The U.S. federal Office of Government Ethics (OGE) has issued a legal warning recommending that senior government officials be required to disclose various circumstances surrounding their investments in non-fungible tokens (NFTs).

In a legal warning to the designated agency's ethics officer, principal Emory Rounds III said that all NFT investments (including fragmented NFTs (F-NFTs) and collectibles) worth $1,000, if at the end of the reporting period "are holding for investment or income generation” must be declared.

The guidance provided by the federal agency also requires officials to declare their NFT investments if they made more than $200 in profits during the reporting period, adding:

"Public financial information disclosure filers must also disclose the purchase, sale and exchange of NFT collections and F-NFTs that meet the nature of securities."

The consultation focuses on NFT investment filings that represent “property” such as real estate. However, the OGE previously ruled that personal assets including clothing, electronics or family photos — or NFTs representing such content — do not need to be declared.

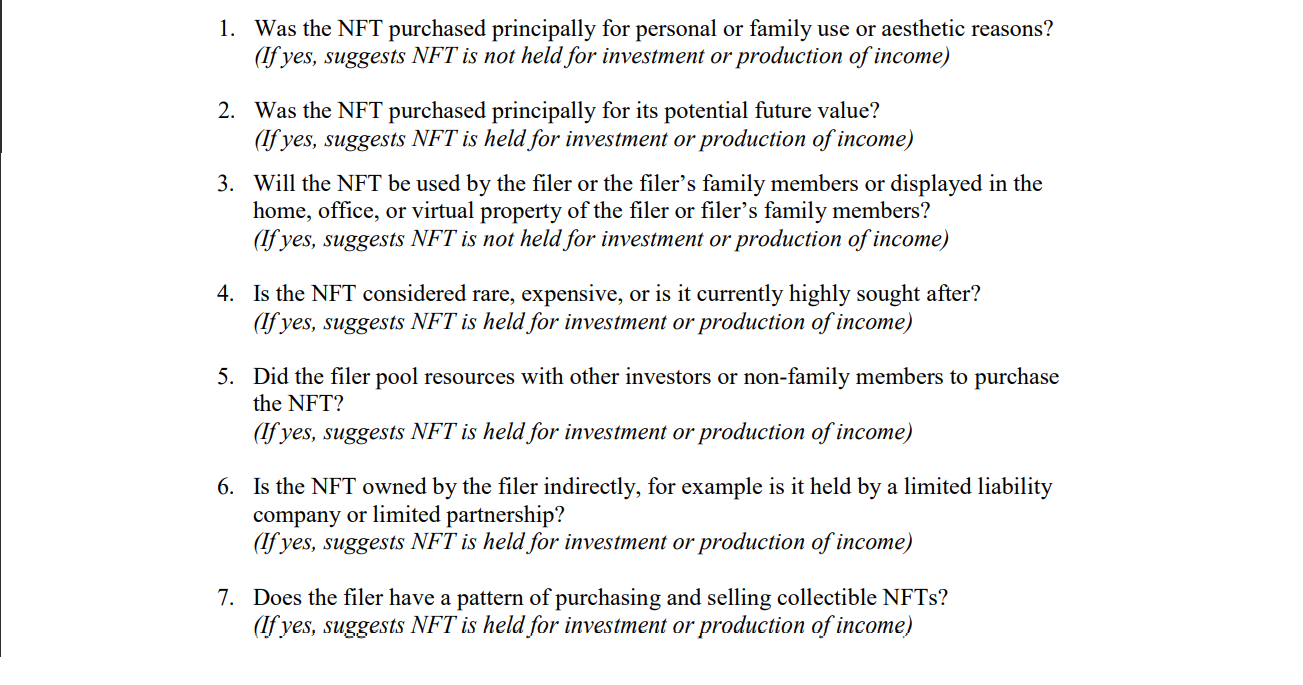

Collections may or may not be required to be disclosed as financial investments, depending on the circumstances disclosed by each filer. Rounds proposes seven questions to help filers self-identify their filing requirements, as listed below.

Considerations for Financial Disclosures. Source: oge.gov

Filers are advised to report NFT investments using OGE Form 278e, in which investors must include details such as the value, type of income, and amount of income of all eligible NFTs. OGE said it will continue to monitor developments in encryption technology and revise the aforementioned guidance as necessary in the future.

Congressman Brad Sherman has suggested that the U.S. Securities and Exchange Commission (SEC) pursue securities cases against cryptocurrency exchanges with "tenacity and courage."

Enforcement Director Gurbir Grewal referred to a case against Poloniex in August 2021, highlighting the SEC's investigation of the crypto exchange. However, Sherman noted that larger exchanges such as Binance and Coinbase warrant investigation:

“The big fish on the major exchanges do thousands of transactions through XRP. You know it’s a security, which means they’re running a stock exchange illegally. They know it’s illegal because they don’t do it anymore, even though it’s It’s profitable. […] I want you to pay attention to that.”

Sherman called for stricter monitoring of cryptocurrency exchanges, while SEC Chairman Gary Gensler and Grewal both cited concerns about cryptocurrency enforcement in the administration's fiscal year 2023 budget application.

Weatherly

Weatherly