Author: flow Source: On Chain Times Translation: Shan Oppa, Golden Finance

Introduction

Restaking is a simple but powerful concept: it allows pledged assets to be used in multiple decentralized It is also called Node Consensus Networks (NCNs) by Jito.

This approach brings many benefits. Most notably, it enhances the security and integrity of decentralized services, as these services can leverage the economic security of the main chain L1 without having to invest significant resources in designing their own (potentially more fragile) security models. From a staker's perspective, this approach maximizes capital efficiency, because a single asset can guarantee multiple decentralized services at the same time and potentially obtain a higher return on capital.

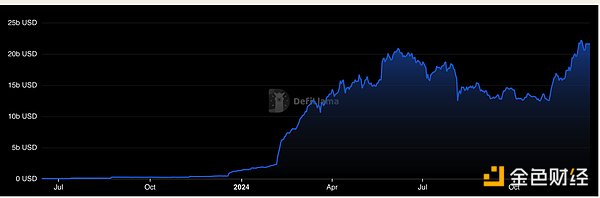

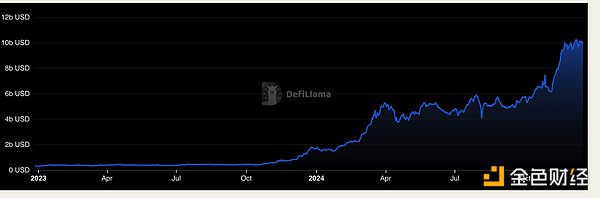

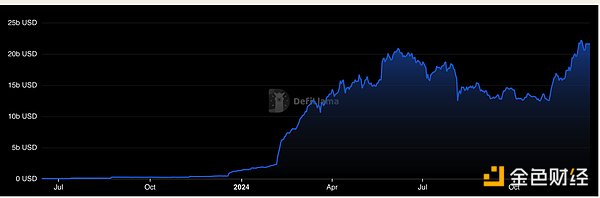

The impact of this concept is far-reaching, and many industry leaders regard re-staking as a disruptive innovation that can be achieved by building a more secure, flexible, and A scalable blockchain environment to accelerate progress. Even though this space is still in its early and experimental stages, re-staking has quickly grown to become one of the largest segments on Ethereum in terms of Total Locked Volume (TVL): from just $1.4 billion at the beginning of the year to $21.6 billion currently .

p>

So far, re-staking has mainly focused on Ethereum, as it is considered the most economically secure and most adopted PoS blockchain. However, with Solana's strong growth during this bull run (especially in contrast to the more stagnant activity on the Ethereum mainnet, much of which has moved to L2 solutions like Base), a legitimate question arises: DoesSolana also offer compelling re-hypothecation prospects?

This article will explore this issue from multiple angles and analyze the potential market opportunities for re-staking on Solana. Let’s dig into it.

1. Solana is mature enough to support re-staking

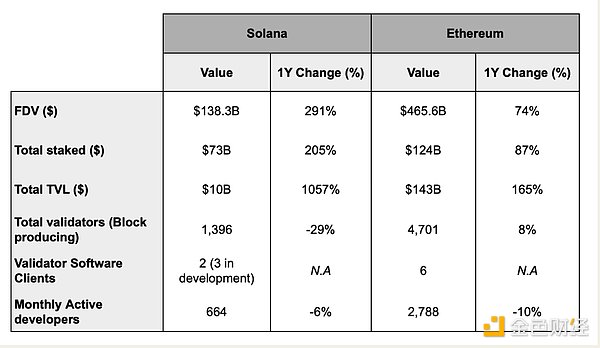

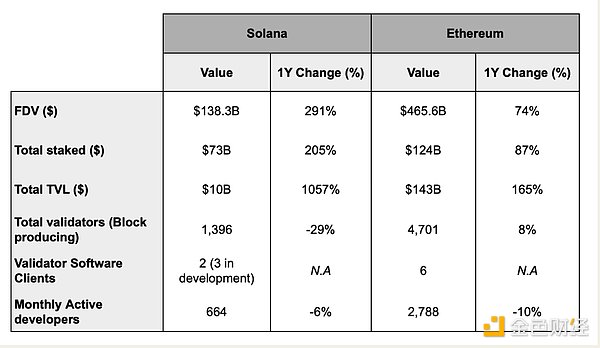

To make re-staking feasible, the underlying chain needs to have strong economic security. This is why staking has mainly chosen Ethereum so far. As of now, Ethereum has pledged more than 34.3 million ETH (worth approximately US$124 billion), has 4,701 block production verification nodes, six different consensus clients, and uses it as the oldest and most reliable block The reputation of one of the chains becomes a reasonable basis for building re-pledge.

However, humans always tend to project the current state into the future, assuming that the status quo will remain the same forever, and that Ethereum will always be dominant. But history tells us that, especially on the technological frontiers, the power ofcreative destructionmay shatter this assumption. Think about how Yahoo, once considered untouchable, was surpassed by Google in the search engine field; similarly, the rise of Apple in the personal computing field replaced IBM, which was once regarded as the "end game."

p>

Following this logic, we may need to ask ourselves:Is Ethereum at a similar historical moment? Is it necessary to build the entire re-staking system solely on Ethereum?

This issue is especially important because new asset issuance is leaving the Ethereum mainnet and moving to other L1 (such as Solana) or L2 (such as Base), while Ethereum However, there is a lack of clarity about the future development direction of Ethereum (for detailed analysis, please see the overview of the current status of Ethereum in the link to this article). If we agree that restaking is a disruptive technology, then we should open up the option to extend it to other L1s, giving developers the freedom to choose which consensus layer to build their trust on.

In this context, Solana is a clear candidate for restaking. As the leading L1 in this cycle, Solana has achieved significant growth, maturity, and security. As of this writing, approximately 65% of the circulating supply of SOL is staked, with a total value of approximately $73 billion (a significant increase from $24 billion a year ago). Additionally, the Solana network has nearly 1,400 block-producing validators, as well as two different client validators, with three new client validators in development (Firedancer, Sig, and Agave).

p>

In addition to this, Solana is extremely low cost and extremely fast, and has gained widespread adoption among users and developers. It is thefastest chain for application development in the crypto space, has achieved true organic growth, and has successfully overcome the "cold start" problem and established a strong network effect. All of this shows that Solana has a bright future and is mature enough to support the implementation of re-staking.

p>

2. The possibility of re-staking on Solana is greater than that of Ethereum

Ethereum pioneered the field of smart contracts, but its high cost limits the scope of developers to build applications on the chain. In contrast, Solana's design gives developers greater freedom and enables a wider range of creative expression on L1. Therefore, it can be said that the design possibility of restaking is greater on Solana than on Ethereum.

First, Solana’s low transaction and computational costs lower the barrier to entry for Node Consensus Networks (NCNs). Unlike Ethereum’s high fixed costs that limit participants, Solana enables the deployment of smaller, more cost-effective NCNs that can be tailored for specific use cases. This allows more services to be outsourced, reducing the scope of direct applications and expanding interoperability within the ecosystem.

In addition, NCNs on Solana can handle more complex operations, and their code density can be higher without sacrificing on-chain computing power (such as on Ethereum) EigenLayer design). This makes it possible to achieve on-chain verifiability, on-chain reward distribution, and on-chain data release, while enhancing the flexibility and robustness of re-staking. Although Ethereum is a "guinea pig" for re-staking, in the long run, re-staking on Solana has greater potential and can support the construction of more practical use cases and applications.

Furthermore, Solana is using liquidity re-pledge tokens (VRTs, as Jito calls them, "Vault Receipt Tokens" ) also has significant advantages. On the one hand, Solana’s low cost can significantly reduce the operating costs of liquidity re-staking token providers such as Kyros. In a business model where a small yield gap will affect overall profitability, this cost advantage increases profit margins while creating space for more competition and the formation of a diverse ecosystem, including providing diversified VRT re-pledge strategies. and more flexible penalty conditions. On the other hand, liquidity re-staking on Solana is more affordable for users, and low transaction fees lower the threshold, making it easier for them to use liquidity re-staking tokens in various DeFi applications without having to overdo it. Worry about the cost. This is an important factor driving long-term capital adoption.

3. Re-staking can bring new innovations to Solana

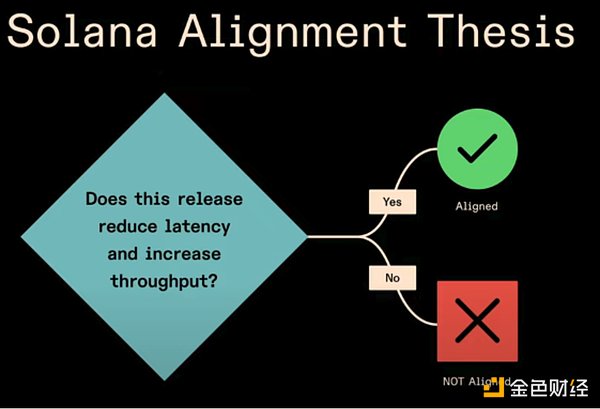

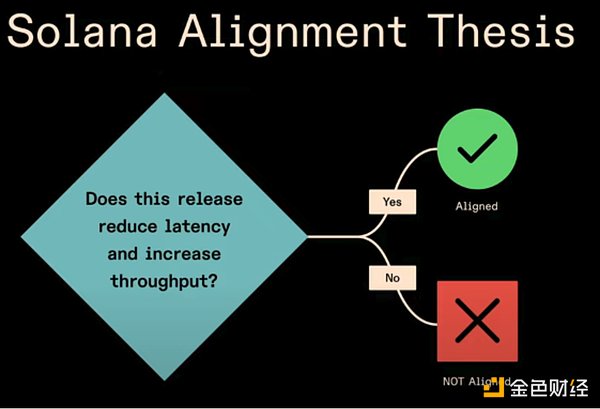

Solana's vision has always been to be a global computing interface for everyone to freely build. In the process of achieving this goal, the core is always to increase the throughput and reduce latency of the underlying chain.

p>

This is a clear and reasonable vision. However, the laws of physics cannot be violated, and it is impossible to increase throughput by 10 times or reduce latency by 10 times in a short period of time. This requires significant resources and effort to achieve an order of magnitude improvement. Therefore, even if it is not immediately possible, a consensus is gradually emerging: Not everything has to happen on L1. This can be verified by the recent discussion around "network expansion".

In this regard, it can be considered that re-staking can open new opportunities when expanding the Solana network and driving innovation in the "network expansion" plan. Design possibilities. While it is currently unclear in what way or form restaking will be implemented, it is likely to evolve into a powerful infrastructure tool for scaling the network. In one case, Sonic claims to be the first sovereign gaming L2 layer built on HyperGrid, the horizontal scaling framework for the Solana virtual machine. Sonic plans to leverage Jito restaking to improve the security and efficiency of its SVM, building a multi-purpose ecosystem for gaming, DeFi, and other applications.

In addition, the hard guarantee provided by re-staking can bring practical use cases for Solana network reliability. For example, Jito TipRouter NCN is being developed to decentralize and improve the security of MEV tip distribution on Solana. As another example, Temporal’s protocol Nozomi plans to use Jito re-staking to redesign Solana’s transaction microstructure to solve problems such as sandwich attacks, slippages and transaction timeouts. This is in line with Solana’s long-term vision and is expected to significantly improve the user experience, ensuring that the chain is not only fast and cheap, but also reliable and easy to use.

In addition to high performance and strong metrics, Solana also demonstrates its startup spirit. Successful projects such as Jito, Kamino, Jupiter, and Helium have emerged over the past few years, but this is just the beginning, and the number of projects choosing to build on Solana continues to grow.

If Solana is becoming the chain of choice for developers, then restaking will have a place here as well. This extends Solana’s economic security to critical services in the ecosystem, such as oracles, bridges, and sequencers, which often operate outside of the base layer but are equally critical. While smart contracts and their interactions themselves benefit from Solana’s security, these other components often require their own economic security models. This often means raising large amounts of capital to incentivize validators, or compromising on security.

