Author: Marcel Pechman, CoinTelegraph; Compiler: Deng Tong, Golden Finance

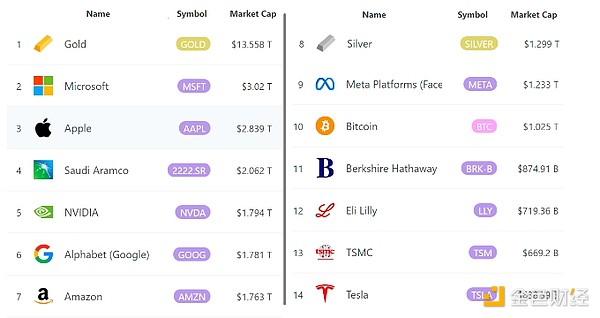

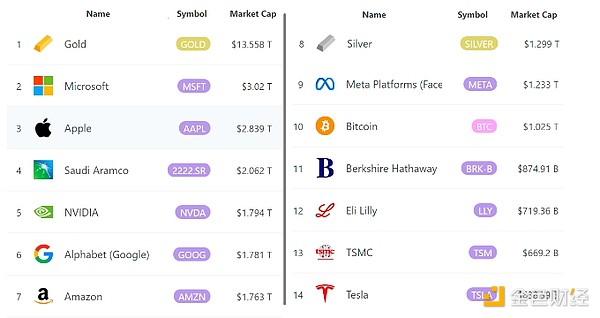

For investors, the rise in Bitcoin prices is very tempting, especially in the short period as of February 15 That comes after a 91% jump to $52,000 in four months. Bitcoin's current valuation of $1 trillion puts it among the top ten tradable assets in the world, even ahead of Warren Buffett's estate, the famed Berkshire Hathaway, which has a market capitalization of $875 billion.

The world's largest tradable asset by U.S. market capitalization. Source: 8marketcap

It would take an additional 34.5% for Bitcoin to reach $70,000 from its current level of $52,000, which would mean an increase of $350 billion in BTC’s market cap. The move would put the cryptocurrency ahead of silver and sterling, including bank deposits and currency notes. The key question is whether current conditions support Bitcoin’s $1.35 trillion valuation.

One might argue that Bitcoin cleared these hurdles when it hit an all-time high of $69,000 in November 2021. A repeat of this feat now looks more likely, given the approval of a spot Bitcoin ETF in the U.S. and the resolution of some risks, such as Binance’s court battles with regulators and the FTX exchange bankruptcy proceedings.

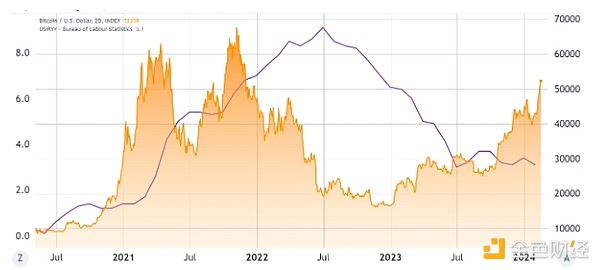

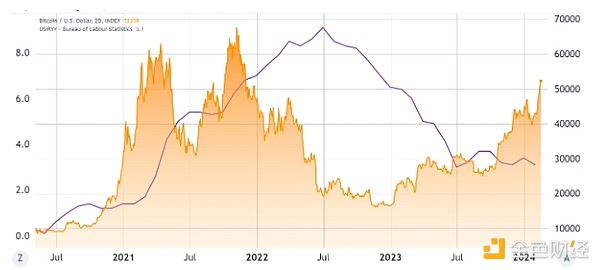

Low interest rates and soaring inflation drive Bitcoin to all-time highs

November 2021, Traditional financial fixed income yields are below 0.50%, which has led investors to seek risk assets with higher yields. us. Inflation, measured by the Consumer Price Index (CPI), also surged to 6.8% year-on-year in November 2021, the highest level since June 1982. Conditions at the time were strongly in favor of scarce assets, while stock market investors were worried about global supply chain disruptions and the pandemic impacting economic activity.

US CPI year-on-year inflation (left, purple) with Bitcoin. Source: TradingView

The latest CPI inflation data for January 2024 shows a year-on-year increase of 3.1%, which is still higher than the Federal Reserve’s expectations, but the magnitude is moderate. It would be naive to assume that current inflation risks are comparable to those seen when Bitcoin reached all-time highs. Data show that investors expect earnings growth for S&P 500 companies to be 10.9%, up from 3.8% in 2023. As a result, investors have little incentive to seek alternative assets compared to late 2021.

Spot ETF will transform Bitcoin into a full-fledged asset class

Since its launch on January 11 , the spot Bitcoin ETF industry recorded an impressive net inflow of $4 billion in the United States, with assets exceeding $35 billion, accounting for 3.5% of Bitcoin's market capitalization. By comparison, total gold ETF holdings are $210 billion, equivalent to 3% of its market capitalization if excluding about 50% spent on jewelry and medals. This does not mean that Bitcoin ETFs are approaching their limits, but it is a rough indication that the asset class is more mature than it was in November 2021.

An important selling point of Bitcoin is the inflow of institutional funds. However, its price is still 25% below its all-time high of $69,000, and even lower when adjusted for inflation or total fiat money supply.

Bitcoin adoption has increased, but optimistic expectations of a price of $100,000 or more have yet to materialize. On the bright side, launching a $3 trillion company in November 2021 is still a distant dream, but for Microsoft and Apple, it's already a reality. Therefore, as long as the dollar continues to lose value, Bitcoin is expected to surge above $70,000, but this is unlikely to happen before the halving in April.

Sanya

Sanya