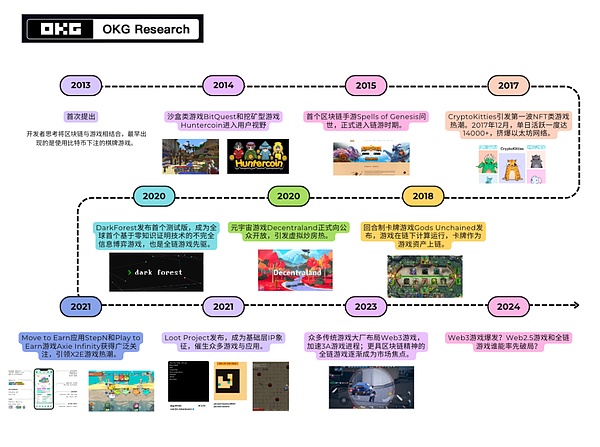

Ethereum founder Vitalik said in 2019: Finance and games will be the first scenarios where blockchain will be implemented.

After the last cycle driven by DeFi financial innovation, the Web3 game sector, which has been dormant for nearly two years, now seems to be recovering. Whether it is frequent financing or multiple games being put into public beta, the Web3 game sector will be very lively after entering 2024. But as a hot topic in the Web3 primary market, is the current popularity of the game sector a “real fire” or a “virtual fire”? What are the changes in Web3 games worth paying attention to in 2024?

1. Web3 games, fun is the last word

Since the decline of P2E (Play to Earn) games, there have been many discussions surrounding the future direction of Web3 games. Among them, the following two directions have received the most attention: Web 2.5 games that are improving towards 3A(Note 1) level production and playability, hoping to attract more players through high-quality game quality; and A full-chain game that will emerge in 2023 and try to start from a perspective that is fair, transparent and consistent with the spirit of an independent world.

Whether Web2.5 games or full-chain games are better or worse is a hotly debated topic at the moment. Although the concept of full-chain games is very popular, the author believes that Web2.5 games are more worthy of attention in 2024, and there is more hope of achieving large-scale user adoption and conversion of Web3 games.

The most direct reason is that compared with full-chain games, Web2.5 games are more like games that should appear in the 2020s. The left side of the picture below is the game interface of a certain full-chain game X; the right side is the game screen of the recently popular Web2.5 game Y. The screen gap between the two is clear at a glance. Although the two games have their own characteristics in terms of game worldview, the latter usually has significant advantages in terms of game production, operational smoothness, and playability.

Playability is the main drawback that previously limited Web3 games from acquiring large-scale players. The monotonous gameplay and rough graphics often make players flash back to more than ten years ago when participating in Web3 games. The only attraction may be to make money and play gold. But for ordinary players, there is always only one hard standard for evaluating the quality of a game, which is whether it is fun or not; Web3 games that focus too much on "Fi" can only attract gold-financing crowds, but cannot achieve the large-scale expansion of Web2 users. Transformation.

The fairness, transparency and autonomy advocated by full-chain games may be the evolution direction of future games, but in the short term, due to technology limitations, it is impossible to build complex game scenes, and can only meet the requirements of low computing and no low The types of games with latency requirements make it difficult for full-chain games to truly attract enough real players. After all, unless they are enthusiasts, under normal circumstances, when choosing between 3A masterpieces and pixel games, most players will still choose the former. Today's full-chain games are just like DeFi around 2018. The concept is greater than the reality, and it still takes time to iterate and accumulate.

So just looking at 2024, if Web3 games explode, the driving force will still mainly come from Web2.5 games. The Web2.5 game track may also see some changes in 2024:

1. Continue to move toward Web2 in terms of playability and gameplay. Close

We always believe that the best state for Web3 technology to penetrate into reality is to "moisten things silently". Although to a certain extent, the relationship between Web2.5 games and Web2 games is more like a supplement than a replacement, if the economic system and game back-end can be transformed, the playability and gameplay will not be affected. In this case, it may be a better choice to let players adapt to the changes brought by Web3 technology to the game system. Web2.5 games will continue to accelerate the integration of Web2 games in terms of game content and user experience in 2024, and gradually integrate the Web3 token model into games to realize the nativeization of in-game transactions and realize the convenient circulation of assets through the integration of internal and external trading platforms.

2. Integration with AI will become the main narrative of Web2.5 games in 2024

< p style="text-align: left;">Whether it is training NPCs based on AI, making the game more realistic through AI blessing, or rewriting game logic through AI to make the game full of more uncertainty and randomness, Web2 .5 Games and AI collide to create different sparks. As Tan Qunzhao, the former co-founder of Shanda Games, expressed in an interview with the media, the focus of promoting the development of the game industry actually lies in technological change. Now Web3 and AI are subverting the game industry and will usher in a golden period for the game industry in the next two years.

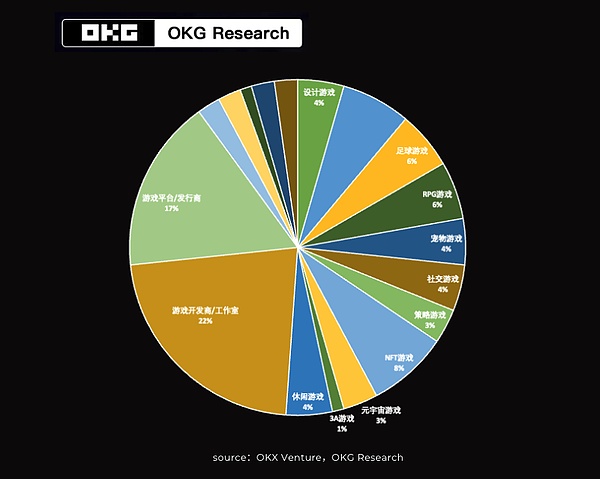

3. Web2.5 game projects will accelerate their evolution towards platform and ecology

Every game has a life cycle, and the life cycle of Web2.5 games is not only affected by the game itself, but also by the overall Web3 market trend. Compared with single game projects, game platforms and game ecology have stronger risk resistance and longer life cycles, and therefore have greater room for trial and error and development potential. Many Web3 game platforms are now actively building game ecosystems and transforming into game platforms, thereby getting rid of dependence on a single game. This trend can also be seen from the financing market in 2023: nearly 40% of the invested projects in the Web3 game track are game studios and game service platforms, and investments in single games tend to be cautious.

Maybe in the future, full-chain games will become the mainstream of Web3 games, but in 2024, we believe that Web2.5 games are the answer we are looking forward to now.

2. Narrative "The Ice Age is coming, can Web3 games become a "fire" in winter?

Putting aside the dispute between Web2.5 games and full-chain games, we might as well look at the basics of Web3 games from a data perspective, and then evaluate the extent of the current popularity.< ;span rootId":"CjMmdfzKFoRfE7xkLV6uysOos1d","text":{"initialAttributedTexts":{"text":{"0":"2. Narrative "The Ice Age is coming, can Web3 games become a "fire" in winter? ? "},"attribs":{"0":"*0+v"}},"apool":{"numToAttrib":{"0":["author","7033220002257829893"]},"nextNum": 1}},"type":"heading3","referenceRecordMap":{},"extra":{"mention_page_title":{},"external_mention_url":{}},"isKeepQuoteContainer":false,"isFromCode":false ,"selection":[{"id":25,"type":"text","selection":{"start":0,"end":31},"recordId":"VRGJdJSeboNlAuxfAT8uhWSWsJe"}]," payloadMap":{},"isCut":false}' >

