Author: Nancy Lubale, CoinTelegraph; Compiled by: Baishui, Golden Finance

NEAR, the native token of Near Protocol, rose 2.3% in the past 24 hours to trade at $5.21, and then continued to rise.

After falling to a low of $3.41 on September 6, it rose 57% on September 24 to an 8-week high of $5.36, according to data from Cointelegraph Markets Pro and TradingView.

NEAR/USD daily chart. Source: TradingView

Some of the factors contributing to NEAR’s growing strength include the implementation of blockchain sharding on the Near protocol, the increase in open interest in the futures market, the increase in total locked value (TVL), and the strengthening of the market structure.

Near Protocol Implements Sharding

Near Protocol, a community-run cloud computing platform focused on interoperability and lightning-fast transaction speeds, has implemented sharding on its network.

According to the project, sharding solves the blockchain trilemma by providing scalability and security without compromising decentralization.

Source: Justin Bons

The platform achieved this following the NEAR 2.0 update on August 12, making NEAR the second chain to implement sharding in production after Elrond (EGLD).

Implementing sharding enables Near Protocol to achieve stable long-term growth as demand for decentralized applications (DApps) continues to grow.

Near Protocol offers a faster and more scalable option with lower transaction fees compared to Ethereum, and sharding plays a vital role in improving efficiency.

NEAR’s price performance can also be attributed to the latest partnership between Nvidia and Alibaba Cloud, which aims to improve China’s autonomous driving industry.

AI-themed crypto tokens, including NEAR, have reacted positively to major announcements from Nvidia, and this time is no exception.

Another catalyst for AI-related tokens came from Democratic presidential candidate Kamala Harris, who hinted at creating an “opportunity economy” for AI and digital assets in the United States. This was the first time Harris publicly shared her stance on the crypto industry.

On-chain data supports NEAR’s price surge

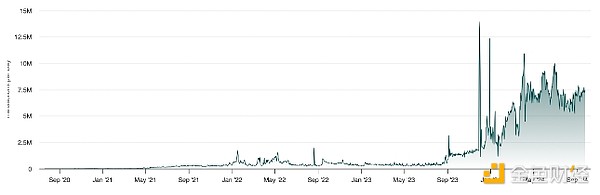

Increases in network activity and network growth have preceded NEAR’s price performance over the past month. According to NearBlocks.io, this is due to the increased activity brought about by the growing adoption of projects on the NEAR Protocol, with daily transactions on the platform increasing by 42% between August 25 and September 24. Similarly, the number of new addresses increased by 30.8% in the same period, proving the growing adoption rate.

The number of daily transactions on Near Protocol. Source: NearBlocks.io

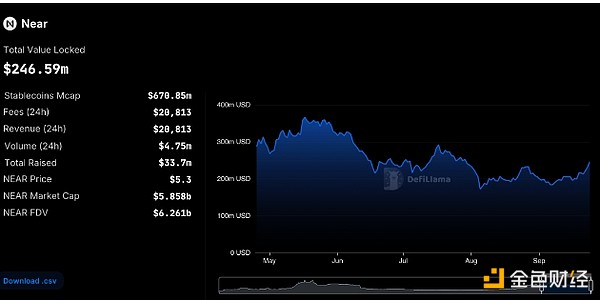

Growth in network activity has led to increased user interaction with the network, which in turn has led to an increase in the total value locked (TVL) on the platform.According to DefiLlama, Near Protocol’s TVL grew 34% from $183.7 million on September 7 to $246.5 million on September 24.

Total value locked on Near Protocol. Source: DefiLlama

The increase in TVL indicates growing activity and interest within the Near Protocol ecosystem. This means that more users are depositing or using assets within NEAR-based protocols.

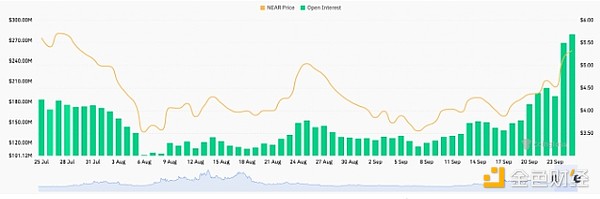

In addition, derivatives data tracker Coinglass shows that NEAR’s OI increased from $114.9 million on September 7 to $279.2 million on September 24, the highest level since June 7. This increase indicates that new or additional funds are entering the market and new buying is occurring.

NEAR open interest. Source: Coinglass

NEAR’s market structure is strengthening, signaling further gains

NEAR’s uptrend broke above the downtrend line on Sep. 23. It also closed above all major moving averages, including the 50-day exponential moving average (EMA) at $4.40, the 100-day EMA at $4.75, and the 200-day EMA at $4.87, which have been acting as barriers since mid-June.

The relative strength index of 70 suggests that buyers are in control of the NEAR market.

The bulls will now focus on pushing the price above $6 and possibly the 19-range high of $6.45. NEAR/USD daily chart. Source: TradingView. Conversely, if the daily chart closes below the 50-day moving average at $4.40, the lows on the daily chart will be lower, invalidating the bullish thesis. The bears could then pull NEAR’s price down another 32% to retest its September 6 low of $3.50.

Alex

Alex

Alex

Alex Miyuki

Miyuki Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki