Gold has been used as a store of value for thousands of years. Because of this, investors widely use it as a hedge against the effects of recession and inflation due to geopolitical tensions. Given recent events such as the COVID-19 pandemic and the military crisis between Russia and Ukraine, many investors have sought alternatives to gold and other precious metals as hedging options. Alternatives to gold that are future-proof are a prerequisite as we move into the digital age. In the search for a challenger to gold's supremacy, Bitcoin (BTC) shines brightest.

Soaring gold prices are often an indicator of anxiety in traditional stock markets, and the current investor consensus is that gold is currently overbought. Gold has risen to $2,000 an ounce as investors weigh the geopolitical and economic fallout from the conflict between Russia and Ukraine.

On the other hand, capital funding for Bitcoin and other cryptocurrencies has increased during the same period. In the last three weeks of February 2022, venture capital buyers poured about $4 billion into the crypto space, according to research firm Fundstrat. In the first week of March 2022, startups in the crypto space received an additional $400 million in funding. The increase in funding shows that global investors are looking to add new areas of investment that they expect to be able to withstand the fallout from the conflict between Russia and Ukraine.

The ongoing conflict has cost the people of both countries economically. Military activity in Ukraine has led to the closure of many businesses, which naturally hurts the local economy. Russia has been under economic sanctions, with restricted bank accounts, inability to use most forms of electronic payments and a devalued national currency. There is still no uniform international law governing the cryptocurrency due to its decentralized nature, which means that it retains its value regardless of the location of the holder. Bitcoin is legal in most countries, with some even declaring it legal tender.

The crisis that resulted in the displacement of individuals showed the potential impact that Bitcoin could have on the future. Bitcoin does not require a huge price to transport like gold. Individuals don't have to declare their bitcoins when crossing international borders, and they don't have to run the risk of being confiscated or stolen for transporting physical gold.

Bitcoin's potential utility in times of need adds to its appeal to traditional investors. That appeal is also growing, partly due to the recent fall in the value of bitcoin. A key advantage Bitcoin has over other cryptocurrencies is mainstream awareness, as it has been around long enough to have gained support and acceptance, and in that time it has even shown an unstoppable trend.

Stability in the face of crisis

The COVID-19 global pandemic has proved to many that Bitcoin can also withstand the impact of the Ukraine and Russia conflicts. COVID-19 has caused economic recession in many traditional sectors worldwide. Coinbase reported that during the COVID-19 peak in March 2020, $1.4 billion in fiat and cryptocurrencies flowed into wallets through its exchange within a 24-hour period.

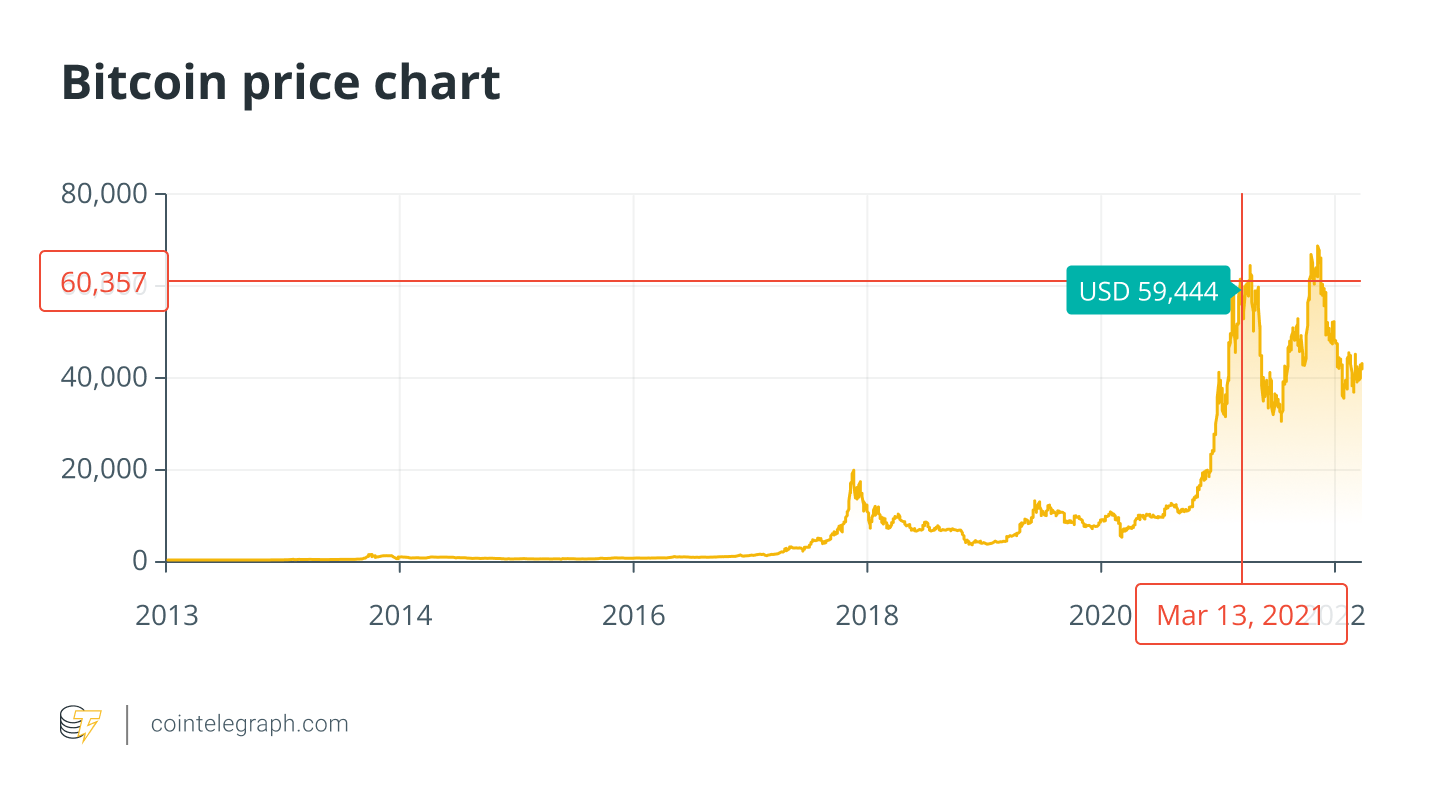

During the first half of March 2020, investors were quick to take note of Bitcoin's success in maintaining its value amid a plunge in the value of traditional stocks. This increased the amount of money flowing into cryptocurrencies, which eventually led to an all-time high of about $60,000 in March 2021. For those skeptical about gold's future viability, the stability bitcoin has shown during that crisis has added to its appeal as a hedging option.

Despite the recent explosion in the crypto space, the crypto market remains in the shadow of traditional market investments in terms of valuation. With mainstream exposure to Bitcoin’s potential, we’re seeing this gap close much faster than initially expected. Investors are always looking for the latest available options for their portfolios.

With many investors looking to diversify their portfolios due to its superiority over gold and the certainty of a digital future, bitcoin appears to be the sweet spot. This incremental flow of capital into the crypto space can only last for so long, until the floodgates finally open, allowing Bitcoin to replace gold as the new king of value preservation.

Cointelegraph Chinese is a blockchain news information platform, and the information provided only represents the author's personal opinion, has nothing to do with the position of the Cointelegraph Chinese platform, and does not constitute any investment and financial advice. Readers are requested to establish correct currency concepts and investment concepts, and earnestly raise risk awareness.

Kikyo

Kikyo