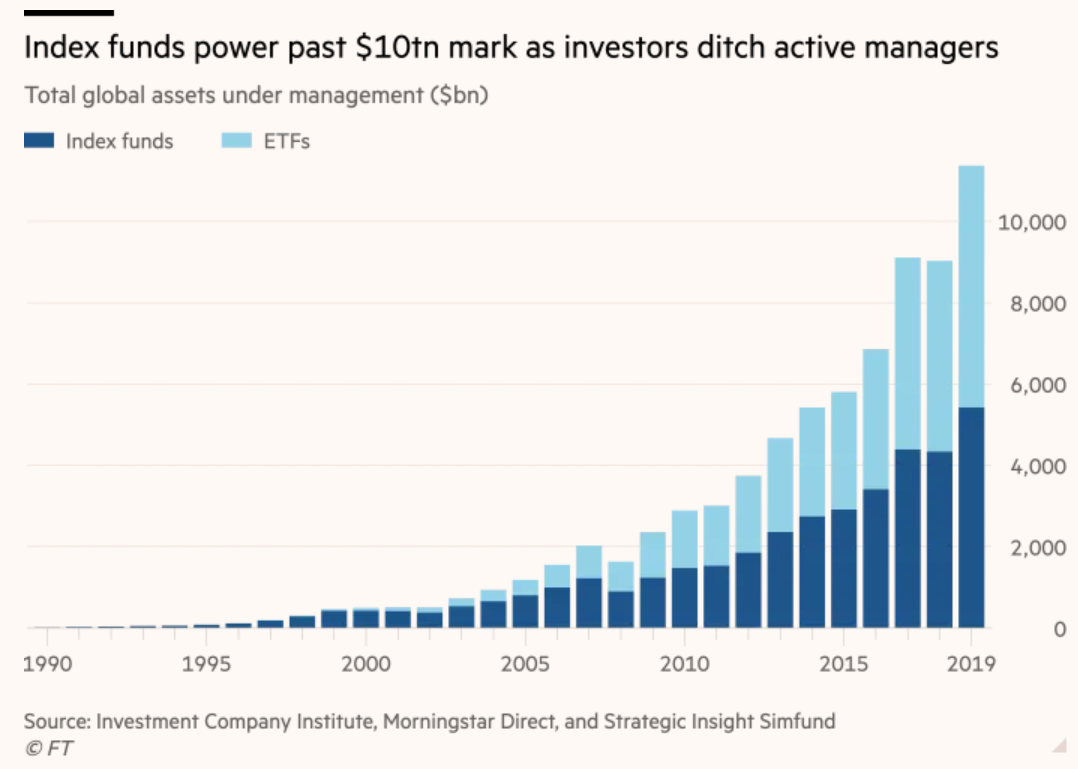

Indexing, or investing in a "basket of assets" within a specific set of rules, has been the number one investment trend for the past few decades. By 2020, the total assets under management (AUM) of index funds will reach $10 trillion . The three largest index funds: BlackRock, Vanguard and State Street collectively manage $22 trillion in AUM. The three major index providers, S&P Dow Jones Indices, FTSE Russell, and MSCI have contributed to a total asset management scale of more than US$40 trillion based on their indexes.

The ability to invest within one set of frameworks or methodologies can get you far, and it provides diversification and lower costs for investors.

Source: Financial Times

Cryptocurrencies are inherently a finance-first field, as products can be associated with tokens from the start, unlike Web 2.0. This environment, while difficult to navigate, is ready for on-chain index providers. Blockchain technology has made the crypto market more transparent and open, which is a key factor in properly constructing the index. Frankly, it’s surprising that we haven’t seen much success in the on-chain index space.

In this post, I explain why on-chain indices are struggling, their strengths and weaknesses, and their role in the future of the crypto market.

A quick rundown of the main points of this article:

- Indexation has always been the number one investment trend. If cryptocurrencies want to reach a market value of $10 trillion, they need to embrace indexation.

- On-chain indices are currently stagnant because they are targeting the wrong demographic.

- Smart contracts are suitable for automating on-chain indexing methods, but require robust frameworks and protocol-level adaptability.

- If governance works as intended, the on-chain index winner will be the BlackRock of crypto.

- On-chain indices lack distribution, which may require a centralization trade-off to optimize.

Strengths and Challenges

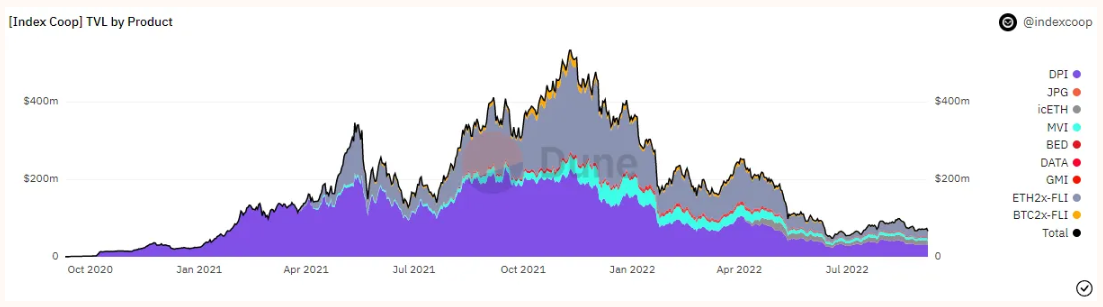

The situation with on-chain indices is not ideal at best. The largest of these, Index Coop, has a total AUM of about $70 million across all products. 21Shares’ Amun hasn’t even hit $1 million in AUM yet. It’s clear that on-chain indices are not thriving.

Source: Dune

This is ironic, since the main advantage of index investing boils down to discipline. If you have a set of rules that you follow no matter what happens, you're less likely to make impromptu decisions based on emotion. This is especially beneficial in a volatile market like cryptocurrencies. Additionally, the methods implemented by many index providers are suitable for execution by smart contracts with less human involvement.

Imagine if the defipulse index implemented a method that took into account the following metrics and automatically rebalanced every month.

- Agreement net income

- Profit Shared with Token Holders

- Developer activity on GitHub

- Free Float / Circulating Supply

- income opportunity

There are many ways to create an interesting on-chain index without relying too much on market cap. Cryptocurrencies as an asset class are already highly correlated, and a cap-weighted index is somewhat useless if you want to market your product to the crypto-native crowd.

In addition to the typical benefits that indices provide, on-chain indices offer transparency and composability. Users can see exactly how asset movements under the index are being handled, effectively a 24/7 audit trail. So why are on-chain indices struggling?

Simply put, on-chain indices:

- wrong targeting

- Not enough Degen (individuals involved in high-risk transactions)

- lack of distribution

Let's break it down.

The target audience is wrongly positioned. Interacting with on-chain indices means users are savvy enough to conduct on-chain transactions and participate in the DeFi ecosystem. Such users are not considered Class 101 market participants and are primarily targeted by TradFi index funds. A finance graduate working at Goldman Sachs would likely not invest through an index fund, but instead try to manage their own money. Index funds appeal to those who are not particularly fond of the minutiae of capital markets and prefer to delegate the decision-making process.

Not enough Degen. A crypto user interacting with an on-chain index is likely enough of Degen not to care about buying something like a "big 10 crypto" index. They want to find the next batch of crypto assets that will generate asymmetric returns, or rather invest in MIM’s Degenbox to increase their stablecoin returns by 5 times. So far, we haven’t seen any on-chain index providers fulfill this need. Also, investing in cryptocurrencies means you are already taking more risk than the average investor, which is quite the opposite of index investing.

Lack of distribution. The distribution of TradFi index funds is excellent. Almost everyone can invest in these funds through a retirement account, bank account, or other avenue. In the crypto space, the space needs to overcome regulatory hurdles before on-chain indices can have the same level of distribution. Nonetheless, on-chain indices have crypto-native strategies to expand their distribution. This includes integrating with popular crypto wallets and exchanges — basically vertically integrating or working as vertically as possible.

