Author: Xiyou, ChainCatcher

Editor: Marco, ChainCatcher

The day after the Ethereum ETF was approved, the crypto market maker and investment institution Jump Crypto started a concentrated large-scale sell-off, and was accused by the community as the culprit of the crypto market crash.

According to on-chain data, in the past 10 days, the cumulative value of ETH sold by Jump Crypto has exceeded US$300 million.

As a crypto subsidiary of the well-known high-frequency trading company Jump Trading, Jump Crypto has participated in the investment and incubation of multiple crypto projects such as Solana and Wormhole. It was once a bellwether of the crypto industry, and its every move has attracted market attention. This abnormal behavior of selling in large quantities has made community users speculate whether they will withdraw from the crypto field.

Ethereum's largest daily drop exceeded 25%, and Jump Crypto's sell-off may be the culprit

On August 5, Ethereum's lowest price hit $2,100, with a maximum daily drop of more than 25%, and the daily price fluctuation hit a new high since November 2022. Ethereum is now quoted at $2,358, which has completely wiped out the gains since the beginning of this year and hit a low point in nearly 7 months.

In addition to the impact of external macro-negative news, the large-scale transfer of tokens by market maker Jump Crypto is the main on-site cause of the panic plunge in Ethereum's price today.

Julian Hosp, CEO and co-founder of crypto investment company Cake Group, posted on social media that the massive sell-off in the crypto market in recent days may be due to Jump Trading, either because the traditional market has been called for margin and needs liquidity, or because of regulatory reasons to withdraw from the cryptocurrency business.

In addition, BitMEX co-founder Arthur Hayes also posted on social media that he learned through traditional financial sources that a "big guy" had fallen and sold all crypto assets, and the community speculated that this "big guy" was Jump Crypto.

According to cryptocurrency detective EmberCN, a few days after the launch of the US spot Ethereum ETF on July 25, Jump seems to have begun redeeming Lido's wstETH worth more than $500 million in exchange for ETH.

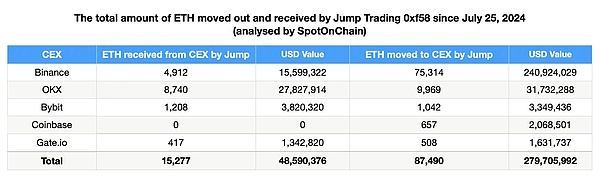

In the past 10 days, on-chain data Spot On Chain shows that since July 25, wallets marked as Jump Crypto have recharged CEX exchanges with a cumulative value of $279 million in ETH.

Currently, Jump Crypto's transfer to CEX is still ongoing. In the past 24 hours, another $46.78 million of ETH has been recharged to the exchange.

As of press time, Jump Crypto has successively transferred more than $300 million worth of ETH to CEX exchanges. These ETH include ETH that Jump Crypto has unstaked from Lido and ETH that has been transferred from other wallets many times.

Currently, the Jump Crypto wallet still holds $101 million worth of wstETH and $8 million worth of RETH, and is in the process of unstacking. 97% of the positions are mainly composed of stablecoins such as USDC and USDT.

Jump Cryptomay exit the crypto space due to CFTC investigation

Jump Crypto's frequent movements in the crypto market have sparked community speculation about whether it is preparing to exit the crypto space by selling hundreds of millions of dollars worth of ETH in a week. In May last year, Bloomberg reported that Jump Crypto was scaling back its crypto business and might exit the U.S. market due to regulatory reasons.

The social media accounts of Jump Crypto's official Twitter accounts @Jump Crypto, @Jump Crypto Engineering, and @Jump Trading have stopped updating in September 2023, May 2023, and September 2021, respectively.

This further confirms users' speculation that Jump Crypto's sale of a large amount of assets may be in preparation for exiting the crypto space.

Combined with its previous investigation by the U.S. CFTC, the already panicked crypto market is rumoring that its crypto-related businesses may be shut down.

In June this year, it was revealed that the U.S. Commodity Futures Trading Commission (CFTC) was investigating Jump Crypto's cryptocurrency business (trading and investment activities) because some investors accused Jump Crypto of being involved in the Terra collapse case in the civil lawsuit filed by the SEC against Terra.

