Author: Stratus Crypto; Translation: xiaozou@金财经

With the SEC (U.S. Securities and Exchange Commission) deadline of January 10, 2023 not far away to rule on Ark21’s ETF application, fund issuers are scrambling to modify their S- 1 document to identify fees and authorized participants.

Most people in the cryptocurrency field believe that the SEC will approve all 13 applications to avoid a situation where one company is the only one.

p>

After the ETF is approved, it is expected that Bitcoin’s marketing war is about to begin as ETF issuers compete for market share.

On Christmas morning in 2023, John Reed Stark, the SEC’s former head of Internet enforcement, posted on Twitter, “According to my 20 years at the SEC "Based on our experience, it seems likely that the SEC will approve several Bitcoin spot ETFs," following a series of recent meeting negotiations between applicants and the SEC. Just a few weeks ago, he commented that a 90% chance of passing was "absolute nonsense."

If the ETF is approved, only time will tell whether $1 billion to $2.4 billion will flow into the ETF as expected.

1. How does BitcoinETF work?

ETFs (exchange-traded funds) hold a "basket" of assets such as stocks, bonds, commodities and, soon, Bitcoin.

As early as 2013, the Winklevoss Bitcoin Trust submitted the first Bitcoin ETF application, but over the years, the application was rejected along with Dozens of other applications.

The SEC is "revisiting" the Bitcoin ETF after an August 2023 ruling said the SEC's rejection of Grayscale's initial application was unfair.

Without exception, more than a dozen applications submitted proposed the establishment of a grantor trust (Grantor Trust), and Bitcoin would be managed by Coinbase and others. Custodian storage is similar to gold and other physical assets corresponding to gold ETFs being stored in a vault. The trust will issue shares representing a "beneficial interest" in the asset (Bitcoin BTC) protected by the custodian.

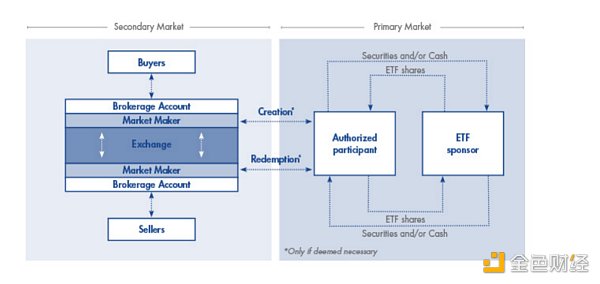

According to the contract, authorized participants are the only ones who can interact directly with the ETF issuer when creating and redeeming shares through a "create and redeem" process one party.

For example...

Retail investors (just like you and me) use our brokerage The account places a purchase order to purchase a specified amount of a specific BitcoinETF (IBIT, HODL) on the secondary market through the listed exchange (NASDAQ). Brokers (JP Morgan, Robinhood) will place redemption orders in the primary market to authorized participants (APs, also known as institutional investors or market makers, such as Jane Street, Wintermute, BlueSky, etc.), and these participants are "Approval" (authorization and contracting) of trading a predetermined asset (Bitcoin physical delivery) or "cash flow creation" (cash delivery) in exchange for a certain amount ofETFdirectly from the issuer (Blackrock, Ark21, Grayscale) strong>Stocks.

2How do authorized participants make money?

Authorized Participant (AP) is a market maker approved by the ETF issuer (BlackRock, Ark21, etc.). During the investment process The role in is to create and redeem shares ofETFs.

There are two ways for AP to make money: one is for market makers to sell products to brokers (JaneStreet), and the other is to sell to representatives Broker for retail clients (Morgan Stanley).

AP can execute trades (even after market close), create/redeemETF through buy and sell orders shares to close the trading spread between the ETF price and the net asset value (NAV), as well as provide liquidity in the market.

Since AP creates and redeems shares, the number of ETF shares available to the public is uncertain.

APMonitor the exchanges where you and I buy ETF stocks, AP Deploy an arbitrage strategy to buy (create) or sell (redempt) shares ofETFissuer/providers.

(1) If BitcoinETFTrades at a Premium

If the market price (MP) is higher than the net asset value (NAV), then the AP can purchase new shares from the ETF issuer in the primary market (at a discount). Typically, APs will short-sell ETF shares and buy Bitcoin (BTC) from the exchange. The AP will execute"create"transactions with the ETF issuer to purchase newly "created" shares at a lower net asset value. These lower-priced (newly created) shares are effectively a cover when they are sold to you and me on the secondary market. The supply shock from new shares typically causes the ETF share price to fall closer to the ETF's NAV, thereby creating profitable short trading/arbitrage space for AP.

The two most common delivery methods between AP and ETF issuers are:

· Physical delivery: AP purchases Bitcoin (BTC), or uses the BTC it holds to trade the underlying asset (BTC) with the ETF issuer to create new shares. There is no capital gains tax on stock transactions because no cash is involved in the transaction.

·Cash delivery: AP sells BTC/other assets for cash, or uses cash on hand to trade with ETF issuers to create new shares. Capital gains tax is levied when buying or selling assets or shares using a cash settlement.

(2) If BitcoinETF trades at a discount

If the market price (MP) is lower than the net asset value, AP can purchase ETF shares in the secondary market, and then conduct stock transactions with the ETF issuer in the primary market in exchange for the underlying assets of the ETF ( Bitcoin), this process is called redemption.

As the supply of shares on the secondary market decreases due to redemptions, the discount will become smaller and the stock price trend will be more in line with its net asset value.

· Physical delivery: When the AP redeems "physical objects" (ETF shares for Bitcoin), the ETF issuer does not need to pay capital gains tax because There is no sale involved (but rather an exchange). This cost savings can help retail investors keep fee costs low because ETF issuers realize low costs, which are then passed on to retail investors.

· Cash delivery: When an AP redeems shares for cash, the AP's cash exchange typically requires a transaction fee to offset the ETF issuer's The cost of liquidating assets (BTC) in the portfolio. Since redemptions will lead to a reduction in the supply of shares on the secondary market, the discount will be correspondingly smaller and the stock price will move closer to the net asset value.

p>

The following are two more specific examples that illustrate the role of AP in ETF investment.

Example 1: BitcoinETF stock creation (investment ETF):

Retail investors want to invest (buy) $10,000 worth of a specific Bitcoin ETF, such as IBIT. If the spot price of BTC:USD is $40,000 and the Bitcoin ETF IBIT is trading at $40,010 on the market, AP receives an order from the investor’s broker to trade (buy) the ETF at its fair value ($40,010) $10,000 worth of IBIT. IBIT is trading at a $10 premium to its NAV, so the profit for AP is $2.50, because given that Bitcoin in our example (the underlying asset) is trading at $40,000 (BTC:USD), while $10,000 is equivalent to 0.25 Bitcoins.

AP's profit is not the entire $10 difference between ETF spot and BTC spot, but (0.25 x $10) = $2.50.

Example 2: BitcoinETF stock redemption (ETF liquidation):

When the ETF is trading at $39,990 and the ETF's NAV is $40,000 (the spot price is BTC:USD $40,000), a retail investor wants to sell his $10,000 position.

In this example, the ETF is trading at a discount. The AP (market maker) will open a trade to simultaneously buy $10,000 worth of Bitcoin ETF shares (IBIT) and sell $10,000 worth of BTC (0.025 BTC) on the exchange where BTC:USD is trading at $40,000, netting Earn $2.50 (0.025 x $10 = $2.50).

These numbers may not sound like much, but you have to consider the volume of transactions. APs are the middlemen between brokers and ETF issuers, just as brokers are the middlemen between retail investors (you and me) and APs.

· ETF issuers profit from the fees paid by APs, which are passed through the chain to brokers and ultimately to retail investors like you and me investor.

· AP makes profits through arbitrage and charging fees to brokers.

· Brokers make money by charging fees or commissions, if the AP has to charge $7 in fees/commissions to make a trade, then a $1,000 trade is only Can purchase $993 worth of ETFs.

