Author: Vishal Kankani Source: Multicoin Capital Translation: Shan Ouba, Golden Finance

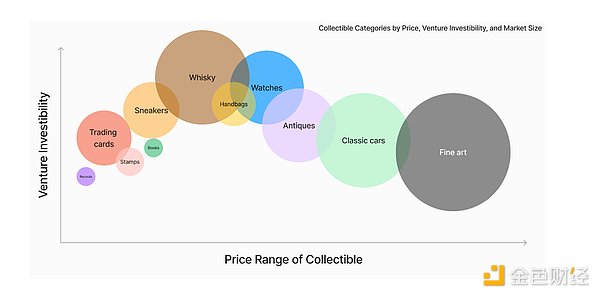

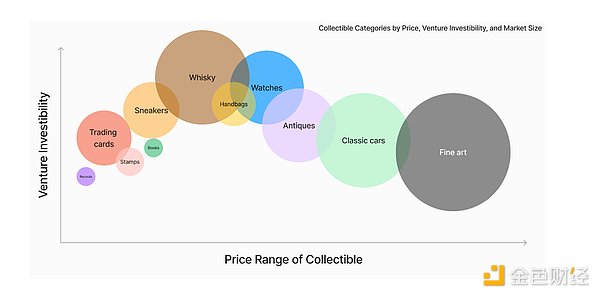

Collecting is big business. Today, more than a third of Americans self-identify as collectors, and the market size of collectibles is now close to $500 billion by 2024. Collectibles are a booming industry - and blockchain is making its way into it.

A growing number of collectors in the world are actually traders whose sole purpose is to buy and sell billions of dollars worth of collectibles - from rare whiskeys to luxury watches to handbags - with the goal of flipping them for a profit. While online marketplaces have typically evolved to serve humanity in the most efficient way, from digital classifieds to everything stores.

For flipping transactions to be as efficient as possible, the collectibles market needs to have 1) instant settlement, 2) physical custody, and 3) authentication capabilities. Leading collectibles marketplaces today, such as Bring a Trailer, StockX, and Chrono24, offer all three of these services. Cash settlement is not an option; instead, physical settlement is the default—with settlement times typically measured in days or weeks. For larger collectibles, such as cars, physical storage quickly becomes an issue as well (where are you going to put them when you flip 20 cars?). For smaller collectibles, which are often traded through vertical marketplaces like Facebook groups, fraud is a constant challenge. All of these factors make trading collectibles in today’s marketplace extremely inefficient.

We see a huge opportunity to create an entirely new market design purpose-built for collectibles traders, called “Blockchain-Enabled Collectibles Markets” (BECMs). These markets offer instant trades through cash settlement, use stablecoins to reduce settlement times from weeks to seconds, and use NFTs as digital representations of physical assets held by trusted custodians or certifiers.

BECMs have the potential to reshape the multi-billion dollar collectibles market as they can achieve the following goals: 1) unify the market and increase liquidity (relative to the current fragmented black market); 2) eliminate the need for personal physical storage, thereby encouraging more trading; 3) increase trust by providing identity verification; and 4) financialize the act of collecting by facilitating lending where lending was previously unavailable. We believe the result of these efficiencies will significantly expand the TAM of the entire collectibles market as more traders, liquidity, inventory, and markets come online.

However, while it is technically feasible to build a BECM for any collectibles category, not all BECMs are created equal. The remainder of this article will focus on what qualities make BECMs worthy of venture capital investment. We will break down seven key characteristics along three design axes: financial, real-world, and emotional.

Financial Axis

Lack of Verticalized Trading Venues

Today, most collectibles do not have dedicated markets or exchanges to aggregate liquidity and facilitate public price discovery; instead, they are traded in many different venues - WhatsApp chats, Facebook groups, auction houses, etc. - which fragment and segment liquidity. This means there is ample opportunity to serve underserved collectibles markets; however, it will be difficult for BECM to compete if existing market structures are already efficient. These markets are less attractive to venture investors.

Based on our initial assessment of the collectibles markets, the wine and spirits, handbags, and watches markets have the greatest potential for improvement. The vast majority of these collectibles are traded on the black market, and lack liquidity and price discovery, making existing markets vulnerable to disruption.

Golden Price Point

For a collectible category to receive venture capital, the price of the collectible must be low enough for collectors to own the asset outright. While ownership of a fraction of an asset is fine for financial investment, ownership of half a luxury handbag defeats the purpose of collecting for a collector. Additionally, super-high-priced collectibles reduce the overall number of buyers, making these collectible categories less liquid. For example, no one will resell a million-dollar Ferrari because demand doesn’t coincide 24/7.

On the other hand, collectibles need to be expensive enough that owning it confers a certain social status, gives a sense of exclusivity, and brings emotional satisfaction. If something is too cheap and anyone can own it, it will not attract emotionally and status-driven buyers, making the market less liquid. Additionally, the price point should be high enough that it is worth it for potential market makers to spend time researching the collectible category. If items are too cheap, they must turn over more times for the unit economics to make sense. However, cheap collectibles do not provide enough social status to attract collectors to form a liquid market.

We believe the prime price range for investable BECMs is about $1,000 to $100,000. This would make collectibles such as sneakers, watches, handbags, and antiques ideal for BECMs. Collectibles such as art and cars are too expensive for most people. Collectibles such as records and stamps may not be a good fit for BECMs because they are lower priced. Their niche nature combined with their low prices make it difficult for the market to generate sufficient trading volume.

Viewed as a Store of Value

Collectors are status-seeking buyers. They have the diamond hands, so to speak. Their presence is essential to a healthy price floor in the collectibles market. This shows that collectibles are not a passing fad, but rather an item of lasting cultural significance. This is because when enough people believe that an item will have cultural significance long into the future, it has a chance to be viewed as a store of value. Collectibles that function as a store of value have cross-generational appeal and are generally not subject to technological change.

Fine art is a prime example. Humans have enjoyed art for thousands of years, and it’s safe to say that people will continue to enjoy it thousands of years from now. Vinyl records are a more ambiguous example. They have broad appeal to older generations, but whether the generation that grew up after the iPod era will continue to value them remains to be seen.

Real World Axis

Difficult to Store

Collectibles that take up a lot of physical space or that deteriorate easily in the average home environment are prime candidates for BECM, and therefore are good categories to invest in. It’s difficult for the average person to store delicate collectibles like wine and art for long periods of time without taking environmental precautions (humidity, temperature, light, etc.). Even if you could magically solve these problems, you’d quickly run into space limitations—storing more than 50 paintings or 100 bottles of wine would be a hassle in most people’s homes. Even if you could magically eliminate space limitations, you’d run into insurance issues.

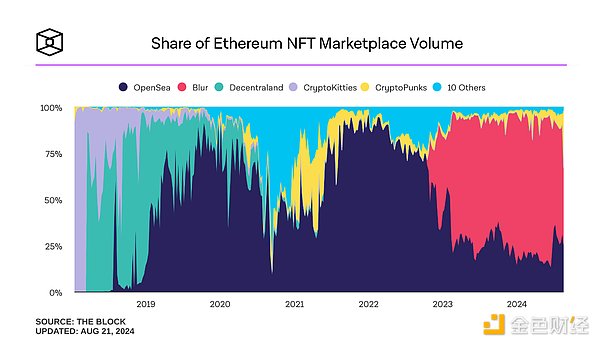

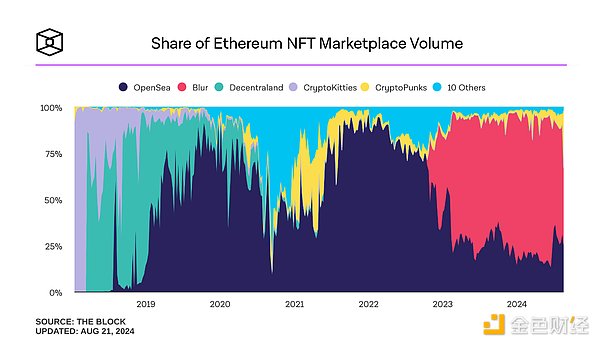

If the collectibles category is not difficult to host, then building a BECM may still be profitable, but the barriers to entry will be much lower, resulting in increased competition, fragmented liquidity, and reduced pricing power. NFTs are the best example of this category: they are not environmentally sensitive, do not take up any physical space, and transparent provenance on the blockchain makes fraud almost impossible, making it difficult to build a defensible NFT market.

Sponsored Business Content

We believe collectibles such as wine, whiskey, and cars face the greatest challenges in storage, so collectors of these collectibles will benefit the most from a BECM. Wine and whiskey are extremely environmentally sensitive and require special vaults to control temperature, humidity, light, and other factors (our investment in Baxus is addressing this precise problem). Cars require large physical garages — most people would have a hard time storing more than 3 or 4 cars at home. Trading cards, sneakers, watches, and handbags are less difficult to store — collectors of these items can still benefit from outsourcing storage, but with smaller marginal improvements.

There is a trust problem

In addition to solving the physical custody problem, BECM must also solve the authenticity problem in order to attract investors.

Today, collectors face a serious trust problem; buyers and sellers in group chats rely on community recommendations and anonymous moderators to vet counterparties. Unsurprisingly, scams exist in almost all collectibles. It is difficult for market participants to have 100% confidence in their purchases. Creating market standards and trusted authenticators is critical to attracting liquidity from collectors, alternative asset investors, and speculators.

There are two ways to do identity verification:

In-house authentication - This requires domain expertise and is more complex to operate. If the marketplace misauthenticates an item, it will bear the responsibility of compensating the collector. However, this can be a good moat, especially if the collectibles are difficult to authenticate. That being said, marketplaces that do authentication in-house must manage potential conflicts of interest and will need to have some oversight to maintain buyer trust.

Outsourcing - This approach is simpler, but will reduce the profits that the marketplace can earn - so outsourcing makes more sense when the collectible categories are easier to authenticate. Another benefit is that outsourcing authentication naturally separates the marketplace and the authenticator, mitigating potential conflicts of interest.

If BECM can build trust and provide a money-back guarantee, it can build a moat that makes it worthwhile as a venture capital. Collectibles such as watches, handbags and wine are rife with fakes. BECM has a great opportunity to increase trust and attract new collectors who may not be willing to collect due to fear of fraud.

Emotional Axis

Time-Based vs. Brand-Based Provenance

In the context of collectibles, provenance refers to how an item acquires its value. For collectibles, provenance is typically time-based or brand-based.

Time-based provenance means that an asset appreciates over time and historical context. Rare books are an example of such an asset. Assets with time-based provenance are traded exclusively on the secondary market - there is no central issuer and the asset is typically one of a kind, or one of a handful of assets. This characteristic can limit secondary market activity as collectors do not need ongoing funds to purchase newly issued assets, and diamond hand collectors suppress the amount of supply available for trading. Constitution DAO is a good example of this - the copy of the Constitution they bid on has not yet returned to the secondary market. Other collectibles with time provenance include antiques, fine art, cars, and guns.

Brand-based provenance, on the other hand, is when a brand builds a reputation over time and the market begins to perceive its products as valuable. Watches are a classic example of brand-based provenance. The top luxury watch manufacturers - Rolex, Patek Philippe, Richard Miller, and Audemars Piguet - are major players in nearly half of the luxury watch market as their names have value. Branded collectibles have a central for-profit issuing body that constantly issues new items. Unlike time-based Provence collectibles, these types of collectibles encourage secondary market activity as collectors need funds to purchase new supply and turn to the secondary market for sales.

As a result, brand-based BECMs are more suitable for venture capital than time-based BECMs.

Communities of passionate collectors do exist

Venture capitalists want to see strong emotions about collectibles; it is a prerequisite to owning a diamond-handed collector. Without them, it is difficult to have organic liquidity. Therefore, BECMs with weak communities will struggle to attract significant funding and lose investment appeal.

The best sign of a thriving community is passion, even to the point of debate. We expect to see car collectors arguing about the best supercars ever and the most underrated brands revered by handbag enthusiasts. A community of passionate collectors will be active in every corner of the internet - in subreddits, forums, and group chats.

The Cambrian Age of Collecting

The future is not limited to BECMs for watches, handbags, and wine. There are hundreds of other investable categories.

BECM's opportunity lies in creating new markets for a variety of collectibles and improving access to a new class of alternative investments.

Joy

Joy