Author: Climber, Golden Finance

On January 11, Beijing time, the long-awaited Bitcoin spot ETF was finally approved, and the expectations of various institutions and investors were finally fulfilled. .

The false news that a Bitcoin spot ETF was approved the day before sent crypto investors on a roller coaster of emotions, but now, everything is a foregone conclusion.

Since the release of the good news that the Bitcoin spot ETF was about to be approved in October last year, the price of BTC has been rising, from around US$26,500 to about US$48,000, an increase of 81%. Other altcoins have also set off a surge. Bull market climax.

Now that the Bitcoin spot ETF has been successfully approved, the most concerning question for investors is how will the price of BTC go in the future? Is the current stimulation of this good news just an appetizer or has it been exhausted? BTC is known as "digital gold". Today, Golden Finance will review the market reaction before and after the adoption of the gold ETF and take stock of the current opinions of authorities from all parties to give as much market reference as possible for this major event in the currency circle.

1. Gold price trends before and after the gold ETF was approved

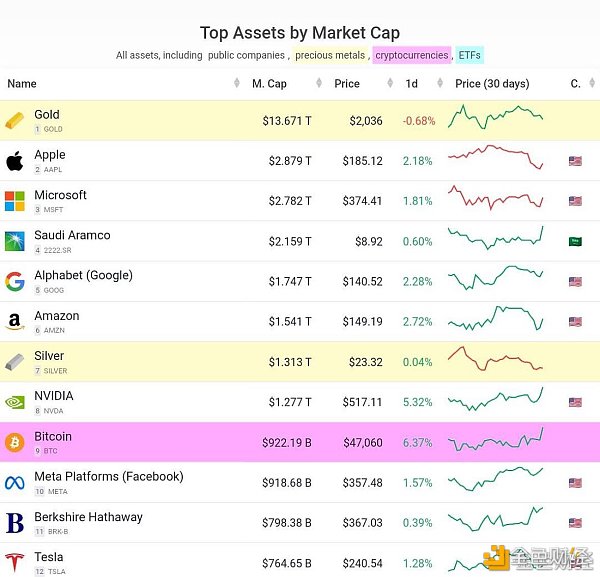

The value of gold is unquestionable, and it ranks first among the world’s major asset classes. And it is nearly 4 times ahead of the second-placed Apple. As the price of BTC reaches above US$47,000, its market value has surpassed Meta (formerly Facebook) to become the ninth largest asset in the world by market value.

As an emerging asset class , it has only been 15 years since the birth of BTC. The false news that the Bitcoin spot ETF was approved caused the price of BTC to continue to rise. After the rumor was refuted, the Google search index search volume for Bitcoin ETF reached a record high of 100. It can be seen that the market's attention and enthusiasm for this event are very high.

BTC is regarded as "digital gold", and the encryption industry believes that it will have the same value attributes as physical gold in the digital world in the future.

The world's first gold ETF (GOLD) was officially listed on the Australian Stock Exchange on March 3, 2003. However, since Australia is not the center of the world economy, In addition, people are not very familiar with gold ETFs, so they were not popular among investors at the time. Instead, they were more of an experimental nature.

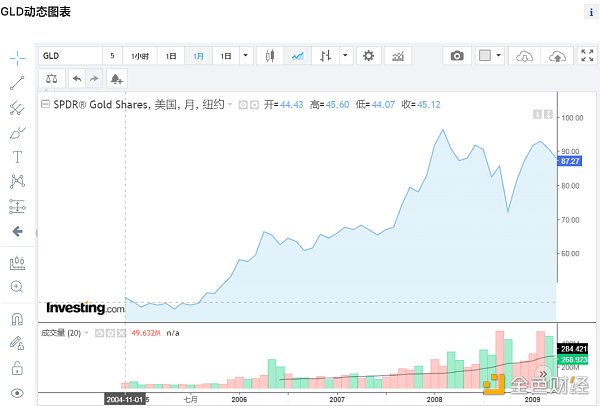

It was not until 2004 that the U.S.'s StreetTracks GoldTrust Fund (GLD) listed gold ETFs on the New York Stock Exchange truly became known and caused a sensation. The specific timeline was that it was approved by the SEC in late October of that year and trading began in November.

