Author: Yashu Gola Source: cointelegraph Translation: Shan Ouba, Golden Finance

Bitcoin prices are offsetting concerns about Mt. Gox due to favorable macroeconomic factors, but some analysts predict that Bitcoin prices may fall below $50,000 in the coming weeks.

A series of adverse events have roiled the Bitcoin market, such as Mt. Gox's repayment of 140,000 Bitcoins to creditors and the German government's ruthless Bitcoin liquidation. Both factors have increased the possibility of billions of dollars of Bitcoin being sold, which has led traders to wonder whether the Bitcoin market will have more downside after a 15% drop in the first week of July.

Analyst: Bitcoin will fall below $38,000

Independent market analyst Matthew Hyland has confirmed a downside price target for Bitcoin below $38,000.

In a July 8 X post, Hyland cited Bitcoin’s breakout from a multi-month consolidation range on the weekly chart to support his bearish view, noting that the probability of the cryptocurrency returning to the same range is low.

Bitcoin’s weekly relative strength index (RSI) reading is around 45, further confirming the bearish outlook.

This RSI level suggests that neither buyers nor sellers are in control of the market. However, the current market downtrend suggests that the RSI has more room to fall, at least before reaching the oversold threshold of 30, which typically signals a price rebound.

Similarly, Bitcoin could continue to fall until the RSI reaches an oversold reading of 30, which could coincide with Hyland’s downside target below $38,000.

“The weekly RSI is almost back to the lows of August/September last year, when BTC was trading at $25,000,” Hyland reminded, adding: “Another red weekly candle could push the RSI lower, providing an opportunity for a bullish divergence”

Is $50,000 the next bottom for Bitcoin?

Anonymous market analyst Stockmoney Lizards also expects the price of Bitcoin to plunge further. However, his downside target is around $50,000.

Chartists cite the so-called “Bat Harmonic” pattern to explain its limited bearish bias. The pattern begins with an initial price move (XA), followed by a retracement (AB), another move (BC), and finally a final move (CD) that extends to 88.6% of the XA move.

Point D is a key area where traders expect a reversal, which is usually confirmed by other signals such as candlesticks or volume. In the case of Bitcoin, Point D coincides with the $50,000 level, after which the price could recover significantly.

Stockmoney Lizards explained: "We are waiting for another liquidity flush, and possible long-term support below 50k to establish support at 52k," adding: "Indicators such as the daily RSI are already oversold, but we think there is still some room to the downside. Ideally, we would consolidate at 52k and form a bullish divergence on high volume which would be our reversal signal. ”

Macroeconomic Outlook for BTC Prices

Supportive economic data from the United States, especially Wall Street’s increased bets on a possible interest rate cut in September, have helped ease Bitcoin’s bearish outlook in the current correction cycle.

According to the Chicago Mercantile Exchange (CME), as of July 8, futures interest rate traders’ expectations for a 25 basis point rate cut in September have increased to about 67.3% from 46.6% a month ago. This shift toward a more dovish outlook has gained momentum after disappointing U.S. jobs data released on June 5 triggered a sharp drop in short-term yields.

Falling yields reduce the opportunity cost of holding safer investment assets such as U.S. bonds. Instead, they boost demand for riskier assets such as cryptocurrencies and stocks. The S&P 500 and Nasdaq both hit record highs at the close of last week, June 5.

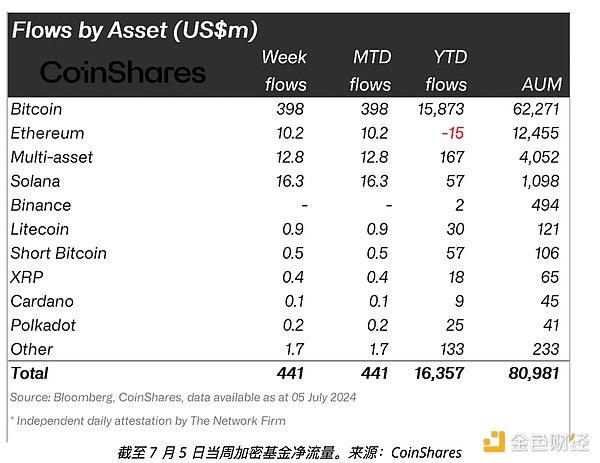

Bitcoin has also caught up with the rally, reversing the decline led by Mt. Gox and the German government. Bitcoin has risen 7% from a low of $53,550 set on June 5. Meanwhile, $398 million worth of funds have flowed into Bitcoin investment funds, including exchange-traded funds (ETFs), each week.

Favorable macroeconomic catalysts, coupled with inflows into Bitcoin funds, provide a positive technical backdrop. Notably, BTC is currently testing its multi-month ascending trendline support, poised for a sharp rally toward its multi-month horizontal trendline resistance around $71,500 in the third quarter of 2024.

Conversely, a break below ascending trendline support could see prices fall to the 0.786 Fibonacci Retracement level around $51,500, a level closer to the aforementioned Stockmoney Lizards analysis.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Nulltx

Nulltx