Source of this article: https://mhonkasalo.substack.com/p/a-brief-roadmap-for-uni-holders-to

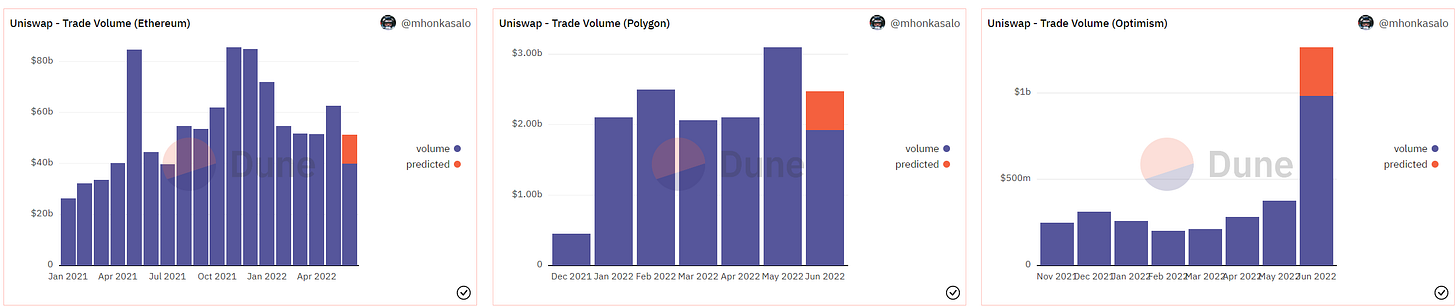

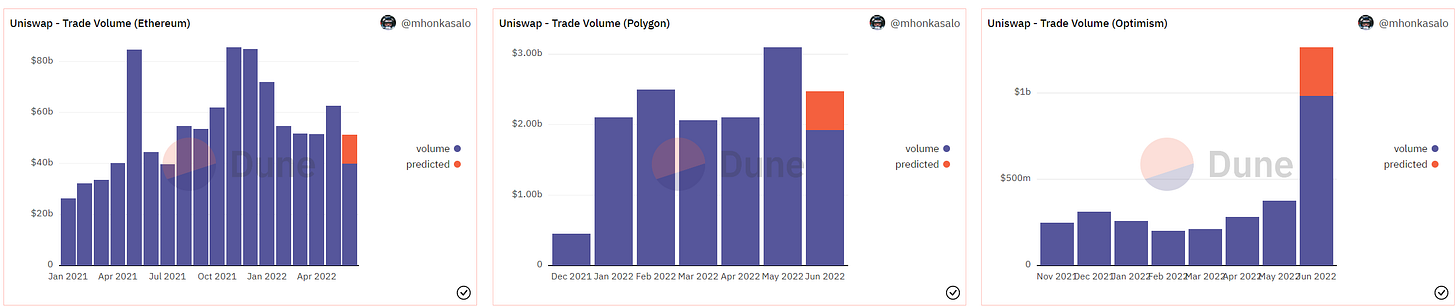

Uniswap is the leading decentralized exchange, with a market share fluctuating between 65-75% on Ethereum over the past year, having found success on platforms like Optimism and Polygon.

This agreement is most likely to become the "global order book" and is also the most important DeFi infrastructure component.

not bad in a bear market

not bad in a bear market

On the downside, there are quite a few downsides to Uniswap’s recent progress. Due to the lack of value capture and activity of Uniswap Labs, the economics of the UNI token are considered poor and do not deliver value to token holders.

Overall, the UNI community should move away from Uniswap Labs. Instead, Uniswap Labs should end up being a (albeit important) team that works on behalf of the protocol. In the short term, the community should start the journey of maximizing its own value.

Note that Uniswap Labs may support the community responsible for (parts of) the project - including for regulatory reasons.

So far, community governance of the project's massive funds (approximately $1.6 billion held in UNI) has not provided much value. Many initiatives and grants arguably add no value to the agreement.

Below is a rough roadmap of what a better community-led effort should look like. This is divided into 4 steps, the 2nd step is a small step for token holders to become more active throughout the protocol:

- fee switch experiment

- Recognized Representative Scheme

- Start building teams outside of Uniswap Labs

- Create a development roadmap

fee switch experiment

Uniswap has a fee switch that turns on LP fees of 10-25% for a given pool.

A common misconception is that startups should not distribute profits, but reinvest them — note that in Uniswap’s case, currently, the market takes no cuts at all and provides the swap service for free. The withdrawal fee does not necessarily equal the profit distribution, but the profit can be included in the treasury.

Whether reducing LP profits will cause Uniswap to become less competitive with other DEXs is a question.

Overall, the next steps should be a data-driven research report:

Sponsored Business Content

- What will be the impact on LPs and if e.g. 10% fees will be detrimental to Uniswap liquidity.

- Advice on which pool is the best place to start.

Recognized representative platform

MakerDAO pays its representatives an annual salary. This is a great idea and can be replicated cheaply with UNI incentives.

It is generally accepted that the delegation scheme is a good idea, because token holders can elect capable people to drive the vision and strategy of the DAO. They are responsible for representing the wishes of token holders and aligning them because their incentives are tied to success.

In practice, starting this means creating a proposal similar to the MakerDAO-endorsed delegate program.

Engagement of the UNI community will be enhanced with the work on fee conversion and the corresponding selection of paid representatives.

Start building teams outside of Uniswap Labs

MakerDAO has core units for MKR holders. These core units require a budget and have a scope of work. Examples include protocol engineering, real world finance, data insight, and more.

UNI holders will vote on onboarding the development team and budget approval through a standardized process. The requirements of the team developing the protocol come from the roadmap.

This is a great opportunity for builders to come in and work on a DEX while gaining an edge instead of setting up a competitor with just minor improvements.

Create a development roadmap

This is actually about:

- Establish a development roadmap (and vision) for the project that UNI holders understand.

- Partner with Uniswap Labs to avoid duplication of effort and strategic synergy.

Uniswap also has more interesting opportunities, such as perpetual swaps and synthetic stock trading - the goal is to exit the "internal DeFi casino".

This will start with a series of Requests for Proposals where the community can come together to advance desired features together.

Joy

Joy