worth approximately US$490 million.

Invesco Galaxy reserves 6,339 Bitcoins, worth approximately US$254 million.

VanEck reserves 2,716 Bitcoins, worth about $100 million.

Valkyrie reserves 2,201 Bitcoins, worth approximately $86.26 million.

Franklin reserves 1,305 Bitcoins, worth approximately US$52.33 million.

WisdomTree reserves 191 Bitcoins, worth approximately US$7.66 million

Finally, Grayscale reserves 523,516 Bitcoins, worth approximately US$21 billion. Compared with the original 581,274 Bitcoins, nearly 60,000 BTCs have been sold.

Why did Grayscale GBTC sell off? The value of carbon chain has been explained in this article before. Grayscale GBTC was founded in 2013. By the time the U.S. Securities and Exchange Commission approved its conversion to an ETF, it had accumulated nearly $30 billion in assets. These assets come from large institutions and qualified individual investors. When Grayscale GBTC charges a high fee (1.5%) compared to the other 10 Bitcoin ETF institutions, this causes some individual investors to consider redeeming cash and choose other investment institutions with lower fees for investment. The result is that Grayscale can only sell BTC.

Secondly, the existence of large institutions like FTX that directly redeem and liquidate causes Grayscale to sell BTC. According to previous reports by Coindesk, FTX has sold approximately $1 billion of the Grayscale Bitcoin ETF, thus explaining the majority of the outflows.

JinseFinance

JinseFinance