Author: Alex Xu

Introduction

Ethena is a rare phenomenal DeFi project in this cycle. After its token was launched, its circulating market value once exceeded 2 billion US dollars (corresponding to FDV of more than 23 billion). However, since April this year, the price of its token has fallen rapidly. Ethena's circulating market value has retreated by more than 80% from its peak, and the token price has retreated by as much as 87%

Since September, Ethena has accelerated its cooperation with various projects and expanded the use scenarios of its stablecoin USDE. The scale of stablecoins has also begun to bottom out and rebound. Its circulating market value has rebounded from the lowest point of 400 million US dollars in September to the current 1 billion US dollars.

In the article "Altcoins keep falling, it's time to refocus on DeFi" published by the author in early July, Ethena was also mentioned. The view at that time was:

"... Ethena's business model (a public fund focusing on perpetual contract arbitrage) still has an obvious ceiling. The large-scale expansion of its stablecoin (the scale reached 3.6 billion US dollars at the time) is based on the premise that secondary market users are willing to take over its token ENA at a high price and provide high income subsidies for USDE. This slightly Ponzi-like design can easily lead to a negative spiral of business and coin prices when market sentiment is not good. The key point of Ethena's business turning point is that USDE can one day truly become a stablecoin with a large number of "natural coin holders", and its business model has also completed the transformation from a public arbitrage fund to a stablecoin operator."

After that, the price of ENA continued to fall. 60%, even if the price has nearly doubled from the low point, it is still 30%+ away from the price at that time.

The author re-evaluates Ethena at this time and will focus on the following 3 issues:

Current business level: Ethena's current core business indicators, including scale, revenue, comprehensive costs and actual profit levels

Future business outlook: Ethena's expected narrative and future development

Valuation level: Is ENA's current price in an undervalued strike zone?

This article is the author's interim thinking as of the time of publication. It may change in the future, and the views are highly subjective. There may also be errors in facts, data, and reasoning logic. Criticism and further discussion from peers and readers are welcome, but this article does not constitute any investment advice.

The following is the main text.

1. Business level: Ethena's current core business situation

1.1 Ethena's business model

Ethena positions its business as a synthetic dollar project with "native income", that is, its track belongs to the same track as MakerDAO (now SKY), Frax, crvUSD (Curve's stablecoin), and GHO (Aave's stablecoin) - stablecoin.

In my opinion, the business models of stablecoin projects in the current cryptocurrency circle are basically similar:

Raise funds, issue debt (stablecoins), and expand the balance sheet of the project

Use the raised funds for financial operations and obtain financial benefits

When the income obtained from the project's operating funds is higher than the combined cost of raising funds and running the project, the project is profitable.

Tether, the issuer of the centralized stablecoin project USDT, is an example. Tether raises US dollars from users, issues debt (USDT) certificates to users, and then uses the raised funds to invest in interest-bearing assets such as government bonds and commercial paper to obtain financial returns. Considering the wide range of uses of USDT, its value is the same as that of the US dollar in the minds of users, but it can do many things that traditional US dollars cannot do (such as instant cross-border transfers), so users are willing to provide US dollars to Tether for free in exchange for USDT, and when you want to redeem USDT from Tether, you also need to pay a certain redemption fee.

As a latecomer stablecoin project, Ethena is obviously at a disadvantage in terms of network effects and brand credit compared to old projects such as USDT and DAI. Specifically, its fundraising cost is higher, because only when there is a higher return expectation, users are willing to provide their assets to Ethena in exchange for USDE. Ethena's approach is to provide users with incentives for project tokens ENA and stablecoins (financial income from project operating funds) to raise funds.

1.2 Ethena's core business data

1.2.1 USDE issuance scale and distribution

Data source: https://app.ethena.fi/dashboards/solvency

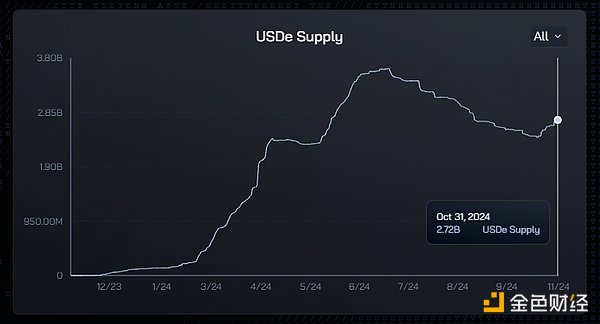

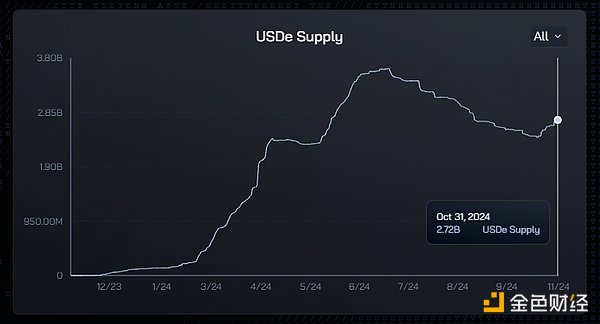

After the issuance scale of USDE hit a new high of 3.61 billion in early July 2024, its scale continued to decline to 2.41 billion in mid-October, and is currently gradually recovering. As of October 31, it was approximately 2.72 billion.

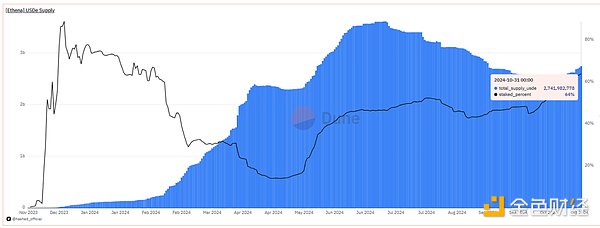

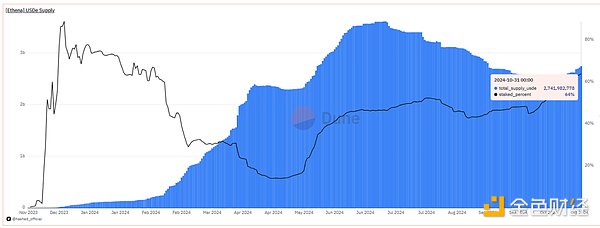

Of the more than 2.72 billion USDE, 64% is in pledge status, and the corresponding APY is currently 13% (official website data).

Data source: https://dune.com/queries/3456058/5807898

It can be seen that most users hold USDE for the purpose of obtaining financial management income. 13% is the "risk-free return" of USDE, and it is also the financial cost of Ethena to raise user funds.

During the same period, the yield on short-term U.S. Treasury bonds was 4.25% (data from October 24), the deposit rate of USDT on Aave, the largest Defi lending platform, was 3.9%, and that of USDC was 4.64%.

We can see that in order to expand its fundraising scale, Ethena still maintains a relatively high fundraising cost.

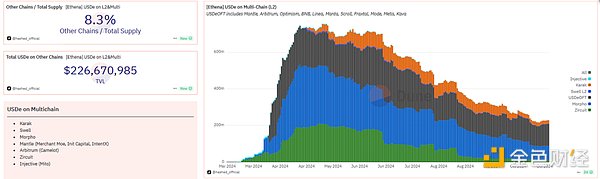

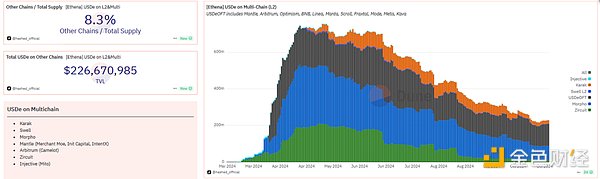

USDE is not only issued on the Ethereum mainnet, but also expanded on multiple L2 and L1. Currently, the scale of USDE issued on other chains is 226 million, accounting for about 8.3% of the total.

Data source: https://dune.com/hashed_official/ethena

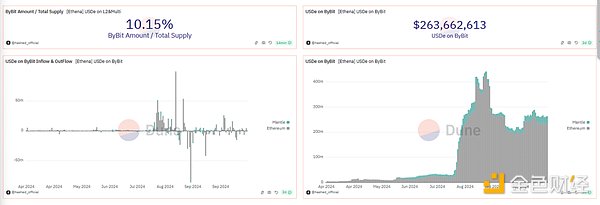

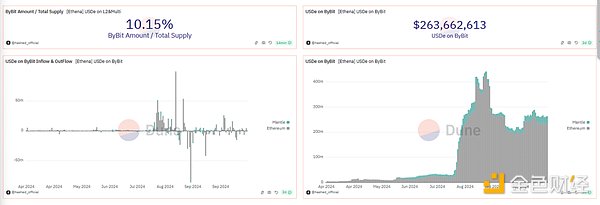

In addition, Bybit, as an investor and important cooperation platform of Ethena, not only supports USDE as margin for derivatives trading, but also provides a yield of up to 20% for USDE deposited in Bybit (reduced to a maximum of 10% in September). Therefore, Bybit is also one of the largest custodians of USDE, currently owning 263 million USDE (more than 400 million at its peak).

Data source: https://dune.com/hashed_official/ethena

1.2.2 Protocol income and underlying asset distribution

Ethena currently has three sources of protocol income:

Income from ETH pledged in the underlying assets;

Funding rate and basis income generated by derivative hedging arbitrage;

Financial management income: holding in the form of stablecoins, obtaining deposit interest or incentive subsidies, such as USDC In the form of Coinbase's loyalty program (Coinbase's cash subsidy for USDC, about 4.5% annualized) rewards; and Spark's sUSDS (formerly sDAI), etc.

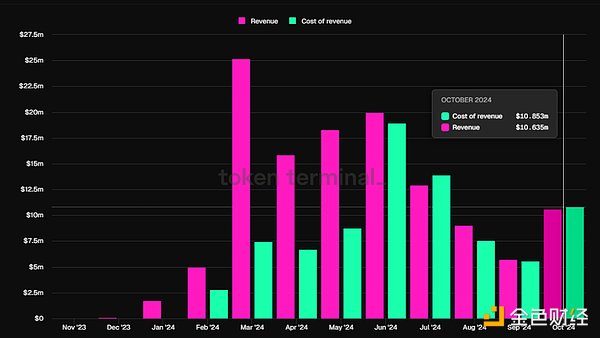

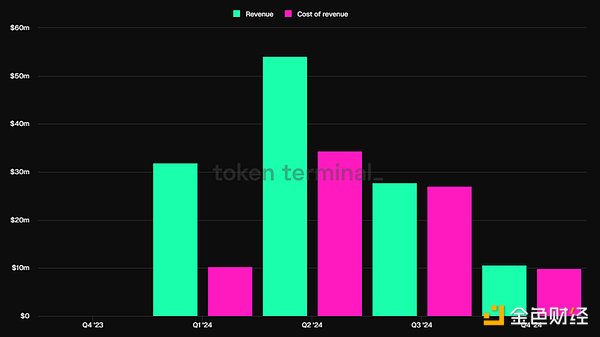

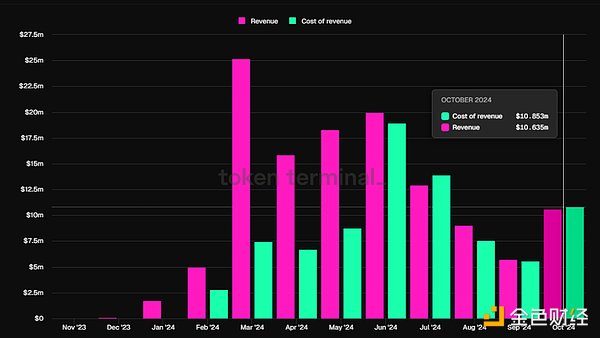

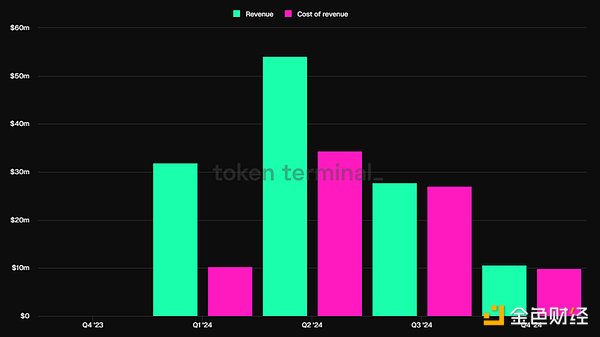

According to the data from Token Terminal approved by Ethena, Ethena's revenue in the past month has come out of the trough of last month. The protocol revenue in October was 10.63 million US dollars, a month-on-month increase of 84.5%.

Data source: Tokenterminal, Ethena protocol revenue and revenue allocated to USDE (cost of revenue)

Of the current protocol revenue, part is allocated to USDE pledgers, and part will enter the protocol's reserve fund to deal with expenditures when the funding rate is negative, as well as various risk events.

In the official document, it is said that "the amount of protocol revenue used for the reserve fund must be determined by governance." However, the author did not find any specific proposals on the reserve allocation ratio in the official forum, and the change in the specific ratio was only announced at the beginning in its official blog. The actual situation is that the distribution ratio and distribution logic of the Ethena protocol revenue have been adjusted many times after the launch. During the adjustment process, the official will initially listen to the opinions of the community, but the specific distribution plan is still determined by the official subjectively and has not gone through a formal governance process.

From the data of the Token terminal in the above figure, it can also be seen that the division ratio of Ethena's revenue between USDE stakers' revenue (the red column in the above figure, i.e., cost of revenue) and reserves has changed dramatically.

When the protocol revenue was high in the early stage of the project launch, most of the protocol revenue was allocated to the reserve fund, of which 86.7% of the protocol revenue in the week of March 11 was allocated to the reserve fund account. After entering April, as the price of ENA began to fall rapidly, the income of the ENA token side did not stimulate the demand for USDE enough. In order to stabilize the scale of USDE, the distribution of Ethena protocol revenue began to tilt towards USDE stakers, and most of the revenue was allocated to USDE stakers. Until the last two weeks, Ethena's weekly protocol revenue began to significantly exceed the expenditures allocated to USDE staking users (ENA token incentives are not considered here).

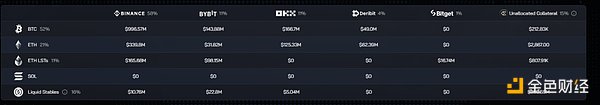

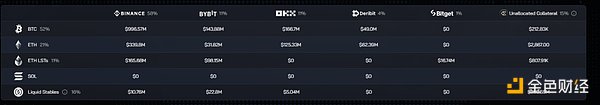

Ethena's underlying assets, data source: https://app.ethena.fi/dashboards/transparency

From the current underlying assets of Ethena, 52% are BTC arbitrage positions, 21% are ETH arbitrage positions, 11% are ETH pledged asset arbitrage positions, and the remaining 16% are stablecoins. Therefore, Ethena’s current main source of income is arbitrage positions mainly based on BTC. The ETH Staking income, which was once the focus, has a small contribution ratio to income due to its small proportion of assets.