There may therefore be situations where a smart contract is secured on-chain and performs correct calculations, but relies on an oracle that provides incorrect data . This constitutes a paradox: if other parts of the system are not equally secure, no matter how strong the smart contract layer is, it will not contribute to the overall security and resilience of the system. Because of this, it makes sense for certain Solana-focused services to use Solana’s restaking. For example, Switchboard (a permissionless oracle network on Solana) is partnering with Jito Redemption to ensure the reliability of its data streams. If successful, this approach will significantly improve the security and reliability of the Solana network.

4. Re-staking optimizes the capital efficiency of DeFi users on Solana

Re-staking provides Solana users with the opportunity to achieve a higher annualized yield (APY) than simply staking. Since one of the main goals of DeFi users is to optimize capital efficiency, restaking becomes an attractive option. It enables DeFi users to unlock new revenue opportunities on Solana without requiring additional capital. For example, instead of purchasing liquid staking tokens (LSTs) to earn yield on SOL and use them in DeFi, users can purchase liquid restaking tokens (VRTs) to earn higher APY while still being able to use them in DeFi Free operation.

It should be noted that re-staking also comes with additional risks, and users need to take this into consideration. However, if managed correctly, rehypothecation can provide an interestingrisk-reward balancing opportunity.

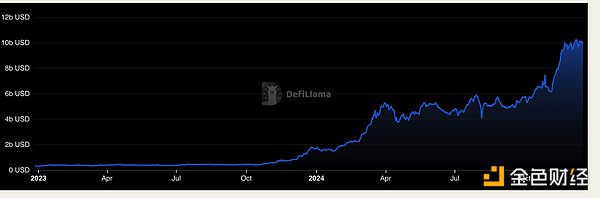

Looking at the continued growth of DeFi on Solana, we can speculate that having a mechanism to optimize capital efficiency will attract a lot of liquidity in the long term. In fact, DeFi activity on Solana is surging.

p>

In the past year, its total locked-up volume (TVL) has grown from less than US$1 billion to more than US$10 billion, and the growth momentum remains strong. Additionally, activity on the Solana network is also on the rise, as evidenced by the surge in network fees. The network recently topped $13 million in weekly fee revenue, up from less than $1 million a year ago.

DeFi on Solana has just started. From a user perspective, this means there will be increasing demand for solutions that optimize capital efficiency, further demonstrating the potential of Solana re-staking.

Conclusion

Solana’s re-staking is still in early trials stage, but it represents a promising narrative, and many interesting application scenarios have emerged. As the ecosystem continues to mature and grow, the argument for restaking will become stronger. If we assume that Solana can gain market share comparable to the Ethereum restaking market in the long term, the market opportunity will be huge.

Currently, Solana restaking infrastructure is mainly dominated by two protocols: Solayer and Jito (Re)staking

strong>.

• Solayer As one of the first to enter the market, it has built a complete re-hypothecation stack and has achieved over $350 million in TVL.

• Jito seems more likely to lead this trend in the long term. With a strong technical foundation, the highest TVL in the Solana protocol, and a clear vision, Jito has established its position as a leader in the Solana ecosystem. Its flexible re-collateralization stack has built-in integration of Liquid Re-collateralization Tokens (VRTs) from day one and supports multiple asset types, further enhancing its potential.

From a user perspective, this indicates that there are significant opportunities in the Jito liquidity re-hypothecation market. If you’re interested in this emerging trend, here’s an overview of the main trade-offs between different VRTs.

p>

Anyway, I want to end with a quote from Freeman Dyson:

“When great innovation occurs, it almost always appears in a messy, incomplete, and confusing form that is only partially understood even by its discoverers; by others. It’s a complete mystery. Any guess that doesn’t seem crazy at first glance is doomed to be hopeless.”

This sentence perfectly describes it. The current status of Solana re-staking: Early, promising, and fertile ground for new opportunities in DeFi.

Weatherly

Weatherly