According to court documents, investors accused Jump Crypto of participating in Terra's (UST) fraud scheme. The two conspired to manipulate UST prices to mislead investors that UST could maintain price stability. In fact, institutions were behind the manipulation. Jump Crypto made a profit of nearly $1.3 billion from this manipulation.

However, the report also pointed out that the CFTC's investigation does not mean that Jump Crypto has committed any illegal acts. So far, there has been no public progress in the investigation of Jump Crypto.

Four days after the CFTC announced its investigation into Jump Crypto, Kanav Kariya, who has served as president of Jump Crypto for more than three years, announced his resignation.

Jump CryptoFrom glory to fall?

As a department of Jump Trading, a world-renowned high-frequency trading company specializing in cryptocurrency and blockchain technology, Jump Crypto has been born with a halo.

In 2021, Jump Trading completed the fundraising of its seventh investment fund, which raised a total of US$350 million, setting a fundraising record for the company's funds. It announced the establishment of a crypto investment department, Jump Crypto, and invested 40% of the seventh investment fund in the cryptocurrency field. The president of Jump Crypto is Kanav Kariya, who is only 26 years old.

According to Kariya's previous statement, Jump Crypto once had about 140 employees, of which more than 100 were developers.

Backed by Jump Trading, Jump Crypto has always been an important market participant in the crypto field, and has participated in and led the investment and incubation of many well-known crypto projects as a market maker and investor, including Solana, Wormhole, Pyth, Serum, Avalanche, etc., and can be said to have been a leader in the direction of the crypto market.

But after entering 2022, Jump Crypto seemed to be experiencing a Mercury retrograde, encountering a series of crises, including the theft of the incubated project Wormhole, the collapse of Terra and FTX, etc., resulting in serious financial losses.

In February 2022, Wormhole, a cross-chain bridge incubated by Jump Crypto, was hacked, with losses exceeding $300 million, and all losses were borne by the team. Later, Wormhole separated from Jump Crypto and operated independently.

In May of the same year, as a major investor in Terra, with the collapse of the ecosystem, Jump Crypto not only had to face huge losses, but also faced criminal charges that the company cooperated with Terra to manipulate the price of UST coins.

In November of the same year, FTX collapsed. As an investor in FTX, Jump Crypto lost $206 million in the bankruptcy of FTX, the largest loss among all companies except FTX or Alameda.

These crises caused Jump Crypto to suffer heavy losses. Subsequently, in May 2023, Jump Crypto was reported to have reduced its cryptocurrency business (such as splitting Wormhole) for regulatory reasons and planned to withdraw from the US market.

As more and more market makers entered the cryptocurrency market, competition became extremely fierce. Latecomers such as Wintermute and DWF Labs rose rapidly and eroded market share, causing the once glorious Jump Crypto to continue to decline in recent years.

According to Rootdata data, as of August 5, Jump Crypto participated in 91 crypto projects, including 31 projects led by it, but only 15 projects were invested in after 2023.

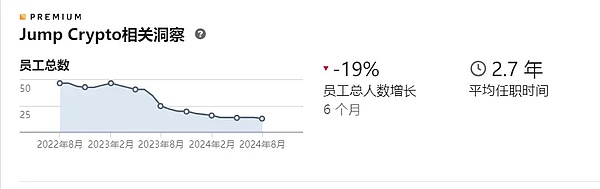

In addition to the reduction in the number of investment projects, the number of employees at Jump Crypto is also shrinking. According to LinkedIn data, the number of employees in this department is currently around 20, and the number of employees has decreased by 19% in the past six months.

Although Jump Crypto is not as influential as before, the projects initiated or participated by people who left Jump Trading and Jump Crypto still dominate the development and trends of the crypto industry.

For example, the parallel EVM project Monad, which completed a $225 million financing with a valuation of $3 billion in April, all the founding team members came from Jump Trading. Among them, the founder Keone Hon was the head of research at Jump Trading and worked in the company for 8 years. Another co-founder, James Hunsaker, is a senior software engineer at Jump Trading and a core maintainer of PythNetwork.

TheBlock

TheBlock

TheBlock

TheBlock Coinlive

Coinlive  Others

Others Bitcoinist

Bitcoinist Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph