BONK's price appears to have hit a plateau, signaling a potential period of consolidation. The number of traders remains stable, but trade volume is declining. The Relative Strength Index (RSI) is currently below the overbought stage, suggesting the market may be calming after a surge in early March.

The RSI for BONK has dropped from 79 to 67 in the past twenty days, indicating a move towards stability. Historically, an RSI above 70 often precedes price hikes, while a lower RSI like 67 suggests a period of market consolidation.

The Exponential Moving Averages (EMA) for BONK are converging, indicating a potential bearish trend and the possibility of a new correction or market consolidation.

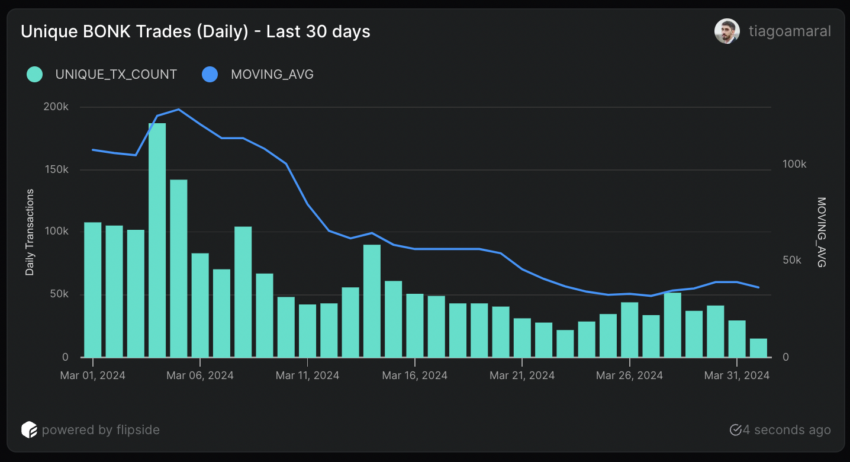

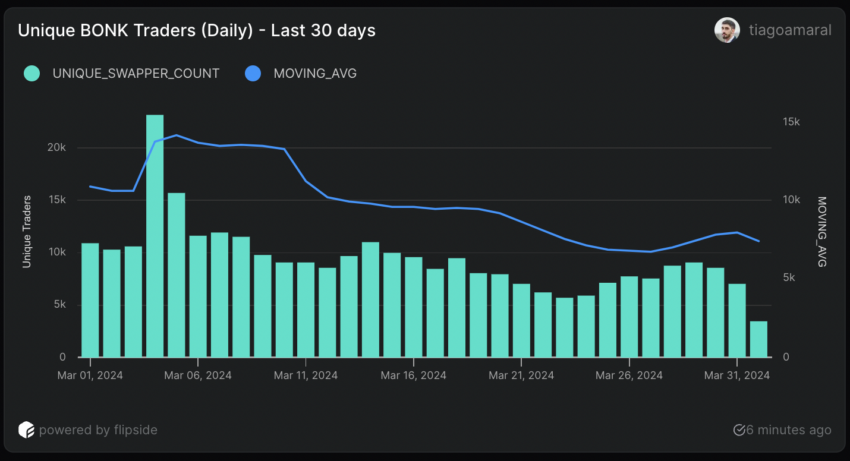

Trading activity for BONK has been on the decline, with daily trades dropping from a peak of 187,000 to 22,200 by March 23. The number of active traders has also decreased, from 9,030 on March 29 to 7,050 by March 31.

BONK's short-term EMA lines are converging towards a long-term EMA line, suggesting a move towards market consolidation. If BONK can hold above the support level of $0.000024 and $0.000021, its price may stabilize. However, failure to maintain this support could lead to a downturn towards $0.0000195, while an uptrend could see the price retest resistance levels at $0.000035 and $0.000036.

Aaron

Aaron