There are also regulatory issues that need to be addressed strategically if on-chain index providers have their own tokens.

back to governance

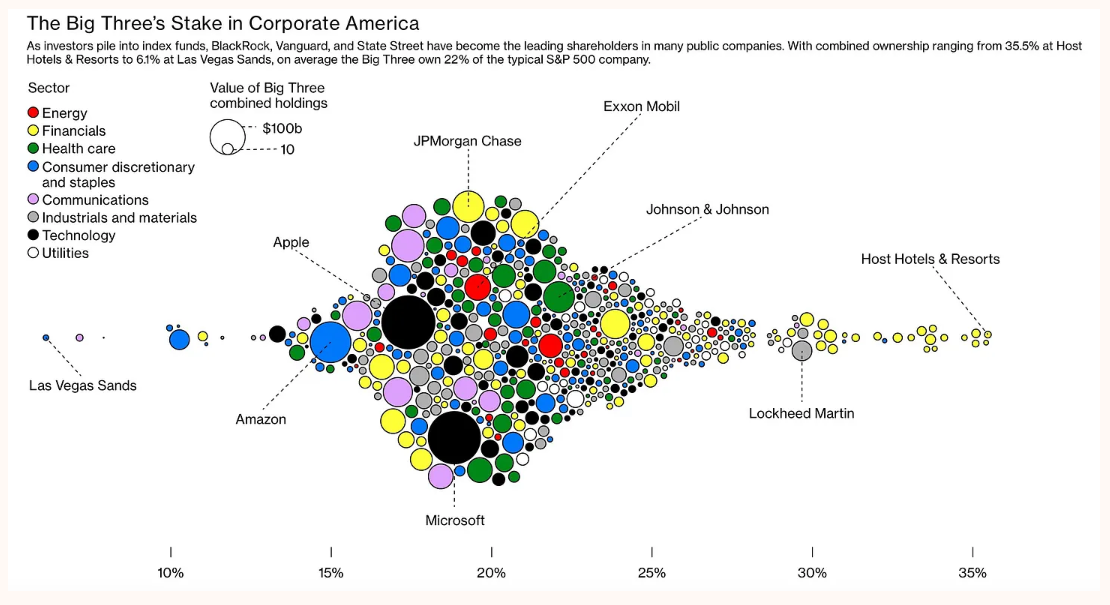

In the first article I published, I wrote about the endgame of tokens (see CT Chinese compiled version "The Evolution Direction of Tokens" ), and I think the endgame of tokens is actually tokenized equity. Based on this thesis, if crypto governance really works, the winner of the on-chain index will be the BlackRock of crypto, with a lot of influence over many protocols.

BlackRock, for example, has been advancing its ESG agenda because the firm is a top-five shareholder in most of the S&P 500, giving BlackRock significant voting power. Sound familiar?

Source: Bloomberg

Given the recent drama and discussions surrounding DeFi 1.0 protocols, imagine if there was an entity so large and influential they could also participate in these governance forums. Some will say it only complicates the situation, but others will say that it gives small token holders more say if on-chain index providers properly represent their constituents.

Becoming a $10 Trillion Asset Class

Cryptocurrencies remain the preferred asset class for venture capital. I can almost guarantee that most pure liquid (non-VC) active managers in crypto have not outperformed the broader crypto market over the past few years. However, if all goes well, cryptocurrencies will mature and within the next decade, the asset class will become similar to stocks. When this happens, a thriving indexation environment is needed for cryptocurrencies to continue to grow as an asset class.

On-chain indices are poised to capture this growth, provided they can balance their growth and distribution strategies between institutional and crypto-native degen. In order to scale and compete with off-chain index providers, some kind of centralization trade-off is necessary. Those companies that do this successfully and grow on both the institutional and crypto-native side will ultimately win.

Joy

Joy