Currently, GLD’s gold trading volume ranks first among all gold ETFs, and some countries have subsequently launched gold ETFs.

Data released by the World Gold Council (WGC) show that the current total holdings of various institutions in gold are 3,225 tons. However, due to the rise in gold prices, the total global gold ETF asset management scale has increased to US$214 billion.

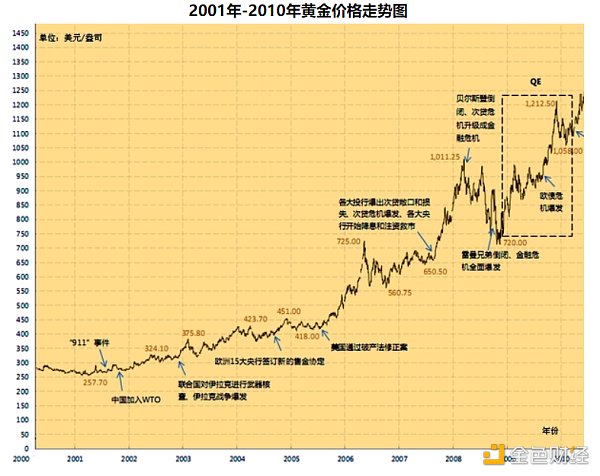

From the picture above We can intuitively see that one year before the United States passed gold ETFs in 2004, the price of gold per ounce was in the range of US$320 to US$420. At the same time, before and after the adoption of ETF, gold's stage high was around US$450, but it was followed by a wave of decline of about 10%, and continued to fluctuate sideways for nearly half a year.

Also from StreetTracks GoldTrust This trend can also be seen in the historical price trend of the fund (GLD). It can be seen from the figure that since the adoption of the ETF in November 2004, the ETF has been falling all the way, and the lowest point did not even appear until early May of the following year.

The price of gold has been rising ever since, and overall it still maintains a relatively strong upward trend. However, what we still need to see is that with the development of time, there are many major events in the world that are affecting the price of gold, such as Federal Reserve policy, geopolitics, economic crisis, etc.

That is to say, in fact, in the value trend of gold, the adoption of gold ETF can only be said to be a small episode, and there are more factors that are enough to influence the rise and fall of gold prices.

Similarly, the adoption of Bitcoin spot ETF may also be the same. In the final analysis, it depends on the consensus of global economies on the value of BTC.

In February 2021, the world's first Bitcoin ETF was approved in Canada, but because it was in the crypto bull market at the time, it did not have much reference.

2. Opinions of all parties

According to CoinGecko statistics, there are currently only 8 countries in the world that provide spot Bitcoin ETFs, and the country with the most such ETFs is Canada. : There are 7 spot Bitcoin ETFs with total assets of US$2 billion, accounting for 48.2% of the global US$4.16 billion in spot Bitcoin ETF assets.

The other countries are: Canada, Germany, Brazil and Australia, as well as the tax havens of Jersey, Liechtenstein, Guernsey and the Cayman Islands.

The U.S. Bitcoin spot ETF is about to be approved. How do all parties view this event and how do they judge the future trend of BTC?

Valkyrie Investments Co-founder Steven McClurg expects as much as $200 million to $400 million to flow into his ETFs through the first week; the first batch of 10 ETFs is expected Launched simultaneously, the overall market will reach $5 billion in the first few weeks of trading.

In addition, Steven McClurg predicts that Bitcoin will be worth $150,000 by the end of 2024, as spot Bitcoin ETFs may create a "supply shock" that drives up demand.

Crypto trading platform BitMEX Founder Arthur Hayes expects Bitcoin to see a 20% to 30% correction in early March, saying that if The U.S.-listed Bitcoin spot ETF has begun trading, and the correction may be larger.

Hayes said that hundreds of billions of fiat currencies are expected to flow into these ETFs in the future, and the price of Bitcoin may climb to $60,000 or even approach its all-time high price of $70,000 in 2021. However, after reaching this high point, he foresees that Bitcoin may face a significant correction of 30% to 40% due to the shortage of USD liquidity.

Matrixport stated that MicroStrategy’s stock price may indicate that Bitcoin is priced at $38,000, and Ethereum will perform better than Bitcoin.

The reason given is that MicroStrategy, already an unofficial Bitcoin spot ETF, has seen its share price fall 14% since the end of December, while Bitcoin has risen 8% during this period. The overlap of the two time series gives the impression that MicroStrategy priced Bitcoin at $38,000.

But Matrixport previously predicted that if the approval goes as expected, it is optimistic that the price of Bitcoin will reach $50,000.

Coinbase Global released a report stating that in the long run, spot Bitcoin ETFs may add billions of dollars to the market capitalization of the entire crypto market. The ETF would loosen restrictions on large fund managers and institutions buying and holding Bitcoin and could also open the door to new products such as loans, futures and options.

ARK Invest CEO Cathie Wood said: “We believe the SEC’s approval will shine a bright light on institutional investors. Green light. In fact, it does not require institutions to allocate large amounts of Bitcoin to the value of Bitcoin, because it is gradually becoming a scarce asset."

Wood also Comparing Bitcoin to digital gold, and predicting that after the approval of the Bitcoin spot ETF, a substitution effect between Bitcoin and gold may occur.

Standard Chartered Bank analysts pointed out that the incident is expected to attract US$50 billion to US$100 billion in capital inflows this year. And the bank predicts that BTC will rise to US$100,000 by the end of this year and further rise to US$200,000 by the end of next year.

James Butterfill, director of research at CoinShares, said that driven by the possible approval of a Bitcoin ETF by the U.S. government, institutions are increasing investment by 20% from the assets currently managed by asset managers. (approximately $3 billion) could push the price of Bitcoin to $80,000.

Galaxy Digital: Bitcoin is expected to rise 74% in the first year after spot ETF approval (based on Bitcoin price on September 30, 2023 US$26,920 as a starting point); over a longer period of time, the potential size of funds invested in Bitcoin products is between US$125 billion and US$450 billion.

Crypto circle KOL Shenyu said that the approval of ETF released an obvious positive signal, which means that blockchain assets such as Bitcoin and Ethereum have been integrated with Traditional assets are also accepted and begin to enter the balance sheet.

Guosheng Securities: With reference to the promotion of gold prices by the launch of gold ETF, the Bitcoin spot ETF is worth looking forward to. If the Bitcoin spot ETF is approved, it means that the huge traditional wealth world recognizes Bitcoin and even the Web3.0 world, which will further accelerate the integration of the two.

TetherAdvisor Gabor Gurbacs: It seems important whether the Bitcoin spot ETF’s capital flow is US$500 million or US$5 billion in the first few weeks, but in the long run it is not in this way.

Approximately $500 trillion in assets worldwide have access to Bitcoin in both physical and financial forms. Assuming a global allocation of 0.5% would mean $2.5 trillion in flows, plus subsequent appreciation and the additional fund investment and credit that comes with it.

However, there are also opinions that the approval of the Bitcoin spot ETF will not have much impact on the crypto market. For example, JPMorgan Chase analyst Nikolaos Panigirtzoglou believes that the approval of the spot Bitcoin ETF will not Bringing in a lot of new money.

He noted in a recent report that these ETFs have been listed in Europe and Canada and have received "little investor interest since their inception."

Generally speaking, all walks of life are generally optimistic about the subsequent BTC trend that the Bitcoin spot ETF can pass, especially the long-term prospects are very promising.

Summary

The crypto market’s expected hype about the adoption of the Bitcoin spot ETF has reached a staged watershed, and the price of BTC has risen to close to before At the high point of the two bull markets, investors cannot help but worry about a market correction. But if it is as predicted by most institutions and mainstream opinions, then getting off the market at this time means that the cost of chips will increase.

It is indeed difficult to accurately predict the trend of BTC in the short term, but BTC has been growing after experiencing ups and downs in the 15 years since its birth. If the Bitcoin spot ETF is approved, it means that BTC, which has always been regarded as a niche asset, has the qualifications to enter a wider world.

So, if you missed the 69,000-fold increase in Bitcoin in 15 years, will you continue to miss the wealth code that may play a role in the gold price trend in the next 10 years?

JinseFinance

JinseFinance

JinseFinance

JinseFinance Wilfred

Wilfred JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Catherine

Catherine Bitcoinworld

Bitcoinworld Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph