Author: NingNing, independent researcher Source: X, @0xNing0x

The value cornerstone of Restaking is EigenLayer's AVS. From the perspective of block space economics, Rollup L2 is the abstraction of Ethereum's block space resale, and AVS is the abstraction of Ethereum's economic security sale.

There is a theoretical assumption in the market that although Restaking increases Ethereum's consensus load, LRT projects with higher Staking yields can help increase Ethereum's pledge rate and price and thus enhance the economic security of the main network.

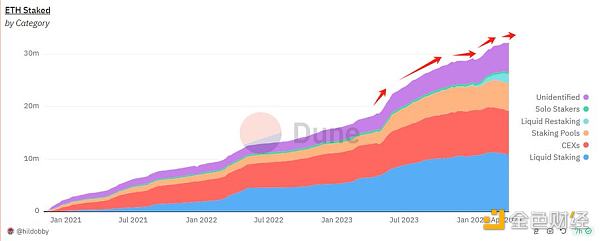

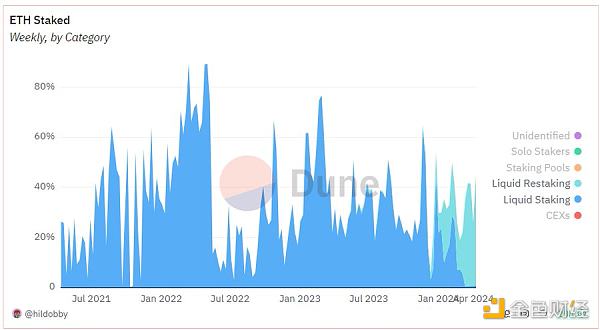

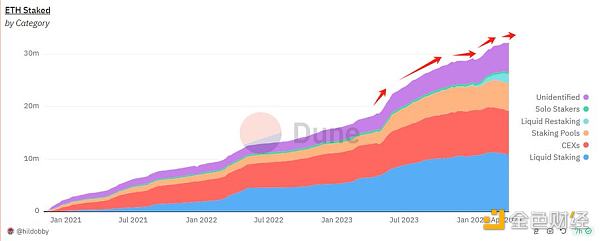

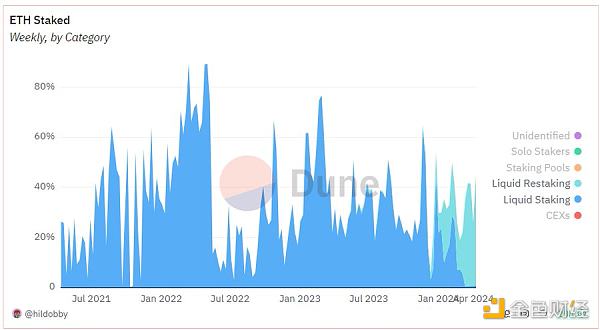

Observing Dune's on-chain data dashboard, we will find that the above assumptions are somewhat inconsistent with the facts:

The net inflow growth trend of ETH Staking brought about by the Restaking Fomo craze lasted for a short time. The time interval is only from January 19 to February 13 this year, less than one month. Although the net inflow is still above the 0 axis, it is in the historical bottom range.

The overall positive impact on ETH Staking is far less than that of the Shanghai upgrade.

Since 24 years, the total number of Ethereum Staking has increased from 29.206 million to 3212.14, with a growth rate of 10%. However, the slope of this growth trend is almost the same as that during the sideways bear market in Q3 2023. And January 24 is exactly the market adjustment period after the Bitcoin ETF is passed.

It can be seen here that the PMF of the Restaking project is the high ETH-based passive income of Restaking + market adjustment period. The correlation with EigenLayer's AVS narrative is relatively weak.

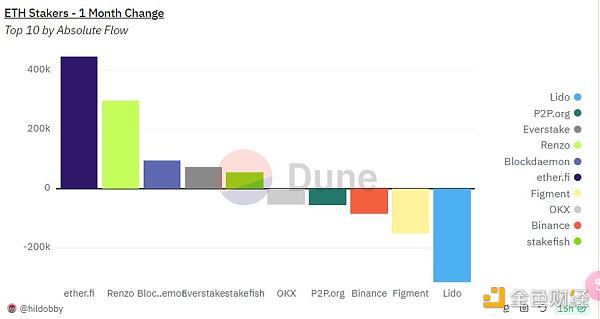

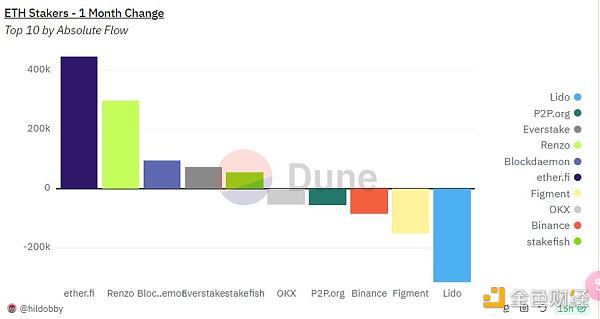

Restaking projects such as Etherfi and Renzo are swallowing up the new staking share of LST such as Lido and Rocket Pool. Currently, Restaking projects account for 40% of the new staking market share.

From the monthly changes, traditional staking protocols and platforms such as Lido, Figment, Binance, and P2P.org are outflowing, while Restaking protocols such as Etherfi and Renzo are experiencing a large net inflow.

But it is worth noting that Figment and Binance are constantly investing in the primary market to incubate the Restaking protocol, while Lido is passive due to the constraint of reaching the 1/3 Staking market share threshold.

So, in fact, Restaking can be seen as a siege jointly launched by the Restaking project and Lido's competitors.

In this process, Lido lost market share and gained ethical security within the Ethereum ecosystem. Figment and Binance are just transferring assets from one hand to the other, issuing assets in the bull market at the cost of losing some passive income. Etherfi is the first successful case.

JinseFinance

JinseFinance