Author: Jason Mallory

Source: Arcane Research

In June, listed Bitcoin miners sold nearly 25% of their Bitcoin holdings at low prices. This article analyzes recent Bitcoin sales data from listed miners and predicts whether they will continue to sell BTC in the coming months.

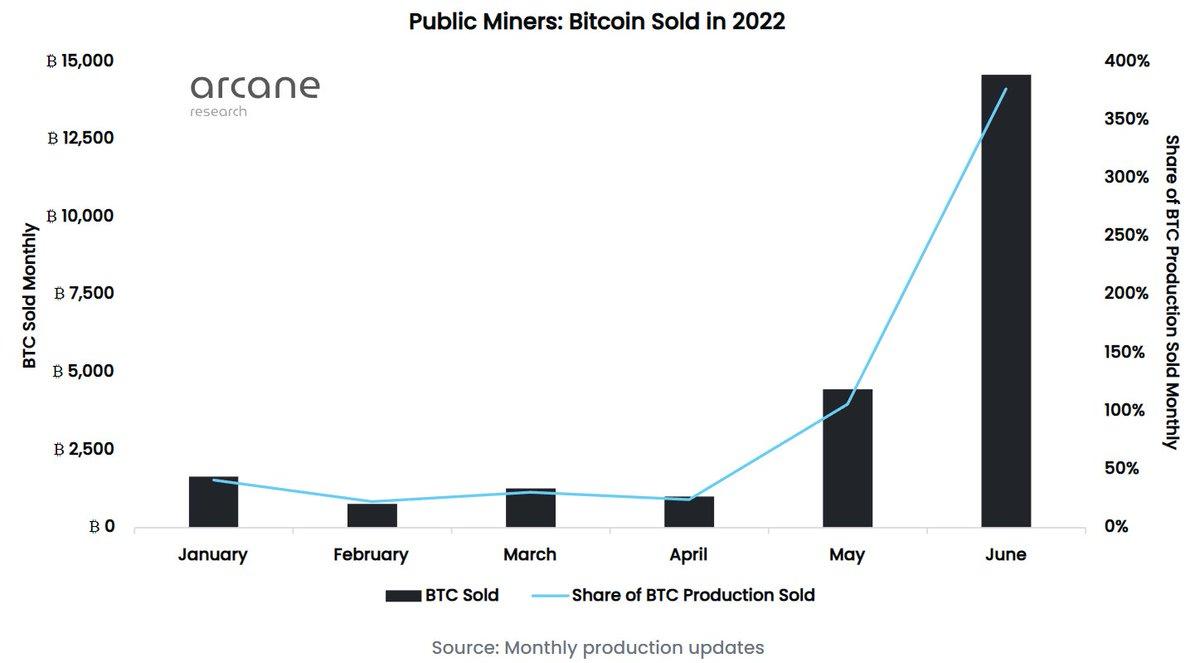

From January to April of this year, listed miners only sold 20% to 40% of their Bitcoin production, as most of them struggled to produce Bitcoin as part of their “hodl at all costs” strategy part.

This strategy worked until the bitcoin price plummeted from $40,000 to $30,000 in May this year. Falling bitcoin prices have sparked financial difficulties, forcing miners to start liquidating their precious bitcoin positions, with May being the first month in which they sold more than 100% of their bitcoin production.

Many people were shocked by the large amount of bitcoin sold by listed miners in May, but in June, they sold about 14,600 bitcoins - almost four times the amount in May. Listed miners produced only 3,900 BTC this month, meaning they sold almost 400% of their supply, eventually depleting nearly 25% of their holdings.

Core Scientific and Bitfarms were the worst sellers.

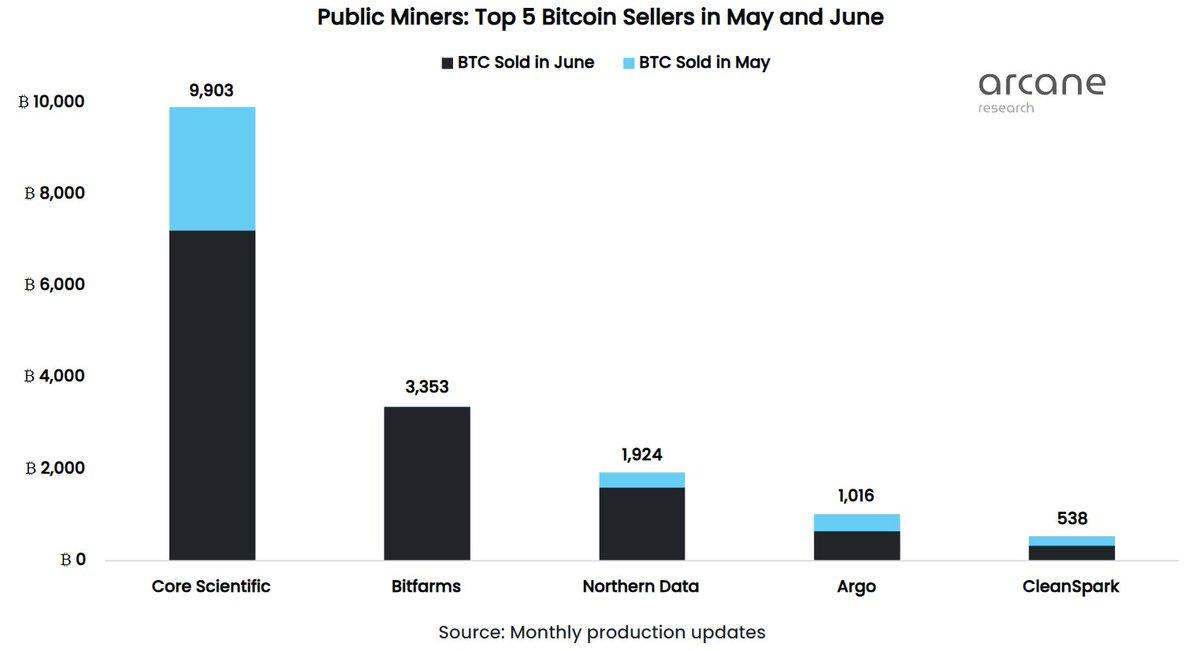

Some miners dumped most of their Bitcoin holdings in May and June, while others managed to hold on to their coins. As the chart below shows, Core Scientific was by far the largest bitcoin seller, dumping nearly 10,000 bitcoins in May and June. Core Scientific began selling bitcoin in May this year, and intensified its selling after selling more than 7,000 bitcoin in June.

Bitfarms is the second-largest bitcoin seller in this bear market, selling 3,353 bitcoins in June. German company Northern Data was the third largest seller, dumping all of its bitcoin and ether in May and June. In the following article, we will delve into the reasons that forced these companies to dump Bitcoin.

The Marathon and the Hut 8 currently hold the most Bitcoin, having not dumped Bitcoin in May and June.

While some listed miners have been dumping most of their holdings, others have yet to sell any. Marathon, which has so far avoided selling bitcoin, is now the company with the most bitcoin on its balance sheet with 10,055 bitcoins, followed by Hut 8 with 7,405 bitcoins. Riot also had 6,654 bitcoins, ranking third. Although it sold slightly more bitcoins than usual, it was far from the amount sold by Core Scientific and Bitfarms.

During the gold mining period of 2021 and early 2022, Core Scientific can maintain most of its Bitcoin production by tapping capital markets to pay fees. This allowed them to build the largest Bitcoin reserve of any previously listed mining company at more than 10,000 Bitcoins.

Core Scientific currently holds only 1,959 bitcoins after a massive sell-off in May and June, which means their bitcoin reserves have slipped all the way down to No. 6. Core Scientific remains by far the largest company by hash rate, regularly producing around 1,000 bitcoins per month. They're churning out bitcoins, which means they're likely to climb up the rankings in the coming months, unless they decide to change their tactics after being hurt by a "hodl at all costs" tactic.

Why have listed miners been dumping their Bitcoin holdings?

Most miners have recently increased their bitcoin sales to free up liquidity on their balance sheets as they need dollars to pay for upcoming infrastructure upgrades and machine deliveries. In 2021, they would be able to cover these costs by issuing stocks or bonds, but recently, due to the fatal combination of Fed rate hikes and declining investor interest in Bitcoin, miners' access to outside capital has been greatly weakened. Depleted capital markets mean these companies increasingly need to fund their operations with their own working capital, largely composed of stored bitcoin.

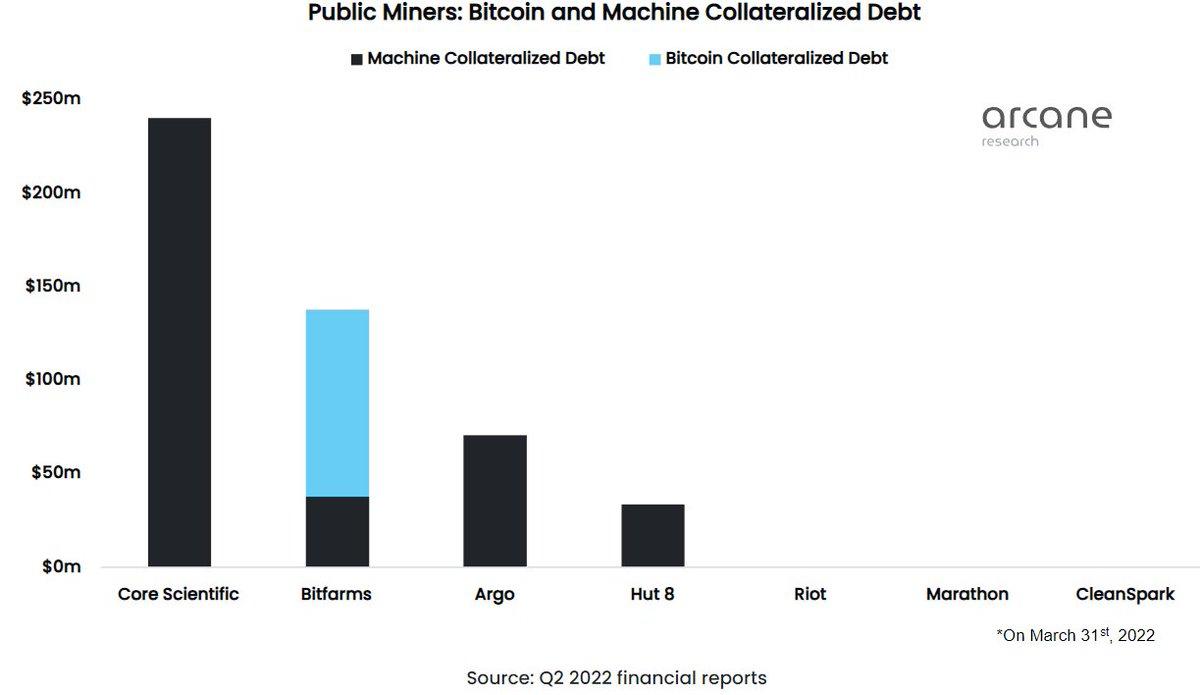

The weakness in the capital markets affected all listed miners, but that doesn't explain why specific miners like Core Scientific and Bitfarms sold more than others. To find out why, we have to look at the structure of their balance sheets. Core Scientific and Bitfarms have the largest bitcoin and machine collateralized debt positions. Plunging bitcoin and machine prices forced the companies to sell bitcoin to pay off these loans.

The graph above shows the Bitcoin and machine-collateralized debt positions of listed miners as of March 31, 2022. We see that Core Scientific and Bitfarms are by far the most indebted companies, and coincidentally, they are also the largest sellers of Bitcoin in this bear market. We also saw that Marathon, CleanSpark, and Riot were not selling as much Bitcoin, and they had no Bitcoin or machine-backed debt before this bear market started.

Bitfarms issued a press release in June explaining why they sold 3,000 BTC. The company used the proceeds to pay bitcoin and machine-backed debt. In particular, they had problems with their Bitcoin-collateralized line of credit with Galaxy Digital, as the drop in the price of Bitcoin forced them to sell Bitcoin to pay off the loan.

Will these listed miners continue to dump their bitcoins?

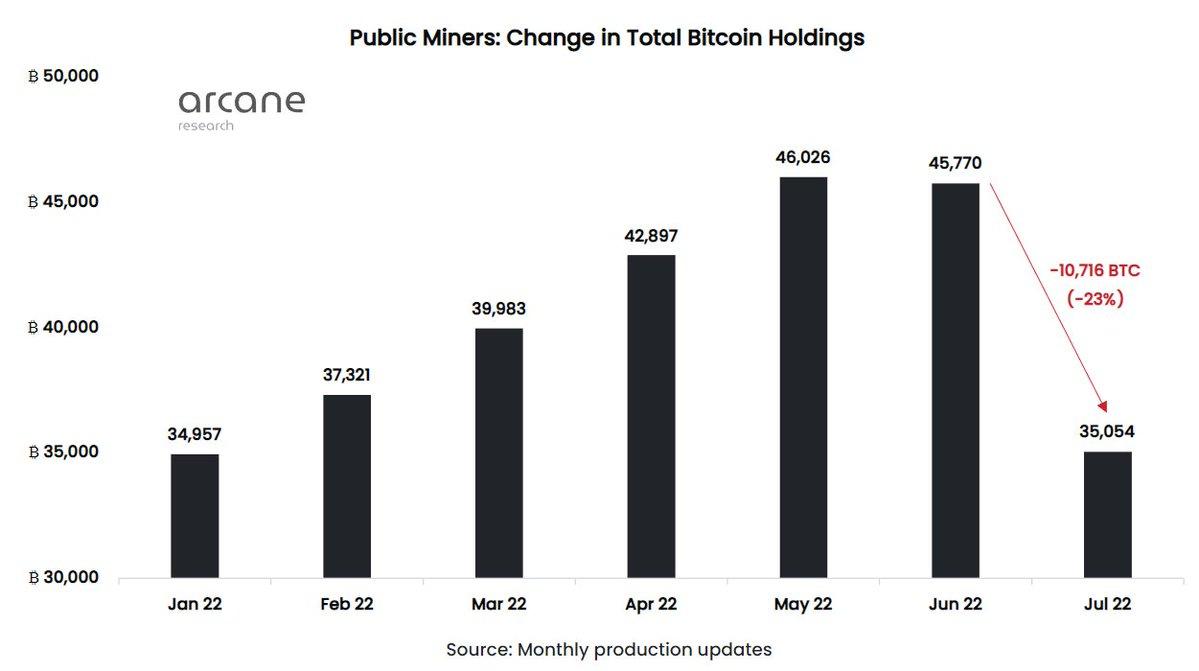

The chart below shows how listed miners accumulated Bitcoin holdings in the first few months of 2022, then dumped a lot of Bitcoin in June, and the total amount of Bitcoin held is now the same as at the beginning of this year.

I think we have now experienced the worst Bitcoin sell-off from listed miners. They continue to sell larger Bitcoin productions than they did in the first months of 2022 due to dwindling outside capital, but the extreme Bitcoin sell-off we saw in June will not last.

There are two reasons. First, they can sell less bitcoin now than in early June. Their Bitcoin holdings shrank by nearly 11,000 in June. The 23% drop came largely from the sell-off of Core Scientific and Bitfarms. Some miners, such as Marathon and Hut 8, still have a lot of Bitcoin on their balance sheets to sell, but if they haven't sold, they may not need to sell unless the price of Bitcoin falls further.

The second reason is that the main cause of their sell-off - bitcoin and machine-collateralized debt - has now been reduced significantly, and the worst risks have been removed from the system.

Xu Lin

Xu Lin

Xu Lin

Xu Lin Xu Lin

Xu Lin Edmund

Edmund Edmund

Edmund Joy

Joy Edmund

Edmund Bernice

Bernice Brian

Brian Xu Lin

Xu Lin Coinlive

Coinlive