Source: Vernacular Blockchain

In just two years, it went from being unknown to being valued at more than 13 billion US dollars, and then in another two years, it was "cut off" from a valuation of tens of billions of US dollars 9 What kind of experience will it be like to experience such a seemingly "roller coaster" of ups and downs, to the point of considering selling yourself?

This is the truest portrayal of OpenSea in the past four years - not long ago, OpenSea CEO and co-founder Devin Finzer revealed thatOpenSea has received acquisition intentions for It remains open to potential acquisitions, but did not specify when or by whom.

As a "unicorn" level existence that was almost discontinued in the NFT trading market, how did OpenSea rise rapidly, and how did it fall to the front in the competition in the NFT market? What possible disruptors and variables will the future NFT market structure usher in?

01 OpenSea: A unicorn with a valuation of over 10 billion, now “cut off”

Like Uniswap and Dune, OpenSea is also an entrepreneurial miracle that started from scratch and rose rapidly in the Web3 field -Especially in the two years starting from 2021, OpenSea's valuation has been overwhelming, rising from once no one cared about it to US$13 billion , becoming the “top spot” in the entire NFT market.

The beginning of all the stories begins in January 2018, when the two co-founders of OpenSea, Devin Finzer and Alex Atallah, created OpenSea for users to buy and sell NFTs.

But because the entire NFT market is still deserted except for Cryptokitties, which once triggered short-term speculation, the platform's NFT trading users and transaction volume have been hovering at low levels.

Until March 2020, OpenSea had only 5 employees, and the monthly transaction volume fluctuated around US$1 million. Calculated based on the 2.5% commission at that time, it meant that the monthly income was only 2.8 Fortunately, Animoca Brands invested US$2.1 million at the end of 2019, allowing OpenSea to maintain financial balance.

OpenSea’s real take-off started in 2020. The two joint ventures planned to double their business volume by the end of 2020. Unexpectedly, with the gradual recovery of the encryption market starting in the second half of 2020, OpenSea’s The business volume soared rapidly, and the task was completed ahead of schedule in September 2020.

Starting in 2021, the NFT bull market has completely kicked off. The number of active users and transaction volume of OpenSea has been rising. In July 2021, the transaction volume surged to 350 million U.S. dollars, and it gained The US$100 million financing led by a16z has a post-money valuation of US$1.5 billion.

A month later, in August 2021, OpenSea’s trading volume soared tenfold again, reaching US$3.4 billion, earning more than US$85 million in commission income.

From then until January 2022, OpenSea was almost unbeatable, with a monthly trading volume of more than 3.5 billion US dollars, occupying 90% of the market share of the NFT industry, and a highest valuation of more than 13.3 billion US dollars. Therefore, from the data From a dimensional perspective,OpenSea is definitely "too big to fail" in the entire NFT market, even far exceeding Uniswap's market share and influence in the DEX track.

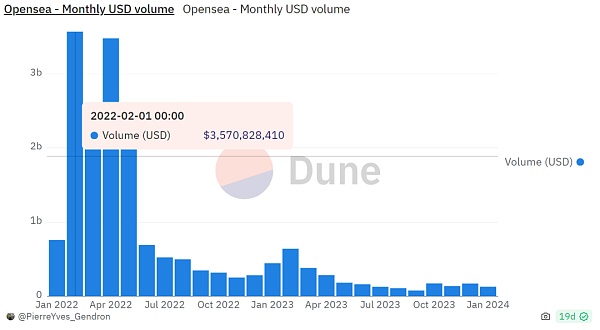

OpenSea’s monthly trading volume from 2022 to 2024

OpenSea’s monthly trading volume from 2022 to 2024

And this has also become OpenSea’s swan song to dominate the NFT trading market. As the first to lay out the NFT trading market and completely explode The pioneer of dividends,OpenSea's transaction volume plummeted in June 2022:

From nearly $2.6 billion in May to less than $700 million in June, OpenSea's monthly trading volume has now dropped to US$120 million, a drop of more than 95% from the peak in January 2022.

According to reports from Bloomberg citing people familiar with the matter, Tiger Global Management has currently written down the value of its shares in OpenSea by 94%, and Coatue has also reduced the value of its shares in OpenSea by 90% to US$13 million, almost It's all "toe chop".

02 NThe evolution of the FT track

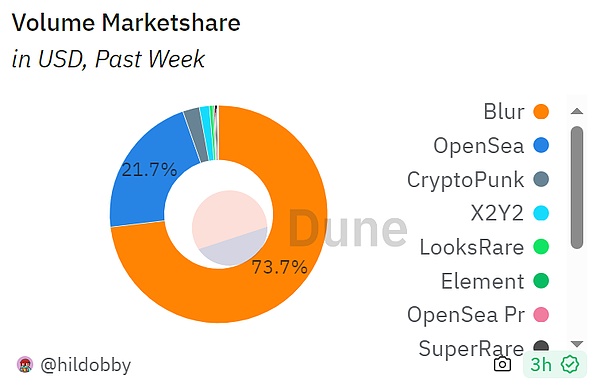

The heaviest blow to OpenSea is It is the new overlord that now accounts for more than 70% of the NFT trading market - Blur,an NFT platform launched at the end of 2022. Through Airdrop Token, it quickly surpassed OpenSea in less than a year and became the largest NFT. market.

Dune data shows that as of the time of publication in the past week, Blur’s share of the NFT market was as high as 73.7%, ranking first; Opensea’s share was 21.7%, ranking second.

NFT trading platform market share

If we review the evolution of the NFT track pattern and Blur's extremely powerful "disruption" ability, we will find that all changes have Not surprising.

"Vampire Attack" by LooksRare, x2y2

< p>First of all, the rise of OpenSea is inseparable to a certain extent from its first-mover advantage gained through perseverance in the trough.

After the NFT bull market broke out, OpenSea’s dominant position in the NFT trading market Competition in product dimensions and “vampire” attacks have almost never stopped. As we all know, there is an obvious trend in the Web3 and encryption world. Whether it is DeFi, NFT, chain games or infrastructure, there are more and more similar projects, but The homogenization competition is serious, and the differences among everyone are almost limited to differences in names, UI, token incentives, transaction fees, etc.

“In market competition, it doesn’t matter who copies who, what matters is who is first.” This is especially true for Web3. This view has been repeatedly proven since Sushi’s vampire attack on Uniswap. .

So starting in 2022, a number of "OpenSea killers" such as LooksRare and x2y2 began to focus on OpenSea's delay in issuing Tokens, and temporarily gained a relative advantage by relying on the incentive form of Token distribution. , but Airdrop’s involution failed to really shake Opensea’s position.

Almost all of the transaction reward mechanisms triggered a large number of false orders. After a short period of prosperity, they quickly fell into silence, and no strong competitor emerged to truly occupy the NFT market share.

Blur: The real "wall-breaker" in the NFT track

At the end of 2022, Blur appeared and launched Bid Airdrop, which went further than the transaction reward mechanism (Bid Airdrop is a marketing strategy in crypto asset projects that aims to attract participants by participating in auctions or bidding (distribution of tokens by users), which completely solves the problem of insufficient NFT market depth:

Encourage bids (make offer), the closer the bid is to the floor price (floor price), the more rewards, "essentially "The leeks of the secondary market acquisition platform Token are subsidizing bidders." This is also similar to the rise of Aave - an agreement that helps large players "ship" is a good agreement.

Looking at the development trajectory of the past year, Blur and its founder Tieshun can be said to be the top "wall-breakers" in various "mature tracks":

NFT trading track:Blur subverted OpenSea, which was firmly established in Diaoyutai, and "cut off" its valuation from US$13.3 billion to US$1.4 billion;

NFT lending track:Blend’s total loan transaction volume exceeded US$4.6 billion, becoming the leader;

L2 track:Blast’s TVL exceeded US$1.78 billion, according to L2Beat According to statistical data calculation, it is second only to Arbitrum (USD 12.34 billion) and Optimism (USD 6.6 billion), higher than a series of other L2s such as Base and zkSync, and ranks among the top three L2s.

03 New trends in the NFT market

Since 2023, in addition to Blur completing the "replacement" of OpenSea, There are also some potential variables that have emerged.

First of all, the rise of pan-Bitcoin NFT represented by Ordinals has set off a new wave of "BitcoinFi", and the activity of transactions within the Bitcoin ecosystem has reached a new peak.

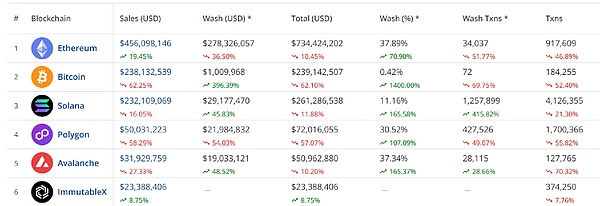

According to the Cryptoslam data below, NFT sales on the Bitcoin chain reached US$238 million in the past 30 days, making it the second largest blockchain in terms of NFT sales, second only to Ethereum ( US$456 million), higher than Solana (US$232 million) and Polygon (US$50.03 million).

Dune’s latest data shows that as of February 16, the cumulative number of Ordinals inscription castings The fee exceeded 6150 BTC, which is more than 320 million US dollars.

This has also given rise to the rise of Bitcoin-based NFT trading markets such as the OKX Web3 Wallet Ordinals Market and the UniSat NFT Trading Market. As of last week, the total transaction volume of the OKX Web3 Wallet Ordinals Market has exceeded US$1.3 billion.

In addition, starting from the second half of 2023, the NFT market seems to have begun to gradually stabilize. The floor prices of many blue-chip NFTs have begun to rebound or rise sharply. The NFT track in the Solana ecosystem has also ushered in A new hype cycle.

At the same time, ERC404 and other inscription-like pan-NFTs have re-emerged as “new assets” with duality. Such pan-NFTs can be used both in OpenSea transactions can also be traded on Uniswap, which may also have a greater impact on the NFT market structure in the future.

In particular, Uniswap has previously acquired the NFT trading market Genie, sending a clear signal to enter the NFT trading market - Genie aggregates transactions in other NFT markets, and Uniswap provides transaction depth.

In general, competition in the NFT market has been competing around the product dimension and asset dimension:

Blur’s product dimension through the liquidity reward mechanism Innovation, dimensionality reduction in the first half of 2023 hit many older generation NFT trading platforms such as OpenSea and x2y2;

OKX, UniSat, etc., relied on the new asset class of inscription to rise rapidly in the second half of 2023 , opening up new territory;

Now that 2024 has begun, the rising popularity of ERC404, as a new asset type, will give traditional Token trading protocols such as Uniswap new NFT tickets, thus Stirring the NFT market landscape in 2024? Worth paying attention to.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Miyuki

Miyuki Alex

Alex Jixu

Jixu Alex

Alex Bitcoinist

Bitcoinist Others

Others Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph