Author: Jason Chen, Source: Author’s Twitter @jason_chen998

I’ve been so busy lately that I finally had time to write the OEV article I owed you. The oracle machine track is really busy this round. Big brother Link ranks first in the growth list today and has a market value of over 10 billion again. There is also the recurring "demon coin" TRB, and the launch of OEV in cooperation with FlashBots last month. UMA, whose solution has tripled, and @API3DAO, which this week collaborated with Polygon to solve OEV by issuing ZK Layer2, this article focuses on explaining what OEV is, why it is so important to oracles, and how to implement API3 solutions.

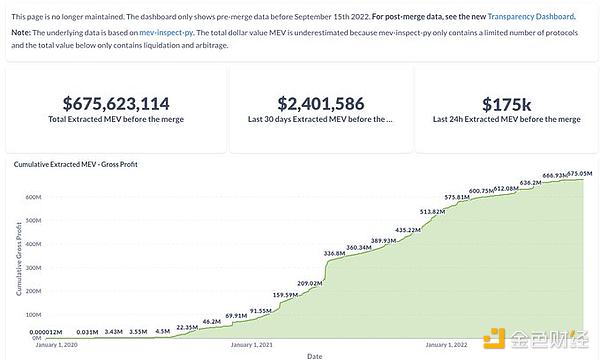

OEV’s full name is Oracle extractable value, so it is a subset of MEV. MEV mainly achieves the maximum extractable value by manipulating the order of blocks, essentially through technical means. People make money by artificially creating information gaps. OEV in the field of oracles also has the same problem. After all, in such a high-frequency trading market as Web3, price is the most important cornerstone data for transactions. The timeliness and accuracy of price feeds by oracles directly determine the price. The price difference result of the transaction, so I have always felt that the original English meaning of Oracle "oracle" is still very accurate. It is really like the hand of God with the ability to "manipulate" the results. At present, the entire MEV field has produced 650 million Net profit in U.S. dollars.

OEV is an oracle Use its price-feeding ability to control the most upstream of transactions to steal the value that would otherwise flow to third parties. Because the oracle price-feeding machine needs to submit data to the chain, it will cost a lot of gas and cannot be achieved in high-frequency and real-time. Delay spreads will occur. For example, if the price of ETH has a deviation of 1%, if it is 1000U now, the next update will be 990U or 1010U. However, if the user's liquidation price on a certain lending agreement is 1005U, the agreement will wait until the oracle normally. It is already too late to automatically feed prices, so in order to quickly sell liquidated assets, Defi protocols usually provide huge liquidation bonuses, accounting for about 5% to 10% of the total amount. This amount is OEV, and Aave has liquidated it in the past three years. 2 billion US dollars, of which more than 100 million US dollars are used as liquidation rewards, so both UMA and API3 hope to capture as much of this part of the funds as possible and return it to the protocol and the users themselves, and API3 will also capture part of it OEV uses it to repurchase and destroy its own tokens to achieve positive feedback from the business that empowers currency prices.

At present, API3 has been connected to 16 chains. It has cooperated with Polygon to launch a ZK Layer2 specifically for OEV. As a service chain product, why do you need to issue another chain of its own?

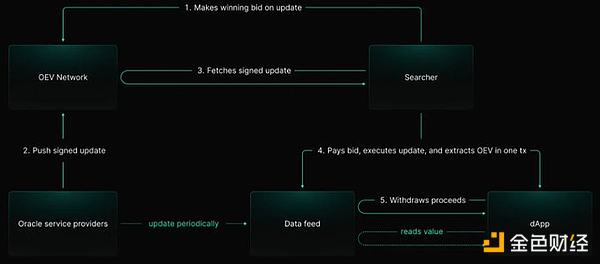

Here we need to extend a concept closely bound to MEV, the order flow auction OFA. It also solves the MEV problem through a game mechanism and returns profits to users. All pending transactions initiated will be forwarded to a private In the transaction pool, a third party conducts the auction, and the higher bidder can obtain the right to publish the transaction, so the bidder will evaluate the profit after obtaining the transaction to determine the price, and the income of the auction is very large A portion is returned to users to compensate them for the value they create.

So API3 was launched ZK Layer2 is a platform dedicated to OFA to help capture OEV value using the API3 protocol. API3 will give the highest bidder the power to update specific protocol data. The winner pays when performing data source updates, allowing the corresponding dApp to immediately After receiving the revenue, API3 launched ZK Layer2 for this purpose. Through ZK and on-chain auctions, the entire process is efficient, timely, transparent and credible.

API3 completed US$3 million in financing in 2020, including placeholder, dcg, Hashed and other established institutions, and sold a total of 10 million Tokens, which means the cost is 0.3, locked for 2 years, and linearly released 2 year, so it has almost been released this year, and it is basically in full circulation. However, please note that the market maker of API3 is DWF. Everyone understands it and makes your own judgment.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Olive

Olive Beincrypto

Beincrypto Cointelegraph

Cointelegraph