Author: Ignas, Crypto KOL Source: X, @DefiIgnas Translation: Shan Ouba, Golden Finance

1/ After Durov was arrested for not preventing crimes on Telegram, cryptocurrencies may become a target in the future.

It sounds far-fetched, but politicians have claimed that cryptocurrencies can support crimes such as terrorist financing and money laundering.

So, what if?

2/ The government may attempt a 51% attack on BTC because two mining pools control more than 50% of mining power.

Mining pools allow combining computing power, sharing costs and increasing the chances of rewards.

This leads to stable payouts, low barriers to entry, and shared financial risks.

3/ Chainalysis reports that Iran, the Lazarus Group, and scammers use mining pools to launder money by mixing illegal funds with legitimate mining rewards.

This makes detection difficult when funds are sent to CEXs.

Governments may try to censor these mining pools.

4/ In practice, however, a 51% attack on Bitcoin is nearly impossible due to the large amount of computing power and coordination required.

A. Antonopoulos explained back in 2014 that there is nothing the state can do with Bitcoin right now.

5/ A more realistic scenario is a regulatory crackdown.

Privacy in cryptocurrencies is already under attack.

For example, the founders of Tornado Cash, and more recently the CEO and CTO of Samourai Wallet were arrested and charged with money laundering by providing “obfuscation” services.

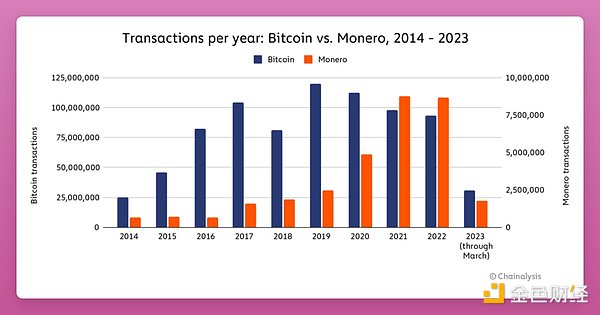

6/ Multiple countries, such as Japan, South Korea, and even the UAE, have already banned privacy coins like $XMR and $ZEC.

The EU is also considering a ban.

In practice, this means that these privacy coins will be delisted from CEXs, which will lead to lower liquidity, lower adoption, and fewer opportunities to cash out to fiat.

7/ China provides a clear example of a ban on cryptocurrencies.

In 2021, China declared all cryptocurrency transactions illegal, banning trading, mining, and related financial services.

The government has also targeted online platforms and social media to block cryptocurrency-related information and advertising.

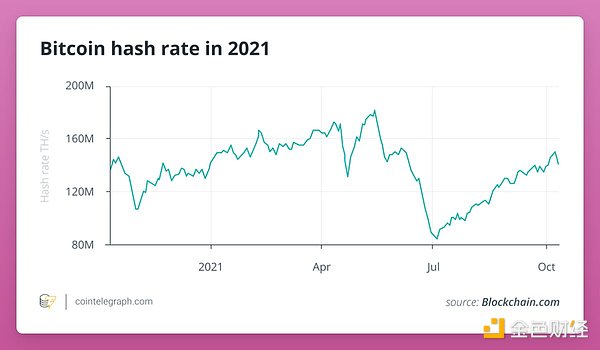

8/ At its peak, China accounted for 75% of global Bitcoin mining operations in 2019.

The crackdown caused the computing power securing the Bitcoin network — its hash rate — to drop by nearly 50%.

However, it quickly recovered as mining migrated to other countries.

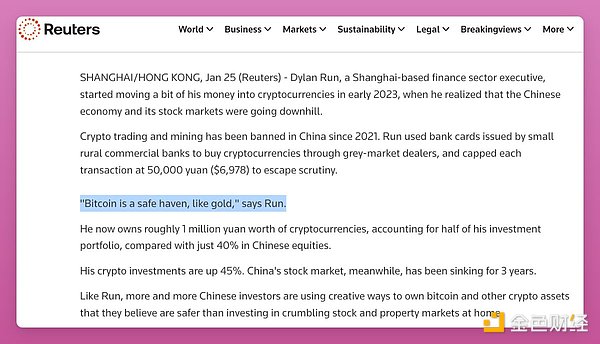

9/ Reuters reported that users used small rural commercial banks to buy cryptocurrencies through gray market dealers and set a $7,000 cap on each transaction to evade scrutiny.

