Author: rektdiomedes

Source: rektdiomedes twitter

Radiant Capital, a new lending protocol, recently successfully launched on Arbitrum, harvesting $250 million in TVL in just 2 days. What kind of project is Radiant Capital? This article will unveil Radiant Capital for everyone.

Radiant Capital is a lending protocol like Aave or Compound. According to Radiant Capital's official introduction, Radiant Capital's goal is to become the first full-chain currency market, where users can deposit any major asset on any major chain, and then borrow and lend across multiple chains.

With the continuous increase of TVL, Radiant Capital has now become one of the largest protocols on Arbitrum, attracting a lot of attention.

The Radiant team chose to launch its V1 version at Arbitrrum. They plan to use Stargate's technology to achieve the goal of "multi-chain" or "full-chain" when releasing V2.

The Radiant team has spent 8 months in development, striving to invent a new but very necessary DeFi primitive. Therefore, considering the current state of replacing L1, Radiant releases v1 on what it considers to be the most secure and decentralized blockchain - Arbitrrum.

Arbitrrum's transaction fee reductions, combined with the security and institutional adoption of Ethereum, have enabled Radiant's team to build an ecosystem that provides users with competitive interest-earning opportunities while maintaining a high level of security.

Radiant’s cross-chain interoperability will be built on top of Layer Zero, v1 utilizing Stargate’s stable router interface. Lenders wishing to recover their collateral will be able to specify which chain to withdraw funds to, and what percentage of funds they wish to send to each chain.

Radiant focuses on core products that are resistant to oracle manipulation, and has spent over $2 million on security audits performed by Layer Zero and Stargate. Radiant itself has undergone a full audit by Solidity Finance, and Peckshield's second audit is nearing completion.

Radiant v2 will allow full cross-chain lending and lending on BTC, ETH and USDC, with additional assets to be gradually rolled out later as voted by the Radiant DAO.

DeFi funds are currently extremely fragmented across chains, as evidenced by dozens of different currency markets, all of which have only their own liquidity. Borrowers are forced to choose a chain, and the assets they withdraw must exist on the same chain.

If DeFi users want to deposit wBTC on Arbitrum and withdraw ETH on mainnet, they have to go through a series of cumbersome transactions across multiple user terminals to do so. This creates a suboptimal lending experience.

Radiant's goal is to become the first full-chain money market where users can deposit any major asset on any main chain and borrow various supported assets across multiple chains. Radiant's primary goal is to consolidate approximately $22 billion of decentralized liquidity currently spread across ten alternative layers.

Lenders who provide Radiant with liquidity will earn passive income from the assets they deposit. Borrowers can withdraw collateralized funds for liquidity (working capital) without selling assets and liquidating their positions.

Radiant Capital’s code is built on Geist, the 2021 Fantom lending protocol, which is built using the Aave codebase. The Degens of DeFi definitely know Geist. I've been a big fan of the project since the early days of Geist. I thought staking/locking and fee sharing and yield UX would be breakthrough inventions.

Radiant's primary vision is to unify multiple money markets and on-chain decentralized liquidity under one secure, user-friendly, and capital-efficient full-chain protocol. Therefore, Radiant's mission is to leverage the resources in the Radiant DAO to realize this vision.

The Radiant team analyzed all money markets and concluded that Geist Finance showed the greatest potential in quickly bootstrapping liquidity - they raised about $10 billion in TVL in less than two weeks. In addition, their protocol also provides a stable and secure Aave loan pool framework.

Radiant believes that leveraging Geist's code base provides a good foundation for its development team to implement cross-chain functionality through the Layer Zero communication protocol, like the one popularized by Stargate.

However, I think the fatal flaw that caused them to be unsuccessful is that they actually use a specific chain, so they can't move in the direction of embracing super chains. However, Radiant Digital was originally built towards the goal of multi-chain/full-chain, which will take some time.

Radiant Digital's deposits and borrowings are very detailed with other DeFi lending agreements, so there is no need to go into details here. However, they have added an interesting innovation - one-click cycling, which is very convenient for users who want to do leverage.

