Author: Arjun Chand, Bankless; Compiler: Baishui, Golden Finance

Restaking is one of the biggest cryptocurrency investment topics in 2024, and with the EigenLayer mainnet now up and running, the excitement is only growing.

It is a Lego building block in the cryptocurrency field that others can use to create different financial applications. The coolest thing that came out of this is the concept of liquidity restaking. There are now applications that allow you to restake your ETH with EigenLayer, and they are making waves in the ecosystem and attracting billions of dollars.

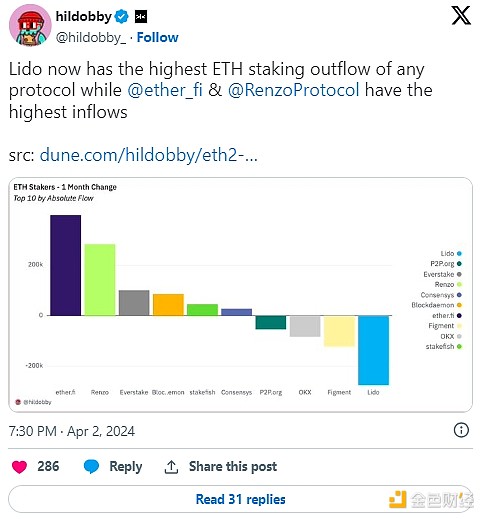

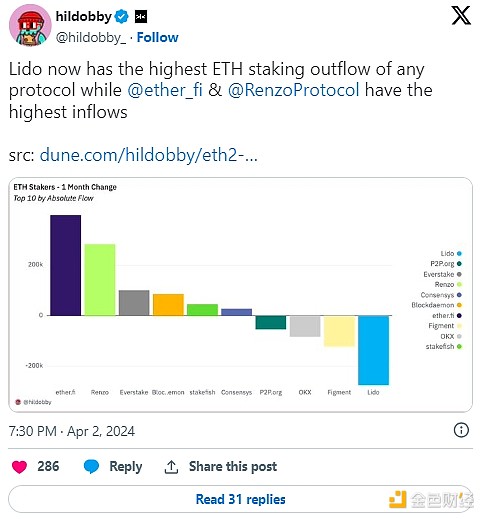

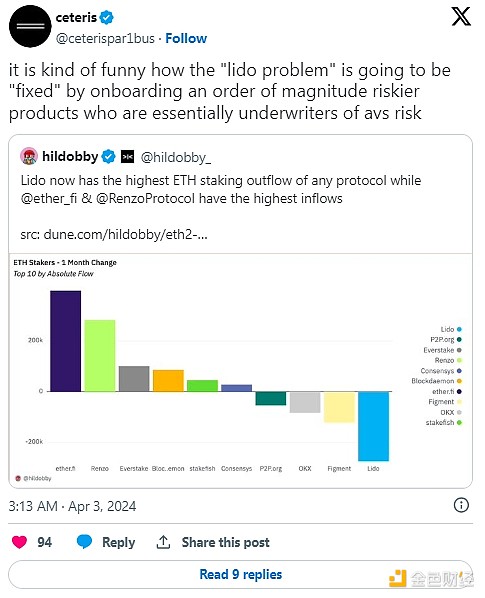

There is a clear shift in the way people stake ETH. More and more people are choosing restaking protocols instead of the usual liquidity staking options. In fact, Lido has seen more ETH outflows than any other protocol. On the other hand, restaking platforms like Ether.fi and Renzo are getting the latest inflows.

As of this writing, Lido’s market share of staked ETH has fallen below 30% after years of climbing. Additionally, Ether.fi’s recent shift in the amount of ETH staked in Rocket Pool is a real indicator of how people are moving their funds to re-staking protocols.

So why is everyone rushing to re-stake their ETH? What does this mean for Lido’s future? Today we’ll explore these questions and more.

Why are liquidity restaking protocols so hot?

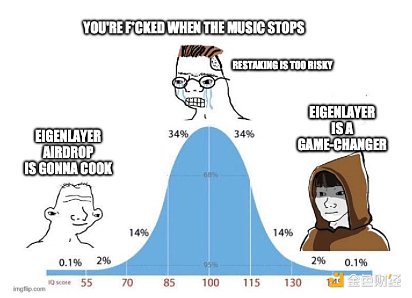

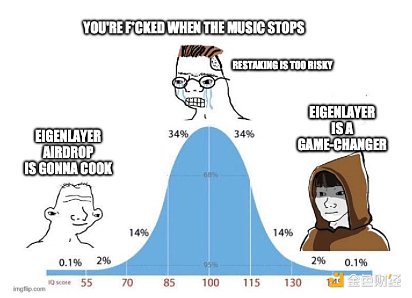

EigenLayer has been hailed as a game-changer for the Ethereum ecosystem. Rumor has it that this could be the largest airdrop in DeFi history.

From VCs to degens, everyone wants a piece of the EigenLayer pie, and collecting EigenLayer restaking points is the best way to increase your chances of getting an airdrop.

There are multiple ways to collect these points!

Native Restaking - You can run an Ethereum validator node and create an EigenPod to join native restaking. This method is a bit technical and may not be for everyone as it requires a lot of effort.

Liquidity Restaking with LST - A simpler option is to restake Liquidity Staking Tokens (LST), such as stETH from Lido or rETH from Rocket Pool. Simply deposit your LST into EigenLayer and you can start collecting points. But there’s a catch: with EigenLayer set to launch mainnet soon, there’s a cap on these deposits. This is to keep an eye on the system and ensure it remains stable as more users come onboard. It also leaves room for new protocols to emerge and prevents big players from taking over the re-delegation scene.

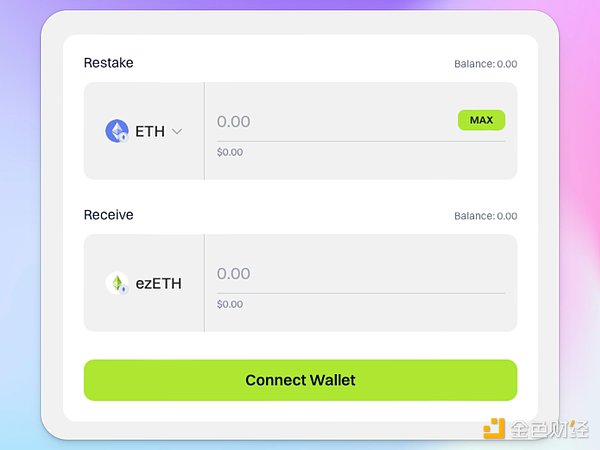

Liquidity Re-staking with LRT — The latest trend is using liquidity re-staking protocols like Ether.fi and Renzo. Deposit your ETH or LST and you’ll get liquidity re-staking tokens (LRT), like eETH for Ether.fi or ezETH for Renzo. Holding LRT can be rewarded in a variety of ways: extra yield, more points, and the potential for airdrops through various protocols. That’s why everyone is so excited about liquidity re-staking protocols right now.

When the right incentives are in place, crazy things can happen, and that’s exactly what’s happening with liquidity re-staking protocols.

Let’s take Ether.fi as an example and break down the incentive flywheel that drives the re-staking craze:

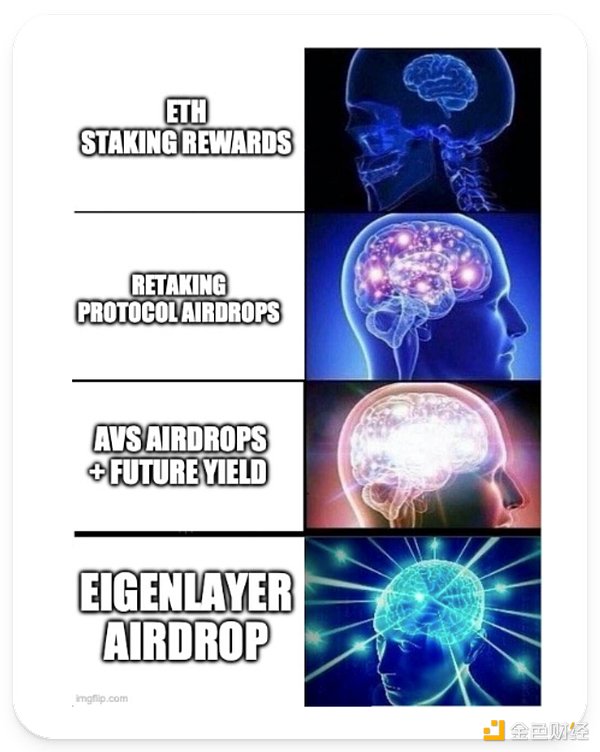

EigenLayer Points — Ether.fi passes 100% of EigenLayer Points and any other benefits of holding eETH/weETH to its users.

Liquidity Re-staking Protocol Points — In addition to this, users can also earn Ether.fi loyalty points and badges through certain actions. From the outset, the Ether.fi team has made it clear that these loyalty points will play a role in the decentralized governance of the protocol, providing users with a two-for-one airdrop mining opportunity. Recently, Ether.fi distributed 60 million of its native token ETHFI to users via an airdrop. But the rewards are not over yet. With more ETHFI airdrops still remaining, users are incentivized to continue holding eETH after the airdrop.

Active Validation Service (AVS) Airdrop - The protocol that created AVS using EigenLayer has announced additional airdrops for those who participate in restaking. For example, earlier this year, Ether.fi users received a nice bonus through AltLayer's ALT airdrop.

Ethereum Native Staking Rewards - On top of all these benefits, users can also earn the standard ~3.3% APR for staking ETH, which is the reward you get on the Ethereum network. After the ETHFI airdrop, staking incentives on the platform are even stronger, with a potential annualized return of over 50% on ETHFI.

Future AVS Yield – This part of the flywheel hasn’t even started yet. The whole idea behind EigenLayer is to earn additional yield by using ETH to secure other protocols and networks. The Liquid Restaking Protocol will put your capital to work, securing AVS and earning yield in return.

Combine these incentives with the energy of a bull market, where investors are willing to take on risk for higher returns, and you have a powerful engine for growth.

Is Staking the Future of Lido?

We are witnessing this in real time as new restaking protocols quickly accumulate billions in TVL. As these LRTs become more trusted and attract more capital, their rise seems unstoppable, attracting more users and investment.

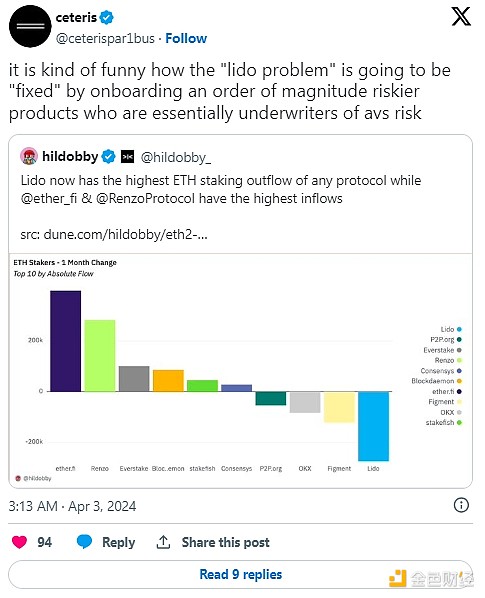

However, the financial landscape seeks balance. When capital moves to new opportunities, it tends to pull out of others. In the restaking meta, liquidity staking protocols like Lido are at the other end of the spectrum — Lido still holds over 29% of the market share of total ETH staked, but its share is slowly declining due to the emergence of restaking protocols.

The reason for this shift is simple: opportunity cost.

Why would a user settle for a single-digit APY on liquidity staking when restaking can offer the same yield plus additional benefits and lucrative airdrop opportunities? In a bull market, the choice seems obvious.

This doesn’t mean Lido is disappearing. Its role in securing the Ethereum network and promoting stability and decentralization is irreplaceable. Restaking protocols, while offering higher returns, come with greater risks, such as the possibility of ETH slashing. In contrast, Lido offers a safer, more reliable option for ETH yields with less risk of slashing.

Both have a place in the ecosystem as they cater to users with different risk profiles. It remains to be seen whether restaking protocols will be able to sustain their growth and maintain TVL once the airdrop incentives dry up. However, this dynamic shows that even giants like Lido can face competition if the incentives are right.

The rise of the restaking meta may prompt Lido to innovate and perhaps even launch its own restaking platform. Only time will tell how the market will develop.

Top LRT Protocols to Consider

It’s not just Ether.fi that’s leading the LRT craze. If you decide to embrace restaking this cycle, here are three other restaking protocols to keep an eye on:

Renzo

Renzo is EigenLayer’s restaking token (LRT) and strategy manager.

With nearly $3 billion in ETH revalued, Renzo is the second-largest LRT protocol by ETH staked, and growing fast, with over 510k ETH in net inflows in the last three months, comparable to Ether.fi.

Users can use Renzo to restake ETH, wETH, and LST (on select chains) on multiple networks, including Ethereum, Arbitrum, BNB Chain, Mode, and Linea.

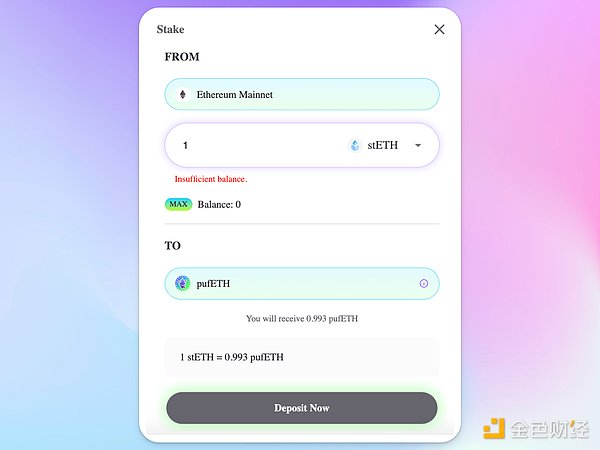

Puffer Finance

Puffer is a decentralized native liquidity re-pledge protocol (nLRP) built on Eigenlayer. Puffer has over $1.3 billion in restated ETH, accounting for nearly 14% of the total LRT market supply.

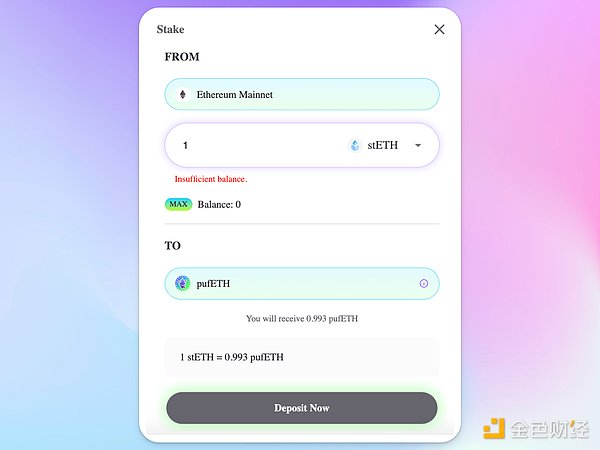

Staking stETH and wsETH with Puffer on Ethereum will generate pufETH, which can be further utilized in liquidity pools on platforms such as Pendle and Curve.

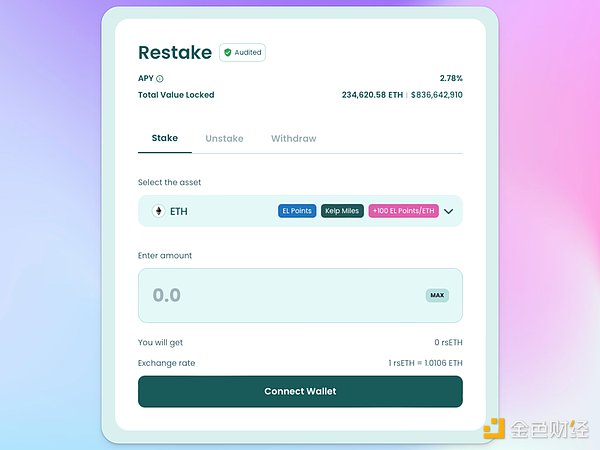

KelpDAO

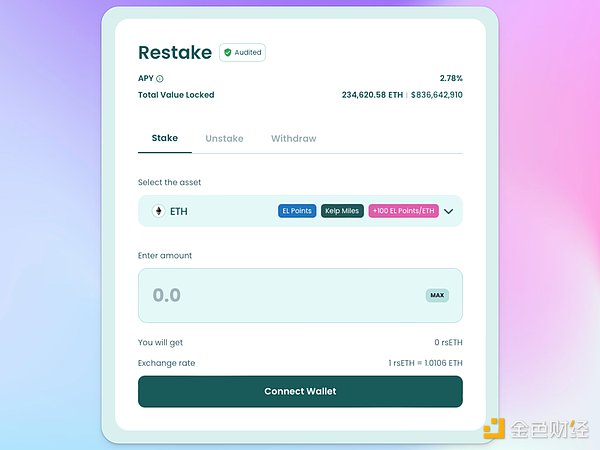

Kelp is a multi-chain liquid staking protocol that is building an LRT solution rsETH for Ethereum on EigenLayer.

Kelp allows users to stake ETH and LST on Ethereum, as well as ETH on various L2s such as Optimism, Base, Mode, Arbitrum, Blast, and Scroll.

Conclusion

Given that EigenLayer could become one of the largest airdrops in the history of cryptocurrency, it would be wise to position accordingly and accept re-collateralized dollars.

JinseFinance

JinseFinance