Author: Ryan McEnrush, a16z partner; Translation: 0xjs@金财经

The power grid is a large and complex system of wires and power plants that is critical to our economy and is The basis of our industrial strength. Currently, the United States faces a serious challenge: U.S. electricity demand is expected to nearly doubleby 2040 due to factors such as artificial intelligence computing, reshoring, and “electrification,” but our grid infrastructure and operations are struggling to keep up. Step up.

To seize an energy-rich future, we must simplify the production, transmission and consumption of electricity; this requires a decentralized grid. The construction of large power plants and long-distance transmission lines is cumbersome, but technologies such as solar energy, batteries and advanced nuclear reactors bring new possibilities. It is these and other more "local" technologies that can avoid costly long distance cabling and be deployed directly on site, whichwill help support significant load growthin the coming decades.

While historical industrial expansion relied on large, centralized power plants, the 21st century marked a shift toward decentralized and intermittent energy, from a "hub and spoke" model to distributed networks. Of course, this evolution will bring new challenges, and we will need innovation to bridge the gaps.

Growing Pains

The U.S. power grid consists of three major interconnections: East, West, and Texas, and is staffed by 17 NERC coordinators Management, ISOs (Independent System Operators) and RTOs (Regional Transmission Operators) oversee regional economies and infrastructure. However, actual generation and delivery are handled by local utility companies or cooperatives. This structure has worked in times of low load growth, but scaling grid infrastructure to meet today's demands is becomingincreasingly challenging andexpensive.

Connect Entry issues

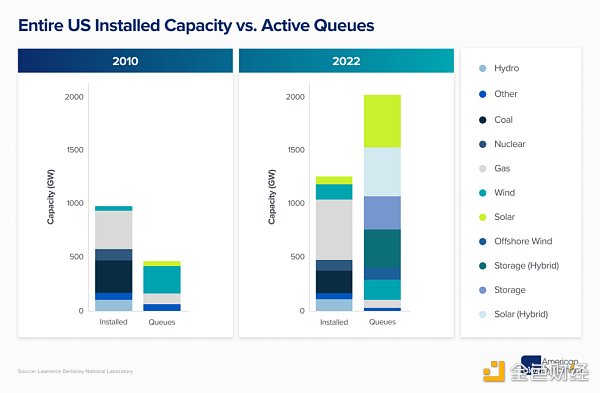

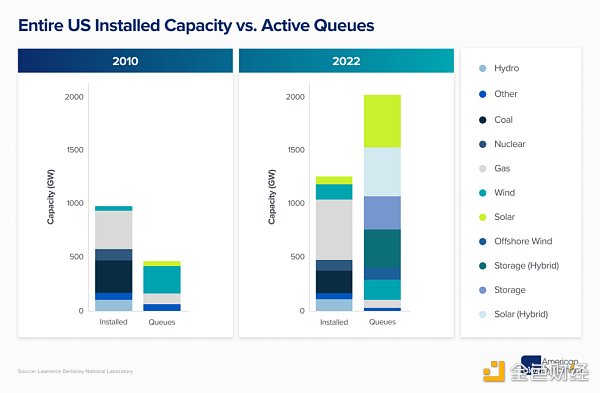

Grid operators use Admission queues to manage the entry of new assets and assess whether the grid can support new assets at that location without imbalance. Add power and determine the cost of necessary upgrades. Today, more than2000 GW are waiting to be connected to the grid, with more than 700 GW of projects entering the queue for 2022 alone. That'sa a big number: The entire U.S. grid has only 1,200 GW of installed generation capacity.

But in reality, Many projects have withdrawn due to grid connection costs. Historically, only 10-20% of queued projects come to fruition, often taking more than 5 years after application for final connection – and these times are only getting longer. Feasibility studies are complicated by generators often submitting multiple speculative proposals to identify the cheapest access points and then withdrawing unfavorable proposals once the costs are known. California grid operator CAISO was forced to stop accepting any new requests in 2022 due to a surge in applications, and plans to do so again in 2024.

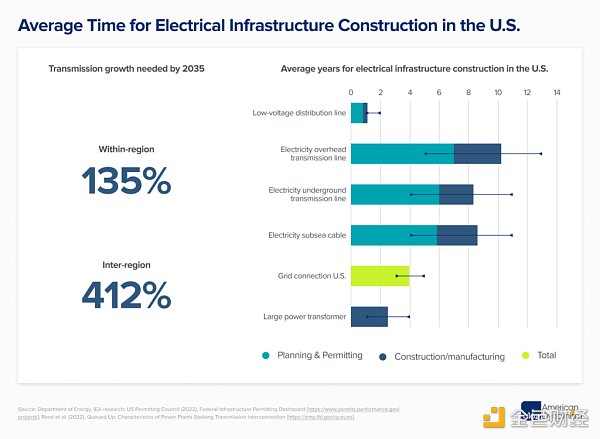

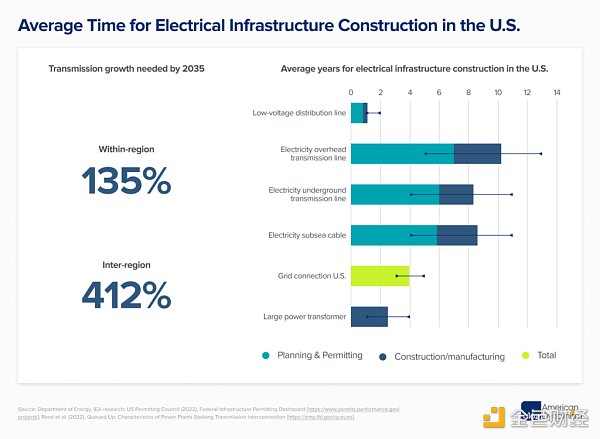

This is a key rate-limiting factor and cost driver in our energy transition. A recent U.S. Department of Energy report found that to meet high load growth through 2035, intraregional transmission integrating new assets must increase by 128% and interregional transmission must increase by 412%. More optimistic forecasts predict growth rates of 64% and 34% respectively.

The proposed reforms could help alleviate this development backlog. The Federal Energy Regulatory Commission (FERC) is pursuing a “first to prepare, first to serve” policy, adding fees to filter proposals and expedite review. The Electric Reliability Council of Texas (ERCOT) adopts a “plug and manage” approach that allows for faster connections but disconnects projects if they threaten grid reliability — a step that quickly adds new Great success has been achieved with grid assets. While these policies mark progress, streamlining other regulations like NEPA is also critical to speeding up construction.

But even with approval, grid construction still faces supply chain obstacles, including lead times of more than 12 months, a 400% surge in the price of large power transformers, and a shortage of specialty steel. Meeting federal goals to grow transformer manufacturing also depends on support for the electrical steel industry, especially the upcoming 2027 energy efficiency standards. All of this comes as grid outages, mostly weather-related, are at a 20-year high, requiring hardware replacement.

This And that doesn’t include transmission

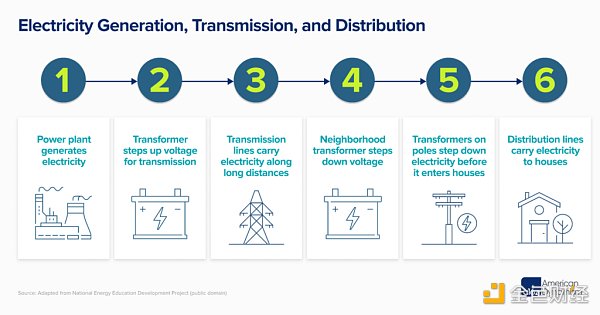

Ultimately, the cost overhaul of building grid infrastructure manifests itself in higher prices for consumers. The "retail price" consumers pay is a combination of the wholesale price (the cost of generating electricity) and the delivery fee (the cost of the infrastructure required to get the electricity to you). Crucially, while the price of cheap renewable and natural gas generation has fallen, the price of delivering it has risen sharply.

This incident is caused by many reasons. Utilities use distribution charges to offset losses in customer generation, designed to ensure fixed-return revenue for infrastructure investments (akin to cost-plus defense contracting). The development of renewable energy requires extending power lines to remote areas that are less used due to their intermittency. Additionally, as electrification and self-generation increase, loads become more volatile and infrastructure designed for peak demand becomes inefficient and costly.

Policy and market adjustments are responding to these rising transportation costs, with California’s massive adoption of distributed power systems such as rooftop solar being a notable example.

California’s Net Energy Metering (NEM) program initially allowed homeowners to sell excess solar energy back to the grid at retail prices, ignoring utility companies’ distribution costs. Recent changes now essentially buy back electricity at variable wholesale prices, reducing solar panel owners' income during peak generation periods, which typically coincide with the lowest electricity prices. This adjustment lengthens the payback period for solar installations, prompting homeowners and businesses to invest in electricity storage to sell the energy when it is more profitable.

California Utilities also proposed a billing model in which a fixed fee would be based on income levels and usage fees would be based on consumption. The move is aimed at making wealthier customers bear more of the costs of grid infrastructure and protecting low-income individuals from rising retail electricity prices. While this specific policy was recently shelved in favor of a similar but less extreme version, such an idea could lead to wealthy customers going completely off the grid. Defection could result in higher costs for remaining users and trigger a “death spiral.” Some believe this is already happening in Hawaii's electricity market, with some areas quickly switching to electric heat pumps.

Keeping the lights on

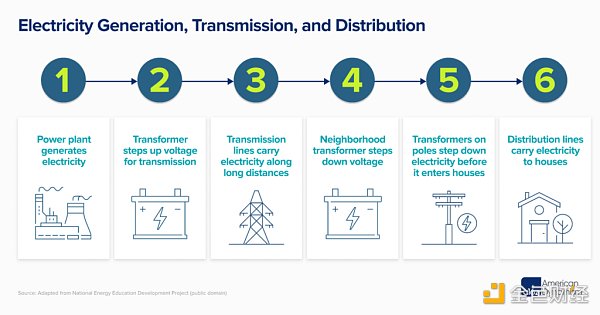

Electricity is not magic; the grid is complex. At any time, the power produced must match the power demand, or "load"; this is what people mean by "balancing the grid." At a high level, grid stability relies on maintaining a constant frequency—60 Hz in the United States.

Congestion caused by excess capacity on power lines (dumping power into the grid) can lead to curtailments and local price differentials. Any frequency deviation can also cause damage to generator and motor equipment. Wind, solar, and batteries—reverse resources that lack inertia—also complicate frequency stabilization as they proliferate. In extreme cases, deviations can cause power outages or even damage grid-connected equipment.

Due to the inherent fragility of the power grid, the assets connected to it must be carefully considered to align reliable supply with forecasted demand. The growth of intermittent power (unreliable supply) combined with the rise of "electrification" (surges in demand) is creating seriouschallenges strong>.

When is enough, enough?

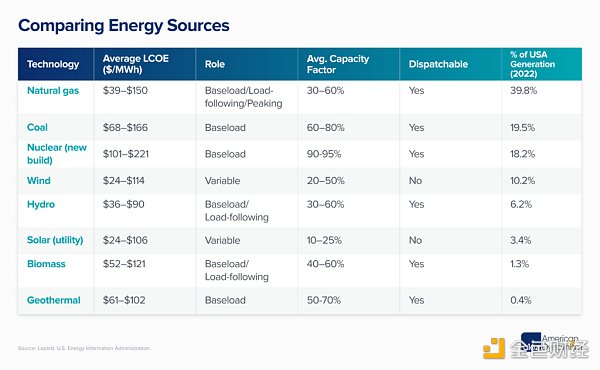

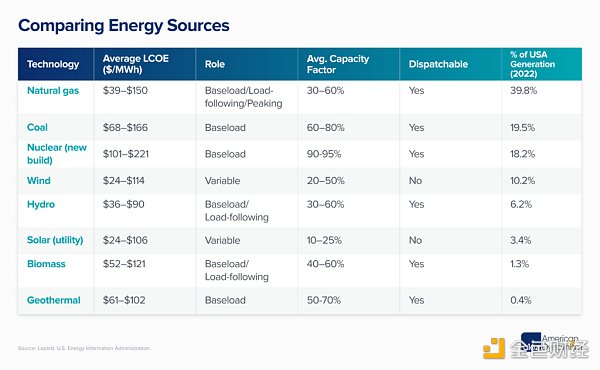

About two-thirds of the load is balanced by wholesale markets through (mostly) day-ahead auctions, where prices are determined by the cost of the last unit of electricity required. Renewable energy has no marginal cost and often outbids other energy sources when active, leading to price fluctuations - prices are extremely low when renewables meet demand and soar when more expensive energy is needed (note: bids are different from < strong>Levelized cost of energyLCOE.)

The unpredictability of solar and wind power, as well as the closure of aging fossil fuel power plants, puts pressure on grid stability. This leads to blackouts (underproduction) and curtailments (overproduction), such as the state of California, which will generate 2,400 GWh of waste in 2022. Addressing this issue will require investments in energy storage and transmission improvements (discussed below).

The unpredictability of solar and wind power, as well as the closure of aging fossil fuel power plants, puts pressure on grid stability. This leads to blackouts (underproduction) and curtailments (overproduction), such as the state of California, which will generate 2,400 GWh of waste in 2022. Addressing this issue will require investments in energy storage and transmission improvements (discussed below).

Additionally, as electricity supplies become more unpredictable, natural gas plays an increasingly important role due to its cost-effectiveness and flexibility. Natural gas often supports renewable energy through "peaker plants" that come on only when needed. Generally speaking, the intermittency of solar and wind power makes natural gas power plants and other types of power plants intermittently profitable, and sometimes even running at a continuous loss for technical reasons. So when "peakers" set wholesale prices during renewable outages, it causes costs to rise, creating volatility for consumers.

The demand for electricity is also changing. Technologies such as heat pumps, while energy efficient, can cause load peaks in winter when renewable energy generation is low. This requires grid operators to retain a certain buffer of power assets, and renewable energy sources are often ignored in resource adequacy planning. Grid operators typically follow a "1 in 10" rule, accepting power shortages once every decade, but the actual calculation is more complicated. In ERCOT, lacking a traditional capacity market to replace price increase incentives, we have seen "emergency reserves" grow as renewables enter the grid.

Sponsored Business Content

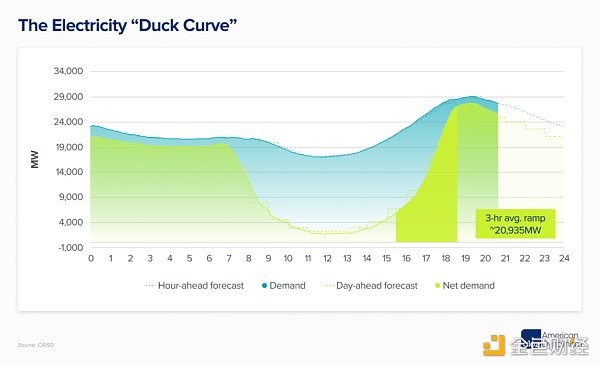

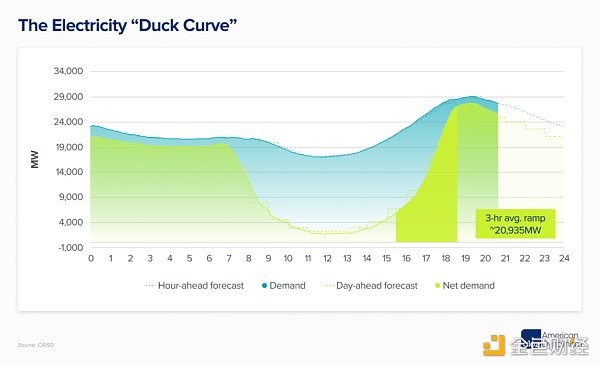

Regions with high solar penetration like California also face a "duck curve," requiring grid operators to rapidly add more than 20 gigawatts of power as daylight fades and demand increases. This is both technically and economically challenging for a factory designed to produce continuous output.

Renewable energy Intermittency creates hidden costs, forcing grid operators to take risks or invest in new assets. While the levelized cost of energy assesses a project's economic viability, it oversimplifies the asset's true value to the wider grid. However, the LCOE does highlight the economic challenges of building new assets such as nuclear power plants. Although more expensive than today's natural gas, nuclear power offers a compelling path to decarbonizing reliable electricity. We just need to scale up reactor construction.

But we cannot rely solely on nuclear power. Relying solely on a single energy source is risky, as France's nuclear challenge amid Russian energy sanctions and natural gas problems amid frigid weather in the southern United States have shown, not to mention volatile commodity prices. Regions with large amounts of renewable energy, such as California, also face uncertainty due to their daily reliance on imports. Even places like Iceland or Scandinavia that run on almost 100% clean energy will maintain reliable backup or import options during a crisis.

Becoming smart

As power demand grows, the grid struggles to cope with the increasing complexity of decentralized and intermittent renewable energy sources. We can't force this transformation with brute force; if we're going to do this,we really need to get smart.

The current grid is old and “dumb,” relying on power plants to adjust production based on forecasted demand while making small real-time adjustments to ensure stability. The grid was originally designed for one-way flow from large power plants, but it has been challenged by the concept of multiple smaller sources delivering power in all directions, such as your rooftop solar charging your neighbor's electric car. Furthermore, the lack of true visibility into real-time power flows poses pressing problems, especially at the distribution level.

Residential solar, batteries, advanced nuclear and (possibly) geothermal energy provide decentralized power, reducing the need for infrastructure. However, integrating an ever-changing and unstable grid still requires innovative solutions. Additionally, the efficient use of utility-scale power systems can even be significantly improved through local storage and demand-side response (such as turning off the thermostat when the grid is stressed), thereby reducing the need to build underutilized assets that are only online briefly during peak periods of demand.

The "smart grid" aims to achieve all these goals and more, and can be divided into three main technology groups:

-

Meter front end

Dynamic line ratings, solid state transformers, voltage management and power flow systems, better conductors, infrastructure monitoring, grid scale generation, grid scale storage and more.

Instrumentation backend

Heat pumps, appliances, residential solar, home energy storage, electric vehicle chargers, smart thermostats, smart meters, microreactors and small modular reactors, micro Power grid, etc.

Power Grid Software

Virtual power plants, better forecasting, equipment management, energy data infrastructure, cybersecurity, ADMS, interconnection planning, power financial instruments, automation of bilateral agreements, and more.

Specifically, there are two major trends that are crucial to the future of the "smart grid".

First of all, we need to build a large number of energy storage facilities to smooth local peak loads and stabilize the intermittent power supply of the entire power grid. Energy storage batteries are already critical for small bursts of electricity and, as prices continue to fall, could even cover longer periods of time. But scaling up batteries to hundreds of gigawatt hours also requires expanding the supply chain. Fortunately, strong economic conditions will likely continue to accelerate deployment; entrepreneurs should look to plug in batteries wherever possible.

The second is to accelerate the deployment and integration of distributed energy asset networks. Anything that can produce electricity will become electric. Allowing these systems to interact with home and grid-scale energy systems will require a variety of new solutions. Collections of “smart” devices such as electric cars or thermostats could even form virtual power plants that mimic the behavior of larger energy assets.

What is the future?

A core challenge in grid expansion is to carefully balance the transition between centralized and decentralized systems, taking into account economic and reliability issues. Centralized power grids, while simple and (usually) reliable, also face complex demand fluctuations and high fixed costs - for example, most large nuclear power plants around the world are government-funded, and decentralized power grids are still being deployed. Early stages, but cheap, do not automatically ensure reliable power, as the preferences of some rural communities in India indicate.

To be clear, the centralized grid we have today is certainly not going away—in fact, it needs to scale—but it will besurrounded by the growing number of decentralized assets Consumed by the network. Ratepayers will increasingly adopt their own generation and storage, challenging traditional power monopolies and driving regulatory and market reforms. This trend toward self-generation will reach its culmination in energy-intensive industries that place a premium on reliability—Amazon and Microsoft are alreadypursuing nuclear-powered data centers—and every effort should be made to accelerate the development of new reactors and deploy.

More broadly, ratepayers need electricity that is reliable, affordable and clean, often in that order. ERCOT, with its unique location, easy-to-innovate “pure energy” market, and relaxed interconnection policies, will be key to watch to understand if, when, and how this can be achieved with a decentralized grid. There is no doubt that successfully navigating this transition will lead to significant economic growth.

Crucially, building this decentralized grid will require our most talented entrepreneurs and engineers:We need someone with serious expertise in pre-user, post-user and grid software technology Innovative "Smart Grid" Policy and economic trends will accelerate this power development, but the responsibility for ensuring this decentralized grid operates better than the old grid will fall on the private sector.

The future of America’s electric grid lies in leveraging new technologies and embracing free markets to overcome our nation’s challenges and pave the way for a more efficient and dynamic energy landscape. This is one of the great undertakings of the 21st century, but we must rise to the challenge.

The world is changing rapidly, and the grid must change with it.

JinseFinance

JinseFinance

The unpredictability of solar and wind power, as well as the closure of aging fossil fuel power plants, puts pressure on grid stability. This leads to blackouts (underproduction) and curtailments (overproduction), such as the state of California, which will generate 2,400 GWh of waste in 2022. Addressing this issue will require investments in energy storage and transmission improvements (discussed below).

The unpredictability of solar and wind power, as well as the closure of aging fossil fuel power plants, puts pressure on grid stability. This leads to blackouts (underproduction) and curtailments (overproduction), such as the state of California, which will generate 2,400 GWh of waste in 2022. Addressing this issue will require investments in energy storage and transmission improvements (discussed below).