1. Explanation of MACD indicator

1. Conceptual definition MACD (Moving Average Convergence Divergence) is about the relationship between two moving averages. One is a fast line and the other is a slow line. Basically, the function of the MACD indicator is to judge and speculate the change or continuation of the price trend.

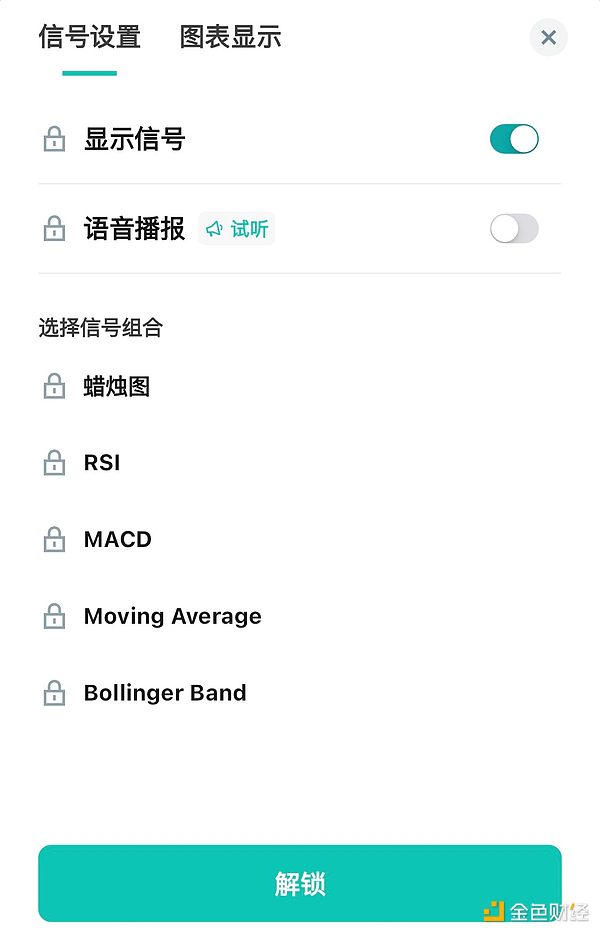

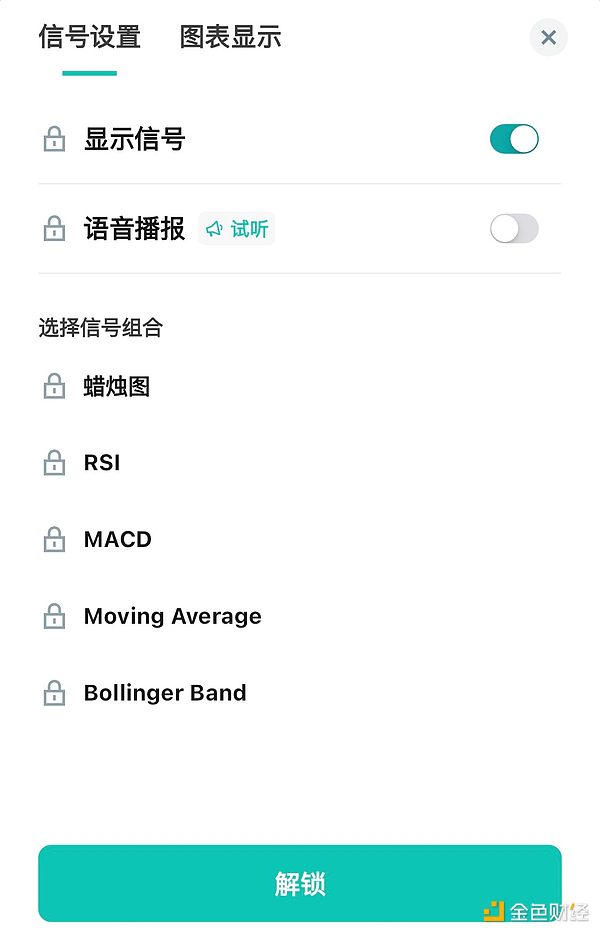

2. How to turn on the MACD indicator? Open the indicator library, search for the MACD indicator, and select it. The MACD indicator will appear below.

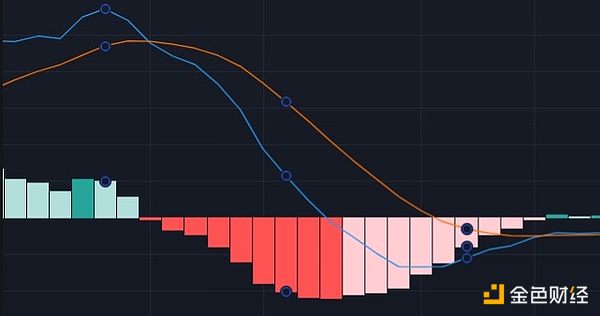

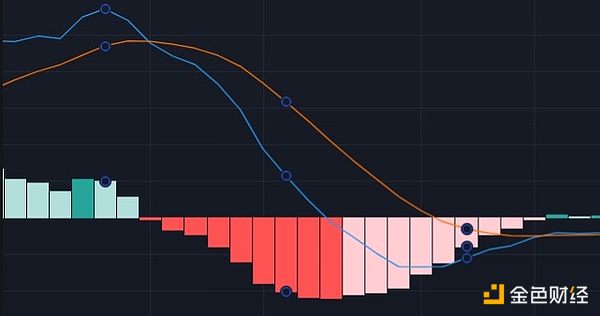

3. Blue line and orange line The green line (DIF, fast line) is the difference between the short-term (12-period) EMA and the long-term (26-period) EMA, also called the "fast line". It reflects market changes in a shorter time span, so it is more sensitive than the slow line. The orange line (DEA, slow line) is the 9-period EMA of DIF, also called the "slow line". It is a smoothed line calculated by DIF, reflecting market changes in a longer time span, so it is smoother and lagging than the fast line. The MACD energy column shows the difference between DIF and DEA. Based on these three elements, we can judge the trend and momentum changes of the market.

2. MACD Golden Cross and Dead Cross Trading Strategy

When the price is in a downtrend, the fast line crosses the slow line upward, which is the so-called golden cross. This means that the trend is about to change from a downtrend to an uptrend, which is a long trading opportunity. When the price is in an upward trend, the fast line crosses the slow line downward, which is a dead cross. This means that the trend will change from rising to falling, so this is a reasonable short entry point. This is the traditional use of MACD.

Three, MACD divergence trading strategy

1. MACD top divergence When the high point of the price is higher than the previous one, it is a top-to-top high. Logically speaking, MACD should also form a top-to-top high to correspond to the trend momentum of the price. However, at this time, MACD forms a top-to-top low, and the trend momentum of the price shows signs of weakening. The second high point is higher than the first one, which is a top-to-top high. When the price forms a top-to-top high, but MACD forms a top-to-top low, it is a top divergence. Seeing that the price forms a top-to-top high, but MACD forms a top-to-top low, it is a top divergence. The price trend is likely to turn downward. We need to find the key price + MACD trend reversal divergence to confirm the trend.

2. MACD bottom divergence When the low point of the price is lower than the previous one, it is a bottom-to-bottom low. However, MACD forms a bottom-to-bottom high, which means that the buyer's momentum begins to intervene, and the price decline momentum gradually weakens. The trend will most likely change from a downward trend to an upward trend. When the price forms a bottom-to-bottom low, MACD forms a bottom-to-bottom high, which is a bottom divergence. When the bottom divergence is formed, it means that the trend will most likely change to an upward trend, which is a reasonable opportunity to buy and go long.

3. MACD trend reversal trading strategy Key price + MACD trend reversal divergence, as long as two vertices are found to form a line, the bottom macd also finds the corresponding two vertices. The first step is to determine the key support level. We can see that the price has tested this support level many times and has risen a lot, so this is the key support level. When the price returns to this key support level again, we can look for a long trading signal. For example, we find a mountain peak that has gone through a round of ups and downs and returned to the support level. However, please note that you cannot go long now. Because we need one more signal to confirm that this bottom divergence is valid. We can draw a downward trend line to see a descending wedge triangle, which is a bullish chart pattern. When the price breaks through the descending wedge triangle, we can enter the market to go long. If these two points are met and the downward trend line is broken, we can consider going long. Or we can draw a line at the previous high of the downward trend. When the price breaks through the previous high, it means that the trend has been broken. The price is likely to change from a downward trend to an upward trend. We can enter the market to go long after the price breaks through the previous high. Summary: Key price + MACD trend reversal divergence.

4. How to find the support level? The support level can be understood as multiple retracement points, forming a valley or a peak, and there will be multiple retracements at the foot of the mountain. It can be a small range of prices or a point. The MACD divergence + key price we just talked about, the key price is whether this support level has been broken.

Kine Protocol's smart K-line function is a high-quality tool customized exclusively for lazy friends. Customized indicators and voice broadcasts can help any Kine Protocol user friends plan their transactions and trade their plans. If you want more customized indicator strategy displays and multiple warning reminders, please activate the smart K-line signal warning function.

JinseFinance

JinseFinance