Author: Cody, Twitter@0xhopydoc; Compiler: Kaori, BlockBeats

Editor's note: Cody Poh, investment assistant at Spartan Capital, wrote an article expressing his value judgment on Ethereum Layer 2. He believes that there is a theoretical "glass ceiling" in Layer 2 valuation. Ethereum L1 ensures the security of L2 activities through its consensus mechanism, thus theoretically limiting the value of L2 to not exceed L1. And individual Layer 2s may still do well, but that's more due to idiosyncratic reasons rather than general growth across the industry. Beyond that, he believes aggressive token releases and incentives will continue in this cycle until a clear winner emerges from the Layer 2 competition.

Last June, when Optimism was trading above 5 billion FDV, I was outspoken on Twitter about my optimism about the red coin. The value is severely underestimated.

Optimism generates over $40 million in annualized fees and has just announced a vision for Superchain, an ecosystem in which opt-in chains will pay Optimism's ordering fees or profit. In other words, I would pay around $5 billion for a chain ecosystem that includes Base and OP mainnet.

As the EIP-4844 upgrade approaches, it is expected to occur on March 13, 2024; the value of Optimism, a direct beneficiary, has increased significantly, and currently FDV has More than $15 billion. Therefore, I think now is the time to review the original investment thesis as the major catalysts are in play.

The more skeptical I get when I think about the further incremental upside Optimism could gain. Don’t get me wrong, I think Optimism along with the OP Stack and the broader Superchain ecosystem have become important infrastructure within the Ethereum ecosystem. The $OP token may still do well this cycle, but I still have some important questions about Layer 2 as a whole:

1.

strong>There is a theoretical "glass ceiling" in L2 valuationThe relationship between Ethereum L1 and L2 To put it simply, Ethereum L1 ensures the security of activities on L2. Based on this, the overall value of L2 should theoretically not exceed Ethereum L1;Because Ethereum’s consensus mechanism provides verification of the authenticity of activities occurring in L2. This approach makes no sense if a lower-cost chain is used to protect activity that occurs on a higher-cost chain; otherwise, why would L2 settle on this base layer?

Theoretically, L2 or even L3 could choose to settle on any blockchain, which ultimately depends on which blockchains they wish to inherit. characteristic. For a second layer that chooses to settle on Ethereum L1; this blockchain chooses the security provided by Ethereum validators through the consensus mechanism; it also chooses the liquidity that Ethereum has accumulated , and a bridge facility also secured by the Ethereum consensus mechanism.

This assumption should be considered correct unless "Settlement Layer as a Service" becomes more of a commodity during this cycle with the likes of Dymension ization, or other general-purpose Layer 1 could provide the same feature set that Ethereum L1 currently provides as mentioned previously.

The counterargument to this "glass ceiling" problem is that if any Layer 2 can scale in a way that attracts the next million users Take off and it will become a reality. The added value may eventually filter into the Ethereum base layer, which will effectively lift the aforementioned “glass ceiling.” My only doubt about this view is:

Considering Ethereum (330 billion FDV) Current trading valuation; I feel it will be difficult to push Ethereum to a certain level with the crypto native currency alone. Ethereum will need significant external inflows (hopefully from the ETH ETF, for example) to move above some of the valuation targets we have set this cycle.

In fundamental cryptocurrency investor circles, "security need" or "currency need" is still a relatively new term concept; it calls for this school of thought to become the overarching framework when it comes to infrastructure investment

Going from Layer 2 back to Layer 1 value Accumulation is often cut by more than an order of magnitude; this problem becomes even more severe after the EIP-4844 upgrade is implemented, as the cost of backhauling data to Ethereum will actually be reduced by more than 10x - not to mention that Layer 2 will be batched Process multiple transactions, so in order to do 10x the processing volume on Ethereum, you will pay 10x more.

2. Layer 2 war is essentially a cannibal war

According to the above logic; the collective TVL on Layer 2 is always a subset of the entire TVL on Ethereum, because part of the reason why Layer 2 chooses to settle on Ethereum is deep liquidity. When we have a bullish bias on a single Layer 2 token, we are basically making the following assumptions:

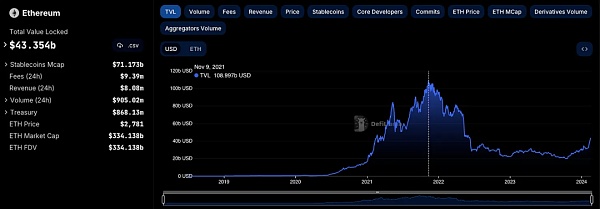

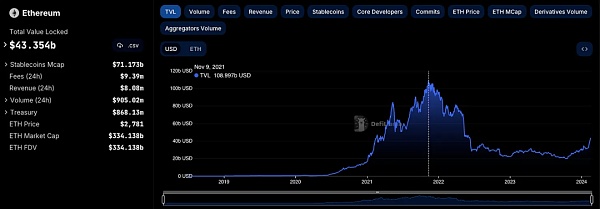

· ETH TVL will still double or triple what it is now, and in a more optimistic scenario one assumes it will double from current levels;

ETH TVL currently exceeds 40 billion, peaking at more than 100 billion in the last cycle; and each Layer 2’s ETH TVL is required to be three or four times the previous peak to have enough TVL and conduct tens of billions of dollars in transactions; Offers enough upside to make investing fun.

