Trump's 50-minute speech at the Nashville Bitcoin Conference on July 27 was hailed as another milestone in the crypto asset industry. But after the meeting, someone counted and found that Trump did not mention Ethereum, blockchain, or Web3. The only time he mentioned Vitalik, he later found out that he misheard.

Why didn't Trump mention Web3? Of course, I don't know the exact reason. I can only ask the guy who wrote the speech for Trump, who is said to be David Bailey, CEO of Bitcoin Magazine. But if you put this matter in the big framework of the entire crypto industry, it is actually not difficult to understand.

In short, Trump's speech basically reflects the claims of the progressive Bitcoin supremacists.

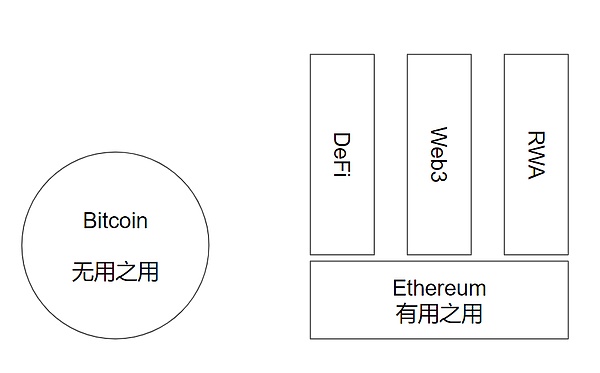

Bitcoin and Ethereum are two leading companies in the Crypto industry and are often compared together. But in fact, the two are completely different, and can be said to represent two completely different schools of thought: Bitcoin is "useless use" and Ethereum is "useful use".

The goal of Bitcoin is to be digital gold and a benchmark for the value of the digital world. It has no other use, especially no use value. Precisely because it has no use value, you cannot analyze it from the perspective of utility, and you cannot use indicators to measure its value. Therefore, Bitcoin is invincible because you can't think of the logic to defeat it. But on the other hand, Bitcoin leaves little room for application development and ecological construction, and it is difficult to build anything on it. There are many Bitcoin supporters who continue to claim that Bitcoin is the first and should be the last blockchain application. Bitcoin has fully utilized the reasonable value of blockchain. Bitcoin has done everything that blockchain should do, and what Bitcoin has not done is what blockchain should not do. All other blockchain innovations except Bitcoin are self-conceited. These views are typical claims of fundamentalist Bitcoin supremacism. This is of course an extreme admiration for Bitcoin, but it is also a surrender to Bitcoin's inability to support greater value as an infrastructure.

Ethereum is different. Its original goal was to be a global computer, but now it is a digital economic settlement layer and a dedicated computer. It is a useful thing and has been an ecological infrastructure since the beginning. This is Ethereum's advantage, but it is also its weak link. Since it is useful, its usefulness can be decomposed and measured based on some indicators, such as performance, TVL, number of users, throughput, etc. Because Ethereum is useful, in theory, if you make a blockchain that surpasses Ethereum in all indicators, it is a more useful blockchain and can beat Ethereum. Since 2017, there have been countless Ethereum Killer public chain narratives, some of which once received high valuations. This is the logic behind them.

So it can be compared like this: Bitcoin is a big ball, which is perfect in itself, but you cannot build a superstructure on it. Ethereum is a flat plate, which provides you with a good basic condition for building a superstructure, but it is more fragile than Bitcoin.

Although Trump talked a lot in this speech, it was actually just a repeated spiral reinforcement of Wall Street's Bitcoin logic, that is, recognizing the value of Bitcoin digital gold, expressing confidence in its value, and providing policy guarantees after being elected, one wave higher than the other, but that's all, and it did not involve other aspects, and did not involve the topic of blockchain in changing the Internet application paradigm at all.

Bitcoin and Ethereum offer different promises. Bitcoin is to establish a firm position as digital gold and continuously increase its market value. Ethereum, on the other hand, is laying the foundation and providing support for applications such as DeFi, Web3, and RWA.

I don’t think Trump’s understanding of this industry is so specific, so his speech mainly reflects the long-term and consistent position of the people at Bitcoin Magazine, that is, we have finally established Bitcoin as a mainstream compliant asset, and now we can bring all kinds of businesses and derivatives around this new asset to the mainstream financial circle. What gold had in the past, we now add to Bitcoin. Wall Street prefers this kind of narrative. As long as customers like to trade, there will be commissions to earn.

On the contrary, creating new technologies, tools, platforms, and application paradigms is what Silicon Valley likes to do. So for things like creating DeFi, Web3, RWA or industrial blockchain on Ethereum, we can't expect Wall Street to be particularly active. We still have to do something first, and then Wall Street will join in.

Of course, this does not mean that Trump's statements, if they are really implemented, will have no meaning for DeFi, Web3, RWA and other aspects. The significance is still very large. First of all, if a large amount of funds flow into digital assets, it will also affect these superstructure areas. On the other hand, Trump's statement that he wants to replace the SEC is very intriguing. Because although this guy Gensler is hated, to be honest, he basically gave the green light to Bitcoin during his tenure and did not make it too difficult. If we only look at Gensler from the perspective of Bitcoin, even if it is not a high score, it is very qualified. Gensler's real conservatism is reflected in his strong obstruction of the Ethereum ecosystem, especially Web3. In particular, when Hester Peirce's "Token Safe Haven" proposal had already been drafted, it was shelved for a long time, which seriously hindered the development of Web3. So the replacement of Gensler actually has little significance for Bitcoin, but it may be good for Web3.

If the United States wants to become a paradise for Web3, the attitude of the SEC rather than Wall Street is more critical. Only by allowing Web3 projects to apply tokens for user incentives and governance in a natural and reasonable way, while implementing effective supervision and resolutely cracking down on the sickles and fraudsters who issue coins to cut leeks, can Web3 obtain a longer development cycle and actually grow a business flywheel. Only in this way can the industry truly get rid of the cycle of ups and downs.

I don't know how deep Trump's understanding of this issue is, but it seems that Kamala Harris should not move in this direction. The more people think they represent the direction of history, the more unscrupulous they are when infringing on personal freedom and rights. So this US election is indeed related to the interests of the Web3 industry, let us wait and see.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Davin

Davin Beincrypto

Beincrypto decrypt

decrypt decrypt

decrypt Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph