Author: Sankalp Shangari, Rising Capital; Translator: Yangz, Techub News

I spend a few hours every week reading, researching, and chatting with some of the smartest founders and investors in the industry. This is a true portrayal of the industry that I witnessed firsthand at TOKEN2049 and Solana Breakpoint.

I have been involved in cryptocurrency since 2013, so please believe what I say about the current situation in the industry. Without further ado, let's take a peek at the current state of the industry from the perspectives of overall atmosphere, popular projects and narratives, founders and VCs.

Overall atmosphere of the industry

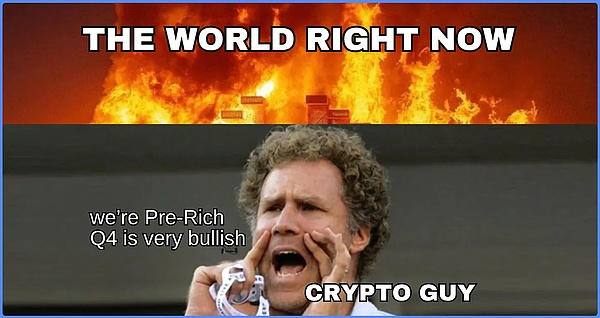

For the past decade, we have been marketing the dream that cryptocurrency will revolutionize the world and solve real-world problems. But to be honest, this promise has not been fulfilled. Instead, we have collectively become thrill-seeking degens, jumping from one Ponzi scheme to another like squirrels on espresso.

A very appropriate example is the more than 500 peripheral activities in TOKEN2049. The projects are well-funded, the marketing budget is often greater than the actual revenue (if any), and the gorgeous booths and five-star venues cover up the reality of extremely low user adoption. VCs that once invested in projects as long as there was a white paper have now suspended their investments. The good news is that only serious projects can get funding now. The bad news is that it took the industry so long to get here.

What we see is 100+ L1/L2s competing for the attention of the same crypto audience, which undoubtedly reduces engagement and meaningful conversations. From Ethereum to the Solana meme to Base, the industry is like Icarus, flying dangerously close to the sun. These narratives work well in the short term, but where is the long-term vision? Where is the mass adoption we are promised? Jumping from one narrative to another, from one chain to another, is not the way of the industry.

After years of jumping from ICO hype to DeFi liquidity mining craze, from NFT mania to GameFi distribution Ponzi scheme, then PoS staking, re-staking and now Bitcoin staking (seriously?), what is the next so-called "narrative"? The people I chatted with were very worried about the direction of the industry. A lot of things are happening, but there is little to show for it.

VCs are frustrated that they did not expect the explosion of memecoin and they cannot touch this track with regulated funds. Project founders are also complaining that VCs no longer provide nutrients for every weed in the garden, but hope that one will grow into a rose. Degens are tired of chasing various narratives, and former DeFi veterans are disappointed that the so-called airdrops and points did not make them rich (Grass, EigenLayer, Blast, etc.). Only investors who focus on the trading (CEX, DEX, perps), gambling (Rollbit, Shuffle, Polymarket, memecoins) tracks and the infrastructure that supports it all are satisfied. And the sponsors, large exhibition stands and multi-million marketing budgets of F1 events are proof of this.

Meanwhile, artificial intelligence and various technology stocks are grabbing investors' attention. For example, Nvidia offers returns similar to cryptocurrencies, but in fact, better returns, less risk and stricter regulation. Smart TradFi funds are getting returns from stocks with less risk. If you can just buy options on MSTR or COIN to get risk exposure, why bother studying cryptocurrencies?

Fortunately, the industry is not completely shrouded in haze, and there is still light at the end of the tunnel. Some outstanding projects are getting funded and real use cases with real revenue potential are starting to emerge. Fortunately, VCs are becoming more selective and Sony and various global banks and financial companies are starting to get involved. Just let’s be clear, this is not yet the mass adoption we were promised.

So where is the opportunity? I will explore this question below, but I believe the answer is always in the eyes of token holders. There are currently two types of games emerging in the cryptocurrency industry.

One is the short-term narrative-driven game, which emphasizes quick in and out. There is nothing wrong with this, but it is mostly played by degens, short-term project founders and KOLs who want to get rich quickly.

The other is the long-term large VC game, which is mainly played by top developers and founders backed by large VCs, who hope to get huge returns from listings and potential future infrastructure.

Overall, while these events are a bit like parades on a rainy day, there are a few founders, projects, and VCs that may surprise us in the next few years. I have been in this industry for 11 years and will continue to do so, but I want to be clear that if Bitcoin reaches $100,000, the industry will return to Ponzi scheme status very quickly, faster than the project parties can casually tout "decentralization". At that time, no one will care about the fundamentals until the market rings the alarm bell.

Industry People

Industry Passengers (65%)

These people are like energetic puppies, chasing every opportunity to get rich quickly. They hope to catch the next Bonk, WIF or Poppet and quickly get out with their winnings. This group of people includes:

Hopeful speculators: They believe in getting rich overnight and will switch from one memecoin to another in a short period of time, just like children at a carnival, tempted by all kinds of candy.