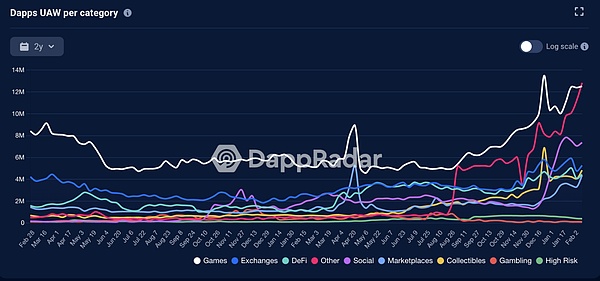

After P2E (Play to Earn) innovations such as Axie and Stepn triggered a boom, Web3 games The sector has been tepid in the past two years. However, judging from on-chain data, whether it is the number of active addresses or transaction volume, gaming is still the most active area of Web3: the average daily independent active wallets (UAW) remain at around 6 million , the average daily transaction volume on the chain is about US$100 million, far exceeding DeFi and other sectors.Starting from August 2023, the game sector UAW has experienced substantial growth, and by February 2024 it has exceeded 12 million, which is higher than that of DeFi and other sectors. It will increase by more than 142.44% during the same period in 2023.

In the primary market, Web3 games also performed well. According to incomplete statistics from OKX Venture, in the first three quarters of 2023, a total of 923 investment and financing events occurred in the Web3 industry , among which there were 91 investment and financing events in the game track, accounting for 9.86%.Although affected by the market downturn, the amount of financing fell sharply compared with the previous two years, but the financing proportion was relatively stable, maintaining around 10% .The active participation of top investment institutions shows that the capital market is optimistic about the Web3 game sector in the long term.

However, compared to the outstanding performance in on-chain data and primary market, the market is more looking forward to Web3 games It will usher in an overall outbreak in 2024. Compared with other sectors, we believe that Web3 games have the potential to become a key explosive area in the new cycle. The reason is:

From a narrative perspective, Web3 game narratives are enough to carry the hope of breaking through the circle and growing. BitMEX co-founder Arthur Hayes recently wrote that the importance of narrative in the encryption market often exceeds the technology itself. We don’t entirely agree with this point of view, but we do agree on the importance of narrative. The Web3 industry is entering a "cold period" of storytelling, with more funds and projects concentrated at the infrastructure level and a lack of new growth points in terms of large-scale user adoption and transformation of narratives. Whetherreshaping the game industry with the help of Web3 technology or breaking through the industry with Web3 through games, the nearly 3 billion Web2 game players and nearly 600 million Web3 users around the world give Web3 games a strong narrative foundation. .

Although P2E games represented by Axie Infinity and StepN failed after a brief outbreak due to their Ponzi-biased economic model, they have never Overall, more Web3 native project founders are standing on the shoulders of their predecessors and actively exploring game products that better meet market demand; more and more traditional game giants with rich experience are gradually entering and starting to build 3A chain games, which may be possible in the future. In terms of playability, it brings a qualitative leap to Web3 games: these make the game sector difficult to ignore anymore. According to a previous report by market research provider Markets and Markets, the global blockchain gaming market will be worth US$4.6 billion in 2022 and is expected to grow to US$65.7 billion by 2027.

From a practical perspective, as an extremely money-burning and time-consuming industry, the explosion of the gaming sector requires the joint promotion of multiple factors such as capital, time and technology. As the time progresses to 2024, these elements seem to be gathering. The improvement of technical infrastructure such as modular public chains, AA wallets, ZK, and L2 has given Web3 games stronger support. The outstanding performance of Web3 games in the primary market in the past few years has also given many project parties sufficient capital and Time to polish and test game products.

Of course, these also make the market look forward to the performance of Web3 games in the new cycle. After all, after several years of accumulation and multiple rounds of financing, it seems that it’s time for many Web3 games to hand in their “report cards.”

Note 1: 3A games are an informal classification in the video game industry, usually referring to high investment , high-quality and high-selling game types.

Davin

Davin

Davin

Davin CryptoSlate

CryptoSlate Beincrypto

Beincrypto Coindesk

Coindesk Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph