By Cesare Fracassi

Source: Coinbase Institute (Original link: https://blog.coinbase.com/coinbase-institute-research-crypto-prices-and-market-efficiency-d45c1f3c5b25 )

How should we evaluate the recent highs and lows in cryptocurrency prices? From the perspective of market efficiency, cryptocurrency prices reflect the market's assessment of the future prospects of digital assets. This perspective can help us understand historical trends in cryptocurrency prices and their correlation with the overall financial market:

Over the past 5 years, the cryptocurrency market has delivered very large returns, partly due to the adoption of institutional and retail investors, and the laying of the foundation of web3.

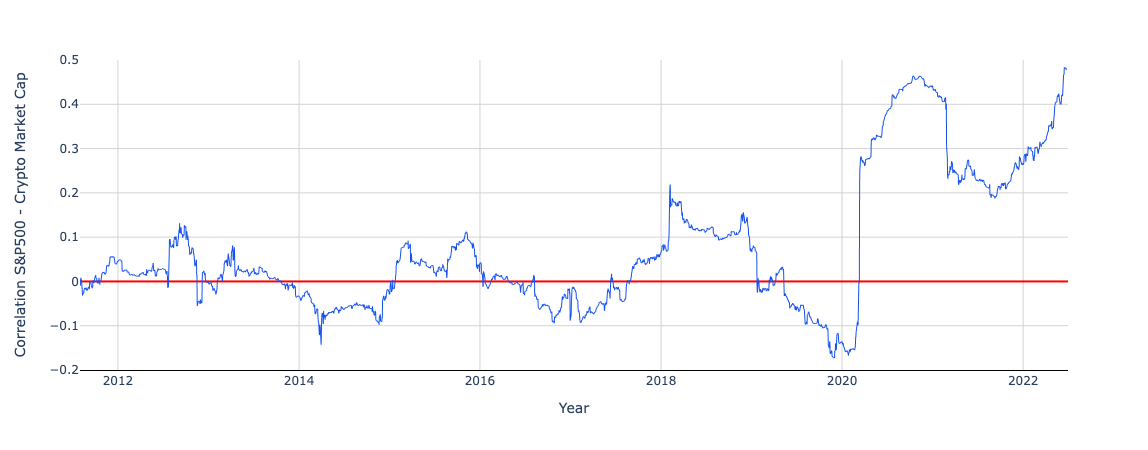

The cryptocurrency market was initially uncorrelated with financial markets, but the correlation has risen significantly since 2020. As a result, the market expects crypto assets to become increasingly intertwined with the rest of the financial system.

Today, the risk profile of the cryptocurrency market is similar to that of oil prices and tech stocks.

Deteriorating macro factors accounted for 2/3 of the recent decline in the cryptocurrency market and 1/3 were due to a weakening outlook for cryptocurrencies.

Introduction

Over the past eight months, the market capitalization of all cryptocurrencies has fallen by more than two-thirds, from a peak of $2.9 trillion to its current level of less than $1 trillion. This is not uncommon in the cryptocurrency market: Since 2010, the total cryptocurrency market capitalization has experienced nine quarterly declines of 20% or more (a typical indicator of bear market conditions).

Every time a cryptocurrency price drops significantly, commentary from the media and pundits usually takes one of two forms:

(1) The “cryptocurrency is dead” reaction, where cryptocurrencies are painted as a giant Ponzi scheme, giving investors fear of missing out on huge returns (FOMO) and then anxiety when prices drop And despair (Fear, Uncertainty, and Doubt, referred to as FUD). Falling prices are a sign of a bursting bubble and we should flee the market before prices drop to zero.

(2) The “HODL” reaction, cryptocurrency is seen as a groundbreaking technology. The cycle of crypto winter and crypto summer is a feature, not a bug, of disruptive innovations like national banks in the early 18th century, railroads in the mid-19th century, and the internet and artificial intelligence in the late 20th century. We should hold cryptocurrencies firmly and get through the volatility period, because the price of cryptocurrencies will resume rising in the near future.

However, neither of these scenarios can explain the historical trends we see in the cryptocurrency space and how we see the correlation of cryptocurrencies with the current overall stock market. But there is a third way of explaining price changes: “market efficiency” responses, where prices reflect the market’s assessment of the future prospects of digital assets.

market efficiency

Studying the cryptocurrency market based on an understanding of market efficiency can help us effectively interpret the data. For example:

From June 2017 to June 2022, the market capitalization of cryptocurrencies rose by 860%, which shows that the future of cryptocurrencies is much brighter today than it was then: the adoption of institutional and retail investors, and the laying of web3 foundation (i.e. decentralized Financial applications, non-fungible tokens, decentralized identity solutions, tokenization of real assets, and decentralized autonomous organizations) are partly responsible for the extraordinary returns.

The correlation between stock and cryptoasset prices has risen significantly since 2020: While Bitcoin’s returns were, on average, uncorrelated to stock market performance during its first decade of existence, since the COVID-19 pandemic Since its inception, this correlation has increased rapidly. This suggests that the market expects crypto-assets to become increasingly intertwined with the rest of the financial system, thereby being equally affected by the same macroeconomic forces that drive the world economy.

In particular, crypto assets now have a similar risk profile to oil commodity prices and tech stocks. Beta coefficient (Beta) is a typical index to measure the systemic risk of financial assets. A beta of zero means that the asset is not correlated with the market. A beta of 1 means the asset moves with the market. A beta of 2 means that when the stock market rises or falls by 1%, the asset increases or decreases by 2%. The gif below shows that the betas of Bitcoin and Ethereum have jumped from 0 in 2019 to 1 in 2020-2021 to 2 today - their current risk profile versus more traditional assets - tech stocks very similar.

With the Federal Reserve and other central banks around the world recently starting to raise interest rates, long-dated assets such as cryptocurrencies and tech stocks are deeply discounted and their value has fallen rapidly. It is now worth considering to what extent the current decline is due to deteriorating macroeconomic conditions rather than a deteriorating outlook for cryptocurrencies, especially given that year-to-date, cryptocurrencies are down over 57% in market capitalization in 2022. Notably, at the same time that the S&P 500 is down 19%, if macroeconomic conditions were the only reason for the drop, we would expect the beta-2 crypto asset to drop around 38%. Therefore, we can roughly estimate that two-thirds of the recent decline in cryptocurrency prices is due to macro factors, and one-third is due to the weakening of the cryptocurrency outlook. This is similar to what happened in the dot-com recession of 2000-2001, when the S&P 500 fell 29% and the Nasdaq Composite (mostly made up of tech stocks) had a beta of 1.25, a peak-to-trough decline of 70% %.

The future of the cryptocurrency market

However, market efficiency arguments are mostly silenced when confronted with this topic: the future direction of cryptocurrency prices. The most important pillar of the market efficiency hypothesis is that any traded asset, from stocks to bonds, commodities, and even cryptocurrencies, incorporates the market's expectations of the asset's future value into its price. For example, if the market expects Tesla to sell a lot of cars in the future, the stock price today would be high to reflect that expectation. If Tesla meets this expectation in the future, its stock price will not rise because it has already priced this event into today's price.

Likewise, prices will only change when expectations about the future prospects of an asset change. Therefore, according to the market efficiency view of the crypto market, only a change in the outlook of the crypto industry relative to existing expectations will bring about a price change.

Anais

Anais