Author: Kyle Waters & Tanay Ved, Coin Metrics researcher; Translation: Golden Finance xiaozou

With the overall improvement of market conditions, digital assets will rebound sharply in 2023; as the Bitcoin spot ETF is about to came out, and institutional interest is accelerating. Looking forward to 2024, we will see many important developments and progress. This edition of the State of the Network report will show you how we see some of the most noteworthy trends in the digital asset industry in 2024.

1, spotETFarrival

After ten years of hard work, spot Bitcoin ETF has entered the U.S. financial market. Entering the final step, well-known issuers such as BlackRock and Fidelity Investments are expected to launch related products in 2024. The long-awaited approval of spot ETFs may have a greater impact on the digital asset market in the coming years.

With industry expectations that the U.S. Securities and Exchange Commission (SEC) will approve the ARK & 21Shares Bitcoin ETF, with the earliest deadline being January 10, the issuer’s latest revised SEC filing appears to indicate that as we write As of this article, the SEC is about to give the green light. However, details on the first round of approvals and an exact launch date remain unclear. It is widely believed that the SEC will approve multiple issuers at the same time to avoid accusations of favoritism, as it did when it launched an Ethereum futures ETF last fall. Currently, 11 major spot ETF applicants are expected to be approved in the coming week. The release of spot ETFs also involves many different aspects, such as the estimated size of ETF inflows, competitive dynamics among ETF issuers, and the mature market structure of Bitcoin. Some issuers have already begun a marketing offensive, while others are hoping to gain a competitive advantage in terms of lowest fees. Exactly how this hotly contested contest will play out remains uncertain.

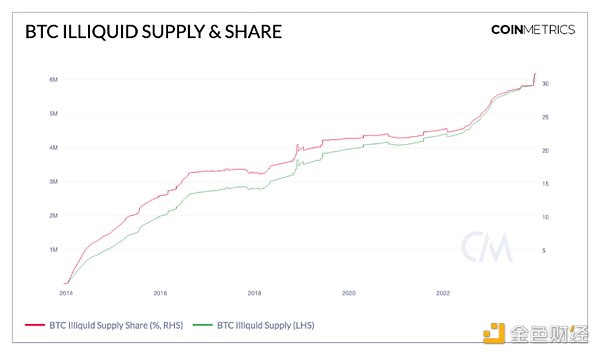

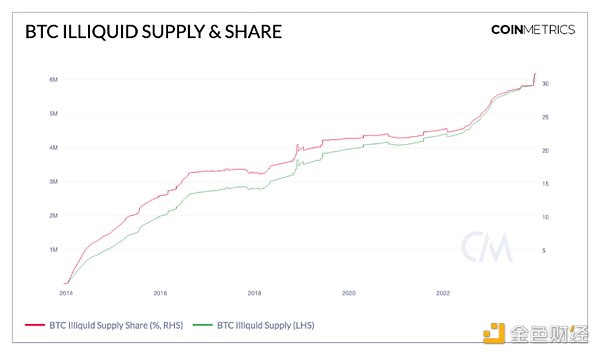

We believe it is also important to consider the supply dynamics on the Bitcoin chain, which may develop in the medium term, and it is here that Coin Metrics' data can provide the greatest help. Bitcoin supply is easily auditable and trackable on-chain, helping to make it a unique financial asset. Anyone running a Bitcoin node can track the whereabouts of all Bitcoins and track transfers. This allows us to infer holder behavior, supply distribution, active addresses, and many other on-chain metrics that would be impossible to calculate for more opaque assets. An important trend parallel to ETFs is the increasing proportion of long-term Bitcoin holders. As the chart below shows, more than 6 million BTC (30% of today’s total supply) have not moved in five years. We believe these dormant BTC are not being counted towards Bitcoin’s “free floating” supply.

In addition, in 2023 , only 30% of BTC is active on the chain, and most BTC remains untouched. It’s important not to oversimplify the determinants of BTC price though, as it’s a dynamic variable affected by many unknown factors, but this growing illiquidity coupled with large inflows into ETFs could Squeeze the market, thereby encouraging more supply to enter the liquid market.

There are many other factors worth paying attention to. Countering forces will shake up the onshore cryptocurrency exchange landscape, and an ETF may lure buyers away from spot exchanges through lower fees and less friction. But at the same time, exchanges such as Coinbase will benefit from serving as ETF custodians. More broadly, the ETF is expected to strengthen and confirm the legitimacy of digital assets, potentially benefiting U.S. exchanges as the industry continues to mature. Coinbase’s average daily spot trading volume has jumped to over $2 billion amid improving market sentiment surrounding ETFs. At the same time, the significant increase in open interest in CME Bitcoin futures reflects the changing market structure focused on the U.S. financial market.

This transformative development is coming, and this year may mark the transition of digital assets from niche to emerging asset class. With BlackRock and other companies also applying for Ethereum spot ETFs, ETH products are expected to be approved and will receive focus from industry players in 2024. But a Bitcoin ETF will be the first to hit the market in a year, and at the same time, another major supply event will dominate Bitcoin’s narrative in 2024: the next Bitcoin halving event.

2, The Fourth Bitcoin Halving

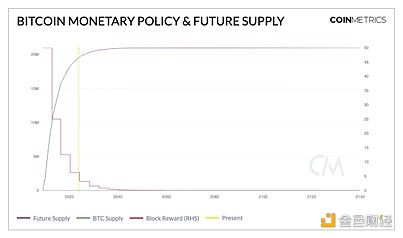

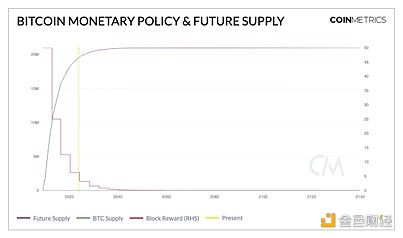

One of the core value propositions of Bitcoin lies in the procedural nature of its monetary policy. Every 210,000 Bitcoin blocks, or roughly every four years, the number of newly issued Bitcoins is cut in half, an event known as a "halving." Bitcoin block 840,000, expected to be mined in April this year, will reduce the reward for newly mined blocks from 6.25 Bitcoin to 3.125 Bitcoin, which will mark the fourth halving event in Bitcoin history and the protocol’s A key milestone as its issuance undergoes exponential decay on the way to the final supply of 21 million Bitcoins.

Although the halving event is a predictable factor in Bitcoin, but still has an important impact. The first is the impact on Bitcoin miners, who are incentivized to invest money and energy into securing the network in exchange for Bitcoin. Miners' income comes from new BTC issuance, and the halving event will reduce BTC issuance and will also reduce the fees paid by traders (Bitcoin block space demand function). Total revenue from absenteeism will almost certainly be reduced in dollar terms, its economics will be affected, and margins will be squeezed for operators with high energy costs and/or inefficient hardware.

To put it simply, if the halving occurs in April 2023, miners will receive a total revenue of $6.8 billion instead of $10.3 billion last year. However, a year-end increase in BTC prices and a recovery in the fee market will help miners in 2023, suggesting that the halving does not necessarily mean annual USD revenue falls by half. Still, with hash rates reaching all-time highs above 500 EH/s, miners are racing to achieve economies of scale and modernize their ASIC rigs to continue to succeed after the halving event.

Just like past halving events, there may once again be a series of debates surrounding the impact of the halving on Bitcoin’s supply and demand dynamics, and whether this reduction in issuance has been “priced in” . Some people believe that the Bitcoin halving is an inherent procedure in the protocol rules and an event that is well understood in advance - especially by the growing number of professional institutions studying Bitcoin. On the other hand, some people explain the reasons for the Bitcoin halving from a traffic perspective, pointing out that after the Bitcoin halving, the sales of miners (the natural sellers of Bitcoin) will decrease. They also believe that halving can strengthen Bitcoin’s monetary attributes and promote Bitcoin as a reliable store of value, attracting new interest through the attention brought by each halving event.

The market may feel the impact of halving-related sentiment throughout 2024. Much of the attention will fall on the profitability of miners, sparking a new round of discussion about the need for Bitcoin to eventually move to a fee-based miner revenue model. But the halving also corresponds to a key moment in Bitcoin’s history, the listing of spot ETFs in the United States. While future results don’t necessarily reflect past conditions, Bitcoin’s history closely echoes its four-year halving epoch. This new epoch is also of great significance.

