On May 9-10, Bitcoin Asia was held in Hong Kong, where many giants gathered and spoke freely. Among them, Han Tongli, CEO of Harvest Fund, discussed the possibility of including BTC and ETH ETFs in the ETF Connect program, which is part of the broader "Stock Connect" program launched in 2014 to connect Hong Kong and mainland China exchanges.

It sounds very exciting. If the plan can be realized, it does mean that mainland residents can buy BTC and ETH ETFs. Han Tongli further stated that "as long as everything goes well in the next two years, we do not rule out applying to include our ETF in the Connect program."

The excited mainlanders must have this question, why can't this plan be realized immediately and it will take another two years? Because there are still some obstacles to the realization of the path mentioned by Mr. Han.The specific main obstacles are as follows.

What is Stock Connect?

Stock Connect refers to a trading and settlement mechanism established between securities markets in different countries and regions, allowing investors to directly invest in stocks or other securities products in the other market through local markets. The stock connect program between the Chinese mainland and the Hong Kong market mainly includes two parts: Shanghai-Hong Kong Connect and Shenzhen-Hong Kong Connect:

1. Shanghai-Hong Kong Connect: It was launched on November 17, 2014, allowing investors from the Shanghai Stock Exchange (SSE) and the Hong Kong Stock Exchange (HKEX) to buy and sell stocks in the other market through their respective trading and settlement systems.

2. Shenzhen-Hong Kong Connect: It was launched on December 5, 2016, expanding the scope of the Connect, including the Shenzhen Stock Exchange (SZSE), and further expanding the types of stocks that investors can trade.

On July 4, 2022, ETF interconnection was officially launched, allowing qualified mainland and Hong Kong investors to invest in ETF products in each other's markets across borders. The interconnection depositary receipt business is also part of the interconnection mechanism. It allows overseas companies to list on the other side's market by issuing depositary receipts (CDRs or GDRs), thereby achieving cross-border financing and investment

In short, the stock interconnection plan is an important measure for the opening up of China's mainland capital market. Having said that, the opening up of the mainland capital market has always been a process of groping in the dark, so it can be imagined that the tradable targets in the stock interconnection plan have strict conditions. For example, stocks usually need to be constituent stocks of the main indices of the two places and meet certain market capitalization, liquidity and other standards.

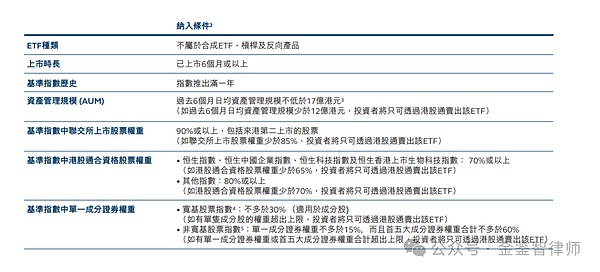

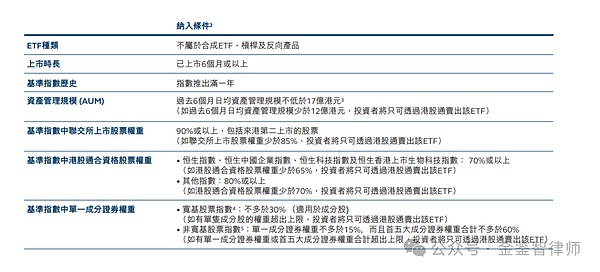

Specific to ETFs, there are many requirements that need to be met for ETFs on the Hong Kong Stock Exchange to become tradable investment targets, as shown in the figure below. However, Hong Kong's BTC and ETH ETFs currently cannot meet the requirements in terms of asset management scale, listing time and index composition.

Image source: Hong Kong Stock Exchange's "ETF inclusion in the Stock Connect Mechanism - Issuer Notes (Updated on May 27, 2022)"

We have always looked at things from a development perspective. There will be no problem with the listing time and management scale, but there will definitely be a disaster in the index composition. Currently, the constituent securities of ETFs in the Stock Connect need to be mainly Hong Kong stocks, but BTC and ETH ETFs arevirtual assetETFs, which do not meet the above-mentioned requirement that constituent securities are mainly Hong Kong Stock Connect target stocks. If we want to break through the obstacles of index composition, we need specific approval and rule-making for such products by regulatory authorities. And this depends on the efforts of excellent securities firms represented by Harvest Fund. Under the current favorable conditions of Web3 in Hong Kong, the regulatory forecasts on the Hong Kong side are not too much of an obstacle, so the pressure is on the mainland.

Does the mainland regulatory policy allow it?

For mainland retail investors, buying and selling virtual currencies has never been explicitly prohibited. If the total assets of the securities account and the capital account are not less than RMB 500,000, which meets the conditions for opening the Shanghai-Shenzhen-Hong Kong Stock Connect, purchasing BTC and ETH ETFs through the interconnection is also a worry-free investment method.

However, to implement the plan to open the Bitcoin Ethereum ETF to the mainland, the financial institutions represented by securities companies in the mainland will be under great pressure. The "Announcement of the People's Bank of China and Seven Other Departments on Preventing the Risks of Token Issuance and Financing" (94 Announcement) and the "Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation" (924 Notice) both clearly stated that financial institutions shall not provide services for virtual currency-related business activities. Financial institutions shall not provide services such as account opening, fund transfer, and clearing and settlement for virtual currency-related business activities, shall not include virtual currency in the scope of collateral, shall not carry out insurance business related to virtual currency or include virtual currency in the scope of insurance liability.

That is, mainland securities firms providing mainland retail investors with BTC and ETH ETF purchase services will clearly violate the 94 Announcement and the 924 Notice.

Summary

The 94 Announcement and the 924 Notice are both policy regulations. The 94 Announcement was issued in 2017, and the 924 Notice was issued in 2021. It can be said that it has been some time since then. Policy regulations have always been changeable, just like the housing purchase restriction policy. It is difficult for us to predict how the policy will change in the future, but in the process of historical development, we will see some unstoppable trends. There must be a big gap between the trend and the current situation. No one knows in what form and at what time the gap will be narrowed, but there are always many people working hard.

JinseFinance

JinseFinance