3, cash delivery and physical delivery

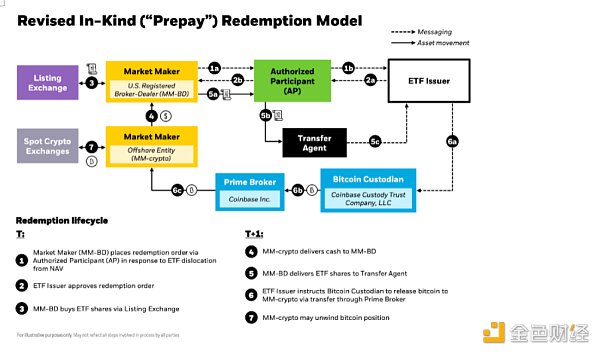

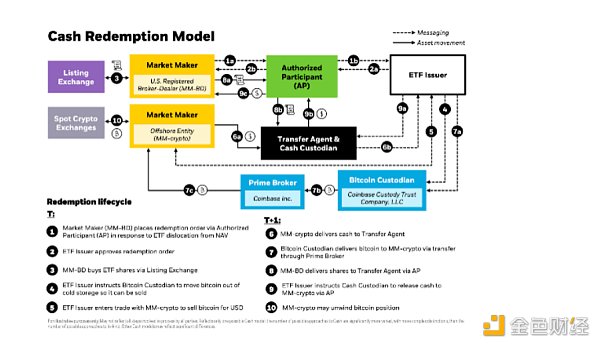

Physical redemption This is standard procedure for ETFs. The SEC (U.S. Securities and Exchange Commission) favors cash delivery of Bitcoin ETFs, which to a certain extent has caused issuers such as Ark21 and Black Rock to flock to them.

Black Rock recently revised its S-1 filing to prioritize cash delivery methods while retaining the option of physical delivery during the ongoing creation/redemption process. options.

AP's delivery with ETF issuers to create new shares involves two delivery methods:

· Physical delivery: AP delivers the underlying asset (Bitcoin) to the ETF issuer. Bitcoins can be purchased on the market or from AP's current Bitcoin positions. In turn, when the AP redeems shares from the ETF issuer (BlackRock, Ark21, etc.), the issuer can also pay the AP using Bitcoin. Physical delivery benefits APs with strategic Bitcoin reserves, which typically cost less than the current BTC:USD spot price.

p>

· Cash delivery ("cash flow creation"): Cash delivery, like "prepayment", adds costs (fees and taxes), and this cost The increase will be passed on to retail investors, making buying Bitcoin more attractive than buying ETFs. These costs include bid-ask spreads, operational costs involved in calculating, executing and accounting for Bitcoin market transactions. That could make smaller APs wary and tip their investment balance toward big banks with trillions of dollars on their balance sheets. The flowchart below is from a recent Blackrock document.

p>

Due to deposit restrictions, banks cannot hold Bitcoin until 2025, when Basel Committee on Banking Supervision (BCBS) guidelines may allow it. Have no more than 2% of cryptocurrency reserves.

A cash redemption requires the AP to sell its ETF shares, which would incur capital gains taxes and return the cash value to the ETF issuer, rather than giving the ETF shares tax-free Convert to Bitcoin (BTC).

The SEC’s decision to adopt cash delivery may be motivated by pressure from banks, or they do not want brokers to handle Bitcoin transactions because there is no FDIC or SIPC insurance to cover losses caused by theft or mismanagement of deposits hosted in hot or cold wallets.

4, cash flow creation and the big problem with Bitcoin

Let's assume 1 Bitcoin (BTC) = 1000 shares of ETF. If the spot price of Bitcoin is $45,000, then the spot price for a retail investor buying 1 share of the ETF (listed on Nasdaq) will be $45 per share.

When an Authorized Participant (AP) wants to purchase (create) new shares of an ETF to fulfill a trading order, cash flow creation requires the issuer to obtain funds from the Authorized Participant (AP) ) where cash is accepted. Please note that AP is a broker-dealer that executes trades on behalf of retail investors (you and me) at Broker-Dealer (BD), and neither the SEC nor FINRA approve these brokers to trade spot Bitcoin assets.

In the cash flow creation model, the issuer will maintain a real-time price quote of theAPs that need to be paid to create 1,000 shares of the ETF. TheAP then enters into a transaction with the issuer to create 1,000 new shares at the issuer's quoted price.

There is a time delay between receiving cash and trading Bitcoin, which will result in a corresponding price difference. The longer the delay, the greater the risk to publishers.

If the price of Bitcoin increases during this delay, the issuer will have to spend more than it receives fromAP money to buy Bitcoin. The issuer's negative cash balance directly reduces the fund's net asset value, thereby reducing performance, and investors may choose ETFs based on performance.

If issuers are able to purchase Bitcoin at a lower price than they receive from the AP, they will have positive cash balances and a higher net asset value.

This situation will incentivize ETF (fund) issuers to bid and quote prices above the market price, creating more by maintaining neutral or positive cash balances. Good performance.

Traders at ETF issuers will be responsible for using multiple exchanges (e.g.: Coinbase, Kraken) and/or market makers (e.g.: Jane Street, Wintermute ) buy Bitcoin at the lowest possible average price to lower its expense ratio.

Different ETFs may use different trading strategies and liquidity sources, thus affecting ETF prices and fees.

For example: ARK21 is waiving fees of 0.25% on the first $1 billion of inflows for six months. BlackRock is offering a 0.2% fee discount for six months on the first $5 billion of new capital.

Retail investors will be watching this closely, and issuers that trade more efficiently may end up being the big winners.

5, Several questions about BitcoinETF

ETF issuers may have been accumulating Bitcoin over the past few months in anticipation of physical delivery. Coincidence or not, ArkInvest has been closing positions recently, possibly in preparation for cash delivery. Blackrock committed $10 million to its Ishares Bitcoin Trust on January 3, 2024.

If the Bitcoin ETF application (S-1 &19b-4) is rejected again, we may see lengthy court proceedings. Equally concerning, Blackrock warned: “Any enforcement action by the SEC or state securities regulators claiming that Bitcoin is a security, or a court ruling to that effect, is expected to have an impact on Bitcoin’s trading value and (spot) Bitcoin ETF) stock has a direct and material adverse impact." (Remember Ripple?)

Friday, December 29, 2023 is the date the SEC will accept filings for revisions Deadline for first round of decision considerations. BlackRock elaborated on the issue of cash vs. in-kind redemptions in its recent revision.

I predict that if a (only) cash redemption model is required, we will at least need more information on why the SEC prefers "cash." Is it just to protect investors?

What will the tax revenue be if applicants have to unwind the Bitcoin they have been quietly accumulating for years at very low cost? Are those “unidentified” whales still absorbing liquidity now?

Will traders "sell the news," or are ETFs already priced into a bull market that ends in 2023?

What proportion of assets will financial advisors allocate to Bitcoin through ETFs?

Will ETF leadership reduce volatility over time?

Is it cheaper to hold Bitcoin in an ETF or on an exchange?

When will there be the first sovereign wealth fund to hold large amounts of Bitcoin through ETFs?

(1) Can I short BitcoinETF?

Shorting a Bitcoin ETF is different from an inverse Bitcoin ETF. Depending on your investment decision, you can open a long or short position in your brokerage account. The price of the Bitcoin Spot ETF will be closely related to the Bitcoin spot price because APs can create and redeem shares through the ETF issuer. If you think the price of Bitcoin (BTC) will fall, you can open a short position on the ETF stock in your brokerage account. If the price of Bitcoin increases, the price of the ETF shares will also increase, resulting in a loss on the trade. One way to hedge is that if you hold Bitcoin (BTC) in a separate exchange account (or cold storage), you may be forced to sell your Bitcoin to cover losses.

(2) Should I buy Bitcoin spotETFor buy Bitcoin directly from an exchange?

There are many different opinions on whether Bitcoin ETFs are good or bad for the cryptocurrency.

We cannot predict the future or accurately time the market, nor can I provide financial advice. Talk to a professional and do your own research.

I have even greater confidence in Coinbase after it was appointed as the custodian of the BlackRock iShare Bitcoin Trust. What BlackRock chooses must be the best.

Bitcoin still has a long way to go. Depending on personal preference, you can build a dollar-cost averaging strategy to repeatedly buy ETF shares or Bitcoin (BTC).

Personally, I would buy low with our DCA bot to ensure OTC transactions are minimized to limit the UTXO amount , especially in high-cost environments. Additionally, the number of parties required to create/redeem ETF shares appears to be much more complex than storing Bitcoin in a cold wallet or even an exchange.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance