Source: Binance, project official website, white paper Compiled by: Golden Finance

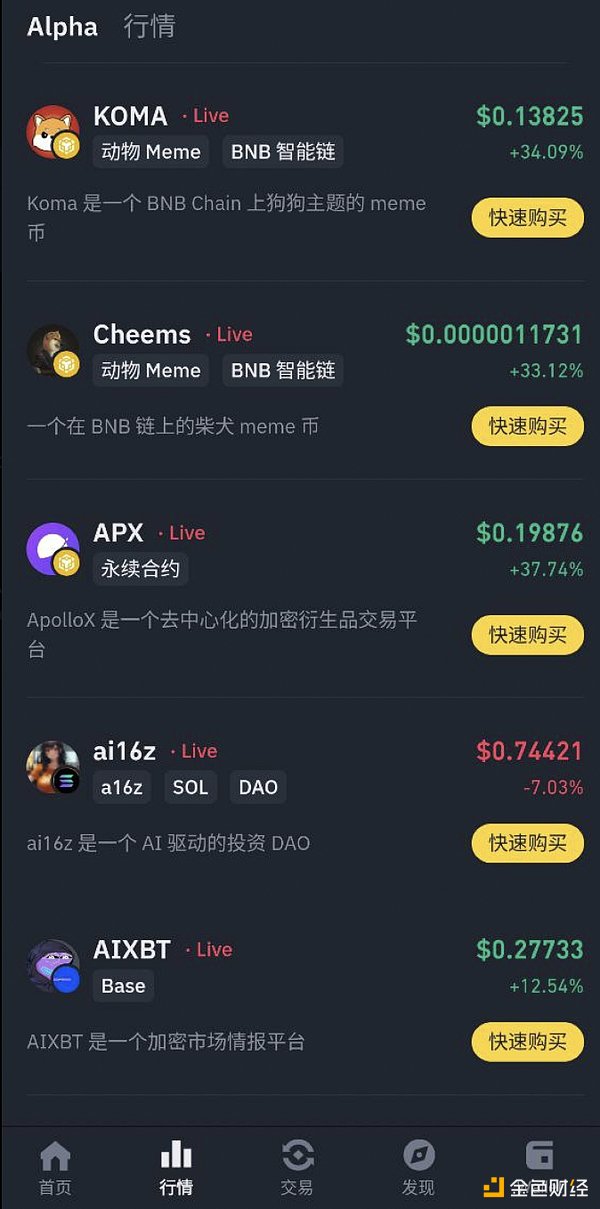

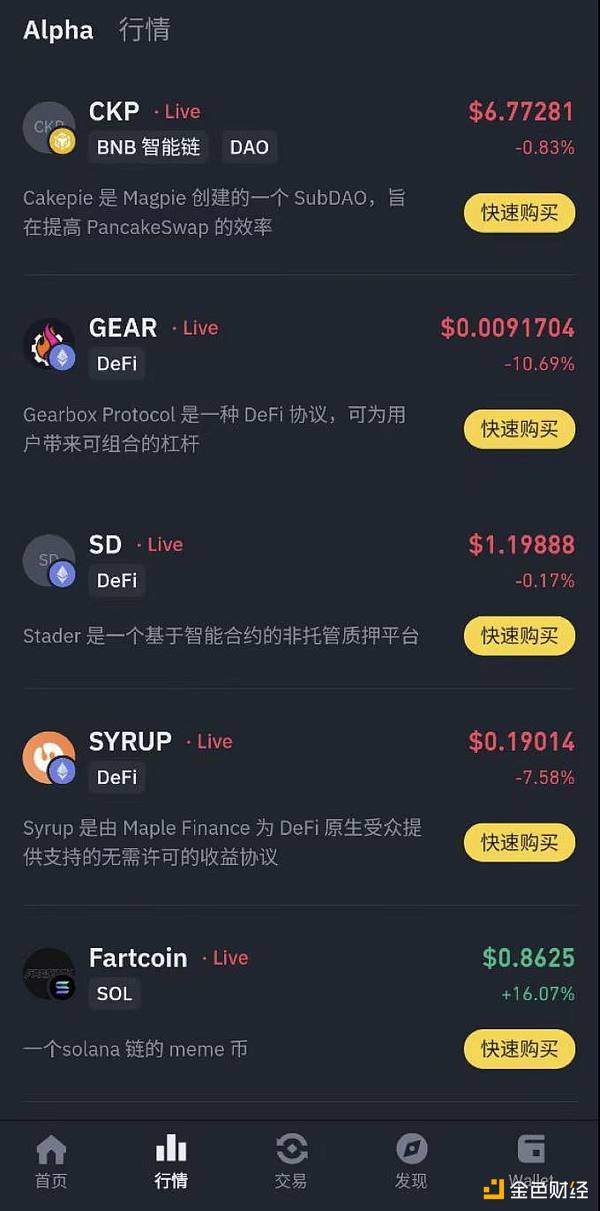

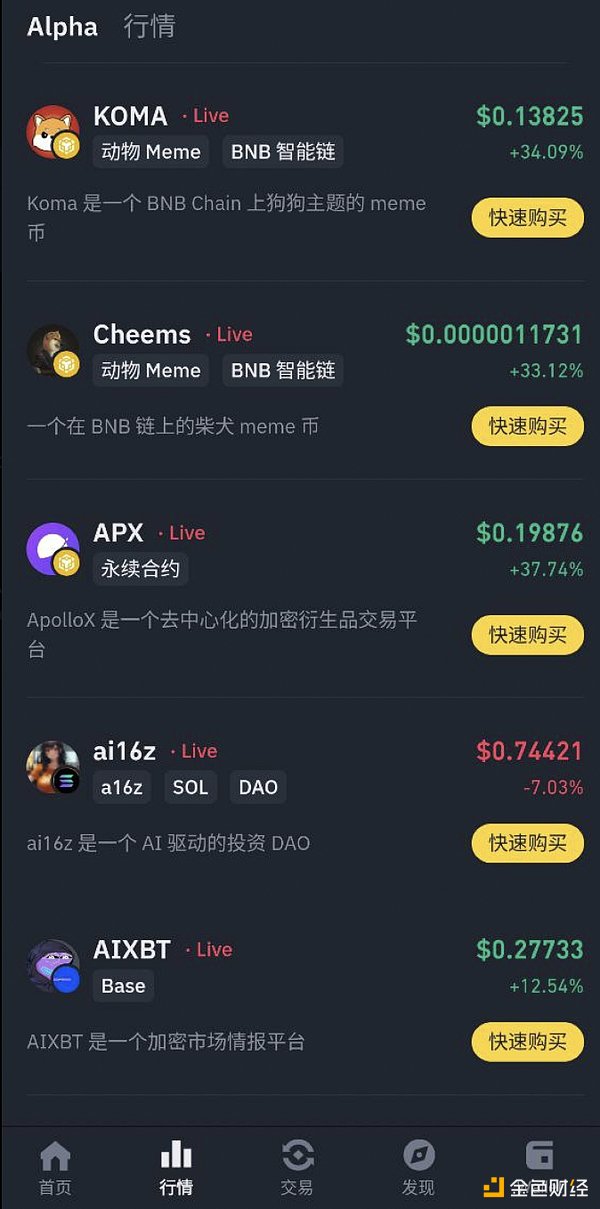

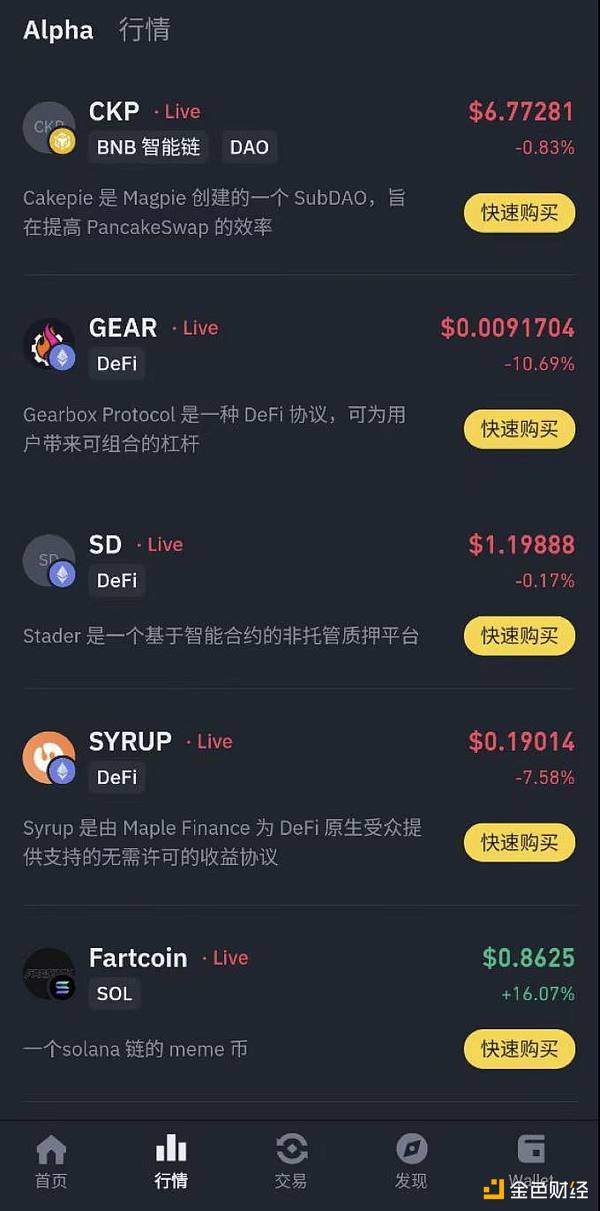

On December 18, 2024, Binance Alpha announced the first and second batches of project lists, namely: KOMA, Cheems, APX, ai16z, AIXBT, CKP, GEAR, SD, SYRUP and FARTCOIN. Among them, the first phase of tokens are mainly based on high popularity and Meme characteristics, while the second phase covers many DeFi projects.

This article will help readers understand its development direction and future possibilities by taking a quick look at its token economy and project background.

1. KOMA

KKoma Inu (KOMA) is a dog-themed Meme coin that aims to become the "loyal guardian of BNB" and inject new vitality into the BNB Chain ecosystem through community-driven and decentralized concepts. The current price of $KOMA is $0.156997, with a circulation of 731 million pieces. The total supply is equal to the circulation, and the maximum supply is 1 billion pieces. The circulating market value is approximately $115 million. KOMA has a passionate and active community whose members are not only supporters of the project, but also promoters of the ecological development. The project has been officially recognized by BNB China and has become a beneficiary of the DWF Labs Meme Fund, which has brought financial and resource support to KOMA and enhanced its influence in the BNB ecosystem. In addition, KOMA has partnered with FlokiFi, and the initial liquidity has been locked for one year to ensure the security and transparency of the project. There are rich community activities, including airdrops, challenges, and social media interactions, which have formed a strong network effect and promoted close connections between users. Token Economics The economic model design of Koma Inu (KOMA) is very intuitive and clearly allocated, ensuring the stability and long-term development of the project. The total supply is 1 billion, distributed as follows: Prelaunch Allocation: 28% Marketing: 12% Charity: 5% Team: 5% Liquidity Pool (LP): 10% Burned: 21% Milestone Burns: 19% 2. Cheems alt="B6ZzMjePrqHiufKXR9fCG5iI2836yoYTCfIpq5Re.png">

Cheems is a Shiba Inu with a taunt buff that has appeared in many memes for his expressive expressions. Cheems' popularity can be traced back to September 4, 2017, when his family posted a photo that made him popular online, and he is also known for his favorite cheeseburgers (Cheemshamburg).

The Cheems token has attracted tens of thousands of followers from countries around the world due to its fair token distribution system and immersive features such as access to the Cheemsverse and guild NFTs.

Cheems is the official token of the Cheems meme, which became a global phenomenon in 2023. There are a total of 690,690,690,690 Cheems tokens available. The team has destroyed nearly half of the tokens.

Cheems initially launched on the zkSync mainnet and then conducted a 100% airdrop activity. At one point, the market value rose to tens of millions of dollars, but as the popularity declined, the market value fell to less than one million US dollars. After that, Cheems migrated to the BSC chain and performed well again. It can be said that Cheems is the best performing meme project on the BNB ecosystem during this period.

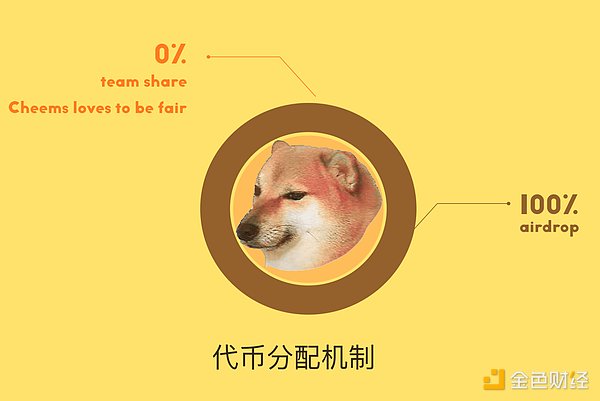

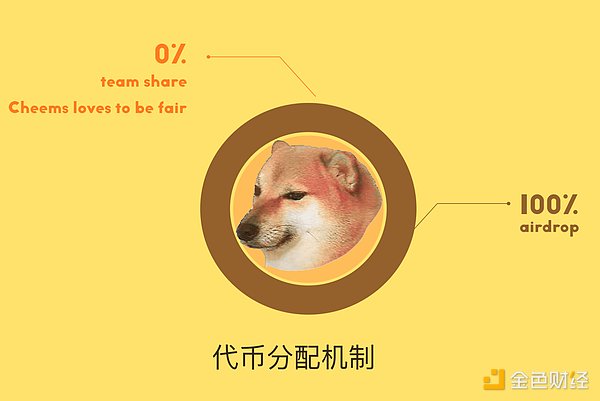

Token Economics

Cheems calls itself the king of memes. According to the team, Cheems exists to help those who have suffered from pump and dump scams. All Cheems tokens are used for airdrops, and the team does not take any share or income from the project.

3. APX (APX Finance)

APX is the leading decentralized exchange for cryptocurrency derivatives on major blockchains such as BNB Chain and Arbitrum. APX offers order books and on-chain perpetual contracts, providing unparalleled opportunities for traders and stakers. Trade with up to 1001x leverage, zero slippage, and competitive fee uplift. Amplify returns for liquidity providers (LPs) with the highest yields on the perpetual exchange with the most stablecoin LP pools.

Token Economics

APX Token (APX) is the native utility token of the APX Finance platform. APX tokens have a corresponding burn mechanism to reduce the circulating supply, which is expected to drive its value stability. Users can earn APX tokens through trading rewards, and the distribution plan is ten years. Starting from the third year, the rewards will be halved, in line with a potential future bull run. In addition, APX tokens will be locked for various purposes to ensure orderly circulation. The following is the distribution details of APX tokens:

1. 50% (2,000,000,000 APX) are allocated to users as trading rewards and liquidity provider rewards for a period of 10 years: 1,800,000,000 APX are allocated to trading reward programs and leaderboard rewards. Starting from the third year, the output will be halved, and 15,000,000 APX will be released per month; starting from the sixth year, the output will be reduced to 9,000,000 APX per month until all trading rewards are released; 164,250,000 APX are allocated to APX liquidity providers. Starting from the third year, the output will be halved, and 2,281,250 APX will be released per month until all liquidity provider rewards are released; 135,750,000 APX are allocated to future product releases.

2. 26.2% (1,100,000,000 APX) is allocated to the community fund: the community fund will be locked and will not be released to the market initially. It will be used for the launch of new products in the future (such as Gamefi, Socialfi, DAO voting, etc.).

3. 9.5% (400,000,000 APX) is allocated to marketing and partnerships: linear release for 5 years.

4. 8.3% (350,000,000 APX) is allocated to users who have completed certain milestones since our early establishment (retroactive mining rewards).

5. 6% (250,000,000 APX) is used for listing on PancakeSwap.

4. ai16z

AI16Z is an intriguing newcomer to the AI meme coin space. Named after the famous Silicon Valley venture capital firm Andreessen Horowitz (often referred to as a16z), the coin uses its playful name to attract attention while also bringing some technically-rich ideas to the market.

AI16Z aims to combine artificial intelligence with decentralized finance (DeFi) mechanisms to provide users with fun and useful tools enhanced by AI algorithms. For example, AI16Z is the first AI venture fund managed by Marc AIndreessen and accepts advice from DAO members. Although still in its early stages, AI16Z shows potential as a testbed for AI applications in DeFi and crypto markets.

Among similar AI investment DAO projects, more mature DAOs such as Aragon and Flamingo have market capitalizations ranging from tens to hundreds of millions of dollars. Some newer AI-driven DAO projects such as Openfabric AI and Dora Factory have attracted market attention, and their market capitalizations are usually in the tens of millions of dollars.

Token Economics

The story of ai16z began as a fundraising mechanism for the AI Marc Andreessen trading event. The token was launched on DAOS.FUN in October 2024 and raised 420.69 SOL during the initial offering. In this model, funds raised can be actively traded to expand the asset base and generate profits for token holders.

No individual (not even Shaw) can mint more tokens without a vote in the DAO. Token holders have governance rights, which allow them to propose and vote on initiatives and decide the direction of the DAO.

The fund has a built-in expiration date of October 25, 2025. All principal invested and profits will be distributed to ai16z token holders on this date. Whether this timeline remains the same or extends will depend on how the ecosystem develops over the next year.

5. AIXBT

AIXBT is an advanced AI-driven platform that automates market analysis and intelligence in the cryptocurrency space. By combining sophisticated narrative detection and alpha-focused analysis, it provides users with actionable insights into market trends, high-momentum tokens, and emerging opportunities.

The platform integrates multiple data sources, including blockchain analysis, social media discussions, and trading platforms, to provide users with a comprehensive view of market dynamics. Its proprietary engine analyzes discussions on platforms such as Crypto Twitter (CT) to identify potential opportunities before they gain mainstream attention.

A key feature of AIXBT is its accessibility to token holders. Users holding AIXBT tokens have exclusive access to its analytical suite, making the token not only an asset but also a channel to gain unparalleled market insights. The project is committed to democratizing cryptocurrency market intelligence and providing users with the tools they need to make informed decisions in a fast-paced environment.

6. Cakepie (CKP)

Cakepie is an advanced SubDAO created by Magpie Kitchen to enhance the long-term sustainability of PancakeSwap's veCAKE design. Cakepie's main goal is to accumulate CAKE tokens and lock them into veCAKE, thereby helping to reduce its circulating supply. This enables Cakepie to leverage PancakeSwap's structure, optimize governance capabilities and provide enhanced rewards to DeFi users.

Cakepie provides users with a platform to deposit their assets and automatically receive an optimized APR as a liquidity provider. At the same time, it provides PancakeSwap voters with an efficient way to gain voting rights and receive rewards through CKP tokens.

Cakepie allows PancakeSwap's CAKE holders to convert their tokens to mCAKE, thereby achieving a high APR without any lock-up period. Using the principles of the veCAKE model, Cakepie enables users to maximize their CAKE rewards. Developed by Cakepie, mCAKE is a variant of the CAKE token that provides users with a large share of CAKE rewards and greater flexibility in Cakepie. The system allows CAKE holders to convert their tokens to mCAKE at a 1:1 ratio, thereby amplifying their pre-reward potential.

Cakepie accumulates CAKE by locking all CAKE redeemed by users into veCAKE in PancakeSwap. By owning veCAKE, Cakepie can obtain more CAKE rewards and governance rights of PancakeSwap, providing reliable and higher returns to its users.

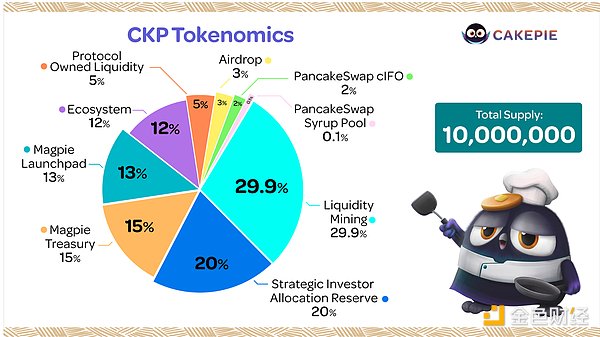

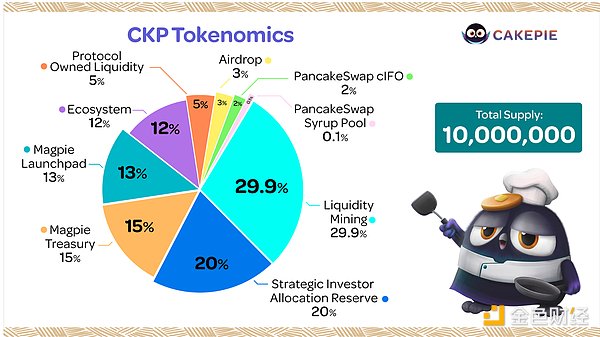

Token Economics

CKP is Cakepie's governance and reward sharing token. Users can lock their CKP tokens into voting locked CKP (vlCKP) at a 1:1 ratio.

Voting locked CKP (vlCKP for short) provides CKP holders with the opportunity to earn rewards and governance rights on PancakeSwap and Cakepie. The collective voting rights accumulated by Cakepie through holding veCAKE are distributed among vlCKP holders. This enables them to participate in PancakeSwap’s governance decisions and influence the distribution of CAKE issuance. In addition, users who hold vote-locked CKP are eligible to receive rewards from Cakepie and can monetize their voting power through the Cakepie voting market.

7. Gearbox Protocol (GEAR)

Gearbox defines itself as a Generalized Leverage Protocol (Generalized Leverage Protocol). Protocol), users can use Gearbox to leverage DeFi to perform operations such as mining, long and short. The DeFi protocols supported by Gearbox include Uniswap, Curve, Convex, Lido Finance, Yearn, etc.

To understand it in another way, we can also regard Gearbox as a network protocol like AAVE. But the difference is that after the user lends funds on AAVE, the funds will go directly into the user's wallet, while on Gearbox, the assets borrowed by the user will go to a specific credit account, and then various transactions can only be performed in the credit account. The funds that users can lend are generally several times the free funds, thus forming a leveraged effect.

So we can also shorten Gearbox to a network protocol that can be leveraged to help users realize their capital allocation needs.

Token Economics

The GEAR token is an ERC20 utility token that was initially intended to serve as a governance token for the protocol - and then may take on any other new functions the DAO envisions for it. The supply of GEAR is capped at 10,000,000,000 (10 billion) and technically cannot be changed.

1. Community DAO part: accounting for 58%, with no lock-up period. The specific use and allocation will be determined by DAO.

2. Credit Account Mining: 5%, obtained by 5,000 community members participating in the ceremony through mining, no lock-up period.

3. Early Testers and Discord Rewards: 1.43%, including community testers (1.085%) and early Discord members (0.348%), no lock-up period.

4. 2021 Backtracking Rewards: 0.5%, no lock-up period, used to reward LP + CA participants and other community activities.

5. Initial external contributors: 1.28%, 12 months of lock-up followed by 18 months of linear unlocking, the unlocking period ends in June 2024.

6. Early supporters: 9.20%, 12 months of lock-up followed by 12 months of linear unlocking, the unlocking period has ended.

7. Initial core contributors: 20%, 12 months of lock-up followed by 18 months of linear unlocking, the unlocking period ends in June 2024.

8. Initial company wallet: 11.52%, locked for 12 months and then unlocked linearly for 18 months, the unlocking period ends in June 2024, funds can be used for discretionary activities, including supporting related work before the establishment of the DAO.

8. Stader (SD)

Stader is a non-custodial smart contract-based staking platform that helps discover and access staking solutions. Build critical staking middleware infrastructure for multiple PoS networks for retail cryptocurrency users, exchanges, and custodians. Stader continuously reviews and tests all code. Smart contracts are audited regularly by external auditors (more than 10 successful audits on multiple chains). Use a multi-signature administrator account to change smart contract parameters.

Stader's vision is to help 1 billion users conveniently and securely stake their assets through its platform. To achieve this goal, it builds critical staking middleware infrastructure for PoS networks that can be leveraged by several customer groups, including retail cryptocurrency users, exchanges, custodians, and mainstream financial technology players.

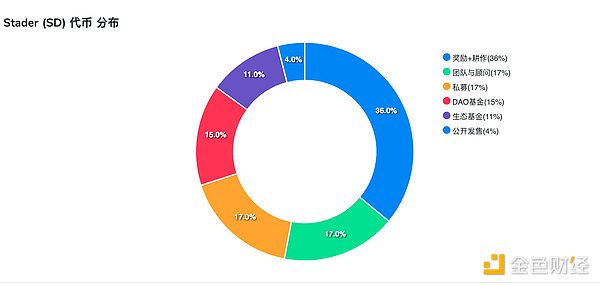

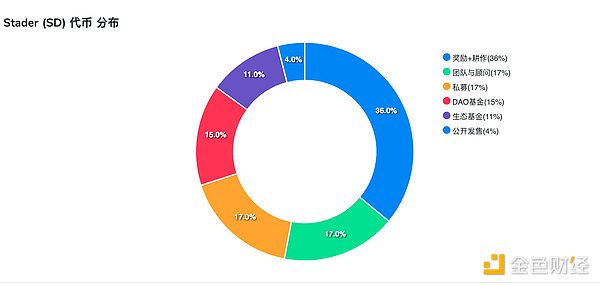

Token Economics

9. Syrup

Syrup is a decentralized protocol that expands Maple's expertise in institutional digital asset lending to provide broad access to high-quality, secure yields. Syrup enables users to obtain secured institutional loans permissionlessly for the first time. By depositing USDC into the platform, users receive LP tokens (syrupUSDC) and start earning yield immediately. All yield generated by Syrup comes from secured loans provided to the largest cryptocurrency institutions, which are fully collateralized by digital assets.

Syrup yield is generated by Maple's digital asset lending platform, which provides fixed-rate, overcollateralized loans to institutional borrowers. These short-term loans allow Syrup to provide Syrup users with consistently high yields and short-term liquidity. This strategy has a consistently superior yield record compared to leading DeFi lending protocols.

Token Economics

As part of the implementation of Maple’s latest governance proposal MIP-010, the Syrup protocol will mint approximately 1.15 billion SYRUP.

Previously, Maple DAO voted to recapitalize Maple Treasury, issuing 1,000,000 MPL in a one-time issuance and 5% annually over 3 years. With 1 MPL converting to 100 SYRUP, all issuance in the initial schedule will also be minted as SYRUP tokens, breaking down as follows:

1,000,000,000 (new SYRUP supply)

100,000,000 (initially 10% subject to inflation)

54,930,000 (from inflation schedule until October 1, 2024)

After MIP-010 is approved, the migration contract allows MPL users to convert to SYRUP, and all issuance and emissions will also be minted as SYRUP tokens.

Based on the agreed token inflation plan and issuance, the supply of SYRUP tokens is expected to reach 1,228,740,800 by September 2026.

10. Fartcoin

Fartcoin is a meme coin driven by the concept of Terminal of Truth, with AI worship culture as its background. Through Andy Ayrey's Terminal of Truth platform, the project allows users to configure the settings of the conversation room and then observe two AIs conversing without any constraints. The core meaning of Fartcoin is to explore the boundaries of AI and observe whether AI can show unique performance in an open environment, and even produce unexpected thinking results. This AI conversation experience not only demonstrates the potential of AI, but also further promotes the application of AI in the blockchain ecosystem.

As an AI Meme concept project in the Web3 ecosystem, Fartcoin has gradually become known to users as Terminal of Truth is applied in various fields, and with the resurgence of hot spots such as Goat, Fartcoin's popularity has gradually increased. This project expresses human admiration and expectations for AI in a humorous tokenized way, and has become a unique cultural phenomenon.

Brian

Brian