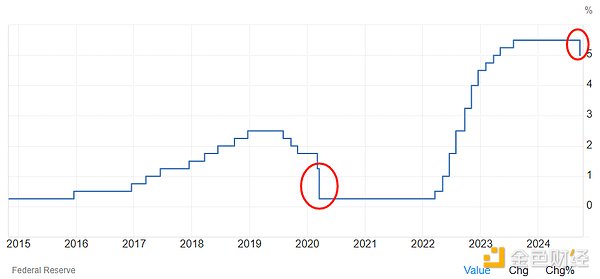

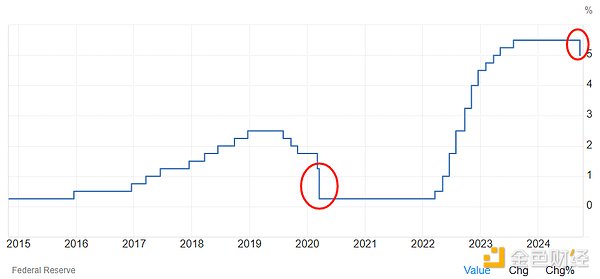

①The Federal Reserve announced a 50 basis point rate cut, lowering the target range of the federal funds rate from 5.25% to 5.5% to 4.75% to 5%;

②Boman, a member of the Board of Governors, cast the only dissenting vote, hoping for a 25 basis point rate cut;

③The "dot plot" shows that 19 policymakers as a whole believe that by the end of the year, there will be another 50 basis point cumulative rate cut on the current basis.

Cailian News, September 19 (Editor Zhao Hao)On Wednesday (September 18) local time, early Thursday (September 19) Beijing time, the Federal Reserve announced a 50 basis point rate cut, lowering the target range of the federal funds rate from 5.25% to 5.5% to 4.75% to 5%.

Before the resolution, the market's expectations for the rate cut were between 25 basis points and 50 basis points. It is also worth mentioning that the last time the Fed cut interest rates was in March 2020, which means that the two rate cuts have been four and a half years apart.

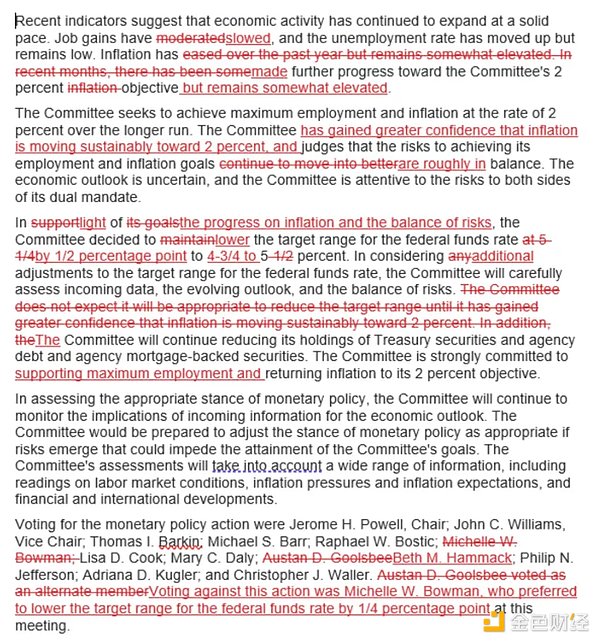

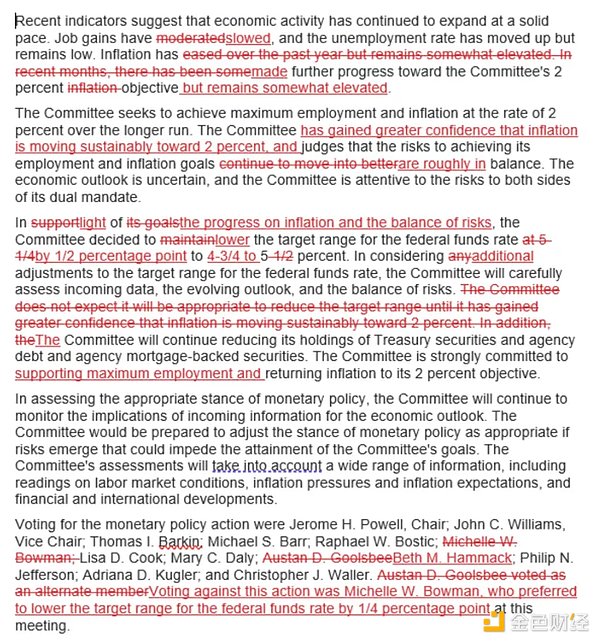

The Federal Open Market Committee (FOMC) wrote in a statement that recent indicators show that economic activity continues to expand at a solid pace, job growth has slowed, the unemployment rate has risen but remains low, and inflation has made further progress toward the 2% target, but it is still somewhat high.

The press release wrote that the FOMC seeks to achieve full employment and 2% inflation over a longer period of time, and the committee has increased its confidence in the continued progress of inflation toward 2%, and judges that the risks to achieving employment and inflation goals are roughly balanced. The economic outlook is uncertain, and the FOMC remains concerned about the risks to its dual mission.

In light of inflation progress and the balance of risks, the FOMC decided to lower the target range for the federal funds rate by 0.5 percentage point (50 basis points) to 4.75% to 5%. In considering further adjustments, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.

The FOMC will continue to reduce its holdings of U.S. Treasury bonds, agency bonds, and agency mortgage-backed securities (i.e., shrink its balance sheet). The FOMC reiterated that the Committee is firmly committed to supporting full employment and returning inflation to its 2% target.

The press release concluded by saying that in assessing the appropriate monetary policy stance, the Committee will continue to monitor the implications of new information for the economic outlook. If risks emerge that could impede the achievement of its goals, the Committee will be prepared to adjust the monetary policy stance as appropriate.

The Committee's assessment will take into account a wide range of information, including labor market conditions, inflation pressures and inflation expectations, and financial and international developments. In this resolution, Governor Michelle Bowman cast the only dissenting vote, hoping for a 25 basis point rate cut.

It should be noted that Bowman is the first Fed governor to vote against an interest rate decision in nearly 19 years. The last time this happened was in September 2005, when Governor Mark Olson voted against the then-Chairman Greenspan.

Based on the comparison with the previous resolution statement, the FOMC changed employment from "stable" to "slowing down"; modified the description of inflation; "entering a better balance of risks" was changed to "roughly balanced"; and deleted the wording "it is not appropriate to lower the target range of interest rates until there is more confidence that inflation will continue to move towards 2%."

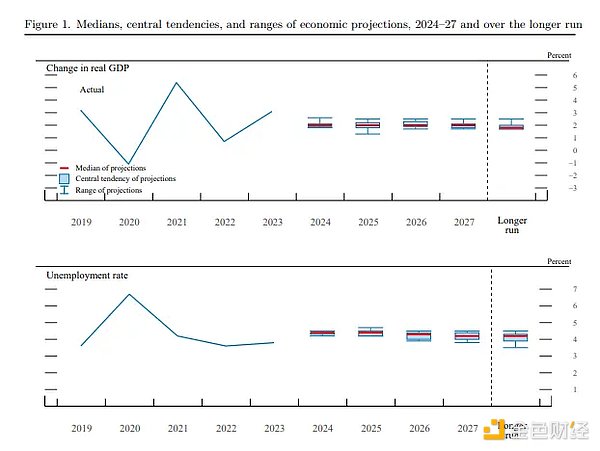

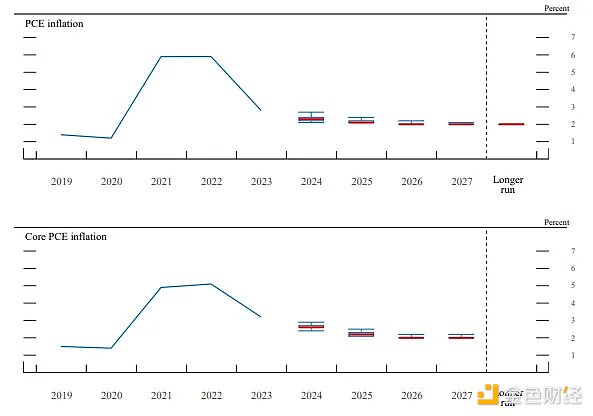

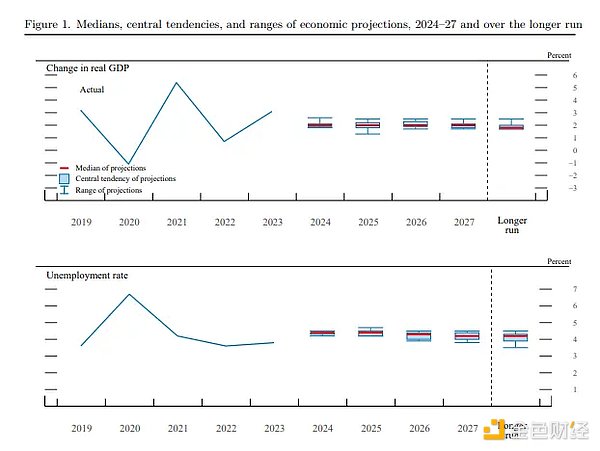

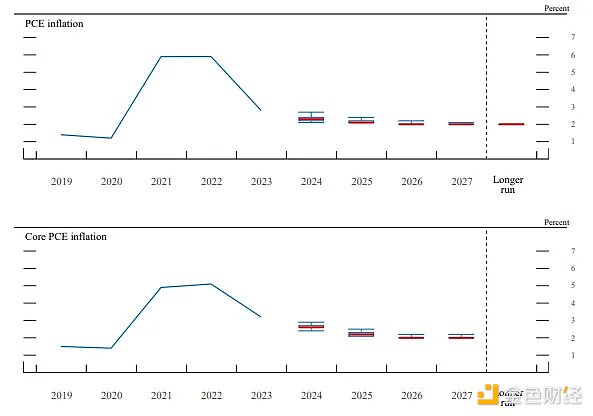

At the same time as announcing the interest rate decision, the Federal Reserve also released the Summary of Economic Prospects (SEP):

Participants lowered their forecast for US GDP growth in 2024 from 2.1% to 2%, and expected growth to remain at this figure for the next three years, with the long-term growth rate remaining unchanged at 1.8%; the unemployment rate forecast for this year was raised from 4% to 4.4%, and will be 4.4%, 4.3% and 4.2% in the next three years respectively.

At the same time, participants lowered their expectations for PCE (personal consumption expenditure) inflation and core PCE inflation this year and next. The PCE inflation rate was lowered from 2.6% (expected for 2024) and 2.3% (expected for 2025) to 2.3% and 2.1%, while the core PCE was lowered from 2.8% and 2.3% to 2.6% and 2.2%.

Analysts pointed out that from the perspective of economic growth and inflation expectations, the description is a completely "soft landing" scenario.

The much-watched "dot plot" of interest rate forecasts shows that the median of the 19 policymakers' expectations for the Fed's interest rate at the end of 2024 falls between 4.25% and 4.5%. This means that they generally believe that by the end of the year, there will be a cumulative interest rate cut of 50 basis points on the current basis. The median forecast also shows that 19 policymakers believe that the interest rate will be between 3.25% and 3.5% at the end of 2025, that is, a cumulative interest rate cut of 100 basis points in 2025; the interest rate will be cut by 50 basis points in 2026 and will be maintained between 2.75% and 3% for a long time.

Wilfred

Wilfred