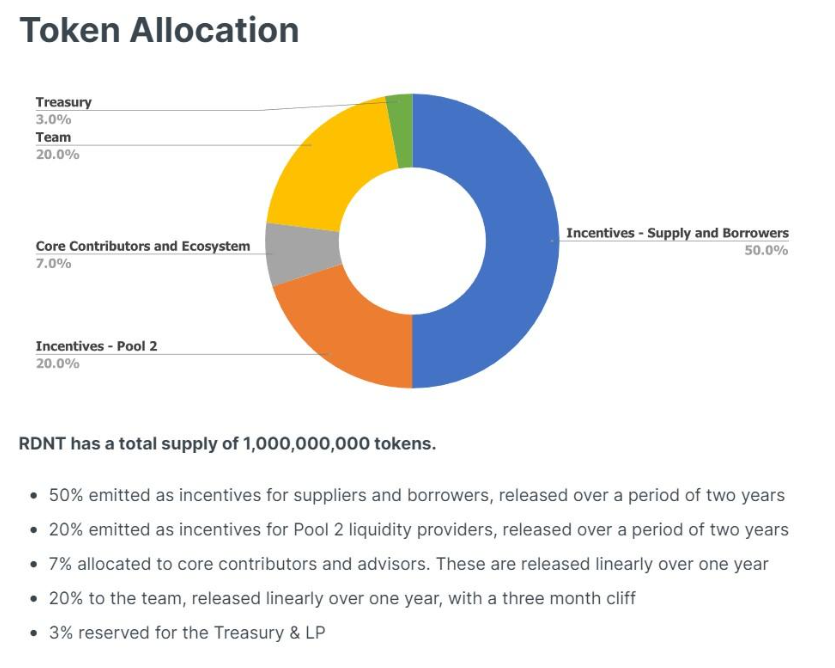

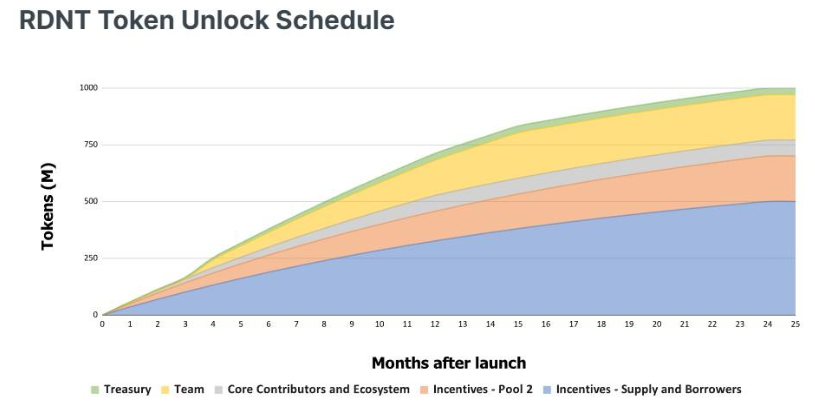

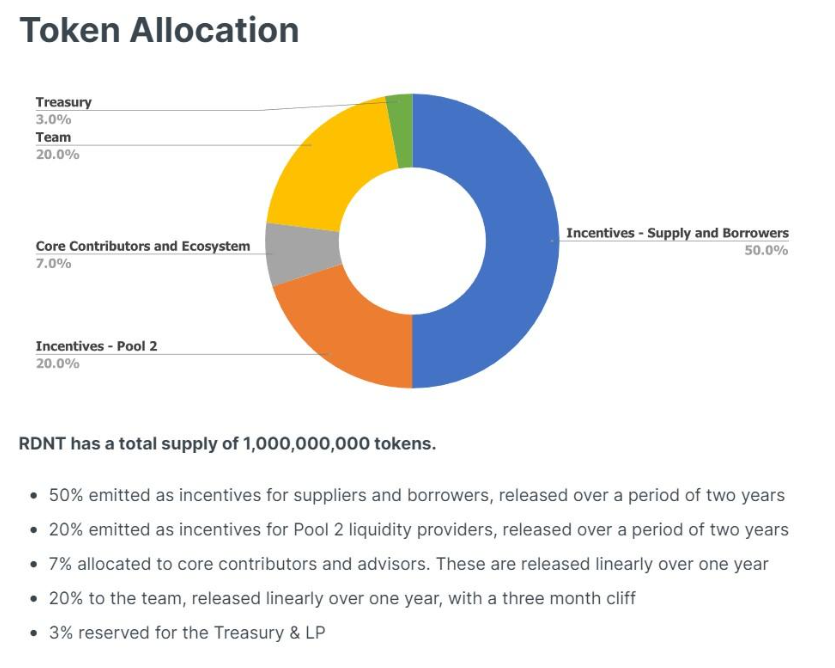

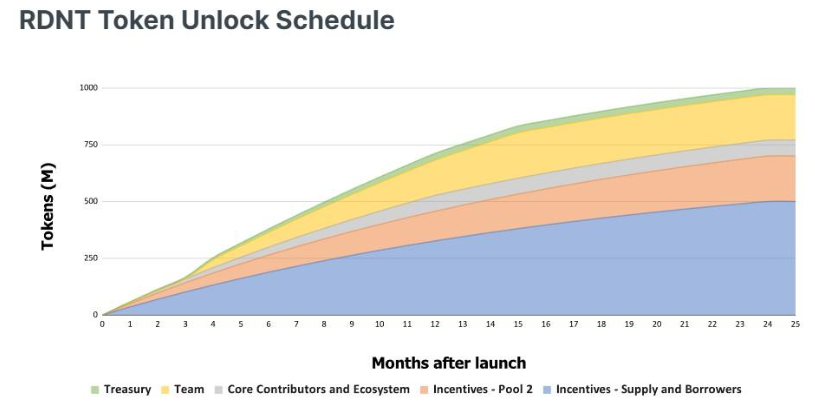

Its protocol uses RNDT tokens to incentivize borrowers and lenders. The following figure shows the detailed information of RNDT tokens:

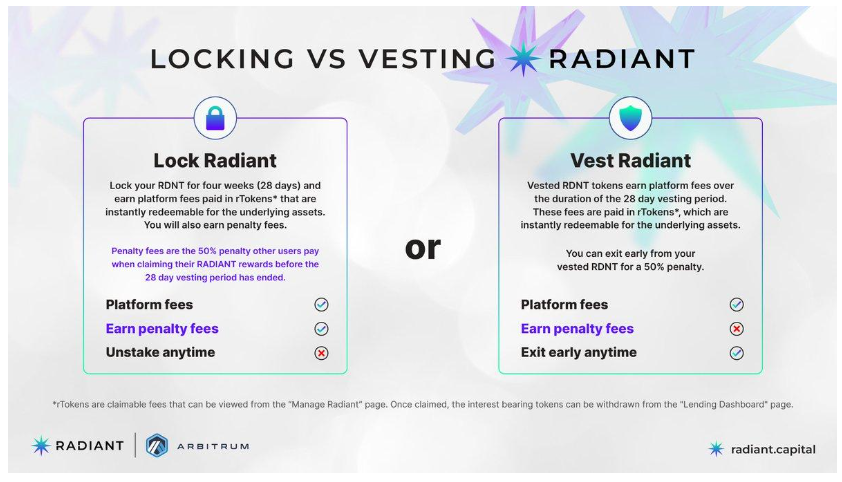

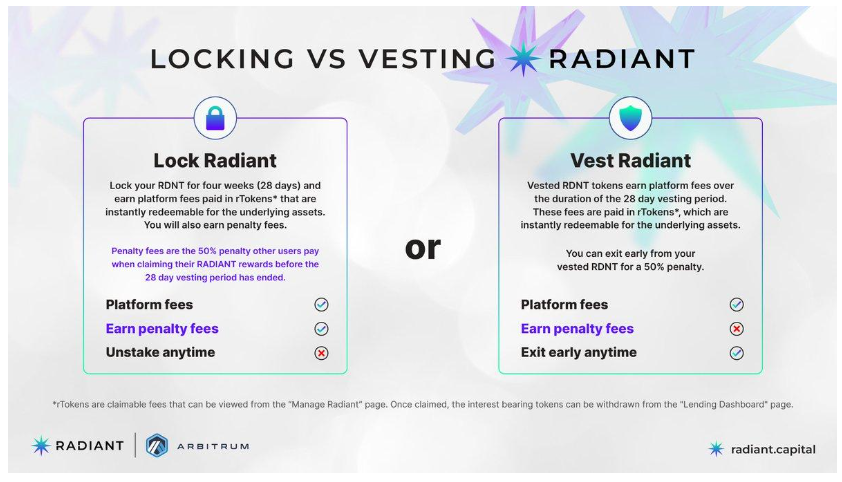

The earned RNDT has a 28-day vesting period at the beginning, and a 50% penalty will be charged if it is withdrawn early. You can also "lock" RNDT for a short period of time, and get 50% of the default fee from investors who exit the lock-up period early, as well as a part of the agreement fee income.

The RNDT token is also being used to incentivize the liquidity supply of "Pool2", which is currently the RDNT/WETH pool on Sushiswap - Arbitrrum.

20% of the released RNDT will be used for Pool2 rewards. There are two main benefits of staking RDNT/WETH LP tokens: 1. Earn extra RDNT rewards. 2. Ensure the longevity and health of the platform by supporting deeper protocol liquidity.

The iteration of lending agreement and AMM design can promote the healthy and long-term development of DeFi. Radiant Capital is undoubtedly a very interesting cross-chain lending agreement. We will wait and see how far it can go.

As always, this article does not constitute investment advice. Everyone must do their due diligence, because even the best protocols may have some degree of risk such as smart contract vulnerabilities.

Catherine

Catherine