Author: iWitty

Source: iWitty's Twitter

The Current State of Institutional Lending in Cryptocurrencies

In the second quarter of this year, the crypto market suffered a severe setback. There has been a massive deleveraging recently due to the collapse of many centralized lending platforms. Celsius now has only $98 million in outstanding loans, Coinbase bonds are trading at a 10% yield, and major market makers (MMs) have lower trading caps.

Why is institutional lending important?

Institutional lending has a significant impact on the cryptocurrency market. Less available loans -> less trading capital for market makers -> less trading volume -> wider spreads and lower market depth.

Experienced players are now unable to enter and exit positions as needed. Even the top trading pairs are starting to suffer as more and more loans are being called back.

Who Needs Credit?

loan = leverage

Cryptocurrency trading platforms require loans to obtain trading funds. Most credit flows to market-neutral market makers, who use the credit to place orders on the order book, allowing market takers to execute trades efficiently. Market makers are like the "invisible hand" in the cryptocurrency market, providing liquidity to the market. No matter which cryptocurrency you are selling or buying, you may be dealing with a market maker without your knowledge.

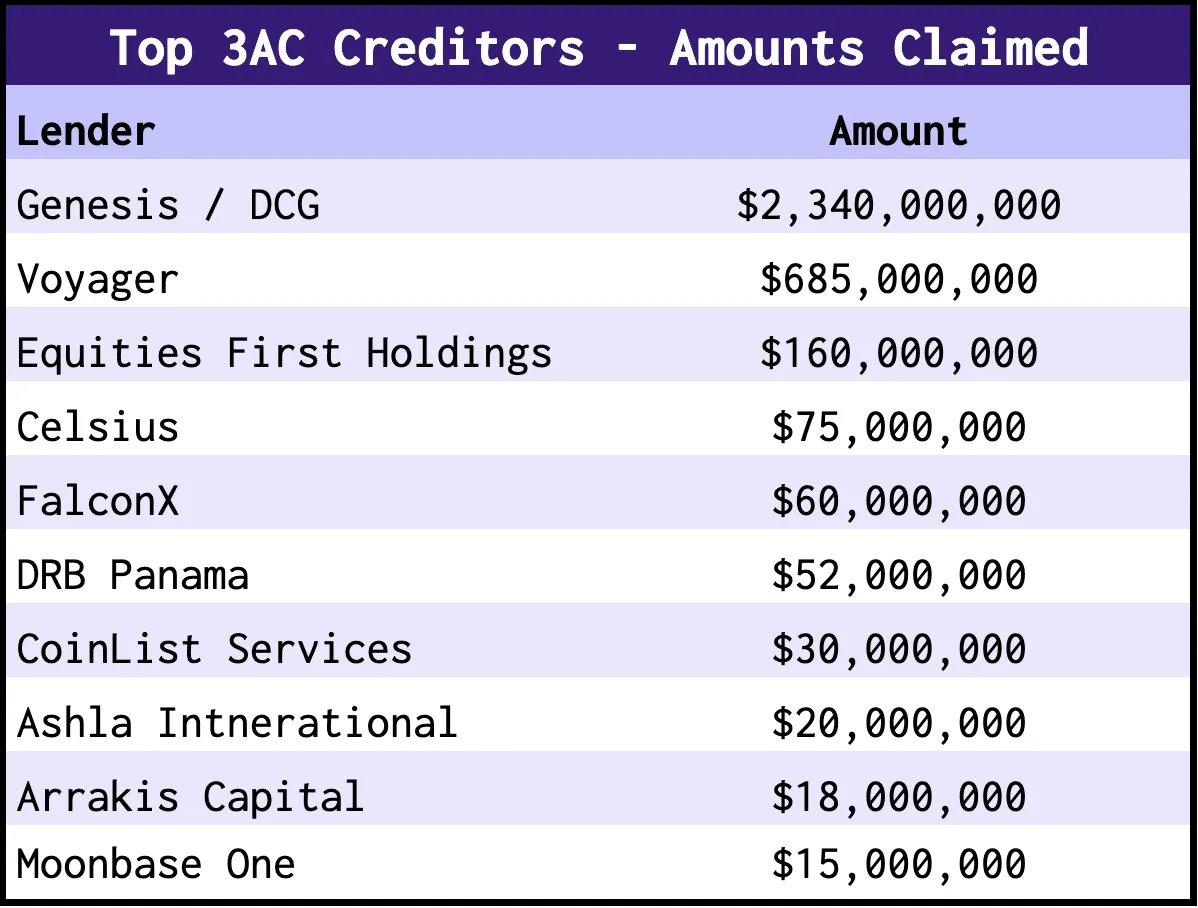

Some loans will be directly popular with institutions such as Three Arrows Capital (3AC). There are many more loans that we don't know about. These loans are very risky, as can be seen from the high interest rates. But not always.

How important is a market maker?

According to Coinbase’s Q1 report: “A relatively small number of institutional market makers … account for a significant portion of our platform’s trading volume and net revenue.”

Institutions (including high-frequency trading) account for 76% of trading volume in Q1 2022

largest lender

Centralized lending institutions include Celsius, BlockFi, Genesis, etc. Decentralized lending institutions include Clearpool, Maplefinance, etc. There are also some exchange credit lines and customized credit.

Most of the loans are made by centralized lending platforms, however, most of these platforms have failed.

These platforms also have a huge principal-agent problem, causing risk management to get out of hand. That is to say, the upper limit of the consumer's income is X%, and if the guarantor takes additional risks in order to exceed X%, then he can obtain additional profits. Will the guarantor pursue more than X% for higher profits?

How much credit is lost?

At peak times, centralized lenders issued an average of tens of billions in loans per month.

Their absence, combined with market conditions, would lead to call-backs and massive deleveraging. We've seen Celsius' loans shrink from billions to $9,800.

Future loan terms will be stricter (higher APY, more collateral, etc.). After all, many loans were heavily undercollateralized in the past, and the lending sector would borrow heavily on loans that were completely unsecured. There will be no more such loans in the future.

Impact of the global macro environment

Now, TradFi has been de-risking, and the risk curve for cryptocurrencies and crypto-lending has gone further. This has affected all crypto credit, with some Coinbase bonds currently trading at yields of just over 10% (closer to 15% last week).

Without encrypted loans from most centralized institutions, the encryption industry will encounter liquidity problems, which are manifested in:

- Trading volumes are stagnant

- Huge and ever-widening altcoin bid-ask spreads

- Greater price slippage on orders

While the top trading pairs still maintain relatively good liquidity, the liquidity situation discourages would-be institutional players. Until new sources of credit emerge, this may be the new normal across the crypto market.

The Future of Crypto Credit

Given the importance of credit in the cryptocurrency market, we believe new business models will emerge. These models will include more structuring and grouping, and lenders that are closer to the core business of the trading platform will gain more advantages.

Joy

Joy