Crypto Aid Provides Relief Amidst Escalation of Israel-Hamas War — How?

Crypto Aid Israel raises $185,000 in a mere ten days. This achievement highlights the dedication of both Israeli Web3 community members and international companies.

Catherine

Catherine

Author: @Web3_Mario

Summary: Last week we discussed the potential of Lido to benefit from changes in the regulatory environment, hoping to help everyone seize this wave of Buy the rumor trading opportunities. This week there is a very interesting topic, which is the popularity of MicroStrategy. Many predecessors have commented on the operating model of this company. After digesting and studying it in depth, I have some of my own opinions and hope to share them with you. I think the reason for the rise in MicroStrategy's stock price is the "Davis Double Click". Through the business design of financing the purchase of BTC, the appreciation of BTC is tied to the company's profits, and the capital leverage obtained by combining the innovative design of traditional financial market financing channels has enabled the company to have the ability to exceed the profit growth brought by the appreciation of BTC it holds. At the same time, as the holdings expand, the company has a certain BTC pricing power, further strengthening this profit growth expectation. The risk lies here. When the BTC market fluctuates or reverses, BTC's profit growth will stagnate. At the same time, affected by the company's operating expenses and debt pressure, MicroStrategy's financing ability will be greatly reduced, which will in turn affect profit growth expectations. At that time, unless there is a new boost to further push up the BTC price, the positive premium of MSTR's stock price relative to BTC holdings will converge quickly. This process is the so-called "Davis Double Play".

Friends who are familiar with me should know that the author is committed to helping more non-financial friends understand these dynamics, so they will replay their own thinking logic. Therefore, first of all, let's add some basic knowledge, what is "Davis Double Play" and "Double Play".

The so-called "Davis Double Play" was proposed by investment guru Clifford Davis, and is usually used to describe the phenomenon that in a good economic environment, a company's stock price rises sharply due to two factors. The two factors are:

Company profit growth: The company has achieved strong profit growth, or its business model, management and other aspects have been optimized, resulting in increased profits.

Valuation expansion: As the market is more optimistic about the company's prospects, investors are willing to pay a higher price for it, thereby driving up stock valuations. In other words, the stock's price-to-earnings ratio (P/E Ratio) and other valuation multiples have expanded.

The specific logic of the "Davis Double Click" is as follows: First, the company's performance exceeds expectations, and both revenue and profits are growing. For example, good product sales, expanded market share or successful cost control will directly lead to the company's profit growth. At the same time, this growth will also increase the market's confidence in the company's future prospects, leading investors to be willing to accept a higher price-to-earnings ratio P/E, pay a higher price for the stock, and the valuation begins to expand. This positive feedback effect of linear and exponential combination usually leads to an accelerated rise in stock prices, which is the so-called "Davis Double Click".

To illustrate this process, suppose a company's current P/E ratio is 15 times and its future earnings are expected to grow by 30%. If investors are willing to pay 18 times the P/E ratio for the company due to the growth of its earnings and the change in market sentiment, then even if the earnings growth rate remains unchanged, the valuation increase will drive the stock price up significantly, for example:

Current stock price: $100

A 30% increase in earnings means that earnings per share (EPS) will increase from $5 to $6.5.

The P/E ratio increases from 15 to 18.

New stock price: $6.5 × 18 = $117

The stock price rose from $100 to $117, reflecting the dual effects of earnings growth and valuation improvement.

The "Davis Double Kill" is the opposite, usually used to describe the rapid decline in stock prices under the combined effect of two negative factors. The two negative factors are:

Declining company earnings: The company's profitability has declined, which may be due to factors such as reduced revenue, rising costs, and management errors, resulting in earnings lower than market expectations.

Valuation contraction: Due to declining earnings or worsening market prospects, investors' confidence in the company's future has declined, resulting in a decline in its valuation multiples (such as the price-to-earnings ratio) and a decline in stock prices.

The whole logic is as follows. First, the company fails to achieve the expected profit target or faces operating difficulties, resulting in poor performance and declining profits. This will further worsen the market's expectations for its future. Investors lack confidence and are unwilling to accept the current overvalued P/E ratio. They are only willing to pay a lower price for the stock, which leads to a decline in valuation multiples and a further decline in stock prices.

Also, let's take an example to illustrate this process. Suppose a company's current P/E ratio is 15 times, and its future profits are expected to fall by 20%. Due to the decline in profits, the market begins to have doubts about the company's prospects, and investors begin to reduce its P/E ratio. For example, reduce the P/E ratio from 15 to 12. The stock price may drop significantly as a result, for example:

Current stock price: $100

A 20% drop in earnings means that earnings per share (EPS) drops from $5 to $4.

The price-earnings ratio drops from 15 to 12.

New stock price: $4 × 12 = $48

The drop in the stock price from $100 to $48 reflects the dual effects of falling earnings and shrinking valuations.

This resonance effect usually occurs in high-growth stocks, especially in many technology stocks, because investors are usually willing to give high expectations for the future growth of these companies' businesses. However, this expectation is usually supported by relatively large subjective factors, so the corresponding volatility is also very large.

After supplementing this background knowledge, I think everyone should be able to roughly understand how MSTR's high premium relative to its BTC holdings is generated. First of all, MicroStrategy has switched its business from traditional software business to financing the purchase of BTC, and of course it does not rule out corresponding asset management revenue in the future. This means that the company's profits come from the capital gains of the appreciation of BTC purchased by diluting its equity and issuing bonds. With the appreciation of BTC, the shareholders' equity of all investors will increase accordingly, and investors will benefit from it. In this regard, MSTR is no different from other BTC ETFs.

The difference is that its financing ability brings leverage effect, because MSTR investors' expectations of the company's future profit growth come from the leveraged benefits obtained from the growth of its financing ability. Considering that the total market value of MSTR's stocks is at a positive premium relative to the total value of BTC it holds, that is, the total market value of MSTR is higher than the total value of BTC it holds. As long as it is in this positive premium state, both equity financing and its convertible bond financing, along with the purchase of BTC with the funds obtained, will further increase the equity per share. This gives MSTR the ability to grow profits differently from BTC ETF.

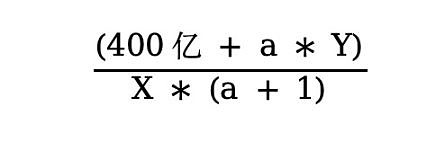

For example, assuming that MSTR currently holds 40 billion US dollars in BTC, with a total outstanding share of X, and its total market value of Y. Then the equity per share is 40 billion / X. If financing is carried out with the most unfavorable equity dilution, assuming the ratio of new shares issued is a, this means that the total outstanding shares become X*(a+1), and the financing is completed at the current valuation, with a total of a*Y billion US dollars raised. If all of these funds are converted into BTC, the BTC holding will become 40 billion + a * Y billion, which means that the equity per share will become:

We subtract it from the original equity per share to calculate the increase in equity per share due to diluted equity, as follows:

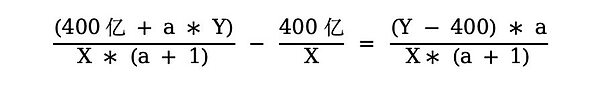

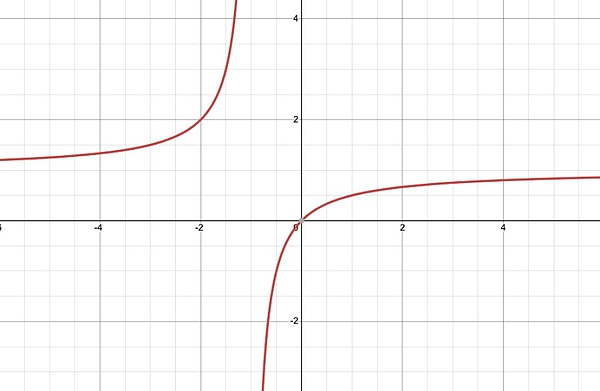

This means that when Y is greater than 40 billion, that is, the amount of shares it holds When the value of BTC is high, that is, when there is a positive premium, the equity growth per share brought by completing the financing to purchase BTC is always greater than 0, and the greater the positive premium, the higher the equity growth per share. The two are called linear relationships, and as for the impact of the dilution ratio a, it presents an inverse proportional feature in the first quadrant, which means that the fewer additional shares are issued, the higher the equity growth rate.

So for Michael Saylor, the positive premium between the market value of MSTR and the value of BTC it holds is the core factor in the establishment of its business model, so his best choice is how to maintain this premium while continuously raising funds, increasing his market share, and gaining more pricing power for BTC. The continuous enhancement of pricing power will enhance investors' confidence in future growth under high price-to-earnings ratios, enabling them to complete fundraising.

To sum up, the secret of MicroStrategy's business model is that the appreciation of BTC drives the company's profits to rise, and the positive growth trend of BTC means that the company's profit growth trend is positive. With the support of this "Davis double-click", MSTR's positive premium begins to expand, so the market is betting on how high a positive premium valuation MicroStrategy can complete subsequent financing.

Next, let's talk about the risks that MicroStrategy brings to the industry. I think the core is that this business model will significantly increase the volatility of BTC prices and act as an amplifier of volatility. The reason is the "Davis double kill", and BTC entering a high-level oscillation period is the beginning of the entire domino effect.

Let's imagine that when the growth of BTC slows down and enters a period of volatility, MicroStrategy's profits will inevitably begin to decline. I want to expand on this here. I see that some friends attach great importance to their holding costs and the scale of floating profits. This is meaningless because in MicroStrategy's business model, profits are transparent and equivalent to real-time settlement. In the traditional stock market, we know that the real factor causing stock price fluctuations is financial reports. Only when quarterly financial reports are released will the real profit level be confirmed by the market. In the meantime, investors only estimate changes in financial conditions based on some external information. In other words, most of the time, the reaction of stock prices lags behind the actual changes in the company's earnings, and this lagging relationship will be corrected when the quarterly financial reports are released. However, in MicroStrategy's business model, since its holding size and BTC prices are public information, investors can understand its real profit level in real time, and there is no lag effect, because the equity per share changes dynamically with it, which is equivalent to real-time settlement of profits. In this case, the stock price has truly reflected all its profits, and there is no lag effect, so it is meaningless to pay attention to its holding costs.

Bringing the topic back, let's see how the "Davis Double Kill" unfolds. When BTC's growth slows down and enters the oscillation stage, MicroStrategy's profits will continue to decline, or even return to zero. At this time, fixed operating costs and financing costs will further reduce corporate profits, or even be in a state of loss. At this time, this shock will continue to erode the market's confidence in the subsequent development of BTC prices. This will translate into doubts about MicroStrategy's financing capabilities, thereby further undermining expectations for its profit growth. Under the resonance of these two, MSTR's positive premium will converge quickly. In order to maintain the establishment of its business model, Michael Saylor must maintain the state of positive premium. Therefore, it is necessary to sell BTC in exchange for funds to repurchase stocks, and this is when MicroStrategy began to sell its first BTC.

Some friends may ask, why not just hold BTC and let the stock price fall naturally? My answer is no, to be more precise, it is not allowed when the BTC price reverses, but it can be tolerated appropriately when it fluctuates, because of MicroStrategy's current equity structure and what is the best solution for Michael Saylor.

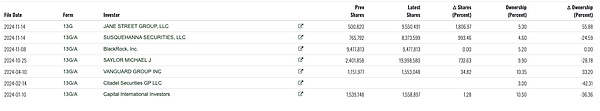

According to the current shareholding ratio of MicroStrategy, there are many top consortiums, such as Jane Street and BlackRock, and Michael Saylor, as the founder, only holds less than 10%. Of course, through the design of dual-class equity, Michael Saylor has an absolute advantage in voting rights, because the stocks he holds are more Class B common stocks, and the voting rights of Class B common stocks are 10:1 with Class A. So the company is still under the strong control of Michael Saylor, but his equity ratio is not high.

This means that for Michael Saylor, the long-term value of the company is much higher than the value of the BTC he holds, because if the company faces bankruptcy and liquidation, it will not get much BTC.

So what are the benefits of selling BTC during the shock phase and buying back stocks to maintain the premium? The answer is also obvious. When the premium converges, assuming that Michael Saylor judges that the P/E ratio of MSTR is undervalued due to panic, it is a cost-effective operation to sell BTC in exchange for funds and buy back MSTR from the market. Therefore, the effect of repurchase on the reduction of circulation and amplification of equity per share will be higher than the effect of reducing BTC reserves and reducing equity per share. When the panic is over, the stock price will pull back, and the equity per share will become higher, which is conducive to subsequent development. This effect is easier to understand when MSTR has a negative premium in the extreme case of BTC trend reversal.

Considering Michael Saylor's current holdings, and when there is a shock or downward cycle, liquidity is usually tightened, so when it starts to sell, the price of BTC will accelerate. The accelerated decline will further worsen investors' expectations for MicroStrategy's profit growth, and the premium rate will further decline, which will force it to sell BTC to repurchase MSTR, and the "Davis double kill" will begin.

Of course, another reason for forcing it to sell BTC to maintain the stock price is that the investors behind it are a group of Deep State with all-powerful hands and eyes. It is impossible for them to watch the stock price return to zero and remain indifferent, which will inevitably put pressure on Michael Saylor and force him to assume the responsibility of market value management. Moreover, I have found the latest information, which shows that with the continuous dilution of equity, Michael Saylor's voting rights have been less than 50%. Of course, the specific source of the news has not been found. But this trend seems to be inevitable.

After the above discussion, I think I have fully explained my logic. I would like to discuss another topic, whether MicroStrategy has no debt risk in the short term. Some predecessors have already introduced the nature of MicroStrategy's convertible bonds, so I will not discuss it here. Indeed, its debt duration is quite long. There is indeed no repayment risk before the maturity date. But my point of view is that its debt risk may still be reflected in advance through the stock price.

The convertible bond issued by MicroStrategy is essentially a bond with a free call option. When it expires, the creditor can ask MicroStrategy to redeem it at the previously agreed conversion rate and stock equivalent. However, there is also protection for MicroStrategy here, that is, MicroStrategy can actively choose the redemption method, using cash, stock or a combination of the two, which is relatively flexible. If the funds are sufficient, more cash will be repaid to avoid equity dilution. If the funds are not sufficient, more stocks will be added. In addition, this convertible bond is unsecured, so the risk of debt repayment is indeed not great. And there is another protection for MicroStrategy here, that is, if the premium rate exceeds 130%, MicroStrategy can also choose to redeem it directly at the original value in cash, which creates conditions for renewal negotiations.

Therefore, the creditors of this bond will only have capital gains when the stock price is higher than the conversion price and lower than 130% of the conversion price. Otherwise, there is only principal plus low interest. Of course, after Mindao's reminder, the investors of this bond are mainly hedge funds that use it for Delta hedging to earn volatility returns. Therefore, I thought about the logic behind it in detail.

The specific operation of Delta hedging through convertible bonds is mainly through purchasing MSTR convertible bonds and shorting an equal amount of MSTR stocks at the same time to hedge the risks brought by stock price fluctuations. Moreover, with the subsequent price development, hedge funds need to constantly adjust their positions for dynamic hedging. Dynamic hedging usually has the following two scenarios:

When the MSTR stock price falls, the Delta value of the convertible bond decreases because the conversion right of the bond becomes less valuable (closer to "out-of-money"). Then more MSTR stocks need to be shorted to match the new Delta value.

When the MSTR stock price rises, the Delta value of the convertible bond increases because the conversion right of the bond becomes more valuable (closer to "in the money"). Then, by buying back some of the previously shorted MSTR shares to match the new Delta value, the portfolio is hedged.

Dynamic hedging requires frequent adjustments in the following situations:

The underlying stock price fluctuates significantly: For example, a sharp change in the price of Bitcoin causes MSTR's stock price to fluctuate sharply.

Changes in market conditions: For example, volatility, interest rates or other external factors affect the convertible bond pricing model.

Hedge funds usually trigger operations based on the magnitude of the change in Delta (such as every change of 0.01) to maintain accurate hedging of the portfolio.

Let's take a specific scenario for illustration. Assume that the initial holdings of a hedge fund are as follows:

Buy $10 million worth of MSTR convertible bonds (Delta = 0.6).

Short sell $6 million worth of MSTR stock.

When the stock price rises from $100 to $110, the Delta value of the convertible bond becomes 0.65, so the stock position needs to be adjusted. The number of shares to be covered is calculated as (0.65-0.6)×10 million=500,000. The specific operation is to buy back $500,000 worth of stocks.

When the stock price falls from $100 to $95, the new Delta value of the convertible bond becomes 0.55, and the stock position needs to be adjusted. The calculation requires adding short stocks of (0.6-0.55)×10 million=500,000. The specific operation is to short sell $500,000 worth of stocks.

This means that when the price of MSTR falls, the hedge funds behind its convertible bonds will short sell more MSTR stocks in order to dynamically hedge the Delta, further hitting the MSTR stock price, which will have a negative impact on the positive premium and thus affect the entire business model. Therefore, the risk on the bond side will be fed back in advance through the stock price. Of course, in the upward trend of MSTR, hedge funds buy more MSTR, so it is also a double-edged sword.

Crypto Aid Israel raises $185,000 in a mere ten days. This achievement highlights the dedication of both Israeli Web3 community members and international companies.

Catherine

CatherineElon Musk made an announcement regarding the plans of X, formerly known as Twitter. Musk confirmed the impending launch of two distinct premium tiers, affirming prior reports and code discoveries.

Joy

JoyThe practice of burning tokens has been a consistent strategy for Huobi since 2018, and as of October 15, 2023, a cumulative total of 301,002,441 HT has been burned.

Jasper

JasperSolana surged by 10% and breached the key resistance at $25, currently trading at $25.96, possibly heading for a 20% rise to reach $30.

Jixu

JixuFinland's progressive push in pioneering digital Euro and redefining the European monetary landscape.

Hui Xin

Hui XinThe emergence of quantum computing has raised concerns within the blockchain community regarding the security of existing systems, but Vitalik believes that a viable solution has been found.

Kikyo

KikyoThe Open Network Foundation (TON Foundation) has teamed up with Blockchain.com to provide seamless access to cryptocurrencies for Telegram's vast user base, which comprises over 700 million monthly active users.

Jasper

JasperAlibaba and Tencent push forward AI investment in Zhipu, shaping China's tech landscape.

Hui Xin

Hui XinBlockchain data analytics firm Santiment has sounded the alarm on the Ethereum (ETH) landscape, revealing a pronounced surge in accumulation by crypto whales.

Jasper

JasperThe freeze order takes the form of "soulbound" NFTs and is firmly linked to the specific wallets under scrutiny.

Catherine

Catherine