Author: Peter Yang

Source: creatoreconomy.so

Since April 2022, the global encryption market has lost $1.2 trillion, and many encryption companies are facing bankruptcy.

what happened?

Inflation is at a 40-year high and the stock market has slumped.

simply put:

1. Terra UST and LUNA crash, losing $59 billion

2. The decline of Three Arrows Capital from $10 billion to bankruptcy

3. The decline of Celsius from $20 billion to freezing customer withdrawals

The $59 Billion Crash of Terra UST and LUNA

Terra is a blockchain protocol led by Korean entrepreneur Do Kwon. The blockchain has two main tokens:

UST is a stablecoin pegged to the US dollar (1 UST = 1 USD).

LUNA is used to stabilize the UST-pegged token.

How UST and LUNA work

There are many types of stablecoins. For example, USDC is a stablecoin backed by actual U.S. dollars in its treasury. But UST is different.

UST is an "algorithmic" stablecoin that magically maintains its peg to $1 using its sister coin LUNA:

1. You can always redeem 1 UST with 1 USD LUNA.

2. So if UST falls below 1 USD, you can make a profit by exchanging 1 UST for 1 USD LUNA. This will eventually bring the price of UST back to $1.

To get people to invest in UST and LUNA, Terra is heavily promoting Anchor, a “savings” protocol that offers 20% annual interest rate (APY).

Of course, this all falls apart if you ask a few questions:

1. Where does the value of UST and LUNA come from?

2. Who would borrow money at 20% annual interest?

Some people did ask these questions, only to be laughed at by Do Kwon as poor.

Behind the scenes, Do knows that if demand dries up, UST will be decoupled. That's why he raised $1 billion in Bitcoin in early 2022 to support the price of UST. Many institutional investors participated in this round of financing and exchanged real money for a large amount of LUNA.

The collapse of UST and LUNA

In May 2022, they finally reaped the consequences:

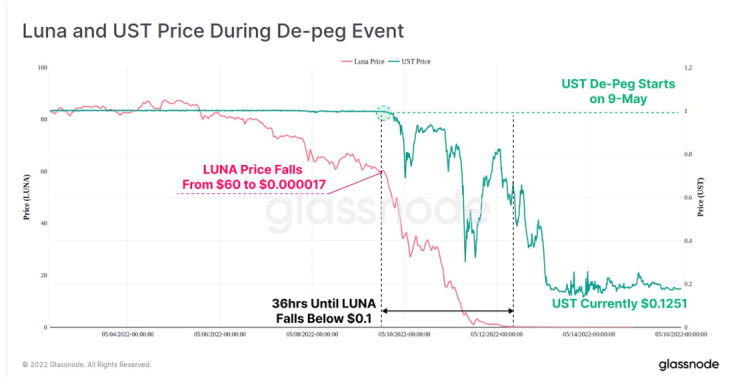

After UST was de-pegged from the dollar, its price dropped 95% from $1 to less than 5 cents in a few days. Terra attempts to maintain the peg by issuing more LUNAs and using its Bitcoin reserves. But the death spiral continued until both UST and LUNA were rendered worthless. $59 billion evaporated in a matter of weeks, $18 billion of which came from the UST “stablecoin.”

However, this is only the beginning:

Crypto crisis spreads.

A large number of funds/companies/products blew up their treasury with UST's yield on Anchor. Promises of billions of dollars - gone forever.

I don't want to get any value on a crypto yield product. I'm guessing there are still some companies that haven't declared bankruptcy yet.

— @DylanLeClair_

How Three Arrows Capital went from $10 billion to bankruptcy

Three Arrows Capital (3AC) is a crypto fund led by Zhu Su and Kyle Davies. At its peak, 3AC managed over $10 billion in assets. Its investments include a list of "celebrities" leading blockchain and DeFi protocols:

3AC's investment

All this success has made 3AC cocky. The fund began borrowing money from lenders and investors based solely on its reputation, rather than providing any collateral. Like Do Kwon, Zhu Su is also confident that cryptocurrencies are about to reach the moon.

Starting in 2021, 3AC made three dire bets:

1. 3AC purchased over $200 million in LUNA to support Terra’s Bitcoin reserves. After the UST/LUNA crash, the investment became $0.

2. 3AC has invested heavily in stETH, which will be introduced in the Celsius section below.

3. 3AC is the largest shareholder of GBTC, and GBTC has suffered heavy losses.

What is GBTC?

The Grayscale Bitcoin Trust (GBTC) is a publicly traded security designed to track the price of Bitcoin. Basically, GBTC bought a large amount of Bitcoin and issued fund shares that reflected the net asset value of its treasury.

GBTC’s premium over Bitcoin turns into a discount in 2021 ( source )

Over the years, the price of GBTC has been higher than that of Bitcoin due to demand from institutional investors who cannot hold Bitcoin directly.

In 2021, Canadian regulators approved several bitcoin ETFs that more closely track the price of bitcoin against GBTC. Institutional investors sold their GBTC shares to buy these ETFs.

GBTC started trading at a discount to its NAV, not at a premium. To reverse this, GBTC asked the SEC to also allow it to be listed as a Bitcoin ETF.

Zhu sees this as a huge arbitrage opportunity. 3AC can buy GBTC shares at a discount and make a profit when the price rises after the ETF is approved.

But as of this writing, the US SEC has still not approved GBTC as an ETF. At the same time, the price of GBTC continues to decline relative to its NAV (currently -30% as of July 2022). 3AC was eventually forced to close its position at a huge loss.

3AC's collapse

When the overall crypto market deteriorated, lenders started asking 3AC to return their money. For example, 3AC borrowed 15,250 Bitcoin and $350 million in USDC from Voyager, a leading cryptocurrency lender. However, due to poor investments in LUNA, GBTC, etc., 3AC has no money to repay the loan.

The company had no choice but to declare bankruptcy. The current whereabouts of Su Zhu and Kyle Davies are unknown.

How Celsius and Other Crypto Lending Firms Freeze $20 Billion in Client Assets

Celsius claims it's 'safe and transparent' when people can't withdraw their funds

Celsius is a crypto lending company led by Alex Mashinsky. At its peak, the firm managed $20 billion in assets for 1.7 million clients. Many of these clients are retail investors attracted by the 10%+ APY on stablecoins that Celsius offers. After all, why wouldn't you want to earn 10x the yield of your local bank on a platform with "military-grade security and a high level of transparency"?

Of course, the real question is:

What does Celsius do with people's deposits to provide 10%+ APY returns?

Let’s take a look at one of Celsius’ largest investments — the $400 million investment in stETH.

What is stETH?

stETH, or “staked ETH,” represents a unit of Ethereum, deposited on Ethereum’s new proof-of-stake beacon chain. Let me explain:

1. Ethereum is upgrading from proof of work (main blockchain) to proof of stake (beacon chain).

2. You can pledge your ETH through Lido Finance and get stETH in return. In the process, you earn 4% APY.

3. The problem is: you can officially convert your stETH to ETH within 6-12 months (2023 or later) after Ethereum upgrades to Proof of Stake.

4. There is a way: you can use the liquidity pool to exchange your stETH for ETH. Liquidity pools are baskets of ETH and stETH tokens that help facilitate token swaps (refer to this article: How to provide liquidity? )

Here's the thing:

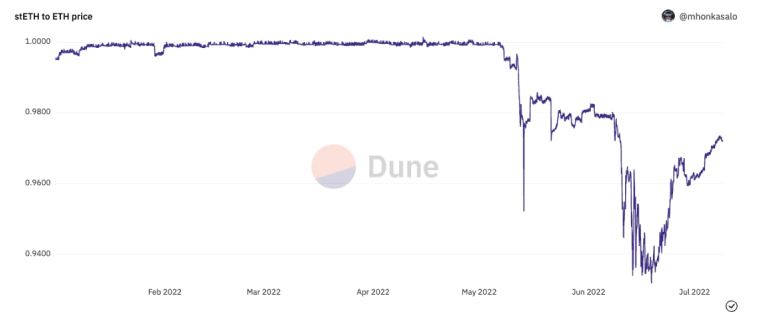

1. Celsius has invested more than $400 million in stETH, and it expects the cryptocurrency bull market to continue.

2. The result is a bear market, and investors in stETH get restless. Many of them started exchanging stETH for ETH, including 3AC and Celsius. Eventually, there will be no more ETH in the liquidity pool, so swapping will be impossible.

3. The price of stETH relative to ETH starts to drop. The value of Celsius' remaining stETH dropped significantly and could not be exchanged for ETH fast enough.

At the same time, Celsius's depositors began to demand the return of funds, and Celsius had no money. People have the same concerns, but Alex Mashinsky dismisses them:

Mike, do you know anyone who can't withdraw money from Celsius?

Why spread FUD and misinformation.

If you're paying for this let everyone know which side you're on, otherwise it's our job to fight Tradfi together...

— @Mashinsky

Just a day after the aforementioned tweet was published, Celsius announced it was suspending withdrawals for 1.7 million customers.

A company that has built a reputation of "the bank is not your friend" is far more risky than a bank.

Consequences of the 2022 Crypto Credit Crisis

So things go like this:

1. As a retail investor, you deposit funds into CeFi lending platforms such as Celsius in order to obtain 10%+APY income.

2. These platforms then lend your money to 3AC and invest it in risky assets such as UST, GBTC, and stETH in pursuit of higher yields.

4. After the crash of UST and 3AC, the CeFi platform can no longer return your money.

This sordid sequence of events was driven by the greed and recklessness of some major crypto institutions — well-known figures in a space that was supposed to be decentralized.

Fortunately, actual decentralized finance platforms such as Aave have been largely unscathed by this crash.

Unfortunately, however, this is no consolation to the millions of retail investors who have been rigged:

The Terra and Celsius subreddit is full of these comments

Finally, let us summarize this crisis by citing a few lessons:

1. Don’t invest more than you can afford to lose – cryptocurrencies are very volatile.

2. Do your own research and don't invest in something you don't understand.

3. Ask yourself questions like "Where are these benefits coming from?"

4. Don’t get FOMO about rapidly rising prices or insane APYs.

5. For God's sake, don't play leverage.

I wish more people learned these lessons because losing money is the worst way to get into this field.

Alex

Alex

Alex

Alex Hui Xin

Hui Xin Joy

Joy Kikyo

Kikyo Brian

Brian Joy

Joy Hui Xin

Hui Xin Joy

Joy Alex

Alex Kikyo

Kikyo