Author: Stacy Muur Source: stacymuur Translation: Shan Ouba, Golden Finance

The Emergence of Solana Modularity Theory

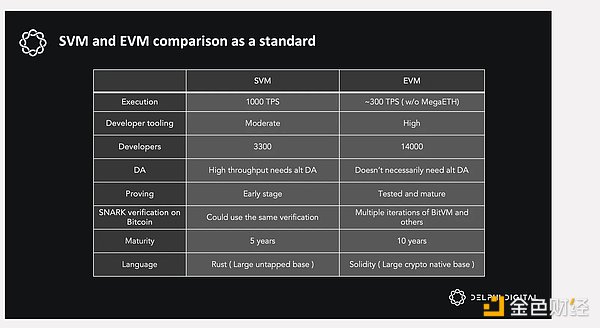

To understand the impact of Solana modularity, we need to review what makes this argument possible. The cornerstone of this journey is the separation of the Solana Virtual Machine (SVM) from the validator client.

In June 2024, the Anza team released the SVM API, allowing for easier and independent adjustments without affecting validator functionality. This paved the way for SVM rollups, Avalanche subnets, and more.

The rapid development of Web3 development, especially with the emergence of consumer applications, autonomous AI agents, and real-world applications, may require higher transaction processing capabilities. Therefore, vertical scaling (Firedancer) and achieving 1M+ TPS may not be the ultimate goal, and rollups may be a good solution.

For many dApps, once they reach a certain level of demand and move away from composability, building an application chain is the logical next step. dYdX, Maker, and some other companies have done this or are planning to do so. If Solana Lisk was an option, they would probably prefer it because it has a high-performance core and execution layer that can handle high congestion efficiently.

SVM Rollups

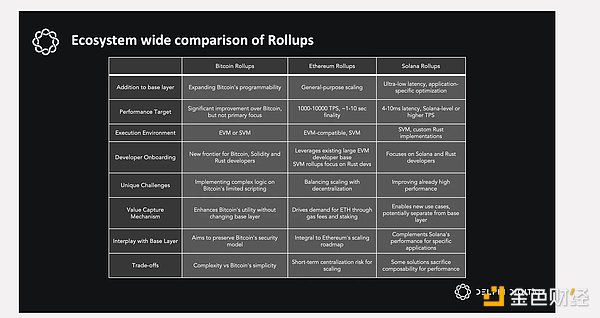

Currently, we observe that there are two major categories of Rollups that support SVM:

SVM Rollups’s benefits include:

Proven, high-performance SVM execution engine (SVM rollups perform even better than Solana)

Focused on matching ETH and BTC liquidity while attracting a new group of developers who can write programs in mainstream languages such as Rust and C++.

Bitcoin Rollups

The Bitcoin Rollup market is still in its early stages, covering SVM Rollups and the broader space. Recent advances in verifying zk-SNARKs on Bitcoin signatures with or without OPCAT show encouraging progress. The combination of Bitcoin and Solana has great potential.

Bitcoin scaling does not require EVM native support, which allows SVM and EVM to compete based on their unique advantages. For example, SVM Rollup can facilitate order book-based DEX, which is ideal for mature market makers and end users.

Currently, two SVM Rollups, Yona and Molecule, both use Bitcoin as the settlement target.

Ethereum Rollups

Eclipse is the only general-purpose SVM Rollup currently on Ethereum. Its addition frees L2 execution from the limitations of the EVM. Since the purpose of L2 is to scale execution, it makes sense to use the best available technology.

Currently, Eclipse is on par with Solana in speed, and is expected to be even faster in the upcoming Firedancer update.

Solana Rollups

Unlike Ethereum, which often uses rollups for general-purpose scaling, Solana takes a different approach.

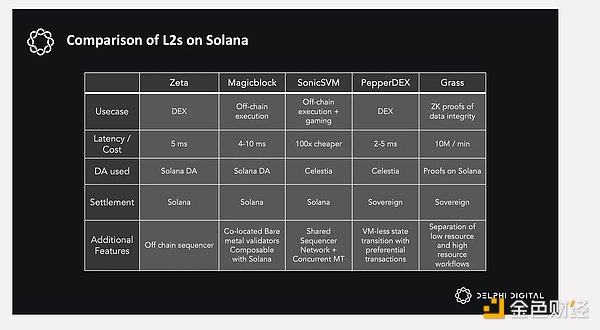

Applications on Solana are creating customized Rollups to meet their specific infrastructure needs or target specific verticals. For example, in a DEX, lower block times can significantly improve liquidity, profitability for liquidity providers (LPs), and overall user experience.

Some examples:

MagicBlock uses custom bare metal validators located near users and composable temporary Rollups to achieve 4-10ms latency for gaming and composability with the mainchain.

Zeta requires 5ms latency to compete with centralized exchanges like Binance. It also needs to provide better trade guarantees and latency for market makers to benefit users.

PepperDEX and SpiceNet optimize trade processing by removing SVMs and general programmability while still allowing permissionless building on their protocols.

Getgrass needs to handle millions of requests per second for its data platform, which no layer 1 can handle. They are building a Solana-based L2 to solve this problem.

SonicsSVM is developing a shared sequence network and horizontally scalable mesh for smooth, fast gaming experiences.

Solana Licensed Environment (SPE)

The next big piece is the Solana Licensed Environment (SPE).

SPE provides private Solana virtual machines for enterprises with specific needs, creating customizable, unbranded environments that leverage Solana’s unparalleled technology. Delphi Digital describes SPEs as a “Trojan horse” for institutional adoption, focusing on businesses that need to control three main areas: their validator set; chain functionality; and the use of gas tokens.

This is particularly important for financial institutions such as banks that must comply with strict regulations, such as OFAC requirements. By using SPEs, these institutions can mitigate potential compliance risks associated with validators on the Solana mainchain.

Notable projects in this category include Rimark, which is developing SPEs for asset tokenization in fintech applications, and Iron, which is building a regulated, crypto-friendly global network of banks and payment channels. These initiatives enable institutions to create feature-rich products that connect on-chain currencies and fiat currencies.

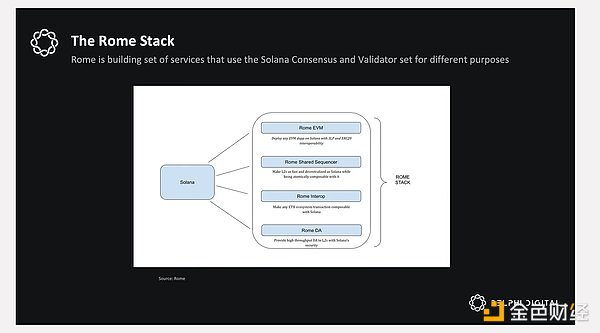

Solana as a Shared Collator

Solana offers more than just SVM, which is valuable in its own right. Its low-latency consensus, staking support, and decentralization of the validator set are also valuable.

Rome Protocol aims to leverage this low-latency consensus and validator set security for a variety of purposes, including:

Rome's approach promotes interoperability between Ethereum Rollups and the Solana main chain. With the rise of SVM Rollups on Solana, Rome also integrates this ecosystem.

Rome sits at the core of the EVM, SVM rollups, and Solana atomic execution, enabling applications to leverage the speed and efficiency of these ecosystems on a simplified ordering layer.

Final Thoughts

Ethereum’s speculative activity has greatly boosted its network effects, attracting developers and facilitating new extensions such as EVM rollups and alternative layer 1s. This phenomenon has been observed with EVM layer 2s and is likely to be replicated with SVM rollups and SPEs.

Solana’s mainchain is undergoing a flurry of innovation including zk-compression, scintillation, token scaling, Firedancer, and decoupling of the SVM. These advances are driving speculative growth, attracting developers, and driving the next phase of scaling.

A key aspect of this cycle is the growth of SVM Rollups, which enables the creation of new chains and Rollups to attract existing and new developers. This in turn can strengthen the core of the main chain, resulting in a broader developer base and more powerful tooling.

Conversely, SPEs represent a strategic expansion into the enterprise market, where institutions demand strict compliance and controls. Providing customized solutions that meet these needs helps build trust and credibility with these institutions.

Alex

Alex

Alex

Alex Joy

Joy YouQuan

YouQuan Hui Xin

Hui Xin Alex

Alex Joy

Joy Aaron

Aaron YouQuan

YouQuan Hui Xin

Hui Xin YouQuan

YouQuan