After June 18, July 5 took over again, and the crypto market once again ushered in a wash.

On July 5, Bitcoin, which had been defending the 60,000 defense battle, could not hide its decline. After the midday trading, it fell below the 58,000 integer mark and continued to fall. It hit $53,363.32 during the trading session and is now hovering around $54,000, a 24-hour drop of 7.13%, and the price returned to the level at the end of February. Ethereum followed closely behind, falling below $2,900 and now at $2,868, a 24-hour drop of 8.62%. In addition to mainstream currencies, most altcoins that were expected to fall to the bottom fell again by 20%.

According to Coinglass data, as of 2:21 p.m., the 24-hour crypto liquidation reached $683 million, of which the main liquidation was long orders, with long orders reaching $590 million, and short orders were less than $100 million, showing a unilateral market trend.

Back to June 18, Bitcoin was still hovering at the main holding support level of 64,000-66,000. In just half a month, it has fallen to the level of 55,000. What happened in the market? Will the follow-up be to buy the bottom and hold on or to give in at the right time?

From the perspective of the event, the overall Bitcoin narrative has not changed significantly. The topics of ETFs and miners are still there. In the long run, it is highly dependent on macro expectations, and there has been no obvious progress in the three.

In terms of macro expectations, although the market supports the view of a rate cut in September, the Fed's direction is still unclear. The minutes of the Fed meeting showed that participants believed that inflation was moving in the right direction, but its speed was not fast enough to lower interest rates. On July 2, Federal Reserve Chairman Jerome Powell reiterated at the European Central Bank Central Bank Forum in Sintra, Portugal that recent inflationary pressures in the United States have eased, but more data is needed to prove that inflation risks have passed before deciding to cut interest rates.

ETF data, on the other hand, was tepid. Despite the market's continuous decline, ETFs actually achieved continuous net inflows for five working days starting from June 25, and only began to flow out on July 2 and July 3. The inflows and outflows were both in the order of $20 million, which was not enough to have a profound impact on the market.

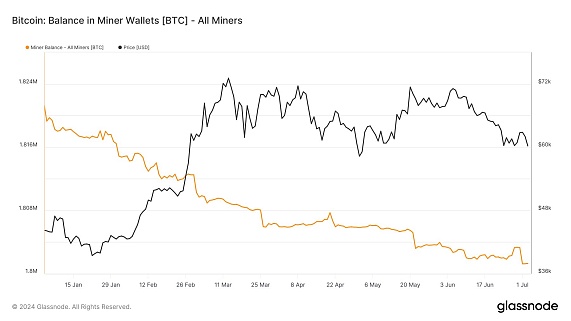

Back to the industry, miners are still selling. In the past week, miners sold more than $150 million in BTC, but the sales volume has obviously decreased, and the corresponding hash rate is gradually recovering, and the miner capitulation effect is gradually subsiding.

Changes in miners' exchange wallets, source Glassnode

But it is precisely because of the above that there is no practical solution to the short-term liquidity depletion problem surrounding Bitcoin. In this context, short-term narratives and market trends are more likely to cause sharp rises and falls, which is also the main logic of this 7.5.

In the past two weeks, two major events closely related to the market have occurred, one is the German government's BTC sale, and the other is the start of the compensation process in Mentougou.

As early as January this year, the German government announced that in the process of investigating the pirated website streaming platform movie2k, it seized nearly 50,000 BTC from suspects, worth about 2.1 billion US dollars. At that time, the investigation agency of Saxony, Germany, transferred the large amount of BTC in the wallet, which caused a sensation in the market. According to German regulations, some federal states stipulate that the seized assets must be sold immediately, but because the asset processing is still under discussion and division, this huge amount has always remained silent.

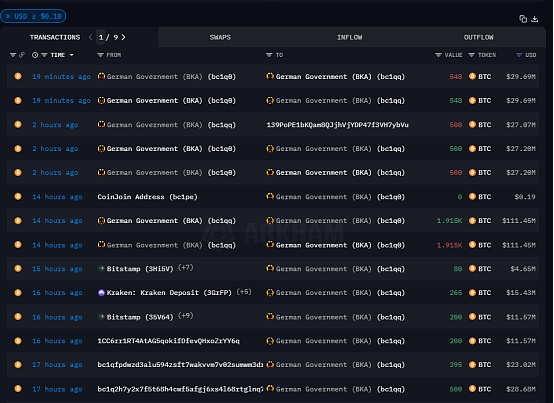

In June, the funds began to move. Starting from June 19, Germany successively sold Bitcoin. On the first day, 6,500 BTC were sold, and then they were transferred out in small amounts. On July 4, the German government transferred 1,300 BTC to the exchange again and transferred 1,700 BTC to an anonymous wallet address. In about half a month, the German government sold about 9,400 BTC and currently holds 41,774 BTC. At 3 pm today, the German government transferred another 500 bitcoins to a new address starting with 139P, worth about 27.07 million US dollars.

The German government wallet address changed today, from Arkham

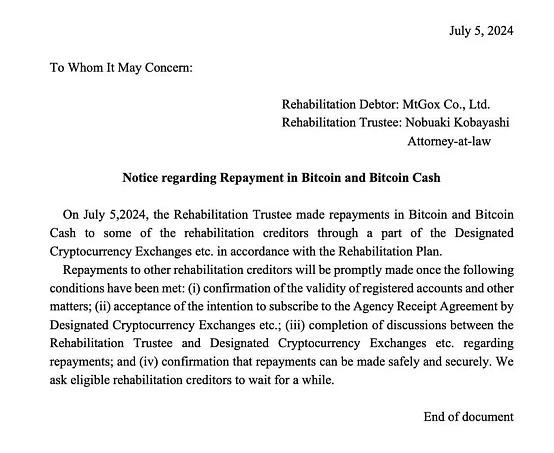

Coincidentally, Mentougou also added fuel to the fire. As early as June, before Mentougou officially compensated, it issued a notice saying that it would start repaying in early July. Although it repeatedly emphasized that it would not smash the market at once, due to panic, BTC almost lost 60,000 at that time because of the potential selling pressure of 140,000. In July, Mentougou officially started to act. On July 4, the Arkham platform showed that Mentougou had conducted a test transfer. On July 5, according to PeckShieldAlert monitoring, the address that received 47,200 BTC from Mt. Gox transferred the funds to two new addresses, of which 44,500 BTC were transferred to the address starting with 16ArP3, and about 2,700 BTC were transferred to the address starting with 1JbezD.

In addition to these two things, the US government and the rumored mysterious Eastern forces were also involved in the mystery.On June 27, more than $240 million worth of Bitcoin was transferred from private wallets to the Coinbase platform, especially wallets related to institutional traders. According to blockchain data tracking, Bitcoin was seized by the US government from drug dealer Banmeet Singh in 2024, and it is unclear whether it was sold later. After that, the US government address once again transferred out 248 BTC and 3,375 ETH. For a time, the market quickly set off rumors that the US government was selling.

If the US government still has traces to follow, the mysterious Eastern power can only be considered a market rumor. Market news said that a province in my country is selling BTC in the past week, with a total of 11,000 pieces, and more than half of them have been sold, with an average daily selling volume of 1,000 pieces. Although the news is not known to be true or false, it is true that there are changes in the addresses of giant whales on the chain.

Combined with the actual selling volume, Germany sold less than 10,000 pieces in half a month, the US government has not changed, the Eastern power is only a few thousand pieces, and Mentougou is only in the initial proposal stage, and the selling pressure is within a controllable range. The exchange data can also prove this. As of 8 o'clock this morning, the number of BTC transferred to the exchange is quite low, even lower than the data a week ago.

But it can cause such a large-scale decline today, and the weakness of insufficient liquidity is undoubtedly highlighted again. Especially today, the United States is in the Independence Day holiday, the market liquidity scale is insufficient, and it is difficult for Wall Street to take over the sell-off, which has caused the spread of market panic and a downward spiral. Long-term profit-makers also took advantage of the situation to sell, and the stampede effect was obvious.

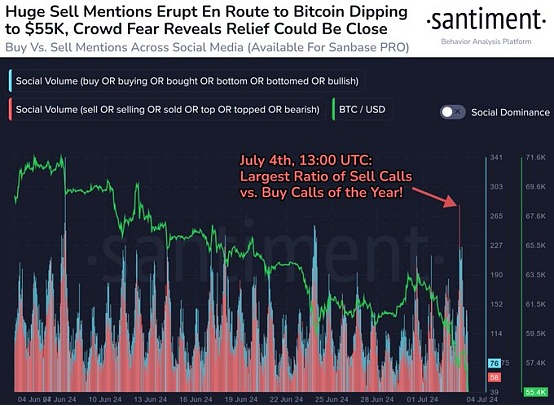

Social media has also exacerbated panic. In the encryption forum, it is politically correct for overseas media to sing the praises of prices instead of pessimism. However, according to Sentiment's findings, in the past 24 hours, the mention of selling is much higher than buying.

The attribution can be analyzed, but how should the subsequent market go? Analysts are still divided on whether to buy at the bottom or to stop while the going is good.

eToro market analyst Josh Gilbert believes that the current negative news is far greater than the positive, and it is expected that the price trend of Bitcoin will further deteriorate in the next few days. The price will be relatively weak in the short term and will test $50,000 or even lower. $52,000 will be the key battlefield between the bear market and the bull market.

Markus Thielen, an analyst at 10x Research, also supports this view, believing that it may fall to $50,000 in the next few weeks, and warned that "as support levels are broken and sellers scramble to find liquidity, selling may accelerate."

But more traders still hold an optimistic view and believe that the bottom price has been formed. A landmark event is that the capitulation of miners has come to an end. With the price of BTC reaching 54,000, only five mining machine models, including four Antminer mining machine models and one Avalon mining machine model, can bring profits to operators, which may mark a local bottom. Dovey Wan, partner of the cryptocurrency fund Primitive Crypto, also said: "Bitcoin miners are only one step away from surrender. The break-even point of S19 is 52,000, which is the perfect position for the local bottom."

From the perspective of events alone, it cannot be denied that the negative news is still continuing. In Germany, although the parliamentarians unilaterally called for a halt to sales to reduce market risks, the sales will continue in view of the consistency of German regulations and codes of conduct. In response, Sun Yuchen also directly called on the X platform, saying that German BTC can be acquired off-site. There is no doubt that this behavior seems to be more for marketing purposes. As for Mentougou, it has notified today that it has begun to repay some creditors in Bitcoin and Bitcoin Cash. The trustee also stated in the announcement again that the repayment will be made through designated cryptocurrency exchanges according to the compensation plan.

However, back to the main point, this level of selling pressure is actually not much, and the direct cause of this is still insufficient purchasing power. From the data, the BTC accumulation in the 24-hour exchange is only 35,000 pieces. This number, back to 21 years, is only the consumption of one day in the bull market. Back to a few months ago, it was only three days, but now, it may take more than three weeks to digest.

On the other hand, the price drop in the main trading section of Asia during non-US time has also occurred many times in this cycle, and weekends usually bring further liquidity lows. But based on this speculation, when it comes to the main US time on weekdays, the carrying capacity will increase rapidly, and the decline is expected to be curbed in the short term.

Before that, the data that needs to be focused on is the non-agricultural data. According to the schedule, the U.S. Department of Labor is scheduled to release the June non-agricultural employment report at 20:30 tonight Beijing time. According to the median forecast of economists compiled by industry media, it is expected that the number of non-agricultural employment in June will increase by 190,000, and the unemployment rate will remain the same as last month at 4%.

The unemployment rate will become the core focus. Technically speaking, a rise in the U.S. unemployment rate to 4.2% will trigger Sam's Law. According to Sam's Law, when the three-month moving average of the unemployment rate rises by 0.5 percentage points or more from the low point of the previous 12 months, the U.S. economy will fall into recession. Simply put, an increase in the unemployment rate indicates that the market is entering a recession, and under this pressure, the possibility of a rate cut will increase. If the employment report is all good, the Federal Reserve is more likely to maintain its existing interest rate policy.

The reason is that the current core of the market is inseparable from liquidity, which has directly led to the so-called grassroots crypto people moving towards macro analysts. In this bull market that looks like a bear market, interest rate cuts seem to be a beacon. But on the eve of the interest rate cut, the last drop in the market is also approaching. Asset management and risk control may be the real beacon for investors.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Alex

Alex Clement

Clement Bitcoinist

Bitcoinist decrypt

decrypt Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph