Niubite.com shared that Shenyu, co-founder and CEO of Cobo, predicted in the 2024 Hong Kong Web3 Carnival "Roundtable Discussion: Fifteen Years of Bitcoin":

The prediction that the price of Bitcoin will reach $1.5 million in 2030 is still conservative. Bitcoin will usher in an explosion of large-scale applications after one or two cycles, and there will be several times more space by then. The core players involved are large financial institutions.

"Institutionalization of cryptocurrency" is undoubtedly a major trend in the future. After more than ten years of development, cryptocurrency is moving from a niche marginal asset to a mainstream asset. The crypto market has gradually transitioned from only a few geeks to being dominated by financial institutions.

For example, spot Bitcoin ETFs, tokenization of financial assets, etc., also require the participation and dominance of financial institutions. Among these financial institutions, BlackRock, as the world's largest asset management giant, not only has a huge influence in traditional finance, but also has begun to make in-depth layouts in Web3. Its influence in Web3 has surpassed Grayscale and MicroStrategy, and it will become a new leader.

What are the main layouts of BlackRock in Web3?

1. Major shareholders of MicroStrategy

Everyone is familiar with MicroStrategy, that is, the US listed company that continues to buy Bitcoin. In fact, the company's main business is business analysis software.

In 2020, the board of directors unanimously agreed to include Bitcoin in the company's main reserve assets. Since then, MicroStrategy has increased its holdings many times, and has boldly bought in several times when the price fell below the cost price.

MicroStrategy's "fool-like" buying of Bitcoin is considered unwise or even stupid by many investment "gods".

But few people know that it is this silly buying strategy that makes MicroStrategy earn a lot of money.

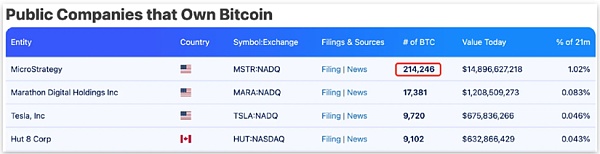

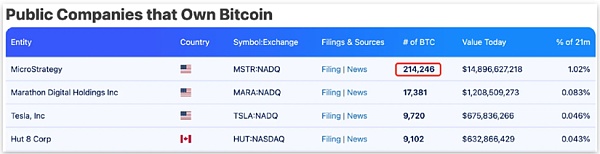

MicroStrategy holds more than 210,000 bitcoins, with an average cost of $35,160 per bitcoin. Based on the market price of bitcoin on April 10, MicroStrategy has made a floating profit of $7.2 billion.

MicroStrategy's continuous buying strategy not only made a lot of money on its bitcoin holdings, but also drove up stock prices, which can be said to be killing two birds with one stone.

It is worth mentioning that MicroStrategy's main business revenue performance is getting worse, but its bitcoin holdings are expanding. This phenomenon has led to a deep binding relationship between the company's stock price and the price of bitcoin.

When the price of Bitcoin soared, the stock of MicroStrategy soared even more, that is, the stock price had a considerable premium.

For example, in the past year, the increase of Bitcoin was 131%, while the increase of MicroStrategy stock reached 360%, a difference of nearly 3 times. In the past six months, the increase of Bitcoin was 150%, but the increase of MicroStrategy stock reached 323%, a difference of 2 times.

It is precisely because of the long-term premium that for many institutions or retail investors, investing in MicroStrategy stocks can not only obtain higher returns (twice or more) than directly investing in Bitcoin, but also save unnecessary troubles such as private key management and compliance.

Therefore, before the spot Bitcoin ETF is approved by the SEC, holding MicroStrategy stocks is actually equivalent to indirectly investing in Bitcoin, which is also the main reason why many asset management institutions hold MicroStrategy stocks.

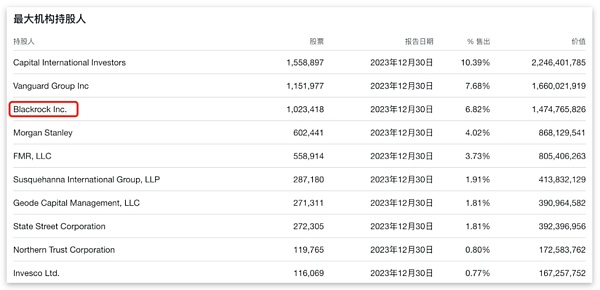

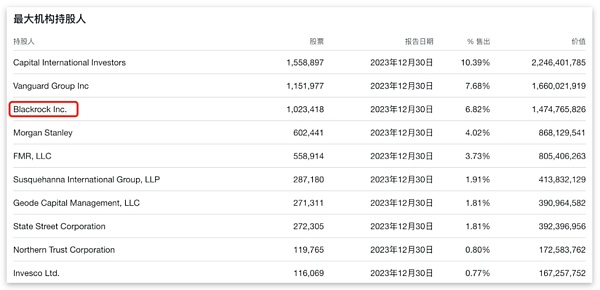

Among the major holders of MicroStrategy stocks, we can see BlackRock.

According to Yahoo Finance statistics, among the largest institutional shareholders of MicroStrategy, BlackRock ranks third, with a shareholding value of US$1.4 billion. It is through this form that BlackRock indirectly holds Bitcoin risk exposure.

Second, Spot Bitcoin ETF

So far, BlackRock's greatest contribution to the crypto market is the Spot Bitcoin ETF.

In June 2023, BlackRock submitted an application for a spot Bitcoin ETF to the SEC. After more than half a year of communication and adjustment with the SEC, the SEC finally approved 11 spot Bitcoin ETFs at the same time on January 11, 2024.

In fact, the spot Bitcoin ETF was proposed as early as 2013, but in the past ten years, the SEC has rejected more than 30 similar applications.

It can be seen that BlackRock has played a very critical role in promoting the approval of the spot Bitcoin ETF, which is mainly due to BlackRock's huge influence in the US political and financial circles.

As the world's largest asset management institution, BlackRock manages about $10 trillion in funds, which is rich enough to rival a country.

At the same time, BlackRock and the US government also have an inseparable relationship. After the collapse of Silicon Valley Bank in the United States last year, the "Wall Street Scavenger" BlackRock was hired as a consultant to help the US government arrange the sale of $114 billion in securities held by the bankrupt Signature Bank and Silicon Valley Bank.

The milestone of the spot Bitcoin ETF has greatly promoted the compliance process of Bitcoin, and this epic benefit was mainly driven by BlackRock.

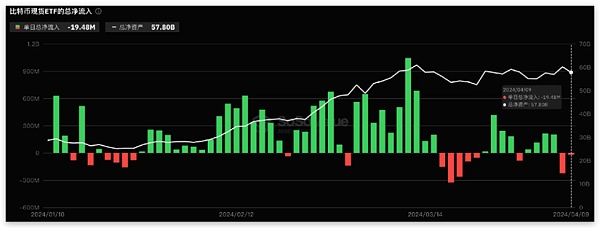

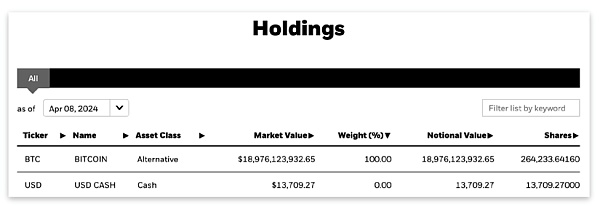

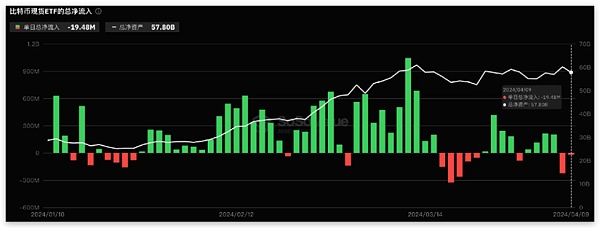

As of now, the total net asset value of spot Bitcoin ETFs is US$57.8 billion, and the ETF net asset ratio (market value as a percentage of the total market value of Bitcoin) is 4.25%. The historical cumulative net inflow has reached US$12.37 billion, and BlackRock IBIT is the spot Bitcoin ETF with the largest net inflow.

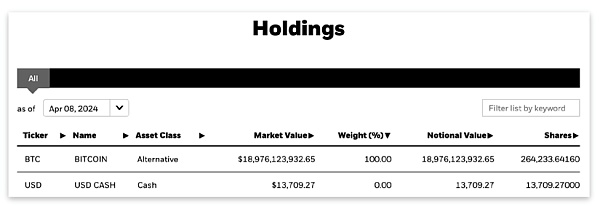

According to statistics, the number of bitcoins held by BlackRock Bitcoin ETF has exceeded 260,000, exceeding the number of bitcoins held by MicroStrategy (210,000).

As an important driving force of the last bull market, Grayscale currently holds 310,000 bitcoins, which is only 50,000 more than the number held by BlackRock IBIT.

With the continuous outflow of Grayscale Spot Bitcoin ETF and the continuous inflow of BlackRock Spot Bitcoin ETF, the number of Bitcoins held by BlackRock IBIT will definitely exceed the holdings of Grayscale GBTC, and then become the institution with the largest number of Bitcoins, which also means that BlackRock will replace Grayscale and become the new leader in this field.

Third, enter the RWA track

After the spot Bitcoin ETF was passed, BlackRock CEO Larry Fink said that the next trend is the tokenization of financial assets.

The tokenization of RWA (real world assets) is a major catalyst for this round of bull market, and it will also be a major trend in the crypto market in the next few years.

For Web3, DeFi mining returns are getting lower and lower, and it urgently needs to be supplemented by real-world assets, while for Web2, it needs to significantly reduce management costs through blockchain technology. RWA builds a bridge between Web2 assets and Web3 assets, and trillions of dollars of real-world assets will enter Web3 through RWA.

According to Boston Consulting Group analysis, by 2030, the tokenized asset market is expected to reach a scale of 16 trillion US dollars, which also means huge potential for tokenization. Obviously, BlackRock has already set its sights on this piece of cake.

On March 20, BlackRock announced the launch of its first tokenized fund issued on a public blockchain, the BlackRock US Dollar Institutional Digital Liquidity Fund (BUIDL).

It is reported that BUIDL will subscribe to Securitize, a digital asset focused on RWA, to serve qualified investors, and the funds will be held by official custodians. The fund will invest 100% of its total assets in cash, U.S. Treasury bonds and repurchase agreements, allowing investors to earn income while holding tokens on the blockchain.

BlackRock and Securitize have launched tokenized funds, triggering a surge in the RWA track. For example, ondo, RIO, CFG and GFI tokens have all seen an increase of more than 1 times. With BlackRock's huge influence, it will surely accelerate the development of the RWA track.

In short, whether it is the spot Bitcoin ETF that brings Web3 assets into the Web2 world, or the RWA tokenization that brings Web2 assets into the Web3 world, BlackRock has played a vital role in these two exploration directions. Through its global influence, it will accelerate the integration of Web2 and Web3, and will also drive more institutions to enter the market. In the process of promoting the large-scale application of blockchain technology, BlackRock has made an indelible contribution.

Weiliang

Weiliang