Freebie lovers: The main purpose of this group of people is to grab all kinds of "wools", such as free gifts provided by various event booths, free drinks and snacks, etc.

Short-sighted investors: They only care about the immediate interests and often ignore the overall situation and the complex game behind the scenes.

Short-term project builders: This type of builder will try to start their own projects, which are usually funded by VCs with similar short-sightedness.

Self-proclaimed "smart" developers and VCs (25%)

This group of people regard themselves as industry elites, aiming to emulate people like Vitalik, Anatoly or Raj, while selling their dreams to VCs. Their strategies include:

Funding first: They will prioritize securing funding for the next 2-3 years and make careful plans to create topics through cooperation with KOLs and flashy announcements.

Token hedging: They usually sell a large reserve of tokens to fund more business and hedge when the token is listed, planning to gradually sell the tokens after cashing out to drive the price down.

Scapegoats: If a bear market comes, VCs and retail investors become the “scapegoats” while these founders enjoy generous salaries and travel the world in business class.

Long-term vision: They will pretend to be advocates of change, and their true intentions will only be revealed after the token is launched. Think of Blast and Friend.tech, where the founders of such projects will soon plan the next Ponzi scheme. There are countless examples like this.

True Builders (10%)

The last group is the true visionaries who are committed to building the "future of finance". These people have the following qualities:

Intelligence: These people are not just selling dreams, but are focused on creating careers that can bring income and real value.

Persistence: Although they may have difficulty gaining attention at first, they always remain steadfast and refuse to launch tokens just to exit liquidity.

Long-term commitment: They take a long-term view, are grounded in reality, dare to speak out, and advocate for the sustainable development of the industry.

In short, these three groups show the life of the cryptocurrency field, from impulsive degens to savvy conspirators, and finally the builders who may really lead us to a brighter future.

L1/L2 and Infrastructure

Ethereum Identity Crisis: Ethereum is currently going through an identity crisis, which we can think of as a "mid-life crisis" where Ethereum is trying to buy a sports car when everyone else is choosing a tram. With most of the attention (and development) focused on Solana and the selected EVM L2, many users are looking at Ethereum strangely. At the end of the day, price is more important than block size. I keep asking myself, are Ethereum's thought leaders too comfortable in their mansions to engage with the grassroots developer community? Why can't we learn about Solana? Is Vitalik really the savior?

Solana, the clear leader: In my opinion, Solana strutted down the red carpet like it had just won Best in Show. The buzz around the Solana ecosystem was even more intense after the Breakpoint event. Not only do they walk the talk, but they also deliver products at an extremely fast pace, such as Firedancer. Also, the Solana community is very organized compared to the chaos at the ETHGlobal event. Solana's focus on a single chain and a unified community gives them a head start. Focus is key, folks!

TON: TADA, a ride-hailing service that uses TON for payments, shined at Token 2049. Many attendees were using the service and sharing TON and TADA referral codes. I am bullish on TON, with 800M users inside and the potential for true mass adoption, TON is poised to be the next serious contender for L1.

VCs Are Looking for the Next SOL Killer: VC money is flowing to the next potential Ethereum or Solana killer. If you can find a project that will give you a 1000x return in the next few years, backing it is as attractive as finding a golden ticket in a chocolate bar. There are more than 10 L1 projects with almost no activity, but their FDV transactions are between $1 billion and $10 billion. This is a huge return for any VC.

Gen Z’s L1s are trending: Projects like Monad and Berachain are the latest hot topics, with Sui and Base also on the radar. In contrast, established L1s like Aptos, Sei, and TIA (L1s for millennials) are losing steam, while baby boomer L1s like Polygon, Algorand, and Cosmos are fading from the spotlight even faster. Sure, we occasionally see price spikes driven by market makers and new narratives, like FTM and AVAX, but these tend to be as fleeting as Snapchat stories. If there were compelling DApps like GMX, Hperliquid, Polymarket, or Friend.tech on these chains, investors might reconsider.

Application Chains: We are witnessing a trend towards specific application chains, such as Solana for meme/payment/transactions, Ronin for GameFi, and Arbitrum for DeFi. This trend, combined with chain abstraction and cross-chain solutions, is improving the user experience and making interactions smoother.

Trend towards B2B infrastructure and service providers: Some OG Chains are providing CDK, SDK, Rollup services. While this strategy may keep the token relevant to the market, it feels like a short-term stopgap measure that works for the founding team to live a yacht life, but the effect is not sustainable for the overall ecosystem.

Simply put, while Ethereum struggles with an identity crisis like a teenager struggling with his hair, Solana is moving forward, fostering innovation and community engagement. It will be fascinating to see which projects truly stand the test of time as this path continues.

Projects and Founders

The harsh reality of cryptocurrency fundraising: The reality is that most projects face a slow and painful death in the wilderness. The glory days of the past when projects could just create a PowerPoint presentation as dazzling as a disco are gone. Fundraising today is like selling ice cubes to an Eskimo, so good luck!

The Never-Ending Hamster Wheel: Funded projects are not much better. They are stuck in a hamster wheel, constantly burning through money. Once money dries up, they have to raise more cash or launch a token. If the token takes off, they may survive for another two or three years; if not, they have to start all over again. Without new users or real revenue, the path to profitability is as murky as a road in the fog.

The Rise of the New Projects: Old projects are like toys that were once popular, but now no one cares about them. Why invest in old projects when new projects like Berachain and Monad are offering grants to attract investment? It may not be the best wine, but it is old wine all the same.

Ponzi Schemes 2.0: Ponzi schemes in the industry keep popping up like weeds after rain. This reminds me of the Celsius and BlockFi era, when lending got out of control and led to a spectacular crash. Now, we are seeing a similar cycle of staking, re-staking, and so-called "staking shared profits". This time, the scale is 10x larger, but how will it end? I think you and I can guess!

The Dilemma of Technical Founders: Most technical founders seem to be completely unaware that cryptocurrency is a completely different "beast". They often don't realize that token economics, product-market fit, community building, and all these buzzwords are the key to success. To succeed, you need not only a good product, but also a large network and luck. If you don’t join the right VC gang or “KOL mafia”, then you’re on your own.

In short, cryptocurrency is a game of strategy, and if you want to play, you’d better know the rules, otherwise you may become another cautionary tale of this wild west.

“They are playing a game. They are playing a game of not playing a game. If I say they are playing a game, I’m breaking the rules and they’ll punish me. I have to play their game and ignore the game I see”--R.D. Laing, British psychologist

Venture Capital Funds

A tough year for VCs: navigating the cryptocurrency “swamp”. VCs either get in too early and see their investment wiped out, or find out that the tokens won’t unlock for another 12-18 months. In the crypto era, this is like waiting for a snail to finish a marathon!

The Smart Few: However, there are a few VCs who are as cunning as chess masters. They help the tokens go public at a high fully diluted valuation (FDV), hedge their risk exposure, and then wait for the tokens to hit bottom and buy them back at a low price. It’s like buying a high-end suit after a fashion show, they know when to hold and when to throw it away!

The Race for Revenue: Most VCs realize that there are projects that can generate real revenue, such as Friend Tech, Pump Fun, and Polymarket. The challenge is to choose the one that is likely to win among the many competitors. Remember, there are over 100 alternatives to Pump Fun alone!

LP interest is starting to pick up, but still waiting for dramatic developments. I’ve been talking to wealth managers and family offices in Asia. Following the emergence of cryptocurrency ETFs, these LPs have become more interested in investing in the cryptocurrency industry, but are still waiting for trusted parties to handle their funds. From time to time, they receive some terrible news, or encounter hacker scams, and then are beaten back to the original.

In short, although the outlook is bumpy and full of challenges, those who have firm beliefs may find a way to success in the chaos of cryptocurrency.

Narrative

The most frequently asked question by investors is, what do you think the next narrative is? Everyone wants to build or invest in the next narrative.

Artificial intelligence projects are the most eye-catching. It seems that every builder in the industry is developing a decentralized computing network. Just like everyone is developing L1/L2 with higher TPS. I am very optimistic about the combination of artificial intelligence and cryptocurrency, and I look forward to communicating with founders in this field.

Asia is leading the crypto space, with as many developers, founders, and VCs as the West. Regulation in Singapore and Hong Kong is clearer than in the West, and Asia’s population is younger and hungrier, leading to higher adoption of cryptocurrencies.

The return of the perpetual product narrative. After GMX, no one likes any perpetual DEX except HyperLiquid. Everyone is waiting for the launch of the HyperLiquid token, with some claiming that the FDV at the time of listing could reach $100 billion. This could set the tone for other innovative perpetual exchanges to launch and perform well.

RWA becomes another focus. Currently, Helium and Solana seem to be leading the race. Helium, with its extended home Wifi signal, is currently working with phone companies to allow their signals to be shared to Helium’s coverage area. Currently, Helium has more than 750,000 users.

The memecoin craze that can’t be killed. Memecoin has been mediocre recently, but it’s here to stay. In my opinion, every dip in major memecoins like WIF, POPCAT, BONK, PEPE, MEW, GIGA, SUN, MOTHER, etc. is a buying opportunity.

Chain abstraction is another exciting infrastructure. But at Token 2049, there are too many players and too many booths in this track. I don't see a clear winner yet, but the use case is clear to me, which is users transacting on multiple chains without chain agnosticism.

Slowing progress of the Bitcoin ecosystem. While there is still a lot of activity around the Bitcoin ecosystem, it is not as popular as it was last year. The entire ecosystem is still messy and far away from real use cases and good user experience.

Too many on-chain derivatives, resulting in a fragmented DeFi ecosystem and increasing risks. I don't have high hopes for the whole staking/re-staking mechanism, but I will keep an open mind if I see something interesting.

Brian

Brian

Brian

Brian Alex

Alex Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian Brian

Brian