Author: Liu Jiaolian

Recently, BTC has broken through the downward channel, rising from around 60k to 67-69k, and is about to break upward. ETH has been fluctuating sideways since August. That sideways movement is really extraordinary.

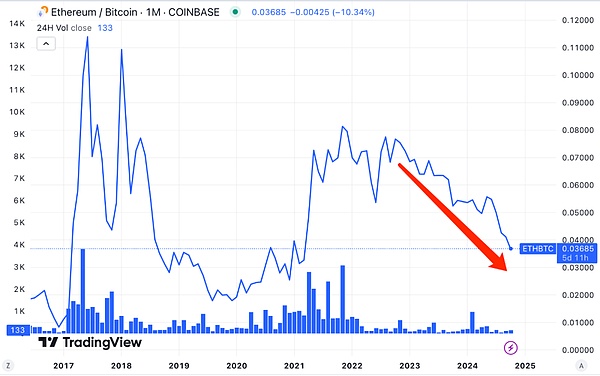

Jiaolian wrote an article called "The Life Dilemma of Ethereum" at the end of August 2024.8.27, which included a chart of the exchange rate trend of ETH/BTC. At that time, it had fallen below the key psychological level of 0.05, but was still above 0.04. Now it has effectively fallen below 0.04 and reached the "3-digit" level.

Since the end of 2022, which is the bottom of the most recent bear market, ETH/BTC has been falling all the way, from close to 0.08 (this is actually a performance close to the peak of the bull market at the end of 2021), all the way down to below 0.04 now, almost halved.

This means that if you did not take advantage of the relative strength of ETH against BTC and change your position to BTC when the altcoin craze at the end of the bull market in 2021 or the oversold BTC at the end of the bear market in 2022, you can only get back half of the amount of BTC if you hold ETH until now. That is, measured in BTC terms, holding ETH has lost half of its value.

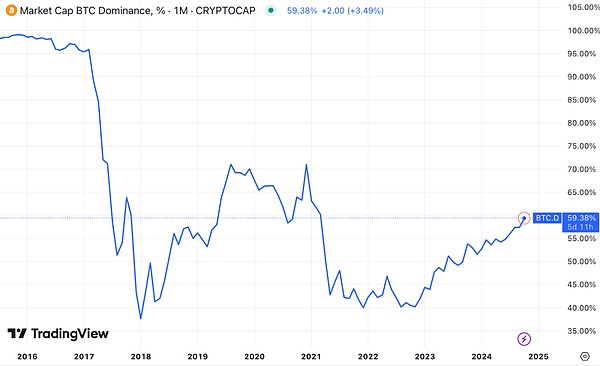

BTC's market value accounts for nearly 60%. And it seems that the market is getting closer and closer to a sudden start. It is hard to say whether ETH/BTC will hit a new low one day. After all, the lowest point in 2019 was 0.02.

But this does not mean that it is wise to change positions now. The reason is simple: everyone knows that making money is buying low and selling high, and losing money is buying high and selling low. Cutting meat now is definitely not selling high.

ETH's current poor performance has actually been "cursed" as early as the end of 2023. Looking back at the 2023 12.20 Teaching Chain Insider: Messari is bearish on Ethereum, ETH/BTC hits a new low, Ryan Selkis, the boss of crypto research institution Messari, openly predicted the decline of Ethereum and the rise of Solana in a research report at the end of 2023.

Earlier, in 2021, Teaching Chain’s 2021.11.24 article Ethereum is attacked from both sides had already written about the huge challenges faced by Ethereum, which was attacked from both sides: "There is a blockade in front and a pursuer behind, and Ethereum is attacked from both sides."

From the perspective of the market value pursuit relationship, it can be said that ETH has a strong enemy BTC in front, and has established its position as a value storage; and there are pursuers behind, and a large amount of market has been snatched away by the side chain (new public chain) represented by Solana - the "speculation" market.

After 15 years of development, only two demands have been verified to be true in the blockchain or crypto industry: one is the value storage of BTC, and the other is currency speculation. These two are truly verified PMF (Product-Market Fit). All other so-called blockchain application demands are pseudo-demands so far, and none of them has been proven to have real commercial value.

"Coin speculation" can be broken down into three major parts: currency issuance, trading, and derivatives. The corresponding on-chain applications are ICO, DEX, and various DeFi (such as lending). "Coins" cover homogeneous tokens and non-homogeneous NFTs (so-called digital collections).