· Layer 2 TVL, which is a subset of ETH TVL, will continue to grow;

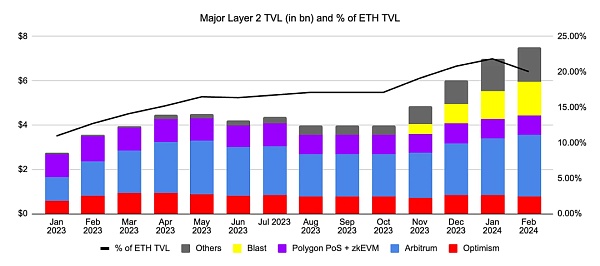

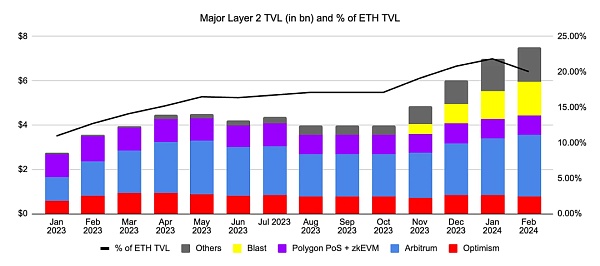

Consider the main Layer 2, including Optimism, Arbitrum, Polygon and newly created Layers, such as Manta and Blast; currently Layer 2 accounts for more than 20% of the total TVL. By investing in Layer 2, we assume that this percentage can reach at least a multiple of that percentage.

As early as January 2023, there were only 3 "rollups" on the market, which accounted for about 10%; fast forward to January 2024, There are more than a dozen universal rollups on the market, but this percentage has only doubled, meaning the average TVL per rollup has been declining.

· An extension of this - your favorite Layer 2s (like Optimism or Arbitrum) somehow manage to get more than those new and shiny mega-farms (like Blast or even Manta) TVL.

For the two structural reasons mentioned above, I am less optimistic about Layer 2 as an industry. I think individual Layer 2s may still do well - but that's more for idiosyncratic reasons than general growth across the industry that will eventually generalize to all Layer 2 technologies; two examples I can think of include:

Optimism - $OP still serves well as a proxy bet for the entire hyperchain ecosystem, with investors betting that Base will eventually attract the next few hundred 10,000 retail investors because it is so close to Coinbase, or Farcaster successfully defeats Twitter and becomes the de facto crypto social app;

Polygon - if compared to Japan's Astar or $MATIC or $POL could go parabolic with partnerships like Nomura/Brevan Howard in traditional finance; or a zero-knowledge proof-driven aggregation paper that excels and achieves atomic interoperability between all zkEVMs;

It is hard for me to imagine a universe in which a single Layer 2 could defeat all its competitors and ultimately defeat all competitors just because it is extremely good at business development. Attract all front-line crypto-native partners, such as gaming and DeFi protocols. If not, how can we be optimistic and invest in any Layer 2?

3. Radical token redemption plan

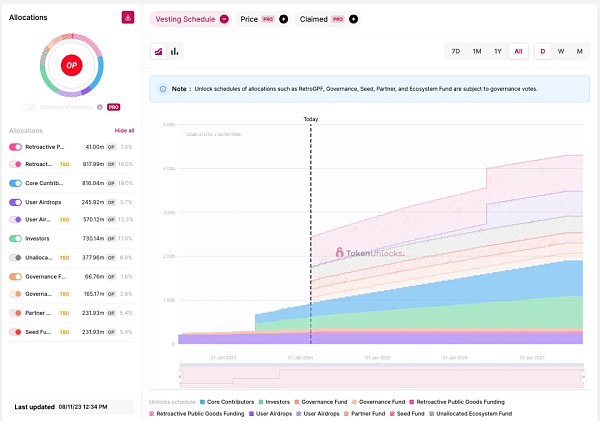

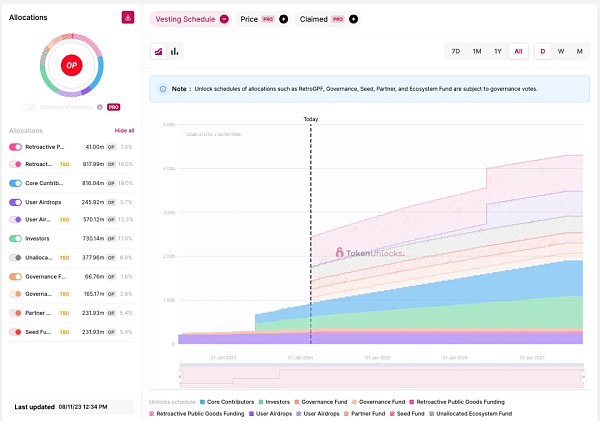

< Another important factor to keep in mind is the aggressive release schedule of these new Layer 2s in the next cycle. This is also why I have a bullish bias on older coins like Optimism and Polygon in this scenario, as they have already gone through the steepest part of their release schedules; of course, in hindsight, this is certainly The extent is reflected in its relatively compressed valuation.

The aggressive monthly unlocking of $OP tokens has always been the Achilles heel of the token price; But as I said, relative to the future circulating market capitalization, the incremental selling pressure will gradually weaken;

MATIC token has almost Upon completion of vesting, by migrating to POL tokens, the future annual inflation rate is only 2%, which is considered reasonable compared to other PoS chains;

On the other hand, Some relatively new Layer 2 tokens will eventually begin to be unlocked in the coming months. Considering the funding scale of these chains and the valuations of their previous seed and private equity rounds; it is not difficult to imagine that investors would not hesitate to sell on the market.

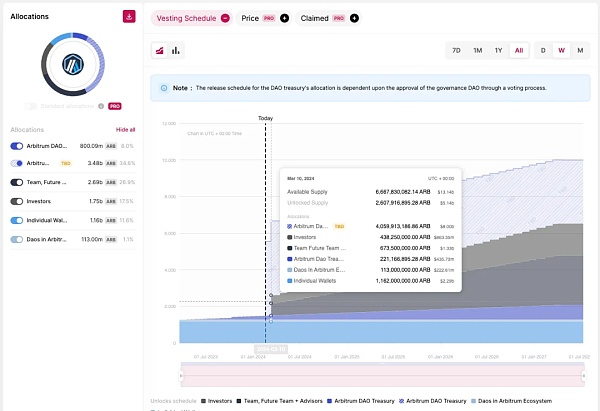

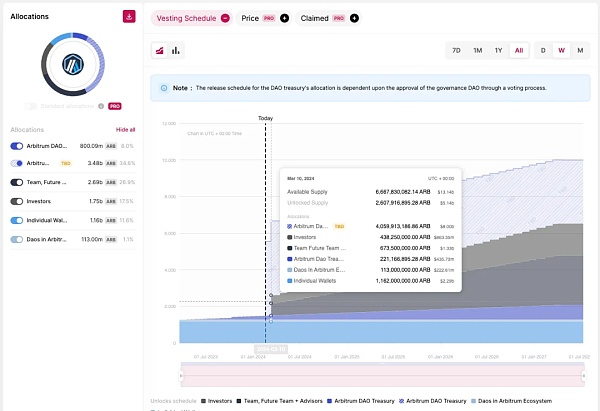

Only 12.75% of $ARB tokens are currently in circulation; the massive cliff unlock of over 1 billion tokens will occur on March 15, 2024. Subsequently, more than 90 million tokens will be unlocked every month through 2027;

Judging from the way they designed the token vesting schedule, it seems that the Starknet team Can't wait to dump $STRK on the market to retail users, after years of building (for next to nothing), and judging by the way they designed the token vesting schedule - I'm an electronic beggar myself;

Four , printing money to promote business development

What’s worse, in addition to the aggressive unlocking schedule, theLayer 2 project has to continue Issue its native token to incentivize and achieve partnerships. After all, the importance of underlying technology is self-evident, and business development has become a key differentiator in this competition.

We've seen how Polygon has provided $MATIC grants and established impressive partnerships with companies like Disney, Meta, and Starbucks . But this has led to a massive sell-off of its tokens and explains why $MATIC is trading very cheaply relative to other companies with newly launched Layer 2 businesses with weak development efforts.

At the same time, we are also starting to see Optimism and Early signs that Arbitrum is issuing tokens to retain users.

Optimism has completed 3 rounds of retroactive public product financing and has issued a total of $40 million in OP (equivalent to in > 150 million) tokens. Arbitrum has also conducted multiple rounds of short-term incentive programs and issued more than $71 million in ARB tokens to projects; it is even considering establishing a 200 million gaming-focused ecosystem fund and long-term incentive program to continue to drive user activity.

It is reasonable to assume that such aggressive incentives will only continue in this cycle until a clear winner emerges from the Layer 2 competition. Until then, , I think Layer 2 as a category will lag behind in terms of price performance overall.

JinseFinance

JinseFinance