Source: Bitcoin Magazine; Compiled by: Wuzhu, Golden Finance

Modern Monetary Theory (MMT) has returned to the spotlight, driven by a new movie Finding the Money and a recent video that went viral on Bitcoin Twitter and Fintwit. In the video, Jared Bernstein, chairman of the President's Council of Economic Advisers, is unable to describe the most basic concepts of government debt and money printing. He claims that MMT is correct, but some of the language and concepts (the most basic) confuse him. This is definitely a shocking statement considering his role.

In this post, I will outline several major flaws of MMT, and perhaps you will be able to use these flaws to debunk MMT. The stakes are high because Modern Monetary Theory believers are gaining power in governments around the world, as Trump has demonstrated. Letting these people in power is a very dangerous proposition, as they will quickly destroy the currency and trigger an economic doomsday. As a Bitcoin supporter, we believe that Bitcoin will replace the credit-based dollar, but we hope that this transition is natural and relatively smooth. If Bitcoin is not ready to take over mainstream currency, its collapse will be catastrophic for many people.

Introduction to Modern Monetary Theory

Modern Monetary Theory (MMT) is a post-Keynesian macroeconomic framework that advocates that fiscal deficits are essentially irrelevant, monetary policy should be subordinate to fiscal policy, and monetary authorities should issue base money to finance large-scale government programs. Modern Monetary Theory promises to eliminate involuntary unemployment and solve social problems such as poverty and climate change. Modern Monetary Theory is rooted in the belief that all currencies are state-created and designed through a legal framework to facilitate government control over economic activities.

According to MMT, governments that can issue money at will will not go bankrupt. However, this power has obvious limitations, such as the inability to control the value of money. MMT also redefines the traditional functions of money—medium of exchange, store of value, and unit of account—claiming that these functions are more a byproduct of government policy than intrinsic properties such as scarcity and divisibility. The theory gives rise to the controversial notion that governments can designate any item (be it an acorn, an IOU, or a bitcoin) as money based solely on a legal declaration, regardless of its properties, a concept that is radically different from real-world economic dynamics.

No Coherent Theory of Value

The most significant shortcoming of MMT is its approach to value theory. Instead of a subjective theory of value, in which prices are generated by the preferences of individual actors (such as personal spending or saving decisions), MMT replaces this with a democratic or collective theory of value.

According to MMT, the value of money is not derived from its utility as a monetary function – such as a medium of exchange, a store of value, or a unit of account. Instead, in MMT, the value of money is derived from the collective acceptance and trust in the state that issues it. This acceptance is said to give money value. In other words, MMT turns traditional understanding on its head: it’s not that something valuable is accepted as money, but that something becomes valuable because it is forced to be accepted as money.

The value of money relies on the state as some kind of economic calculator, not on individual market participants. The aggregate preferences of society are combined with the expertise of central planning, and the result is full employment. This is not a joke. They haven’t gone beyond the theory of value just explained.

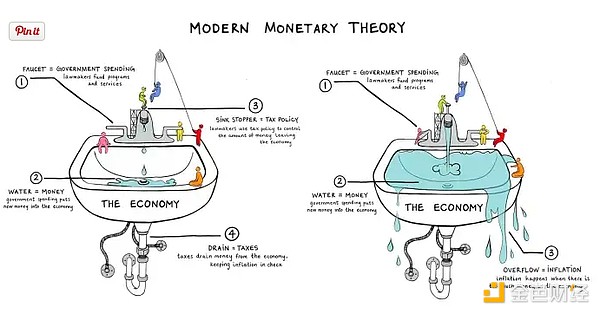

The Mechanism of Modern Monetary Theory: Taxation and Fiscal Policy

Modern Monetary Theory presents a distorted understanding of fiscal policy and taxation, arguing that taxation is the fundamental burden of a country's demand for issuing currency. Proponents of Modern Monetary Theory believe that without taxes, government spending will lead to currency depreciation. This reveals a significant contradiction: Although Modern Monetary Theory advocates strongly deny the importance of deficits, they also believe that taxes are essential to offset the adverse effects of deficits.

Source: MarketPlace

Furthermore, believers in Modern Monetary Theory ignore the broader dynamics of currency markets. Taxes alone do not necessarily promote the demand to hold money. Due to fear of devaluation, individuals may choose to minimize the number of assets they hold, converting other assets into cash only when necessary to meet tax obligations. For example, a person may operate primarily in alternative currencies and acquire only the amount of domestic currency required to pay taxes.

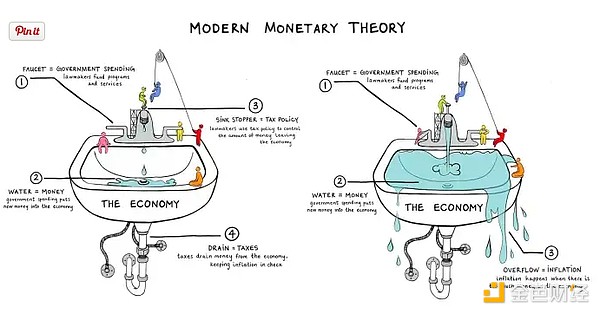

In terms of fiscal policy, MMT argues that the main constraint on money printing is inflation, which in turn is caused by the availability of real resources such as labor and capital. In their school of thought, if they print money, the result is economic growth until labor and capital are fully employed. Raising taxes is the mechanism to fight inflation by pulling money out of the economy.

Another significant flaw in MMT is that it requires a belief that the state can precisely manage fiscal policy outcomes. MMT ignores the inherent limitations of central planning, particularly circular reasoning, where the information guiding fiscal policy is merely a reflection of past government behavior, assuming perfect policy transmission without knowledge of real market data or external market dynamics. Are MMT planners in control? If they are, it's circular. If they're not, it's wrong.

MMT does not acknowledge the existence of unintended consequences that require frequent policy adjustments and weaken the demand for money, because this means they cannot control it. Moreover, market interest rates further complicate the problem for MMT adherents. Micromanaging the economy will lead to a sharp drop in economic activity, a drop in money demand, and a rise in interest rates. Therefore, while MMT claims that the state can enforce the use of its currency, it has no power to control how the market values or trusts that currency.

MMT and Resource Allocation

MMT's approach to resource allocation emphasizes achieving "full employment" through top-down fiscal policy, regardless of the efficiency with which labor and capital are used. MMT proponents believe that full employment of labor, capital, and resources can be guaranteed as long as the right fiscal policy is adopted. However, they have difficulty using MMT principles to prove why seemingly unproductive activities such as digging holes and filling them back are less beneficial than market-derived employment of labor and capital. This often leads to vague explanations of output differences without a clear, consistent standard of value.

According to MMT, all economic activities that consume the same resources must be considered of equal value, blurring the line between productive investment and wasteful spending. For example, there is no fundamental difference between using resources to build necessary infrastructure and building a “bridge to nowhere.” This lack of understanding of value leads to policies that primarily target employment rather than the value created by employment. The result is a massive mismatch of labor and capital.

Conclusions and Implications

The basic principles and policy implications of MMT are seriously flawed. These problems include its incoherent value theory and reliance on a circular fiscal policy logic, as well as its failures and unworkable resource allocation strategies in competitive international currency markets. Each of these risks could have far-reaching consequences if MMT is widely implemented.

For those who follow the Bitcoin space, the parallels between MMT and central bank digital currencies (CBDCs) are particularly striking. CBDCs represent a shift from our current credit-based monetary system to a new form of fiat money that can be tightly controlled through programmable policy, mirroring MMT’s advocacy for pure fiat money governed by detailed fiscal policy. This alignment suggests that regions such as Europe and China that have made progress in CBDC implementation may naturally gravitate toward MMT principles.

These shifts are monumental. There is no way a major economy can shift to a new form of fiat money instantly, no matter what MMT believers would like you to think. This shift will take years, during which we may witness the decline of traditional currencies. As Modern Monetary Theory and these governments inadvertently support Bitcoin, the choice for individuals, capital, and innovators will become clear. Regardless, if people are forced to adopt an entirely new form of money, then the shift of capital, economic activity, and innovation to Bitcoin will be an obvious choice.

JinseFinance

JinseFinance