After peeling off the rhetoric of the clouds and mountains, it all comes down to one word - "speculation". What is "speculation"? It means not creating value, but only transferring wealth. "Speculation" is a game, a game that takes wealth out of the pockets of a bunch of people and puts it into the pockets of a few people.

"Coin" is a tool, "speculation" is the purpose.

See through this essence, and you will understand:

In 2017, ICO was hot, and Ethereum was used to issue coins. ETH/BTC hit a record high of more than 0.11.

In the summer of DeFi in 2020, DEX leader Uniswap pioneered the speculation of local dogs on the chain. By the first half of 2021, SHIB broke the circle, "for a while, new leeks only knew SHIB but not BTC", and NFT pulled the banner of "art" to attract down-and-out artists to enter the circle for "harvesting". What a "silly people with a lot of money, come quickly"... All of these fell on the Ethereum chain, which was crowded for a while, and the fees soared, and it was jokingly called the "noble chain". ETH/BTC also rebounded to 0.08.

A restaurant was packed. Smart people will seize the opportunity and quickly open a new restaurant next to it to share a share of the traffic dividend. So in 2021, the new public chain track broke out. Various so-called new public chains (such as Solana) have emerged, taking over the overflow of Ethereum traffic, and they are very happy.

Everyone knows that these stores with "restaurant" signs are full of customers, but none of them are eating, they are all playing cards (gambling).

So this new restaurant worked harder and simply tore off the fig leaf. Don't talk about encryption vision, decentralization, or value proposition. Guests come to our store just to speculate in coins. Coin issuance tools, go! Meme coins are issued in batches, and hundreds or thousands of them are issued a day. Trading tools, go! Low fees, smooth and smooth. One coin, one meme, one coin, one plate. The plate opens, the plate collapses, three to five days is not short, ten days and a half months is not long. They rush in, work hard, accomplish everything in one go, and disperse in a rush. Those who run slowly can't catch up with the hot shit.

The track of currency speculation, the fat meat of this market, has been "snatched" from Ethereum by the new public chains.

Yesterday's 10.25 Internal Reference: Four Stages of BTC's Blood Transfusion and Blood Sucking on Shanzhai said that the seven-day transaction volume of DEX on Solana chain is close to twice that of Ethereum.

When all the traffic of currency speculation goes to Solana or other places to play, what will be left for Ethereum?

2024 is the year of disillusionment in the crypto industry.

Those who believe in the value of crypto only believe in BTC. Those who do not believe in the value of crypto only speculate in meme coins.

These two types of people no longer step into the door of Ethereum.

People leave and the tea gets cold, users are lost, and the market is lost. This is the main reason why ETH has been declining in the past two years.

Why won't BTC users lose, but become more and more loyal? Because the demand for value storage has extremely strong user stickiness. "Safety" is a truly scarce product.

But the demand for "speculating in coins" is completely different. For this type of user, there is no speculation, and there is no gambling? So there is almost no stickiness. Which chain is more colorful, more exciting, and has more dreams of getting rich, they will all go there in a swarm.

Ethereum technology is advanced, and the architecture is more decentralized, but users are often indifferent to technology. They only care about the perceived experience, whether the operation is simple and smooth, whether it is fun to trade, whether the adrenaline can soar, and whether there are new tricks to play every day, just like the colorful experience of Macau or Las Vegas.

Now the performance of ETH has forced the community to start rumors that Vitalik Buterin has broken up with his girlfriend and is ready to focus on Ethereum. However, even with Vitalik's high-brow talk about technology and high-end application scenarios all day long, he still cannot win back the hearts of those users who run to Solana and other platforms to buy local dogs and hype memes.

So Ethereum still has to think clearly. It is impossible to do value storage better than BTC, and Solana has "intercepted" it in currency trading. So what is its own positioning, which market should it occupy next, and who should pay for it?

If you don’t pay, I don’t pay, and he doesn’t pay, then the coins sold by the Ethereum Foundation every day can only be paid by the leeks in the secondary market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance XingChi

XingChi JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Bernice

Bernice Hui Xin

Hui Xin JinseFinance

JinseFinance JinseFinance

JinseFinance Future

Future Cointelegraph

Cointelegraph