Author: Marco Manoppo

Source: substack

The cryptocurrency space is full of young people, all of whom have strong positions and are often blinded by ideologies that are not always premised on reality. The battle between different ideologies within the crypto space will itself become more complex as the industry matures. In this post, I describe how crypto networks and protocols can benefit from vertical integration, a common concept in business; but for those who adhere sufficiently to the ethos of decentralization, it can create a dilemma .

Crypto Vertical Integration

Brother Macalinao had the right idea, but the wrong approach.

For the uninitiated, the Macalinao brothers are known for " fictionalizing " a DeFi ecosystem within the Solana blockchain. The brothers have launched multiple Solana projects under 11 different aliases, falsely creating the impression that the Solana DeFi ecosystem is thriving, when in fact, most of the total value locked (TVL) is through the different protocols they have built Double counting due to repeated use of collateral. At its peak, the brothers falsified an estimated 70% of Solana’s DeFi TVL ($7.5 billion out of $10.5 billion); this is an extreme form of rehypothecation.

At first glance, what the brothers are doing looks like a hoax. While this is more or less true, there are some lessons to be learned from their actions. They had the right idea, but opted for short-term profits over long-term building of their credibility — but, in crypto, scammers are often forgiven, so maybe they are really smart.

What the brothers have done is basically vertical integration. This "boring" business concept has been around for decades, taught in business schools, web 2.0 technology giants and mid-sized traditional family businesses alike. In layman's terms, it means bringing together multiple aspects of an enterprise's supply chain to oversee the end-user experience as much as possible.

User experience is one of the biggest bottlenecks in the crypto space. The average 20-30 year old still thinks the crypto space is messy, even if they work in big tech companies. How can we expect cryptocurrencies to reach mainstream adoption if even educated young people cannot easily join? I mean real adoption, where your everyday apps run on the blockchain and are powered by tokens, not the kind of "adoption" that buys Dogecoin on Robinhood.

The vertical integration of dApps makes perfect sense, stacking on top of each other to create an ecosystem focused on user experience. I don't want to use multiple hot wallets on multiple L1 chains to try multiple products. Those of us who work in cryptocurrencies and have an early exposure to these technologies may like this, but most just want the seamless product experience they currently get from existing web 2.0 apps.

So, how does the crypto industry solve this problem and provide better products and experiences through vertical integration while maintaining decentralization? Let's find out.

A quick rundown of the main points of this article:

Centralized players in the crypto space are already doing this.

In an open source and forkable industry, execution is more important than innovation.

Products closest to the end user have the most valuable currency and are most likely to be vertically integrated.

Vertical integration removes the need for external composability that can introduce additional risk.

The underlying technology may be decentralized, but in the near future, the killer product will be centralized.

New technology, old routine

All the big centralized institutions in the crypto space have been doing vertical integration for years. Think about it, acquisitions, new product launches that replicate existing companies, and more. We are fortunate that despite the size and reach of Binance, FTX, and Coinbase, the on-chain ecosystem is still ripe for builders and innovators. Relatively new players like Lido and Frax were able to enter the scene and find product-market fit without getting trampled by these crypto giants.

That said, large CEXs have been increasing their on-chain initiatives over the past few years. FTX has Solana and Serum, Binance has BNB Chain and Trust Wallet, and Coinbase is beefing up dApp integration for its non-custodial wallet. With near-infinite funds, these giants should be able to easily replicate any open-source on-chain product.

The question then becomes: is there room for on-chain products to vertically integrate and compete with these giants?

imagine a world

There are two key factors that can make or break on-chain offerings in their efforts to vertically integrate and compete with existing CEXs.

user

The on-chain participants with the most valuable currency are those closest to the end users. Going from Uniswap to Sushiswap is much easier than going from MetaMask to Rainbow. Non-custodial wallets are arguably best positioned to capitalize on the trend of vertical integration and create products that lock users into their ecosystems, similar to what CEXs have been doing.

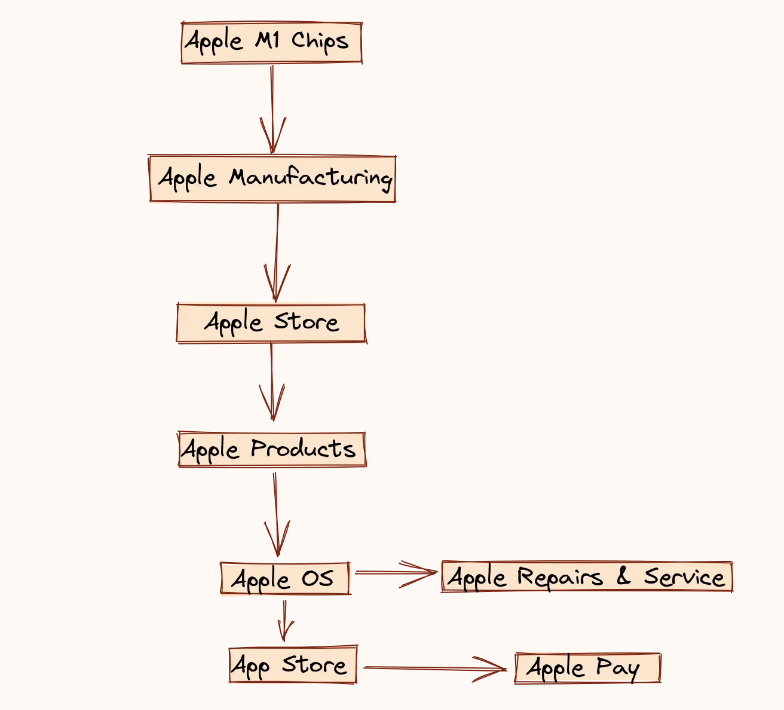

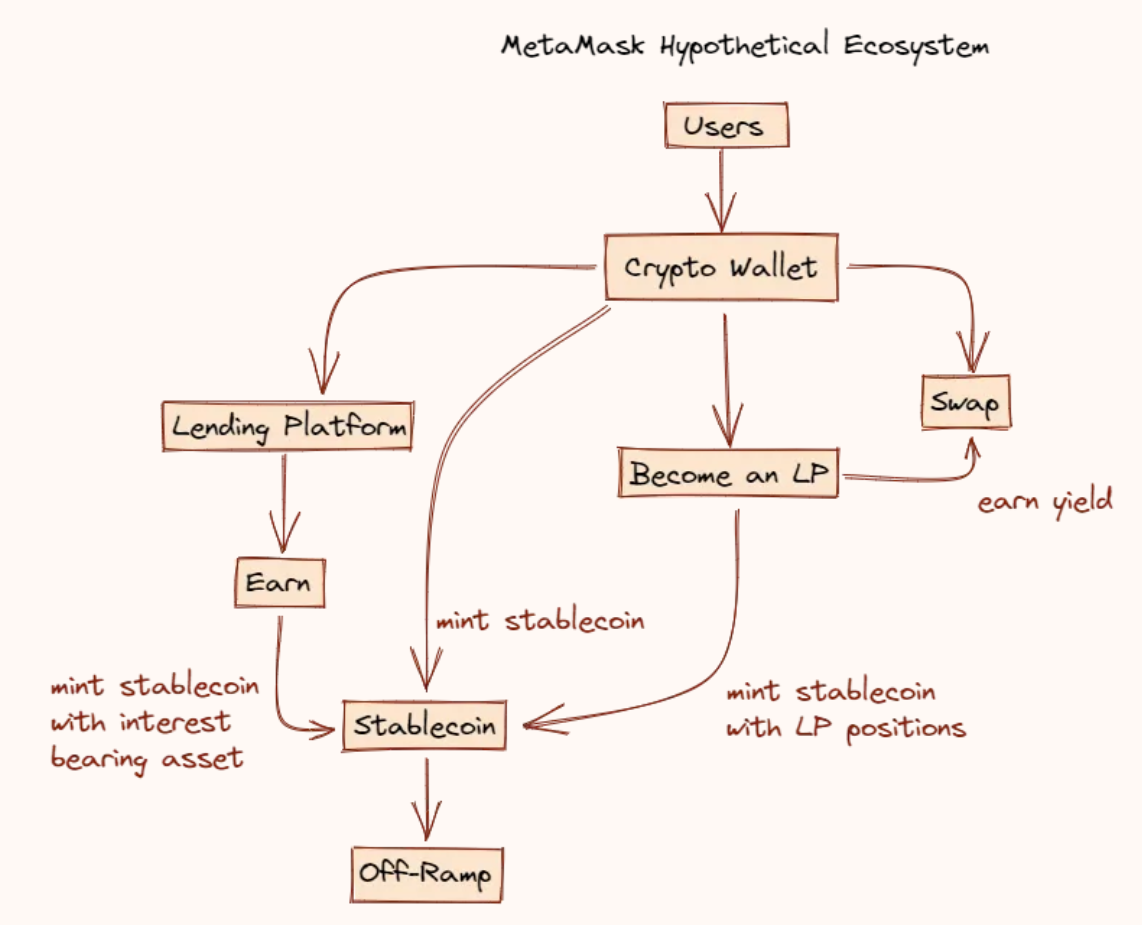

MetaMask has earned over $350 million from its in-app "swap" feature, basically laziness-as-a-service. Users can easily go to Uniswap to trade, but many choose to trade within the MetaMask app. Imagine if MetaMask launched its own AMM with centralized liquidity, became its own Lifinity -style LP, and charged cheaper fees on the most popular currency pairs (ETH/USDC). What if they also decide to launch an on-chain earning product, or even a stablecoin?

implement

The actions of the Macalinao brothers in Solana DeFi have been a big deal for a long time. Almost all of the other Solana founders are aware of this, but somewhat powerless given the speed with which the brothers' deployment has been executed. This is actually commendable.

In an open source world where protocols can fork, having great execution is more important than finding new innovations. That’s not to say we should ignore founders who want to try out new ideas, but we should also take into account how quickly those founders can execute, and whether those ideas are viable.

Daniele Sesta attempted to create such an ecosystem by combining SUSHI-TIME-POPSICLE-ABRACADABRA (though without a wallet component), which in retrospect might have been successful if not for the decline of TIME. Fast execution is important. For a split second, it felt like his DeFi ecosystem could surpass or compete on the same level as the OG DeFi protocol. His mistake was to go too fast and underestimate the risks associated with TIME.

Imagine a world with the following MetaMask ecosystem, which has it all:

In essence, vertical integration removes the need for external composability that can introduce additional risk. It also means that the protocol can evolve more quickly. In order to convince MakerDAO to accept yielding assets as collateral, political and governance procedures are required; but if you make a similar protocol yourself (Abracadabra), you can quickly add new types of collateral and create degen strategies. You can think that these degen products are not good, but it is still a new product innovation with real customer needs.

In fact, major protocols and dApps are already realizing the benefits of vertical integration. AAVE vs. GHO, NEAR vs. USN, and many more. In my day job, we have written a report on the state of stablecoins and the rise of protocol-owned stablecoins.

If you want to go fast, go alone. If you want to go far, go together.

The counter argument to this is the African proverb you just read. A team that focuses on one product is likely to produce higher quality results in the long run. They pay attention to every little detail and are more cautious about security risks.

However, I would argue that the benefits of collaboration are far less impactful in the crypto industry. For non-crypto businesses, you can protect your hard work through patent laws and even geographic advantages. For on-chain products, everything is digital. There are no laws that properly protect your unique innovations, nor do you have any geographic advantage. Winning teams go fast, finding the right balance between execution and measured security practices.

But then it's all centralized!

It depends, but first, I welcome you back to reality. Every successful product and company in the past few centuries has been centralized. They were eventually broken up by governments in the interests of the free market and to foment innovation, but everything from chicken producers to big tech and financial companies was centralized. By bringing everything together, they deliver an experience that the competition can't match.

If governance tokens truly have full governance rights when the industry matures, the crypto space at least allows market participants to own these products from the beginning, rather than waiting for them to go public first. The underlying technology (blockchain) may be decentralized, but the killer dApp is more likely to be centralized.

Adam Neumann raised $350 million from a16z for his new real estate venture, Flow. The Flow here does not refer to the Flowcarbon tokenized carbon credit project he participated in, nor the Flow blockchain, but a project derived from the old WeWork community life plan, which received the largest single investment in a16z's history. While the investment does work from a return standpoint (I'm not bothering to calculate it here), a16z shows that if you become a money-driven NIMBY, you can destroy decades of reputation in a few years building.

Disclaimer, Not Financial Advice: All information in this publication and its affiliates is provided for educational purposes only and should not be construed or regarded as financial, legal, investment or any other form of advice.

Weatherly

Weatherly