3, EIP-4844 and the battle for smart contract platform expansion

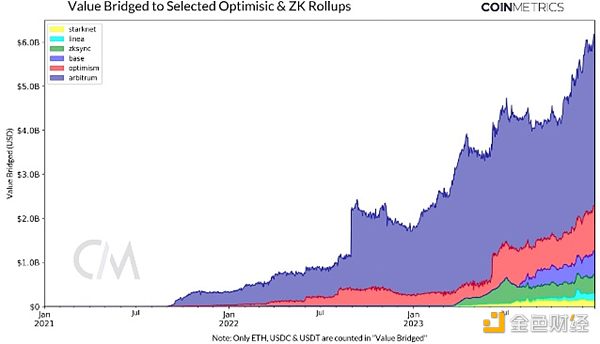

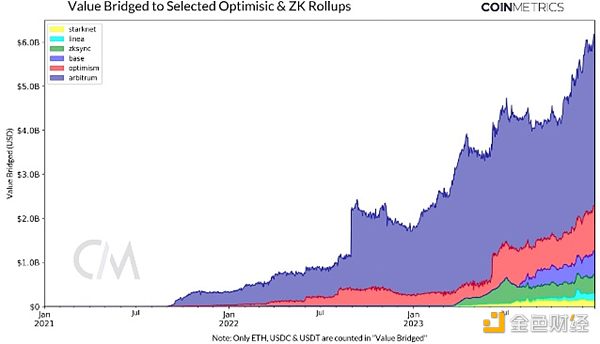

Layer-2 (L2) solutions are solving Ethereum is integral to its scalability issues, such as high gas fees and limited transaction throughput, which will affect user experience, especially during periods of high demand for block space. L2 solutions, such as Optimistic and ZK-rollup, bundle multiple transactions into a "rollup" and then process these transactions off-chain, while leveraging the Layer-1 (L1) network as the "data available" for settlement and security layer". This approach has helped reduce average transaction fees on mainnet from approximately $8 to approximately $0.01 on L2 platforms like Arbitrum. However, with the rapid popularity of rollups, the costs associated with storing data on-chain have become a focus of discussion and a key step in the development of Ethereum (see the EIP-4844 section below).

Bridge plays an important role in this transformation, promoting the flow of assets between the Ethereum main network and various L2s. As shown below, the canonical Optimistic and ZK Rollup bridges already have a large number of ETH and ERC-20 tokens (such as USDC and USDT) locked in the bridge contracts, reflecting the growing demand for transactions on the L2 network. While optimistic rollups like Arbitrum and Optimism have the largest share of bridge assets with 1.3 million ETH and 33,000 ETH respectively, with the launch of Coinbase’s Base, ZK-rollup (zero-knowledge) and application-specific rollups optimized for specific use cases , the L2 field will continue to grow.

Sponsored Business Content

This transformation The key step is the "Dencun" hard fork, which may be activated in the second quarter of 2024. Via Ethereum Improvement Proposal (EIP) 4844 ("proto-danksharding"), the upgrade aims to introduce the concept of "blob-carrying transactions", a new transaction type that enables rollups to Store large amounts of data in a shorter time on Ethereum L1 (Data Availability) at a lower cost. This is expected to reduce the operational overhead of rollup while further reducing L2 transaction fees, ultimately improving the economic viability of Ethereum usage and unlocking new use cases.

Despite some progress on Ethereum’s rollup-centric roadmap and the anticipated Dencun hard fork, questions about long-term efficiency and user experience within the Ethereum ecosystem remain unresolved. The complexity of asset bridging and the need for standardization, coupled with the rapid growth of decentralized rollups of users and liquidity, highlight the importance of interoperability between ecosystems. As Ethereum takes a modular approach to mitigating its limitations, it also faces the potential challenge of redistributing certain activities away from layer one, a shift that could impact the Ethereum mainnet trajectory and ETH utility. While some of the criticism is valid, the Ethereum ecosystem will remain a leader in many important aspects in 2024, including stablecoin liquidity, DeFi activity, total user spending, and other metrics.

