Author: Yueqi Yang, Olga Kharif, Bloomberg; Compiler: Songxue, Golden Finance

-

Coinbase provides custody, trading, and financing for ETF issuers;

The arrangement poses concentration risks and may result in increased scrutiny.

The debut of a U.S. spot Bitcoin ETF thrusts Coinbase Global Inc. into the center of the cryptocurrency’s biggest mainstream moment to date. However, this seemingly enviable industry position also brings significant risks to the company and its partners.

After the U.S. Securities and Exchange Commission finally approved applications from nearly a dozen investment firms, including heavyweights such as BlackRock Inc. and Franklin Templeton, The first exchange-traded funds to directly invest in Bitcoin began trading last week. The products follow years of industry push and are hailed as a key development that will drive wider adoption of the world's largest cryptocurrency.

Most of these ETF issuers will rely on Coinbase to run their funds in some way, while the digital asset exchange will provide custody, trading and lending services to BlackRock and others.

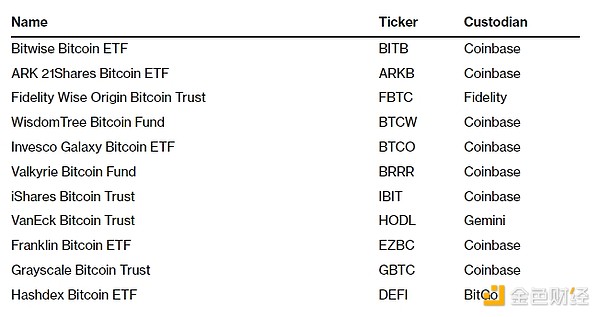

Coinbase Dominance

Most Bitcoin ETFs Issuer selects Coinbase as cryptocurrency custodian

Source: Bloomberg News, Bloomberg Information, U.S. Securities and Exchange Commission

However,while Coinbase stands to benefit from Bitcoin’s push into traditional markets, the arrangements highlight a concentration of risk that some see as potentially dangerous. Meanwhile,the emergence of a raft of funds offering discounted fees on Bitcoin investment vehicles poses a separate threat to revenue from Coinbase’s core trading platform.

“By design, our financial market infrastructure is divided into different roles,” said David Schwed, chief operating officer of blockchain security company Halborn. “When you have one entity responsible for the entire trade life cycle, I think that raises concerns."

Coinbase's multiple roles are a major concern for the SEC itself, which in June accused the company of operating an unregistered exchange, a broker-dealer and The SEC was embroiled in a legal battle with the company after the clearinghouse was deemed to be trading securities. Coinbase disputes the accusations, claiming the SEC overstepped its bounds.

SEC Chairman Gary Gensler made it clear that the agency does not endorse any of the funds’ arrangements and does not “approve or endorse cryptocurrency trading platforms or intermediaries that The agency is largely non-compliant”.

Coinbase is already the world’s largest cryptocurrency custodian and the most popular choice of custody provider for Bitcoin ETFs. But according to its risk disclosure, the issuer also noted that the company may have to limit or curtail some of the services it provides.

Dave Abner, principal at ETF advisory firm Dabner Capital Partners, said: “With so many companies using Coinbase as a cryptocurrency custodian, there is definitely concentration risk. ” “This seems like an unnecessary risk to investors, and I’m surprised that issuers don’t require a multi-custodian setup just to protect against unforeseen problems. ”

< Coinbase Chief Financial Officer Alesia Haas said the company "strives to avoid conflicts of interest" and that the market structure of traditional securities may not be suitable for cryptocurrencies. A spokesperson added that Coinbase’s custody business “is not an issue in our case with the SEC.”

Coinbase is currently the only trading agent for BlackRock, which will buy and sell Bitcoin for its ETF through Coinbase Prime. Its lending business, while only a small part of the organization, is another key cog in the Bitcoin ETF machine. Issuers such as BlackRock can borrow Bitcoin or cash from Coinbase for short-term trading.

But Coinbase’s ability to raise capital (from the company’s own balance sheet) could create a bottleneck for such transactions. To be sure, BlackRock at least has ways to manage the deal, even if it can't raise capital.

Coinbase Institutional Head Brett Tejpaul said,Coinbase offers bundled services across custody, trading and financing to provide a seamless process. Customers using different providers could end up creating more risks, he added.

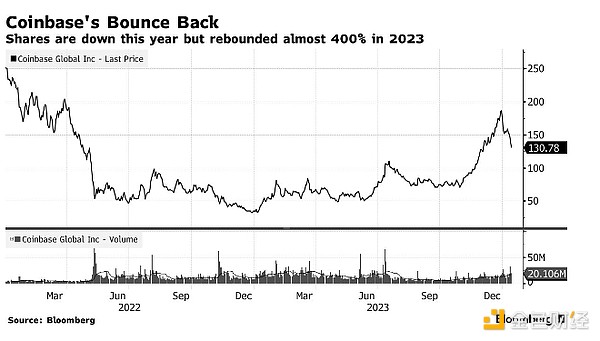

While Coinbase’s stock price rose nearly 400% last year as Bitcoin soared, the new ETF may only provide a boost for the company, according to a recent report from Mizuho revenue increased by 5% to 10%. Analysts estimate that the ETF may only add $25 million to $30 million in custody fees, and up to $210 million in incremental Bitcoin trading revenue on the platform. That’s a drop in the bucket compared to Coinbase’s total revenue of $2.15 billion in the nine months ended September 30.

Some existing customers may start buying Bitcoin through ETFs rather than on Coinbase, which charges higher transaction fees. Even if they don't,low ETF asset management fees could drive fee compression across the space, including at Coinbase, said Mizuho senior fintech analyst Dan Dolev.

Coinbase’s Haas said she doesn’t expect immediate trading fee pressure upon the Bitcoin ETF’s arrival, although the company may face fee compression in the longer term. Greg Tusar, head of institutional products at Coinbase, said: "We believe spot ETFs will be complementary to the cryptocurrency market and Coinbase."

Custody fees are much lower than trading fees, and as competition in this business increases, custody fees There may be further declines. There are alternatives to Coinbase: Fidelity Investments is using its digital assets arm to secure Bitcoin for its ETF. Cryptocurrency exchange Gemini, co-founded by Cameron and Tyler Winklevoss, is also looking to play a role and has secured VanEck Bitcoin Trust as a client.

For some, the fact that, as a public company, Coinbase is subject to more scrutiny than many other companies is arguably an advantage - which may attract more business in the long run . Bitwise chief investment officer Matt Hougan saidhis company chose Coinbase for custody because the company is “the largest and most established.”

Campbell Harvey, a finance professor at Duke University, said:“They want customers to feel as comfortable and confident trading on Coinbase as they do on Nasdaq ."

For now, Coinbase is enjoying a moment of victory. There was a buzz at the firm's sleek New York offices in Hudson Yards on Manhattan's west side as a Bitcoin ETF debuted Thursday. “None of us are sleeping,” said Emilie Choi, chief operating officer of Coinbase. “We’re so excited.”

Over time, ETFs may diversify into using multiple custodians as they look to reduce their reliance on a single company — even if they are not ordered to do so. Haas is prepared for this possibility. While Coinbase has been a trusted choice over what she said were numerous other exchange-traded products and regulated funds, she acknowledged thatas assets grow, issuers may turn to secondary custodians for “redundancy.” Yu and Diversity”. She noted that ETF issuers in traditional financial markets often have multiple custodians, although she expects Coinbase to retain a large portion of its assets.

Huang Bo

Huang Bo

Huang Bo

Huang Bo JinseFinance

JinseFinance Sanya

Sanya JinseFinance

JinseFinance Bernice

Bernice Sanya

Sanya JinseFinance

JinseFinance Kikyo

Kikyo JinseFinance

JinseFinance TheBlock

TheBlock