Source: Liu Jiaolian

Where there is a will, there is a way. If the cauldron sinks the boat, one hundred and two Qin passes will eventually belong to Chu. The painstaking efforts of man and nature will not let him down, and he will suffer hardships while sleeping on the firewood. Three thousand Yue Jia can swallow Wu.

Overnight BTC (Bitcoin) once again pulled back towards the 30-day moving average of 68k. The high in late March and the fall back bent the 30-day moving average. The bulls resolutely counterattacked at this key psychological support level in an attempt to prevent the bears from breaking through the 30-day moving average and completely breaking the good situation of rising prices for seven consecutive months.

Jiaolian previously shared the current situation of Bitcoin volume and price divergence, and how technical analysts generally view this phenomenon. So, do you think the shrinkage is because longs are not active in buying, or because shorts are reluctant to sell?

The shrinking increase before hitting the previous high in 2021 from 66-67k in early March can be described as a short squeeze. As Jiaolian wrote in its March 5 article "BTC has reached its previous high: currency speculators are short-selling and hoarding Coin traders are undefeated, workers are glorious" written in:

"Shrinking and rising prices clearly and unmistakably send a signal to the market: short sellers can block the market by smashing the market. There are fewer and fewer rising chips, and we will run out of ammunition. This is the short squeeze market. Bits rise, bits rise, and after the bits rise, the bits rise. BTC, which has been soaring all the way, is like the wheel of history, ruthlessly rising from the corpse of short sellers. Run over. Short sellers who overestimate their capabilities can only try to control the situation."

Before the correction on March 14, Bitcoin reached a record high of 73.8k.

The black geese fly high in the moonlight, and the Chanyu escapes in the night.

In order to drive Qingqi away, heavy snow covered the bow and knife.

Bitcoin is currently around $70,000. 10 Bitcoins are worth approximately $700,000. Some netizens raised an interesting question: If you were asked to own 10 Bitcoins or 1 million US dollars and hold them for 5 years, which one would you choose? (Assuming you can’t exchange $1 million for Bitcoin)

Now April 2024. Five years later, it will be April 2029.

Let us do a forward-looking deduction.

If you hold Bitcoin, you will experience two halvings in the next five years. One time will be around April-May 2024, and the other time will be 2028, four years later. After two halvings, the issuance rate of BTC will drop from 6.25 BTC per block today to 1.5625 BTC. That is, the annual output will drop from 328,500 coins in 2023 to a mere 82,125 coins! This means that the price of BTC would have to increase at least 4x before miners would be able to pay security fees comparable to those in 2023.

Looking from the power law price corridor, the middle track of BTC in April 2029 is US$396,000, the lower track is US$140,000, and the upper track is US$1.234 million.

In terms of the micro bull-bear cycle, 2025 and 2029 are likely to be so-called bull markets located between the middle track and the upper track. Then in April 2029, the bull market price will most likely be above the middle track. That is, US$400,000 to US$1 million. And at the bottom in 2026, which may be the worst, the lower track is exactly the current height-$70,000.

If you develop according to this assumption, then if you choose to hold 10 Bitcoins, by April 2029, five years later, you may have wealth worth more than 4 million U.S. dollars.

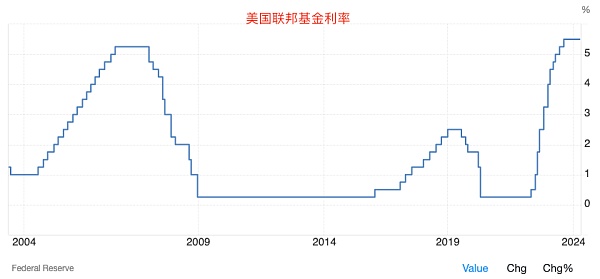

With 1 million U.S. dollars, you are likely to experience a new round of U.S. dollar easing cycle in the next five years. Current signs show that the Federal Reserve will most likely enter the interest rate cut channel this year. Generally speaking, after the interest rate cut channel is opened, a easing cycle will start for as short as 3 years and as long as 6 or 7 years.

Now, the United States, which is tight at both ends, wants to gain another chance before letting go. So Powell (Chairman of the Federal Reserve) played the bad role, Yellen (U.S. Treasury Secretary) played the white face, and Allison (founding dean of Harvard University’s Kennedy School of Government, former U.S. Deputy Secretary of Defense, and the proposer of Thucydides’ Trap Theory) Red face. The black-faced man is hiding far away on the other side of the ocean, singing eagle loudly, but he can't conceal his aura of being strong on the outside but indifferent on the inside. Bai Lian visited again this month, softly begging for peace, but still unable to reconcile the internal tears. The red-faced man was one step ahead and put forward the new theory of "Wu and Yue are in the same boat", hoping to defeat others without fighting.

To maintain strategic focus, we must neither be intimidated by harsh words, nor fall for soft words, nor be deceived by nonsense.

This is the basic skill for successful investment.

The same goes for hoarding Bitcoin.

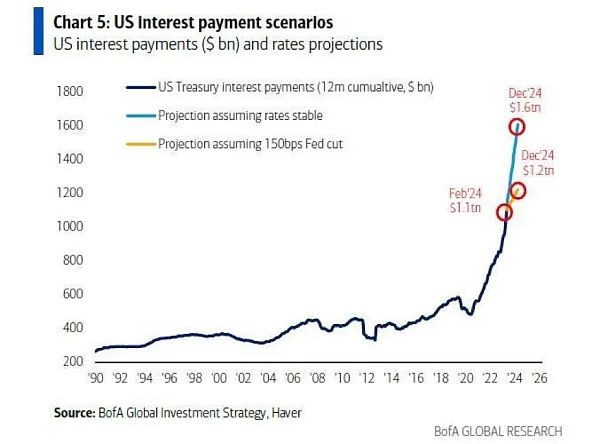

According to Bank of America estimates, by the end of December this year, if the Federal Reserve does not cut interest rates, the federal government will have to pay up to $1.6 trillion in annual interest on U.S. debt!

Therefore, there are only two ways in front of the US dollar:

Or, the Fed cuts interest rates quickly. The result is an inflationary explosion.

Or, the Federal Reserve insists on high interest rates and refuses to lower them, causing interest rates on U.S. debt to explode, paying a large amount of U.S. dollar interest to the market every year. The end result is an inflationary explosion.

And Bitcoin is a hedge against the explosion of US dollar inflation.

There are a lot of unwise investments in today's market. A large amount of inappropriate investment is nothing more than a blind and sad herd effect driven by inflation.

People who are not good at investing are driven by inflation to invest their hard-earned savings over the years into various assets, various investment projects, and various financial products that are either going to go bankrupt or about to go bankrupt. Going inside is like a moth flying into a flame.

Investing doesn’t have to be so hard. What you need is not investment, but just savings - real savings that can maintain their value.

Save Bitcoin. Then it’s time to eat, play, and sleep. From now on, stay away from upside-down dreams and have no worries or worries.

Olive

Olive Olive

Olive Coinlive

Coinlive  Catherine

Catherine dailyhodl

dailyhodl Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph 链向资讯

链向资讯 Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph