Chinese Billionaire's Alleged Fraud Scheme Unravels

Chinese billionaire Ho Wan Kwok faces RICO charges, with his cryptocurrency venture embroiled in a multimillion-dollar fraud and money laundering scandal.

Edmund

Edmund

Source: Lawyer Liu Honglin

Recently, Member Wu Jiezhuang proposed to strengthen resource support for Web3.0 technology research and development, strengthen technical supervision and management, encourage international cooperation, and strengthen Respond to suggestions for publicity and promotion. The Ministry of Industry and Information Technology stated that it will strengthen collaborative interaction with relevant departments to promote Web3.0 technological innovation and high-quality industrial development.

For specific interpretation, please click :Lawyer interpretation! How does the Ministry of Industry and Information Technology formulate a Web 3.0 development strategy that is in line with national conditions?

As soon as the news came out, the circle was shocked and people were shouting: "The favorable policies for blockchain are coming." While celebrating, we might as well take a look at the red lines that cannot be crossed when starting a business in China's Web 3.0 field, and what policies are available to help entrepreneurs flourish.

District Blockchain technology is only 14 years old, and its development has been full of twists and turns, not only in China, but also around the world. Since its birth, China's supervision of blockchain has always been making positive progress, which is organized as follows according to the effective date:

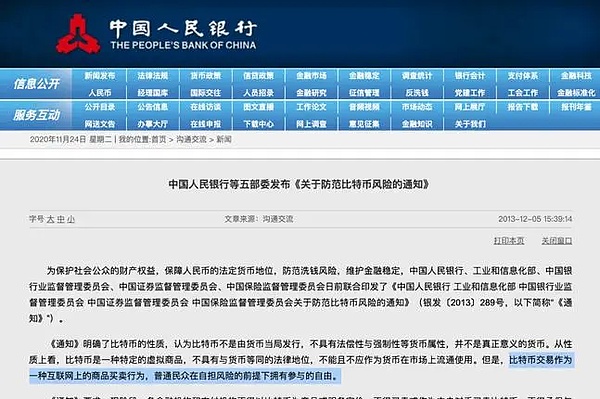

Background: "Bitcoin" has attracted widespread attention internationally, and some domestic institutions and individuals have taken the opportunity to speculate on Bitcoin and Bitcoin-related products. In order to protect the property rights and interests of the public, ensure the legal currency status of RMB, prevent money laundering risks, and maintain financial stability.

Issuing unit: People's Bank of China, Ministry of Industry and Information Technology, China Securities Regulatory Commission, etc.

Main content:

(1) Bitcoin is a virtual commodity, not a currency.

It does not have the same legal status as currency and cannot be used as currency in the market.

(2) Financial institutions and payment institutions are not allowed to carry out Bitcoin-related businesses.

You are not allowed to buy or sell Bitcoin or act as a central counterparty to buy or sell Bitcoin, you are not allowed to underwrite Bitcoin-related insurance business or include Bitcoin in the insurance coverage, and you are not allowed to directly or indirectly provide customers with other Bitcoin-related products. Related services include: providing customers with Bitcoin registration, trading, clearing, settlement and other services; accepting Bitcoin or using Bitcoin as a payment and settlement tool; carrying out exchange services between Bitcoin and RMB and foreign currencies; carrying out Bitcoin storage, Custody, mortgage and other businesses; issuing financial products related to Bitcoin; using Bitcoin as an investment target for trusts, funds and other investments.

(3) Illegal Bitcoin Internet websites will be closed down.

Introduction background: domestic token issuance A large number of financing activities have emerged in the form of initial coin offerings (ICOs), and speculation has become prevalent, seriously disrupting the economic and financial order.

Issuing unit: People's Bank of China, Ministry of Industry and Information Technology, China Securities Regulatory Commission

Main content: < /p>

(1) Token issuance financing is prohibited.