Chinese used over-the-counter trading on OKX and Binance and opened accounts in Hong Kong.

DeFi (and Inscriptions, BRC2s) is also popular.

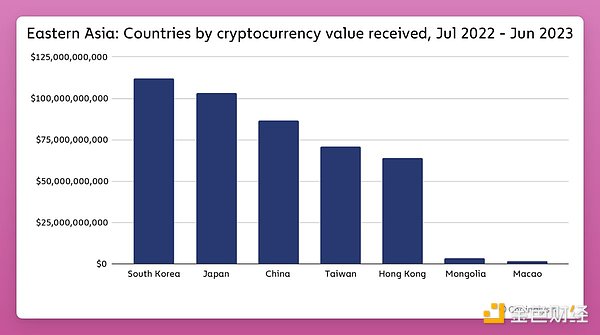

10/ Bans still hinder crypto growth in China.

Despite having a much larger population, China's trading volume still lags behind South Korea and Japan.

Lately, China has been reversing its stance on cryptocurrencies, or at least becoming more open, which is bullish!

11/ Banning self-hosted wallets would be a major blow.

CEXs will likely only interact with regulated custodial wallets, preventing self-custody.

This will take away financial sovereignty and make us dependent on third parties who may freeze accounts.

12/ In practice, global cooperation from all countries is needed.

Banning self-custodial wallets in one country will force us to move to regions that do not enforce such bans.

Despite FUD that the EU "banned" self-custodial wallets this year, they are not actually banned.

13/ However, simpler and more effective bans include:

Prohibiting banks from servicing cryptocurrency businesses

Require cryptocurrency businesses to obtain licenses, but not issue them

Blocking cryptocurrency websites and VPNs

Think “Operation Chokepoint 3.0.”

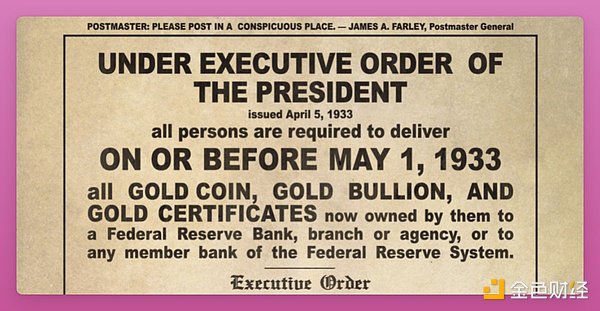

14/ The worst-case scenario would be a total ban on cryptocurrency holdings in the U.S.

Citizens might have to hand over their cryptocurrencies in exchange for dollars.

Violators could face fines, jail time, or asset seizures, with blockchain tracking used for law enforcement.

15/ Banks will be banned from dealing in cryptocurrencies and will be required to report suspicious activity.

Increased surveillance will target those hiding cryptocurrencies, potentially forcing other countries to cooperate.

The US may introduce a central bank digital currency (CBDC) as an alternative.

16/ Sound far-fetched?

Well, in 1933, the US banned the possession of gold.

But studies show that only 20% to 25% of privately held gold is actually turned over to the authorities.

17/ Interestingly, between 1932 and 1934, the value of the dollar against gold fell by more than 40%.

The price of gold soared from $21 to nearly $35 an ounce.

People who decided to hold gold saw their wealth increase :)

18/ If the US and other countries ban cryptocurrencies, it may be due to key economic control issues.

Such a ban could cause prices to plummet and drive the market underground, as it did in China.

But Bitcoin will continue to produce blocks and provide a refuge from government control.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Clement

Clement Beincrypto

Beincrypto cryptopotato

cryptopotato Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph