Bitcoin (BTC) started the new week still battling for support at $20,000. The crypto market experienced severe losses last week.

What seemed impossible a few weeks ago has now become a reality, with Bitcoin returning to $20,000 — the all-time high from 2017-2020 — giving investors a terrifying sense of déjà vu.

Bitcoin fell as low as $17,600 over the weekend, with tensions rising ahead of Wall Street's opening on June 20.

While statistically, Bitcoin’s price drops have been seen before — or even lower — there are growing concerns about the stability of the Bitcoin network at current levels, with attention now focused on miners in particular.

Add to that the consensus that macro markets may not have bottomed yet, and it becomes understandable that sentiment around Bitcoin and cryptocurrencies is at record lows.

Cointelegraph will be focusing on some of the major areas influencing Bitcoin price action in the coming days.

Bitcoin reclaims $20,000 support on weekly chart

Bitcoin closed the latest week at $20,580 - as the largest cryptocurrency has managed to hold a key support level at least on a weekly time frame.

However, the weekly close reclaimed $2,400 from the weekly low, a repeat of which could add to the pain for those betting $20,000 will form a significant support level.

Overnight, BTC/USD hit a high of $20,629 on Bitstamp before consolidating back below the $20,000 mark, suggesting that conditions remain volatile on lower time frames.

Despite some calls for a quick recovery, the overall mood among commentators remains cautiously optimistic.

“During the weekend, while the fiat channel was closed, the price of Bitcoin fell nearly 20% from Friday to a low of $17,600 on high volume. It appears that sellers who were forced to sell their assets triggered stops,” Arthur Hayes, the former CEO of the derivatives trading platform BitMEX, wrote on Twitter that day.

Hayes speculates that a recovery will come once these forced selling ends, but more selling pressure may still be on the way.

"Is it over...I don't know," read another post.

The role of crypto hedge funds and related investment vehicles in exacerbating bitcoin’s price weakness has become a key topic of debate since the Terra LUNA crash in May. With Celsius , Three Arrows Capital and others now also joining the turmoil, a forced liquidation from multi-year lows may be what is needed to stabilize markets in the long run.

"Bitcoin's job of clearing the big players isn't over yet," investor Mike Alfred said over the weekend.

“Bitcoin’s price would drop to a level that would do the most damage to overexposed players like Celsius, and then once those companies were completely wiped out, it would suddenly bounce back and then go up. It’s been the same throughout the ages.”

In the eyes of others, $16,000 is still a hot target, which in itself only equates to a 76% drop in Bitcoin from its November 2021 all-time high. As previously reported by Cointelegraph, the expected bottom for Bitcoin’s price is $11,000 — representing an 84.5% drop from its all-time high

“The $31,000-32,000 resistance level is broken. The same goes for $20,000-21,000. The main targets: $16,000-17,000, especially $16,000-16,250,” concluded the well-known Twitter account Il Capo of Crypto.

It also described $16,000 as a "powerful magnet."

BTC/USD 1-week candle chart (Bitstamp) Source: TradingView

BTC/USD 1-week candle chart (Bitstamp) Source: TradingView

Stocks and bonds have 'nowhere to hide'

Meanwhile, pre-opening weakness in U.S. stocks offers little upside for Bitcoin on June 20.

As noted by analyst and commentator Josh Rager, the correlation between Bitcoin and stocks is still fully functional.

For short sellers, the outlook looks good. The cryptocurrency market gave investors a taste of reality months in advance as data through June 18 showed global stock markets were heading for their “worst quarter ever.”

So the only market players that seem to be able to turn things around are central banks, especially the Fed.

Some are now claiming that monetary tightening won't last long because its downside will force the Fed to start expanding the dollar supply again. This, in turn, will flow cash back into risky assets.

With the U.S. in recession, the Fed itself takes this view - a recession is highly likely, depending on how recent comments from the Fed are interpreted.

Referring to the accommodative environment of ultra-low interest rates, Federal Reserve Governor Christopher J. Waller said in a speech on June 18:

"I hope we never have two years like 2020 and 2021 again, but with the low interest rate environment we're in right now, I believe there's a good chance that we'll consider that even in a typical recession going forward. Similar to policy decisions made over the past two years."

At the same time, however, policy dictates rate hikes, which the Federal Reserve announced earlier this month was a direct trigger for increased losses in risky assets.

Miners in no mood to surrender

Who Is Selling Bitcoin At Lowest Level Since November 2020?

On-chain data has been tracking the investor groups responsible for the selling pressure — some forced, some voluntary.

In participating in the process of finding blocks, miners may have been caught up in the process, and they changed from buyers to sellers, stopping the accumulation trend that has been accumulated for many years.

On-chain analysis firm Glassnode confirmed over the weekend: “Miners sold about 9,000 BTC from their vaults this week and still hold about 50,000 BTC.”

However, the production cost of miners is difficult to calculate accurately, and different equipment faces completely different mining conditions and fees. Therefore, even at current price levels, many mining companies may still be profitable.

At the same time, BTC.com data also brought surprising news. Bitcoin's network difficulty will not decrease due to the departure of miners. Instead, it will adjust upwards this week.

Difficulty allows the Bitcoin network to adapt to changing economic conditions and is the backbone of its uniquely successful proof-of-work algorithm. If miners quit due to lack of profitability, the difficulty is automatically lowered, reducing costs and making mining more attractive.

However, miners have not quit so far.

Likewise, the hash rate, while not at an all-time high, is still above the estimated 200 exhash per second (EH/s). Therefore, the hardware capabilities used for mining are similar to before.

Overview of Bitcoin network fundamentals (screenshot) Source: BTC.com

Overview of Bitcoin network fundamentals (screenshot) Source: BTC.com

Bitcoiner Suffers 'Huge' Losses, Both Sellers and Holders

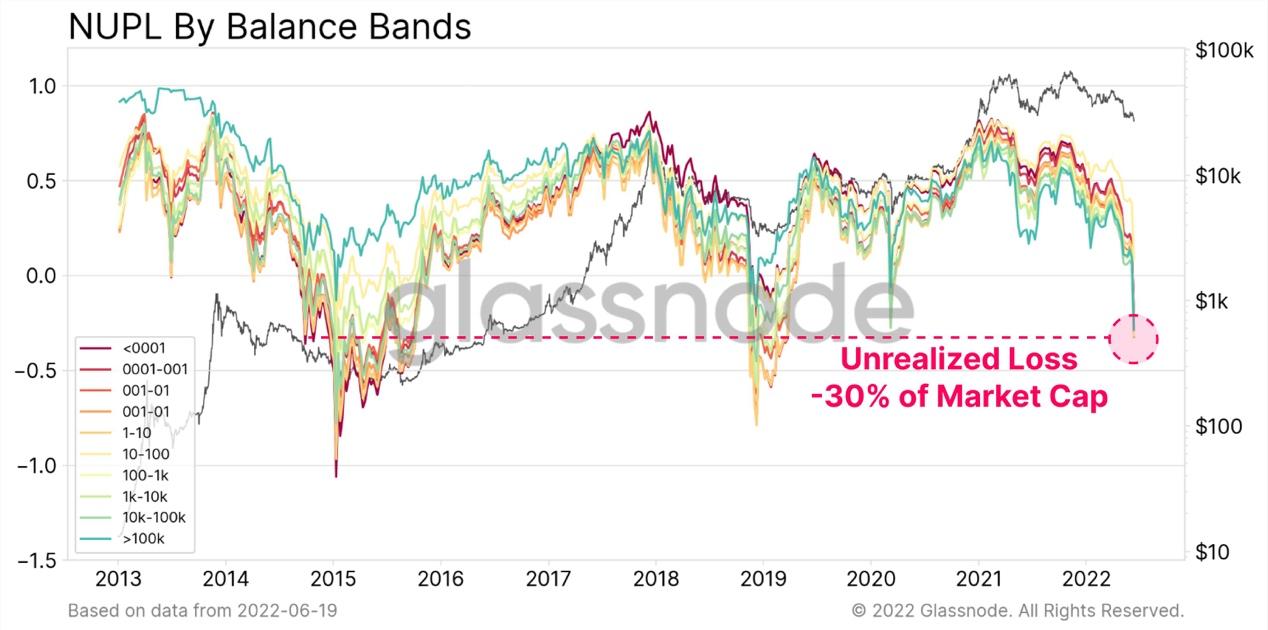

Overall, however, holders large and small who were unable to weather the financial turmoil faced “significant” losses when they sold their bitcoins, Glassnode said.

“If we assess the losses, we can see that almost all groups of wallets, from small shrimps to whales, are now holding large unrealized losses, worse than in March 2020,” the researchers noted in a chart. This chart shows how much Bitcoin holdings have fallen relative to the cost basis.

"The least profitable group of wallets holds 1-100 bitcoins, with an unrealized loss equivalent to 30% of the market value."

Bitcoin Net Unrealized Profit and Loss (NUPL) Annotated Chart Source: Glassnode/Twitter

Bitcoin Net Unrealized Profit and Loss (NUPL) Annotated Chart Source: Glassnode/Twitter

The data suggest that even seasoned investors are panicking, which is arguably a shocking phenomenon considering Bitcoin's history of volatility.

The HODL Waves indicator groups coins based on when they last moved, and it records both who sold and bought coins on dips.

Between June 13 and June 19, the percentage of the overall Bitcoin supply that moved between a day and a week rose from 1.65% to nearly 6%.

Bitcoin HODL Waves chart (screenshot) Source: Unchained Capital

Bitcoin HODL Waves chart (screenshot) Source: Unchained Capital

Market sentiment nearly hits all-time lows

The encryption market sentiment in December 2021 has been "comparable to a funeral", but the encryption market sentiment has surpassed itself.

According to the Crypto Fear and Greed Index, ordinary investors are more fearful now than at almost any time in the history of the crypto industry.

On June 19, the index (which uses a basket of factors to calculate overall sentiment) fell to near an all-time low of just 6/100 - deep in the "extreme fear" category.

The week’s close improved things only slightly, with the index up 3 points, but still hovering around levels that have historically marked bitcoin’s bear market lows.

Crypto Fear and Greed Index (screenshot) Source: Alternative.me

Crypto Fear and Greed Index (screenshot) Source: Alternative.me

Weiliang

Weiliang