Bitcoin (BTC) found new focus below $20,000 on July 14, as the dollar’s strength hit another 20-year high.

BTC/USD 1-hour candlestick chart (Bitstamp). Source: TradingView

BTC/USD 1-hour candlestick chart (Bitstamp). Source: TradingView

Dollar index moves yen, euro in focus

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD bouncing off lows as U.S. inflation hit a 40-year high, according to the latest release of the U.S. Consumer Price Index (CPI).

After briefly dipping below $19,000, the pair briefly topped $20,000 before gaining a foothold below the psychologically important level.

The on-chain analysis resource Material Indicators stated that there has been a key upward trend since mid-June, and the BTC price trend is now at a "critical moment."

That trendline was around $19,600 that day, and BTC/USD is still using it as support for now.

Meanwhile, the cryptocurrency market looks unlikely to see a major rally as it is again dominated by the U.S. dollar today.

The U.S. dollar index (DXY) retreated sharply after the CPI data, reaching its highest level since 2002 - a phenomenon that has followed for most of the year.

The new DXY peak is 108.64, up more than 1% from the 24-hour low.

Dollar Index (DXY) one-hour candlestick chart. Source: TradingView

Aside from being a short-term negative for Bitcoin and risk assets, a stronger dollar is also bad news for the rest of the world's major currencies, with the Japanese Yen particularly on the radar of Bitcoin commentators.

The popular Twitter account Stack Hodler said: "JPY got hammered again today. The BoJ is standing still and waiting for the Fed to reverse. Until then, they will continue to destroy their currency because they have no other choice."

“BOJ+JPY gives us a glimpse of what could happen to ECB+EUR. Do you see why Bitcoin is so important?”

According to Cointelegraph, some believe that the Fed will also have no choice but to stop raising interest rates to suppress inflation until the end of 2022.

Investor and hedge fund manager Bill Ackman tweeted in response to the CPI data: "Today's CPI data showed broad and accelerating inflation, short-term FF futures rose, suggesting FF peaked at 3.68% on 12/22, Fed This was immediately followed by a rate cut to 2.9% on 1/24.”

"The market implicitly expects a more aggressive Fed policy to push us into a recession by the end of the year and then cut rates in response."

Few believe in the rebirth of altcoins

As for altcoins, one analyst warned that the flat rise over the past 24 hours is no reason to think prices won’t continue to fall.

In its latest update of the day, Il Capo of Crypto predicted bearish moves for at least two of the top 10 cryptocurrencies by market capitalization.

For example, the price of ether (ETH) may return to triple digits.

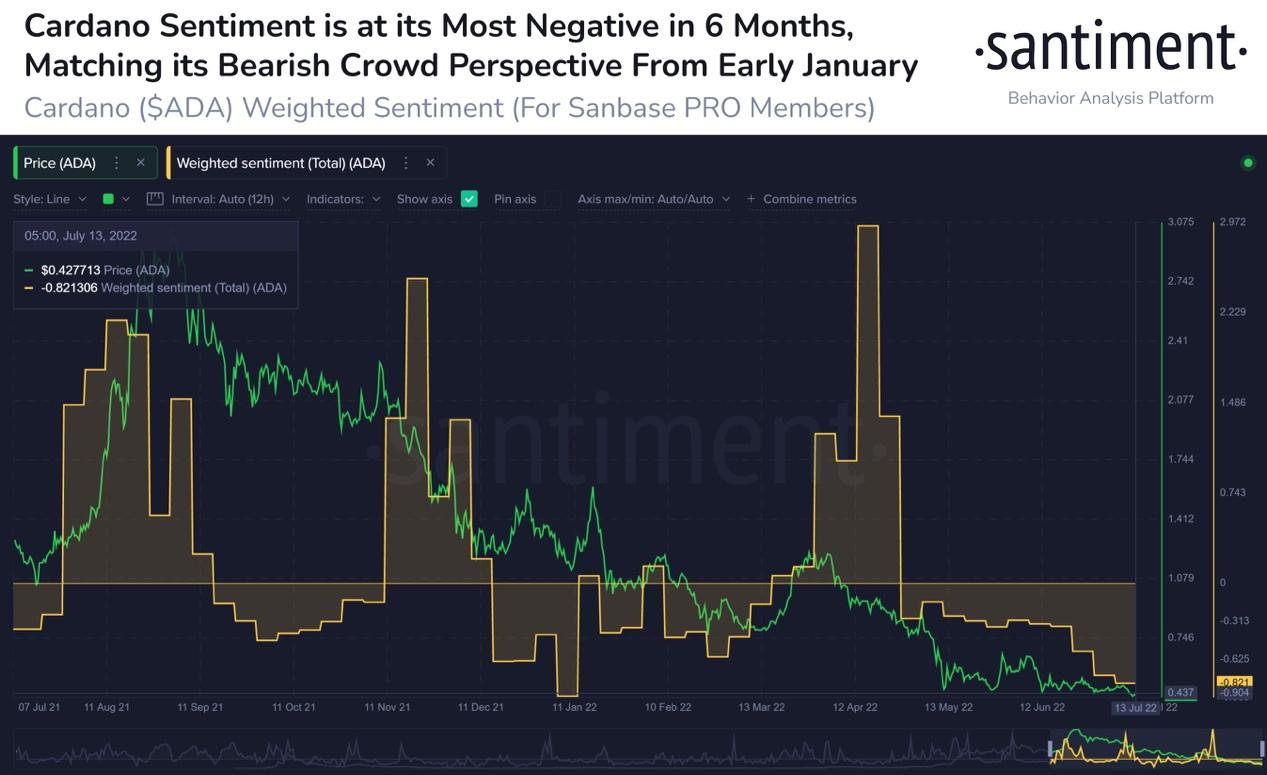

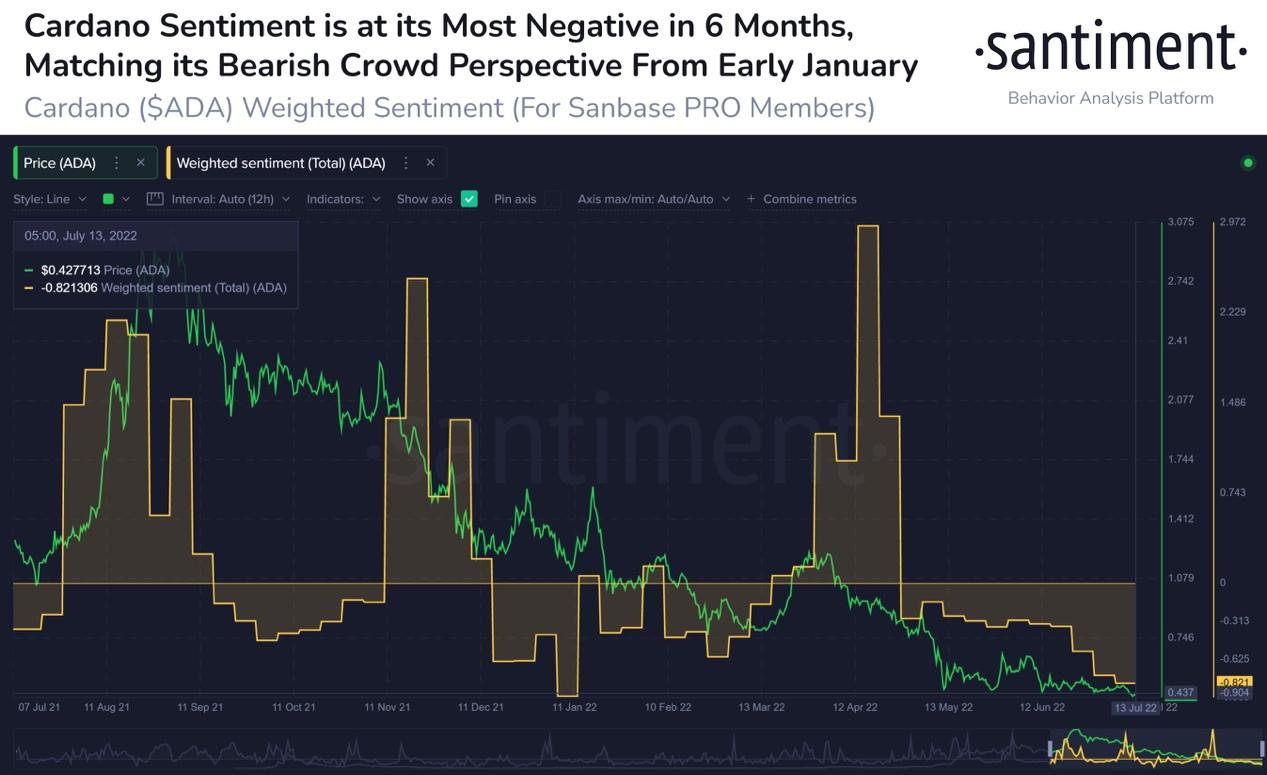

Cardano ( ADA ) faces worse as it breaks below support, which has been tested six times in the past few weeks.

"The support level was broken and now it is being tested as a resistance level, and the trend is worrying." Il Capo of Crypto commented.

Still, data from research firm Santiment revealed the potential for altcoin rebounds, as it has "slumped harder than most currencies" so far this year.

Source: Santiment Twitter

Source: Santiment Twitter

Alex

Alex

Source: Santiment Twitter

Source: Santiment Twitter