However, parallel to Ethereum’s L2 roadmap, there is also the resurgence of Alt L1 blockchains such as Solana and Avalanche – achieving returns of 975% and 300% respectively throughout the year, once again Focus attention on their architectural trade-offs. The discussion focused on comparing a monolithic approach (such as Solana), which unifies execution, data availability, and consensus in a single layer, to Ethereum’s modular approach, which splits some of these Function. This contrast is at the heart of discussions about smart contract platforms and will continue to influence discussions about the relative dominance of each, ultimately seeping into discussions about scalability, user experience, security, and application ecosystem trade-offs.

It is clear that there are many competing efforts underway to expand smart contract platforms; however, it is unclear whether one will be the only one, or whether multiple solutions will coexist. It’s also unlikely that 2024 will give a firm answer. However, the demand for block space is clearly huge, and as we will see in the next section, there will be a large number of emerging applications in 2024 seeking reliable and low-cost block space.

4, stablecoins, RWA (real world assets) and emerging applications

(1 strong>) Stablecoins and CBDC

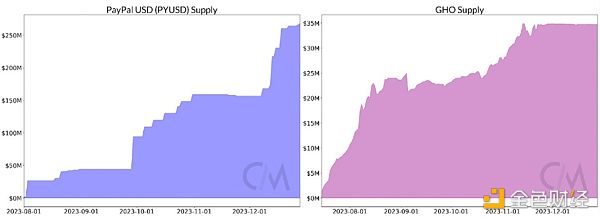

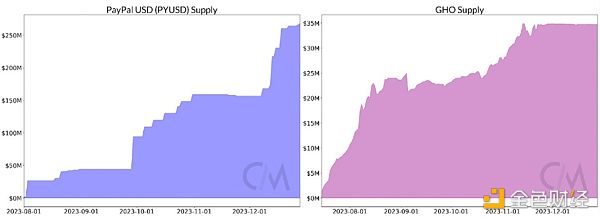

Stablecoins have been a central topic over the past year, and we believe that will be the case in 2024 as well. In 2023, affected by events such as the collapse of Silicon Valley Bank, the stablecoin market of more than 120 billion US dollars has experienced a major reshuffle, which has subsequently affected the development trajectory of the two largest legal currency-backed stablecoins, namely Tether and onshore issuance. USDC, its supply is trending in the opposite direction. However, despite losing some market share in 2023, USDC issuer Circle is considering listing in the United States in 2024. Its business has been greatly boosted by rising interest rates in 2023, and it is planning overseas expansion in places such as Japan and Brazil. expansion. At the same time, the stablecoin industry in general will continue to expand in 2024, solidifying its value proposition and strong product-market fit within the digital asset ecosystem.

A good testament to this expansion is the adoption of new stablecoins such as PayPal’s PYUSD, the euro-backed EURCV issued by Société Générale, and protocol-native stablecoins like Aave GHO currency. This trend is reflected not only in the growing variety of stablecoins – from fiat-backed to crypto-backed – but also in the diversity of issuers, including payments and financial institutions. Additionally, interest-bearing stablecoins backed by off-chain assets such as tokenized U.S. Treasuries and on-chain collateral such as ETH and Liquidity Collateral Tokens (LST) are gaining traction. Although still in their infancy and carrying their own risks, interest-bearing stablecoins are expected to enrich the growing stablecoin ecosystem.

With public blocks The rapid rise of on-chain stablecoins is paralleled by continued research and development into central bank digital currencies (CBDC). With some countries, such as Brazil, looking to launch CBDCs in the new year, 2024 may provide a new perspective on the contrast between permissionless and centralized digital financial infrastructure.

(2)RWAReal World Assets

As we forecast in 2023, Real World Assets (RWA ) ecosystem has seen significant growth over the past year. This is driven by the two main asset classes in the space, tokenization of public securities and private credit, both of which are focused on bridging the gap between traditional finance and the digital asset economy. While the tokenization of public securities brings a huge market for traditional financial assets such as U.S. Treasury bonds to the public blockchain, enabling global access, private credit projects meet the needs of emerging economies by accessing low-cost credit. In 2023, the market size of tokenized U.S. Treasury bonds exceeded $500 million, partly due to the Federal Reserve's interest rate hike cycle, which increased the attractiveness of "risk-free" interest rate returns, supporting projects such as Ondo OUSG, bringing the OUSG market value to 175 million USD, and boosted MakerDAO’s revenue. Faster settlement times, greater transparency and lower operating costs are some of the value propositions that blockchain brings, and it is helping to accelerate this as opportunities expand to other financial instruments such as equities, private market funds and real estate. This trend develops.

Looking forward, initiatives such as Coinbase’s L2 network Base will drive growth in the RWA sector. “Project Diamond” leverages Base’s scaling capabilities, Coinbase’s wallet and custody services, and Circle’s USDC stablecoin to create a regulated capital market for digital financial instruments. Likewise, “Project Guardian,” a partnership between JPMorgan, Apollo, and the Monetary Authority of Singapore, reflects financial institutions’ growing interest in tokenization. While some RWA initiatives run on permissionless blockchains, limiting their full potential, the expansion of this space on public blockchains holds great promise.

5, Staking and Decentralized Finance (DeFi)

In the Ethereum DeFi ecosystem, liquidity staking After the surge after the Shapella upgrade, there are nearly 29 million ETH on the Beacon chain, and Lido manages about 32% of the total (9 million ETH). This on-chain yield serves as a reward for validating the network, increasing ETH’s appeal as a productive capital asset. L2 bridges like Blast further exacerbate this trend by staking idle ETH for yield. The EigenLayer mainnet launched in 2024 will introduce a restaking mechanism, allowing the use of pledged ETH to bootstrap economic security for other networks (such as data availability layers, oracles or bridges), which is essentially a reinvention of the Ethereum security model. use. While restaking will provide greater incentives through higher yields, it can also amplify smart contract, operator and slashing related risks, making restaking a key theme in 2024.

In the broader DeFi ecosystem, we expect decentralized exchanges (DEX) and lending protocols to play a key role in 2024, especially with Uniswap v4 expected to enter the space. The new iteration will feature the creation of custom mining pools and trading strategies through “hooks” and reductions in gas costs (driven by the Dencun upgrade). As protocols become more versatile, they will provide greater flexibility and control over risk management, which may externalize some complexity but also cater to a wider audience and a variety of use cases.

6, AIconvergence with encryption, DePIN and consumption apps

Block Chains are increasingly having an impact on non-financial applications, like decentralized physical infrastructure (DePIN). Access to these basic resources is increasingly democratized through token incentives that promote resource sharing in areas such as storage (Filecoin), network infrastructure (Helium), and computing (Akash). This is also crucial in the field of artificial intelligence, which can support the whole domain to participate in the computing market currently dominated by technology giants in a permissionless manner, and also make the content or data generated by artificial intelligence more secure and trustworthy through blockchain privacy solutions. The convergence of these breakthrough technologies is an exciting development trend.

Gaming and social media will also grow driven by account abstraction (simplifying wallet interactions and transaction processes), thereby improving user experience. The development of L2, especially game-specific L2 (such as Immutable), makes frequent low-value transactions (including in-game item purchases and NFT usage) more feasible. While the NFT space has experienced lulls and is constantly changing as markets like Blur overtake Opensea and inscriptions grow on the Bitcoin network, the space has huge potential to enhance interaction between brands or artist communities. The bull run will revive interest in the consumer application ecosystem and promote mainstream adoption of blockchain technology.

7, Regulation and Policy Outlook

In the past year, the encryption field has encountered a series of regulatory challenges in the United States, and a more optimistic political The formation of environments will be very welcome. There has been some progress on the policy front, and digital asset market participants will continue to look for signs of regulatory clarity. In a promising development for a more politically active crypto user base in the U.S., the Fairshake super PAC (political action committee) successfully raised $78 million to support pro-blockchain candidates in the 2024 U.S. elections. . The ongoing legal battle between Coinbase and the SEC will also be an important area to watch, with oral arguments for the verdict in the lawsuit between Coinbase and the SEC set to take place on January 17. Like the Ripple and Grayscale lawsuits, the outcome of this fight could have far-reaching consequences for the crypto industry, perhaps affecting international regulations. While several jurisdictions around the world have made significant progress on crypto policy, such as the UAE and the European Union (whose MiCA regulations will come into effect in 2024), others still have a long way to go.

8, Conclusion

The digital asset market will mature in 2024. The anticipated launch of the spot ETF is an important milestone in Bitcoin’s relatively short but far-reaching history. 15 years ago today, the Bitcoin genesis block came out, bringing a new currency concept to the world.

JinseFinance

JinseFinance