We often hear crypto games refer to themselves as countries. Often, they do this to signify a sense of community and people coming together behind a narrative. People seem to pay little attention to the economic aspects of a country. Such as currency, fiscal and monetary policy, population growth, etc.

From an economic point of view, web3 and web2 games are very different. And we're not talking about profit models here. Web2 games are either completely closed or at best semi-open. They are centrally controlled, not particularly financial (some things may be sold, not all are NFTs, no global markets, no DEXs, etc). Balance a A closed economy, while challenging, is nothing compared to a balanced open economy, which is the web3 game economy. With NFTs and tokens, they are completely financialized and open.

To understand how hard it is to balance an open economy, consider real-world examples of currency devaluation, hyperinflation, and economic collapse. For decades, we have developed economic tools such as interest rates or fiscal policy to help us balance the economic cycle. In the crypto game, however, there are no economic management tools.

Next, let's talk about some important ideas that web3 studios may need to consider.

Utility Tokens as a Currency

In this research article, we will focus on the dual token economy. They have a governance token (eg AXS) and a utility token (eg SLP).

In this framework, governance tokens in a dual-token economy provide 1) a claim on "government" (i.e. Treasury) resources or 2) governance rights over "government" policy. It can either offer both or neither, in which case the governance token is purely speculative. Overall, governance tokens do not enter the economy in any meaningful way unless they are designed to do so.

Most real-world economies have their own currencies. Therefore, we believe that a game with a dual token model should treat its utility token as the currency of its economy. Studios should analyze this currency from an economic point of view.

For the purposes of this article, utility tokens = soft money = local foreign exchange.

For example, what is the growth of the money supply in the economy? Printing SLP and other in-game FX tokens, like printing new fiat currency, devalues existing currencies. In a traditional economy, things are a little more complicated. The local currency is used for spending or paying taxes, there is trade which creates demand for the currency, there is savings, mortgages and interest rates etc. However, in today's web3 game economy, there are very few, if any, ways to spend in-game currency. There is no trade, limited consumption (all discretionary and discretionary), and certainly no incentive to save. Even if there are spending methods, they are driven by expected ROI, so more tokens will eventually be generated.

Just like in emerging market (EM) economies, if your currency crashes, your economy crashes with it. In emerging markets, currencies depreciate against the U.S. dollar, usually due to political or economic shocks that lead to a loss of confidence in the local economy and currency. This caused a bank run, with locals rushing to sell their local foreign exchange for dollars, which led to a bank run, with locals scrambling to sell their currency for dollars, causing the currency to depreciate even further. Eventually, central banks stepped in. Their tactics include monetary policy tools (rate hikes or cuts), capital controls and currency intervention. You can obviously combine these measures in some way. For example, raising interest rates while implementing some capital controls. This eventually leads to foreign exchange stabilization, usually temporarily.

Crypto game economies are more reflexive and currently use far fewer tools. With this reflexivity, once the community loses confidence, it's game over.

Recently, we have seen some examples of capital controls and currency intervention in crypto games. For example, DG is looking to implement capital controls, and they are already intervening in the market using revenue from primary sales, validator rewards, and even the most recent advertising transaction revenue from buying and burning ICE.

Heroes of Mavia imposes penalties for exiting the ecosystem. We have also seen the development of OTC/grey markets to avoid capital controls such as locked staking.

Open Economy and Global Macro

One of the disadvantages of open economies is their dependence on external factors. We have learned this from globalization and the close connection of local economies in the world economic network. While emerging market economies may be affected by politics, commodity supply shocks, or other national policies, crypto gaming economies are primarily affected by external cryptocurrencies and therefore have a broader macro environment related to capital flows. For example, when the global macro economy deteriorates, people switch from emerging market FX to the US dollar. In cryptocurrency, people exchange the game economy currency for USD or local currency. My guess is that in challenging economic conditions, the percentage of net SLPs sold immediately is significantly higher than when conditions are good.

The reason this is important is that crypto gaming economies will inevitably experience a recession due to global macro conditions. What they should be trying to do, though, isn't going through a recession when the economic conditions are favorable because of policy mistakes by the "government" (that is, studios). To do this, the studio could examine the economic lessons of emerging market economies and draw on some existing economic models.

Coping with Forex Devaluation in Crypto Gaming Economies

Our research on this topic is at a very early stage.

However, in the absence of any external demand (exports) and necessary internal consumption, it seems safe to assume that most of the game's native tokens entering circulation will be sold. Given the "earning money" nature of crypto games and their open economy, this could happen in all market conditions.

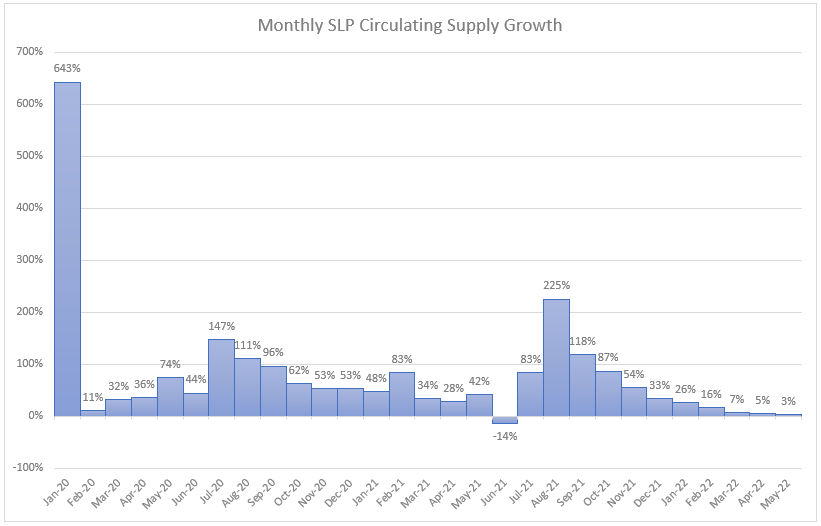

As such, the monthly rate of expansion of the money supply (i.e. growth in circulating supply) should reflect selling pressure and, in our view, is a key metric that studios should be watching. This is not the same as the burn minting ratio. While the burn-to-mint ratio could be 0.8, the unburned 20% could represent any growth rate in circulating supply, leading to varying degrees of selling pressure.

There are different cycles and mechanisms that can help limit money supply growth. Broadly speaking, they fall into two categories, 1) limiting supply growth and 2) increasing demand for the native currency. Here are some examples:

Limit supply growth

- Directly reduce the incentive level of payment.

- Design the breeding cycle to be deflationary.

Suppose 3 lower level NFTs can be combined into one higher level NFT. Destroying 3 lower tier NFTs and owning a higher tier item gives the player less income, but is able to make up for it with other perks/status.

If not possible, set some inflation rate for the breeding process. - Population control is directly related to the money supply in crypto games. Population control measures including breeding seasons or deflationary breeding cycles are part of this.

- To limit the lifetime earning potential of each NFT, a coefficient of less than 1 applies to earning over time.

growing demand

- Mechanisms/incentives for internal spending of capital. Although if you advertise "play and earn", players are more likely to seek cash out. It's not "making money" unless you can convert to your local fiat currency. These must also be non-inflationary.

- Use time as the dimension of the game. While limiting the lifetime earning potential of NFTs limits supply growth, allowing players to repair items to prolong lifespans could be a mechanism to increase demand.

- Design the game in such a way that soft currency cannot be withdrawn, but needs to be used in the game (crafting, progression), and the results of that use can be converted to fiat currency through the market. This could kill the implementation of both tokens, but such a game might have other tokens for materials, items, etc. Added bonus is that this activity can be taxed, whereas players selling your soft currency usually can't unless the studio controls the trading infrastructure like Katana, but even then there is a direct deposit to SLP from Ronin to Binance aisle.

Should the gaming economy ease policy in response to recession?

In emerging market economies, recessions always lead to easier monetary policy and greater fiscal spending. However, these measures are somewhat irrelevant, as emerging market economies are largely dependent on global cycles. For example, a rising dollar tends to trigger all kinds of economic disruption in emerging market countries. So should crypto gaming economies follow the same pattern — increase spending and incentives when times are tight, and spend less when times are good? While counterintuitive, we think the game economy might be better off going the other way, at least initially. They have no foreign trade of any kind, nor basic domestic consumption that is not based on economic returns. As such, in-game FX has nowhere to go but into fiat currencies, and "easing monetary or fiscal policy" is unlikely to have any impact. Instead, teams might consider reducing spending and incentives during a recession, wait for the macro cycle to improve, and then start printing money when they know there may be enough capital to absorb newly issued tokens.

For example, in the case of Axie, the team can significantly steer Treasury through 2021 and early 2022. If they choose to follow traditional policies, they can now turn on the taps, provide incentives and increase spending across the ecosystem. This has to come from ETH in the treasury, not SLP, and in a way that doesn't devalue SLP further. We could even explore debt financing of these initiatives, backed by accruals from the Treasury. However, it is possible for Axie to do so because the Treasury is able to grow in good market and economic conditions. Essentially, Axie's national balance sheet is quite strong.

For teams that didn't bootstrap themselves during the boom, options are few and far between. In this environment, it is almost hopeless that the funds raised will be used to strengthen foreign exchange. Instead, teams can focus on building the product, finding and rewarding real ecosystem contributors, and nurturing the community through a variety of targeted programs and incentives.

Is the two-token model broken?

From an economic point of view, the two-token model does not seem to make much sense. Additionally, there is a potential conflict between governance tokens and soft currencies.

Games using the dual-token model grant the game the right to financial success as well as control over the policies and resources of the governance token. However, players who make the game financially successful (since taxing economic activity is the main monetization model in crypto games) do not have the right to own a highly inflationary native currency. This structure is actually two ways of value extraction. Governance token holders extract value from participants and their economic activities. However, players capture value by mining and dumping the native currency.

In this structure, local foreign exchange will always be sold. Clever economic design can limit the rate at which the money supply grows, which can be absorbed by new entrants, for a period of time. But new players mean more money supply, more selling pressure and more value extraction. The team had to come up with another sink every time, and it looked an awful lot like a dog chasing its tail.

Why are my dogs chasing their tails

Another way is to use the income generated by economic activities to balance the local foreign exchange. This may be the only incentive that does not inflate the native currency. An example is creating an interest rate comparable to local interest rates by distributing part of the revenue to local foreign exchange pledgers. However, this would take funds away from the governance token, and it is difficult to see how governance token holders would vote for it in any meaningful long-term framework.

We now see two interesting examples. For example, Axie is paying out staking returns to AXS holders, and will also be paying out staking returns to landholders. Meanwhile, its player base is dwindling. Therefore, they choose to reward capital and token holders at the expense of players. On the other hand, Decentral Games is using assets in the treasury to balance the ecosystem. For example, they used validator node rewards to buy and burn ICE, and now use revenue from secondary sales and advertising transactions with Mastercard to do the same.

Another limitation of the two-token model could lead to the same conflict between governance token holders and soft currency users. As native FX, these soft currencies require deep liquidity, especially given the fundamental selling pressure of both token economic models. Where does this liquidity come from? A simple answer is that it either has to come from the team (either pre-released or purchased with treasury funds), or from users. However, we know users need incentives.

Source: https://metaportal.substack.com/p/managing-crypto-gaming-economies

Alex

Alex

Alex

Alex Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Brian

Brian Alex

Alex Alex

Alex Catherine

Catherine Kikyo

Kikyo Catherine

Catherine