Author: Brayden Lindrea, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

If history is any indication, the fate of the spot Ethereum exchange-traded fund may be determined this week by a single vote from SEC Chairman Gary Gensler.

In January, the approval of the spot Bitcoin ETF was finally completed by a panel of five commissioners. Two crypto-friendly commissioners, Hester Pierce and Mark Uyeda, voted in favor of the ETF, while commissioners Caroline Crenshaw and Jaime Lizárraga voted against.

Gensler also voted to approve the bill, leading many to believe that his vote ultimately ensured the approval of the spot Bitcoin ETF, which was approved on January 10, 2024, with a 3-2 vote.

The SEC finally votes in favor of a spot Bitcoin ETF. Source: SEC

This week, the five SEC commissioners will vote on May 23 to approve or reject VanEck’s spot Ethereum ETF. Here’s what we know about them.

Hester Peirce

Peirce earned the nickname “Crypto Mom” for a reason — she’s bullish on digital assets and wants to see more decentralization integrated into the broader financial system.

She has yet to confirm how she would vote on a spot Ethereum ETF.

She has, however, become part of the Ethereum community and attended and spoke at the ETHDenver conference in Colorado in late February.

Hester Peirce (left) speaks at ETHDenver. Source: ETHDenver

Peirce has slammed the SEC’s approach to regulating the cryptocurrency industry in the past, calling some of the securities regulator’s methods “ineffective” and “pointless.”

Caroline Crenshaw

Crenshaw is a vocal critic of the cryptocurrency industry and a vocal opponent of the spot Bitcoin ETF decision.

At the time, Crenshaw said the price of a spot bitcoin ETF would be subject to fraud and market manipulation in the broader industry and that by approving a bitcoin product, the SEC would fail to protect American investors.

There is no evidence that Crenshaw has since changed his mind about spot crypto ETFs.

Caroline Crenshaw Source: SEC

“These markets have little systemic oversight and no other adequate mechanisms to detect and deter fraud and manipulation,” Crenshaw said in her dissent to the spot bitcoin ETF.

“[Spot trading] is fragmented and dispersed across different international trading venues, and many markets are not meaningfully regulated,” she added.

Mark Uyeda

Aside from Peirce, Uyeda is the only other commissioner to criticize the SEC’s “coercive regulatory” approach to the cryptocurrency industry.

He disagreed with the SEC’s decision in December to reject a petition from Coinbase that accused the agency of acting arbitrarily and capriciously in refusing to write rules to clarify regulation of the industry.

Uyeda also voted to approve the spot bitcoin ETF but expressed “strong concerns” about how the SEC made its decision.

Mark Uyeda (right) speaks at the Milken Institute conference. Source: Eleanor Terrett

He claims that the commission strayed from the “significant market” test used to decide on exchange-traded products and approved the spot bitcoin ETF “something else.”

Uyeda called the SEC’s reasoning “flawed,” but cited “independent reasons” behind his decision to vote in favor of a spot bitcoin ETF.

It’s unclear, however, what those “independent reasons” are, let alone whether they apply to a spot ethereum ETF as well.

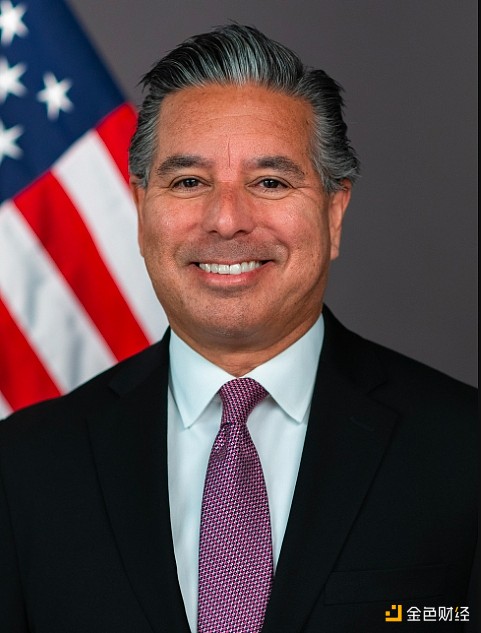

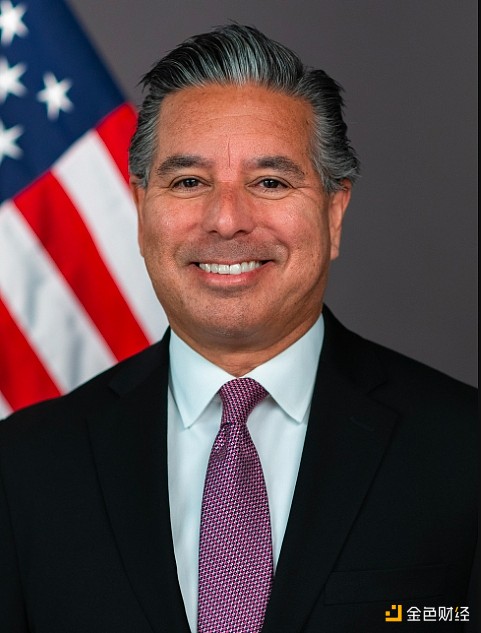

Jaime Lizárraga

Lizárraga voted against approving a spot Bitcoin ETF and was the only commissioner who did not issue a statement following the decision.

However, he reportedly said in a November 2022 speech at Brooklyn Law School that Bitcoin’s promise as a “viable alternative to traditional finance” and “true financial inclusion” has yet to be realized.

At the time, he opposed the view that the SEC was taking a “coercive regulatory” approach to the cryptocurrency industry.

Jaime Lizárraga, Source: SEC

He also believes that most cryptocurrencies are subject to U.S. securities laws and are therefore operating illegally.

There is no evidence that he has changed these views since the spot Bitcoin ETF was approved.

Gary Gensler

While Gensler voted to approve the spot Bitcoin ETF in January, some speculated that he was forced to do so because Grayscale won its appeal against regulators a few months earlier.

It is unclear whether he will approach the current wave of Ethereum ETF applications in the same manner.

Gary Gensler talks to CNBC about cryptocurrency regulation. Source: CNBC

Earlier this month, Gensler confirmed in a May 7 interview with CNBC that the SEC’s decision was still under review:

“This is something that our committee is facing right now. We are a five-member committee, and those documents will be made in due course.”

Gensler was also recently accused of avoiding answering whether Ethereum is a security — even when asked by Congress.

Deadline for submitting Ethereum ETF applications to the SEC. Source: James Seyffart

Meanwhile, there are other potential issues in the works. An investigation into Ethereum's potential security, led by SEC Enforcement Director Gurbir Grewal.

Some fund managers also claim that the U.S. Securities and Exchange Commission (SEC) is less involved in spot Ethereum ETFs. A lawyer for one of the applicants, Bitwise, reportedly said that some fund managers expect the SEC to reject it this week.

Recently, Nate Geraci, president of The ETF Store, noted that technically, the SEC could approve a 19b-4 filing (a trading rule change) but prevent an immediate launch by delaying the S-1 filing (registration statement).

Source: Nate Geraci

Bloomberg ETF analysts Eric Balchunas and James Seyffart predict that there is a 25% chance that at least one spot Ethereum ETF will be approved on May 23, a figure that has dropped from 70% since January.

Weatherly

Weatherly