Token issuance financing refers to financing entities raising so-called "virtual currencies" such as Bitcoin and Ethereum from investors through the illegal sale and circulation of tokens. It is essentially an unfinished business. Approved illegal public financing activities are suspected of illegal sales of tokens, illegal issuance of securities, illegal fund-raising, financial fraud, pyramid schemes and other illegal and criminal activities.

(2) Virtual currency exchange business is prohibited.

Any so-called token financing trading platform shall not engage in the exchange business between legal currency, tokens, and "virtual currencies", and shall not buy or sell tokens or "virtual currencies" as a central counterparty. It is not allowed to provide pricing, information intermediary and other services for tokens or "virtual currencies".

(3) Financial institutions and non-bank payment institutions are not allowed to carry out business related to token issuance financing transactions.

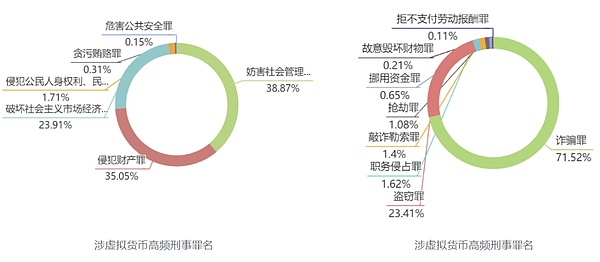

Background of the introduction: Speculation activities in virtual currency transactions are on the rise, disrupting economic and financial order, breeding illegal and criminal activities such as gambling, illegal fund-raising, fraud, pyramid schemes, and money laundering, and seriously endangering the property safety of the people.

Issuing unit: People's Bank of China, Office of the Central Cybersecurity and Information Technology Commission of the Communist Party of China, Supreme People's Court, Supreme People's Procuratorate, Ministry of Industry and Information Technology, Ministry of Public Security, National Market State Administration of Supervision, China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, State Administration of Foreign Exchange

Main content:

(1) Virtual currency cannot be used as currency in the market.

(2) Virtual currency-related business activities are illegal financial activities. Carry out legal currency and virtual currency exchange business, exchange business between virtual currencies, act as a central counterparty to buy and sell virtual currencies, provide information intermediary and pricing services for virtual currency transactions, token issuance financing, virtual currency derivatives transactions and other virtual currency related Business activities involving illegal sales of tokens, unauthorized public issuance of securities, illegal futures business, illegal fund-raising and other illegal financial activities are strictly prohibited.

(3) Domestic staff who provide services for overseas virtual currency exchanges must bear legal responsibility. It is also an illegal financial activity for overseas virtual currency exchanges to provide services to residents in my country through the Internet. Domestic staff of relevant overseas virtual currency exchanges, as well as legal persons, unincorporated organizations and natural persons who know or should know that they are engaged in virtual currency-related businesses and still provide marketing publicity, payment and settlement, technical support and other services to them shall be investigated in accordance with the law. responsibility.

Background: Virtual currency “mining” activities (referring to Dedicated "mining machines" calculate the process of producing virtual currency), which consumes a lot of energy and carbon emissions and contributes little to the national economy. In addition, the risks derived from the production and transaction of virtual currency are becoming more and more prominent. Its blind and disorderly development has a high impact on promoting the economy and society. quality development and energy conservation and emission reduction.

Issuing unit: National Development and Reform Commission, Central Propaganda Department, Central Cyberspace Administration of China, Ministry of Industry and Information Technology, Ministry of Public Security, Ministry of Finance, People's Bank of China, State Administration of Taxation, Market State Administration of Supervision, China Banking and Insurance Regulatory Commission, National Energy Administration

Main contents:

(1) It is strictly prohibited to add new virtual currencies” Mining” projects and accelerate the orderly exit of existing projects.

(2) Supervise the entire upstream and downstream industry chain of virtual currency “mining” activities, and strengthen the investigation and rectification of virtual currency “mining” activities.

(3) Investigate and punish illegal power supply activities in accordance with the law, implement differential electricity prices, and do not allow virtual currency “mining” projects to participate in the electricity market.

(4) Stop all fiscal and tax support for virtual currency "mining" projects, stop providing financial services to virtual currency "mining" projects, and phase them out within a time limit in accordance with the "Industrial Structural Adjustment Guidance Catalog".

InvolvedVirtual Currency casesoften become a mysteryduring the trial process in courts across China. Sometimes the contract is valid (Shanghai Qingpu Court Chain Game Misappropriation Case), sometimes the contract is invalid (Beijing Chaoyang Court Bitcoin Mining Case), sometimes the court supports the return of virtual currency (Shanghai Baoshan Court Virtual Currency Lending Case), some The court does not support the return of virtual currency (Shenzhen Court Mining Machine Investment Return Case).

Original text:

Financial trial work of courts across the country The meeting held that the trading and speculation activities of virtual currencies such as Bitcoin, Ethereum, Tether, etc. have seriously disrupted the economic and financial order and seriously endangered the property security of the people. In order to prevent and control the risks of speculation in virtual currency transactions, relevant departments of the State Council have successively issued a series of policies and measures to clarify that virtual currencies do not have the status of legal tender, prohibit the development and participation in virtual currency-related businesses, and clean up and ban domestic virtual currency transactions and token issuance financing platforms. When hearing dispute cases related to virtual currency, the people's courts should carefully study the adjustments of national financial supervision and industrial regulation and other public policies in different periods, and accurately determine the parties' implementation of the law in accordance with the provisions of Article 153, paragraph 2, of the Civil Code. The effectiveness of legal actions related to virtual currency.

Lawyer’s interpretation:

Political correctness is the first step. In response to the policy call, the court unified its thinking and once again reiterated China's "social influence" on virtual currencies: seriously disrupting the economic and financial order + endangering the safety of the people.

Three negative lists of virtual currencies in China: (1) Virtual currencies cannot be used as money; (2) Virtual currency transactions cannot be carried out in China Business of the firm (it is not allowed to operate in China or for Chinese citizens); (3) ICO, IEO and other public-facing token financing are not allowed in China

Case on virtual currency The trial cannot be lazy or one-size-fits-all with the benefit of hindsight. It is necessary to follow the regulatory policies of different periods to determine the legal effect of the relevant actions in the case. For friends in the currency circle, this can be said to be justice. After all, the behavior before the policy is issued, based on the principle of freedom + your own will, should naturally be legal and valid, and be protected by the law.

Original text:

Virtual currency has some attributes of online virtual property. If the parties agree to use a small amount of virtual currency to offset debts arising from basic relationships such as trade and labor services, if there are no other invalid reasons, the people's court shall determine that the contract is valid. If a party requests the other party to perform its obligation to deliver virtual currency, the people's court may support it; if it is unable to actually perform due to relevant policy restrictions and other reasons, the scope of compensation losses may be determined based on the actual value of the corresponding property accepted by the party paying the virtual currency when the contract was signed. If a party uses virtual currency as a regular payment tool to exchange for legal currency or physical commodities under the guise of a basic transaction contract, the people's court shall determine that the contract is invalid.

Lawyer’s interpretation:

Although virtual currency cannot be used as money, after all, it can Have a certain property value. Folks have always had the habit of using things to offset debts when they owe money and have no money. This also applies to virtual currencies. Therefore, if both parties have an obligation to pay remuneration or give money due to other legal matters, but do not have the money to pay, then the two parties agree to use virtual currency to offset the account, which is legal and valid.

Give an example to understand the application scenario of this regulation: nominally to help employees save taxes, but actually to help project owners save social security Provident fund and other expenses. Many blockchain companies pay their employees' wages by issuing USDT (or even their own project Tokens). If an employee has a conflict with the company and goes to court, the court will say that although your physical job is very hard, you still need to pay. Because workers are not protected by law because they violate policies, they would definitely not be happy to beat them up. Therefore: For workers in the currency circle, you still have to sign the labor contract that needs to be signed, and you can boldly ask for the wages that need to be demanded.

What if the court wants to order the payment of virtual currency, but the other party does not have the virtual currency? The court can use the value obtained by "when the contract is signed" and "the beneficiary party" for conversion. To facilitate everyone's understanding, we will also take salary payment as an example: a project party and its employees have agreed that the monthly salary is USDT equivalent to 100,000 RMB. If the company is unwilling/unable to give USDT to employees later, then the company should give 100,000 RMB to the employees.

Original text:

The parties agree in the contract that the client registers an account on the virtual currency trading platform in his own name and entrusts the trustee to engage in investment activities; or the client directly delivers the funds to Trustee: If the trustee engages in investment management in his own name or actually borrows the name of another person, the two parties may be deemed to have established an entrusted investment contract. If the contract was signed after the announcement of the "Announcement on Preventing Token Issuance Financing Risks" (September 4, 2017), the People's Court should determine that the entrustment contract is invalid because the agency matter is illegal. For the loss suffered by the client, the cause of the entrusted matter can be used as the main consideration in determining the degree of fault, and the losses will be shared by the parties.

Lawyer’s interpretation:

Coin speculation signed before September 4, 2017 The agreement is valid.

After September 4, 2017, the currency speculation agreement signed is invalid because it is necessary to prevent financial risks andto get rich through currency speculation is against public order and good customs.

If the currency speculation agreement stipulates capital guarantee commitments and minimum guarantee clauses that are relatively common in the industry (competition in crypto funds is also fierce), are they effective? ? If the other party’s level of currency speculation is poor, or there is always a technical problem and all the coins are lost, As an investor, can you let the other party pay compensation? The answer is: It depends. The court can each make certain decisions, which will be divided between the two parties.

Therefore, for currency-related investment contracts, regardless of the date of signing, if there is a loss, follow the advice of lawyer Hong Lin: treat a dead horse as a live doctor, in case the court can support it a little bit Woolen cloth? Take back a little bit.

Original text:

Virtual currency “Mining” refers to the process of producing virtual currency through calculations using dedicated “mining machines.” Judging from the trial status of the case, disputes caused by "mining" can be summarized into two types. One is that the parties purchase and lease mining machines that produce virtual currencies in order to obtain virtual currencies through mining activities. Disputes; one is a cooperation model that integrates multiple legal relationships such as the purchase and sale of mining machines, cooperation sharing or custody services. For example, both parties jointly invest in the purchase of mining machines and agree to share the shares after obtaining the virtual currency. Later, due to the failure of the seller to deliver the goods or Undivided disputes arise. "Mining" activities are gradually subject to strict control and orderly withdrawal due to their large energy consumption and carbon emissions, low contribution to the national economy, and limited role in promoting industrial development and technological progress.

When hearing cases, the people's courts should reasonably balance the rights and obligations between the parties based on the impact of public policies on contract performance in different periods. Prior to the issuance of the “Notice on Regulating Virtual Currency “Mining” Activities” (September 3, 2021), national policy did not explicitly prohibit mining activities. The people's court will not support a previous contract in which the parties agreed to buy, sell, lease, and keep "mining machines" or to provide additional services such as related operation management and technology development. During the lawsuit, the People's Court will not support a request to confirm the invalidity on the grounds that the subject matter or purpose of the contract is illegal. . If the contract cannot be performed subsequently due to the introduction of policies, and one party proposes to terminate the contract, the People's Court shall support it. After the contract is terminated, if the performance has not yet been performed, the performance shall be terminated; if the performance has been performed, the party may request restoration to the original status or take other remedial measures according to the performance situation and the nature of the contract, and has the right to request compensation for losses. For contracts after September 3, 2021, in which the parties agree to buy, sell, lease, and keep "mining machines" or provide additional services such as related operation management and technology development, the people's court should determine the contract to be invalid. During the trial of a case, if one party sues to confirm the validity of the contract and requests continued performance of the contract, and the other party claims that the contract is invalid, or if one party sues to confirm the invalidity of the contract and return the property, and the other party claims that the contract is valid, the People's Court shall explain the changes to the plaintiff. Either add a claim, or explain to the defendant that the defense should be performed simultaneously, so as to resolve the dispute in one go. If a party changes its claim or raises a defense in accordance with the explanation, the people's court shall classify it as the focus of dispute in the case and organize the party to fully present and cross-examine the evidence.

Lawyer’s interpretation:

The validity of a mining contract cannot be one size fits all, it depends< strong> "Signing time point" + "Litigation initiation time point".

The mining agreement and the agreed matters signed before September 3, 2021 are legal and valid because the country has not explicitly prohibited it. Mining agreements and agreed matters signed after September 3, 2021, the contract is invalid. Whether it is a pure mining agreement or a variety of mining machine sales + custody services.

Although the contract was signed before September 3, 2021, if one party claims to terminate the contract on September 3, 2021 due to violation of national policies or other reasons, the court should support. This regulation is good for mining investors, but not good for miners. Because if mining makes money, investors can continue to perform the contract; if mining does not make money and wants to exit, they can use this rule to terminate the contract without assuming liability for breach of contract.

< strong>Original text:

Users registered on the virtual currency trading platform to participate in virtual currency transactions before the release of the "Announcement on Preventing Token Issuance Financing Risks" (September 4, 2017). If the trading platform fails to perform the service agreement and causes losses, it shall bear liability for breach of contract to the user in accordance with the law. If the user is also at fault for the loss, the corresponding loss compensation amount can be reduced. After the release of the "Announcement on Preventing Financing Risks of Token Issuance" (September 4, 2017), users registered on the virtual currency trading platform to participate in virtual currency transactions. The failure of the trading platform or the virtual currency issuer to fulfill their liquidation obligations resulted in their If a civil lawsuit is filed with the People's Court on the grounds of loss, the People's Court shall rule not to accept the case and notify the person to apply to the relevant department for handling.

Lawyer’s interpretation:

Old leeks before September 4, 2017, If there is reason and evidence to prove that the exchange maliciously unplugged the network cable, misappropriated its own virtual assets, etc., resulting in losses, it is expected to safeguard its rights;

New Leeks after September 4, 2017 , no matter how badly you are harvested by the exchange, sorry, the court will not file a case. But I can suggest you file a criminal complaint.

For currency-related projects that have been cut off, choosing to trust the people's police is the lowest-cost and most effective way to protect rights. This is something our team has tried repeatedly in practice.

Original text: strong>

In response to a litigant’s request for the delivery or return of “virtual currencies” such as Bitcoin, the People’s Court shall ascertain the holding status of the virtual currencies, clarify whether there is the possibility of delivery or return, and stated in the document. If it is determined after trial that the property cannot be returned or delivered, the parties should be guided to make reasonable claims and encouraged to reach an agreement on property rights and interests. If it is found after trial that there is a basis for actual performance, the people's court clearly delivers or returns the virtual currency in the judgment in accordance with the petition of the parties. If the party with the obligation to deliver or return refuses to perform the obligations determined by the effective judgment, the people's court may, in accordance with the Civil Procedure Law Implement relevant procedures and take appropriate measures.

Lawyer’s interpretation:

In cases involving virtual currency projects, the judgment must be based on the judgment Check whether there are any virtual assets in the executor's wallet, and write the findings in the judgment (mediation agreement). Please like this point and no longer just judge but ignore it.

If during the investigation process, the court finds that the virtual assets in the other party's wallet are not enough, it can suggest both parties to convert them into RMB or other valuable things for execution, so as to save you from having to come to the court later. This point refers to the enforcement case of Shanghai Baoshan Court in May 2022. Shanghai is still advanced enough.

If the court finds out that the other party has sufficient virtual assets, it can directly stipulate in the judgment that the virtual assets should be returned. What should I do if the other party doesn’t give it? Can be enforced. For example, can freeze/transfer assets in accounts that have undergoneKYC on centralized virtual currency exchanges? But what should I do if it is found that the account has assets but the court does not have the private key?

Original text:

In hearing civil and commercial cases, the People's Court found that the perpetrator was suspected of illegally raising funds and illegally issuing securities in the name of token issuance financing or engaging in virtual currency financial management and other asset management activities. , illegal sales of tokens and other economic crimes involving people, criminal clues should be transferred to the investigation agency in a timely manner. Before the investigative agency makes a decision to file a case, the People's Court shall suspend the trial; after making a decision to file a case, it shall rule to dismiss the prosecution; if the investigative agency fails to file the case in a timely manner, the People's Court may report the case to the Political and Legal Committee of the Party Committee for coordination and handling when necessary. The People's Court should accept non-commercial "virtual currency" transactions or compensation behaviors based on the basic legal relationship between the parties, and civil disputes that have nothing to do with the above-mentioned economic crimes involving people.

Lawyer’s interpretation:

Everyone has a responsibility to fight crime, including the courts. . If during the trial of a civil case it is discovered that the style of painting is wrong andsuspected of a criminal offence, the case can be transferred to the police.

The above-mentioned article also made it convenient for the court to kick the ball, and the court was ecstatic. Subtext: The court does not want to take care of the case and can transfer it to the police, and I will suspend the trial; if the police file a case, I will withdraw the case; if the police do not file a case, I will complain to the police.

In 2022, I once stated a point of view:Blockchain compliance applications are NFTs, and NFT compliance applications are digital collections.

As for the direction of China’s Web3.0 compliance entrepreneurship, we must first clarify these three questions:

How to understand it can be viewed from three aspects:

China’s view on virtual currencies in China The restrictions and denials go hand in hand with the encouragement and development of blockchain technology. This is an important prerequisite for understanding blockchain entrepreneurship in China.

Many friends’ understanding of blockchain is narrowly focused on virtual currency, and they think that China’s denial of virtual currency is a denial of blockchain. However, virtual currency is only a scene in the early stages of the development of blockchain technology.

There are many places where you can start a business related to the big concept of blockchain, and there are many application scenarios of blockchain in the business society.

(1) The thinking is incorrect. Many virtual currencies are intended to replace the central bank and have companies or machines issue currency. This is something that any central bank with a reasonable mind will not agree to. You know, money printing machines make a lot of money.

(2) There are too many liars. Scammers are the most diligent people in the world, and they are always following the latest trends in order to fish in troubled waters. Virtual currency is very convenient for capital disk or CX disk to defraud. Of course the country does not welcome this.

(3) Foreign exchange is difficult to manage. As we all know, China has a very healthy and complete foreign exchange management system. The funds that each person can cross the border every year are very limited and registered under real names. Blockchain is so convenient for transferring assets across borders. How can the country Tolerate?

The following content only represents personal opinions and does not constitute investment advice.

Strong people never complain about the environment, and opportunities always favor those who are prepared. What will the blockchain industry look like in 10 years? I have a few bold guesses, which are very irresponsible:

1. In 2023, all major industry institutions and popular fried chicken projects may fail, just like Yinghaiwei in Beijing in 1995.

2. Bitcoin will either become a regular target for alternative asset allocation and the price will slowly increase to more than 100,000 dollars, or it will completely return to zero. (Does not constitute investment advice!)

3. Stablecoins will become the first choice for cross-border trade and cross-border remittances. Mainstream social media and financial institutions will gradually launch their own stablecoin systems. , the global currency war in the Web3.0 era will continue.

4. Security tokens have matured, but the pathis not that Tokens become securities, but that securities become Tokens. Mainstream stock exchanges will choose to use blockchain as the underlying layer. With technical support, debt-type tokens corresponding to RWA are emerging in endlessly.

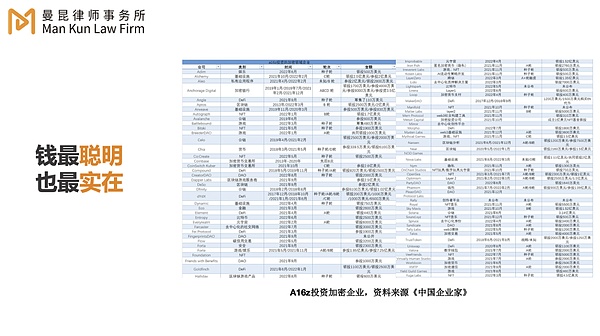

5. There will be crypto-financial centers in the East and the West launching regulatory sandboxes to allow blockchain entrepreneurial teams to issue tokens to raise funds/debts in a registration-based manner, but the amount of funds raised and investors will be affected. It is limited to compliant funds or compliant investors participating in subscriptions and transactions.

6. Functional tokens will become standard features for most Web3.0 applications, just like wallets and points in the Web2.0 era. Functional tokens do not have the function of raising funds, but are only used for user incentives and network data circulation. Cross-project and cross-chain functional token circulation will become a trend, whether it is government-led or initiated by third-party commercial institutions.

7. Online social networking, online games, and e-commerce are standard features for members of the NFT Association. They will no longer deliberately emphasize the virtual reality of NFT, and digital goods that are visible and intangible will become a daily routine. Consumer goods are extremely normal.

8. More importantly, the above conjectures can still happen in China with a high probability.

1. In the Web2.0 era, China has accumulated world-leading Internet infrastructure. Whether it is software, hardware or O2O, the upstream and downstream industrial chains of the Internet industry are very Complete, the Chinese government has obviously tasted the benefits of the Web 2.0 era, and China will definitely not give up its leading position in the world's Internet.

2. China has the best Internet product managers and operational talents in the world. Whether you say they are diligent or involuntarily involved, it is undeniable that China has the absolute largest number of outstanding Internet talents in product design and user management. The dimensions of experience, traffic acquisition, and commercial monetization are definitely far ahead in the world.

3. China has a population of 1.412 billion, and the number of mobile Internet users is 1.2 billion. Such a unified market often attracts the envy and jealousy of Internet project developers from other countries and regions, not to mention that this unified market is protected by an invisible wall.

1. Blockchain in Mainland China should be integrated with industry and use the digital economy to promote the development of the traditional industry. Blockchain is used to reduce costs, increase efficiency, and promote consumption.

2. Hong Kong, China, is becoming a financial center for virtual assets, so its weakness is exaggerated.

3. For Chinese blockchain entrepreneurs, what do you need to know about what you want to do? If you want to combine your business with the real industry, and if your customers are in mainland China, then just settle down and develop in mainland China, and don’t think about issuing coins. If you want to go overseas and do things related to virtual assets, don’t hesitate. Hong Kong’s gradually opening regulatory policies are waiting for you.

Chinese billionaire Ho Wan Kwok faces RICO charges, with his cryptocurrency venture embroiled in a multimillion-dollar fraud and money laundering scandal.

Edmund

EdmundIn 2023, there will be a transition from bull to bear. At this time, the CEX track is also facing a major reshuffle.

JinseFinance

JinseFinanceRecently, the People's Bank of China released the "China Financial Stability Report (2023)". In the chapter on other industries and emerging risks, the report points out that crypto-assets have both financial and digital technology risks.

JinseFinance

JinseFinanceU.S. authorities have brought down the “King” of the crypto world, but the “Queen” remains.

JinseFinance

JinseFinanceChina introduces strict rules for online gaming, focusing on CBDC wallets and in-game spending, causing a major dip in tech stocks.

Kikyo

KikyoA recent study by CoinGecko has shed light on the harsh reality facing Web3 games, revealing that a substantial 70% of games launched in 2023 have faced failure.

Aaron

AaronChina has unveiled new developments in their central bank digital currency project

Clement

ClementThe China Merchants Bank, in collaboration with the Civil Aviation Administration Clearing Center, has launched an e-CNY platform enabling companies and entrepreneurs to pay for business air tickets using the digital yuan.

Coinlive

Coinlive China’s Communist Party has reportedly appointed a Bitcoin (BTC) skeptic as the central bank’s party secretary, putting him in line to become the next governor.

dailyhodl

dailyhodlALSO: Here's why it's important Bitcoin hits $30,000

Coindesk

Coindesk