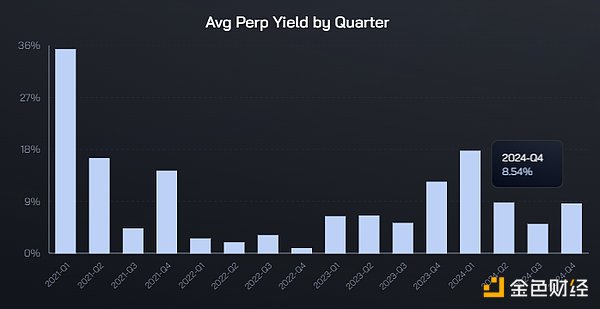

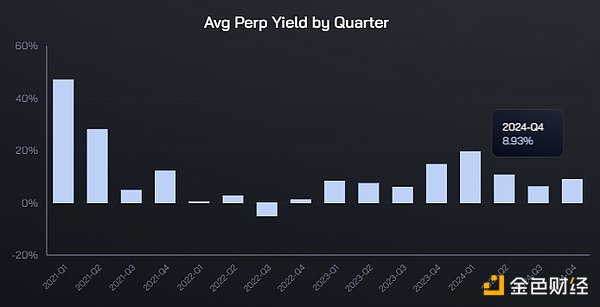

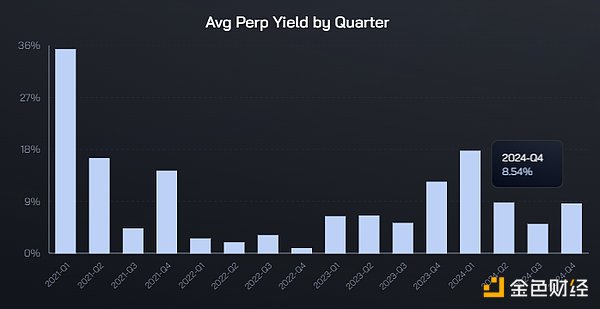

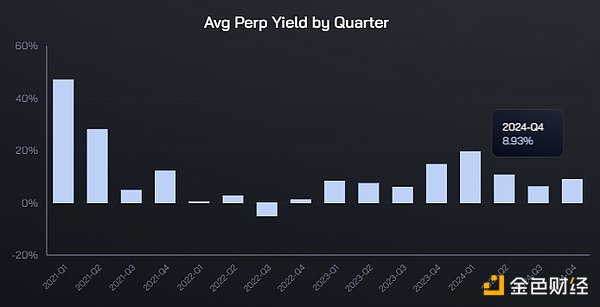

BTC and ETH perpetual contract arbitrage quarterly average yield, data source: https://app.ethena.fi/dashboards/hedging

From the average yield trend of BTC perpetual contract arbitrage, the average yield so far in the fourth quarter has broken away from the low range of the third quarter and returned to the position of the second quarter of this year. The average annualized yield so far this quarter is 8%+, but even in the sluggish market in the third quarter, the overall average annualized yield of BTC arbitrage is above 5%.

ETH's annualized perpetual contract arbitrage yield is similar to BTC, and has now returned to 8%+.

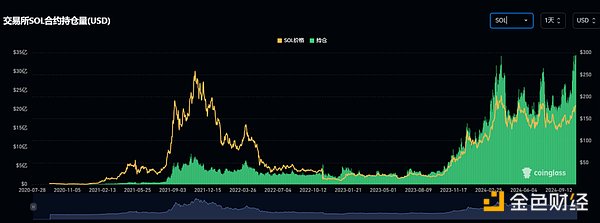

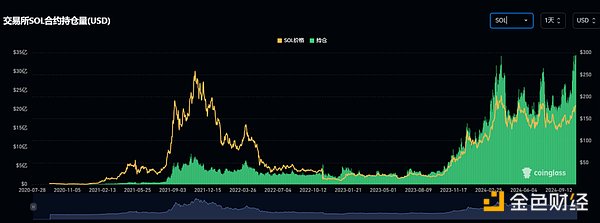

Let's take a look at the market contract size of Sol, which will soon be included in Ethena's underlying assets. Even though Sol's contract holdings have risen sharply this year as Sol's price has risen, and it has now reached 3.4 billion US dollars, it is still far from ETH's 14 billion US dollars and BTC's 43 billion US dollars (both excluding CME data).

SOL contract position trend, data source: Coinglass

As for Sol's funding fee, judging from Binance and Bybit, which have the largest positions, its annualized funding rate in recent days is similar to that of BTC and ETH. Its current annualized funding rate is around 11%.

Annualized funding rates of current mainstream currencies

Data source: https://www.coinglass.com/zh/FundingRate

In other words, even if Sol is subsequently included in Ethena's contract arbitrage targets, its current scale and yield have no obvious advantages over BTC and ETH, and it cannot bring much incremental income in the short term.

1.2.3 Ethena's protocol expenses and profit levels

Ethena's protocol expenses are divided into two categories:

Financial expenses, paid through USDE, the payment object is USDE's pledgers, and the source of income is Ethena's protocol income (derivatives arbitrage and ETH staking, as well as stablecoin financial management).

Marketing expenses, paid through ENA tokens, the payment object is users who participate in Ethena's various growth activities (Campaign). Such users obtain points by participating in activities (different stages of Campaigns have different points names, such as Shards at the beginning and Sats later), and after each quarter's activities, they exchange points for corresponding ENA token rewards.

Financial expenses are relatively easy to understand. For users who pledge USDE, they have clear profit expectations. The official has clearly marked the current USDE yield on the homepage:

The current yield on USDE staking is 13%, source: https://ethena.fi/

What is complicated is the continuous marketing campaigns that Ethena has launched since the project went online. They have different rules, plus the specific behavior of users that uses points to incentivize points, and the introduction of a weight mechanism, which involves the comprehensive calculation of activities on multiple cooperative platforms.

Let's take a brief look at a series of growth activities after Ethena went online:

1. Ethena Shard Campaign: Epoch 1-2 (Season1)

Time: 2024.2.19-4.1 (less than one and a half months)

Main incentive behavior: Provide stablecoin liquidity for USDE on Curve.

Secondary incentive behavior: minting USDE, holding sUSDE, depositing USDE and sUSDE in Pendle, and holding USDE on various cooperative L2s.

Scale growth: During this period, the scale of USDE grew from less than 300 million to 1.3 billion.

The amount of ENA spent, that is, the marketing expenses of the event: the total amount is 750 million, accounting for 5%. Among them, the ENA of the top 2,000 wallets can receive 50% immediately, and the remaining 50% will be distributed linearly in the remaining 6 months. There is no unlocking limit for other small wallets. According to the Dune dashboard created by @sankin, nearly 500 million ENAs have been claimed in June. Before June, the highest price of ENA was about 1.5$, the lowest was about 0.67$, and the average price was about 1$. After the beginning of June, ENA began to fall rapidly from 1$ to about 0.2$, with an average price of 0.6$. The remaining 250 million ENAs were basically claimed during this period.

We can make a very rough estimate that the corresponding value of 750 million ENAs = 5*1+2.5*0.6, which is about 650 million US dollars.

That is to say, the scale of USDE has increased by about 1 billion US dollars in less than 2 months, and the corresponding marketing expenses are as high as 650 million US dollars, which does not include the financial expenses paid for USDE.

Of course, as the first airdrop of ENA, this huge marketing expenditure at this stage is special.

2. Ethena Sats Campaign: Season2

Time: 2024.4.2-9.2 (5 months)

Main incentives: lock ENA, provide liquidity for USDE, use USDE as collateral for lending, deposit USDE in Pendle, deposit USDE in the Restaking protocol, and deposit USDE in Bybit.

Secondary incentives: lock USDE on the official platform, hold and use USDE on the cooperative L2, use sUSDE as collateral for lending, etc.

Scale growth: During this period, the scale of USDE increased from 1.3 billion to 2.8 billion

The amount of ENA spent, that is, the marketing expenses of the event: Like the first season, the rewards in the second season are also 5% of the total amount, that is, 750 million ENA (among which the 2,000 wallets with the largest airdrops also face 50% TGE and subsequent unlocking for up to 6 months). According to the current price of ENA of $0.35, the value of 750 million ENA is about 260 million US dollars.

3.Ethena Sats Campaign: Season3

Time: September 2, 2024 to March 23, 2025 (less than 7 months)

Main incentive behaviors: lock ENA, hold USDE in officially designated cooperation agreements (mainly DEX and lending), and deposit USDE in Pendle

Scale growth: As of now, despite the plan for the third season, the scale growth of USDE has encountered a bottleneck. The current scale of USDE is about 2.7 billion, which is a slight decrease from the 2.8 billion on the start date of the third season.

Amount of ENA spent: However, considering that the third season is nearly 7 months, which is longer than the second season, and the ENA reward incentive is likely to continue to decline, the total ENA incentive amount in the third season is likely to remain at 5% of the total, or 750 million.

At this point, we can roughly calculate the total expenditure of the Ethena protocol since its launch this year (October 31):

Financial expenditure (paid to USDE pledgers in the form of stablecoins): 81.647 million US dollars

Marketing expenses (paid to users participating in the event in the form of ENA tokens): 650 million + 260 million = 910 million US dollars (potential expenses after September are not calculated here)

Ethena Quarterly protocol revenue and financial expenditure trends, source: tokenterminal

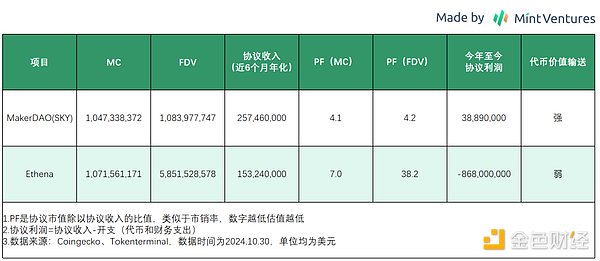

That is to say, unlike everyone's impression that "Ethena is very profitable", in fact, after deducting financial and marketing expenses, Ethena's revenue has a net loss of 868 million US dollars as of the end of October this year. The author has not yet considered the ENA token expenditure from September to October, so the actual loss amount may be higher than this value.

A net loss of 868 million is the price for USDE's market value to reach 2.7 billion US dollars in one year.

In fact, like many DeFis in the previous round, Ethena took the path of raising core business indicators and increasing protocol revenue through token subsidies. It’s just that Ethena adopted a unique points system for this round, delayed the issuance of tokens, and included more partners as participation channels, which made it difficult for participating users to intuitively evaluate the final financial returns of their participation in Ethena activities, which in a sense improved user stickiness.

2. Future business outlook: Ethena’s narrative and future development worth looking forward to

In the past two months, ENA has achieved a rebound of nearly 100% from its low point, and this was when ENA opened the rewards for Season2 in early October. These two months are also two months with intensive news and positive news for Ethena, such as:

October 28: On-chain options and perpetual contract project Derive (formerly Lyra) includes sUSDE as collateral

October 25: USDE is included as collateral for OTC transactions by Wintermute

October 17: Ethena initiated the "Integrate Ethena liquidity and hedging engine into Hyperliquid" proposal

October 14: The Ethena community initiated a proposal to include SOL in the underlying assets of USDE

September 30: Ethena The first project of the ecological network debuted, the derivatives exchange Ethereal, and promised to airdrop 15% of the tokens to ENA users. After that, Ethena Network announced that it would release more information about the product launch schedule and new ecosystem applications developed based on USDE in the next few weeks.

September 26: Plans to launch USTB-the so-called "new stablecoin launched in cooperation with BlackRock". In fact, USTB is a stablecoin with BUILD, an on-chain treasury token issued by BlackRock, as the underlying asset, and has limited direct relationship with BlackRock.

September 4: Cooperate with Etherfi and Eigenlayer to launch the first stablecoin AVS collateral asset-eUSD, which can be obtained by depositing USDE in etherfi. eUSD will be launched on September 25.

It can be said that in these two months, USDE and sUSDE There are still many more scenarios, although the demand for USDE may not be obvious. For example, the stablecoin AVS collateral asset eUSD launched in cooperation with Etherfi and Eigenlayer currently has a scale of only a few million.

In fact, what really drove this round of ENA price takeoff was the well-known trader and crypto KOL Eugene @0xENAS's article on October 12, which strongly called for Ethena: "Ethena: The Trillion Dollar Crypto Opportunity".

After the publication of this article, which was forwarded nearly 400 times, liked more than 1,800 times, and viewed more than 700,000 times, the price of ENA rose from $0.27 to $0.41 in 4 days, an increase of more than 50%.

In addition to reviewing some of Ethena's product features in the article, Eugene mainly emphasized 3 reasons. However, in my opinion, except for the first reason, the remaining 2 reasons are full of complaints:

1. The US interest rate cut has led to a decline in the global risk-free interest rate, making USDE's APY more attractive and obtaining more capital inflows

2. "Cooperation with BlackRock" The newly launched USTB stablecoin is an "absolute gamechanger" that will greatly increase the adoption of USDE, because when the market perpetual arbitrage return is negative, USDE can switch the underlying assets to USTB and obtain the risk-free return of treasury bonds

Complaints: USTB uses BUILD as the underlying asset, which does not mean that USTB is a stablecoin jointly launched by BlackRock and Ethena, just like Dai's underlying assets have a large amount of USDC, but Dai is not Circle and A stablecoin jointly launched by MakerDAO. In fact, if USDE wants to obtain treasury bond income during the period of negative perpetual income, it can directly close the position and configure Build or sDAI, or change it to USDC and store it in Coinbase to eat 4.5% annualized subsidies, without having to issue another USTB to hold. USTB is more like a gimmick product that takes advantage of BlackRock's traffic. Calling such a useless product "absolute gamechanger" can only make people doubt the author's cognitive level or writing motivation.

3. The emission rate of ENA will decrease in the future, and the selling pressure will decrease rapidly compared with the previous one.

Slot point: The actual Season2 reward still accounts for 5% of the total ENA, that is, 750 million token incentives will enter circulation in the next 6 months, which is not much less than the total incentive amount of the previous season. Moreover, ENA will usher in a huge amount of unlocking by the team and investors in March next year, and the inflation expectation of ENA in the next six months is not optimistic.

However, Ethena still has stories worth looking forward to in the next few months to a year.

First, with the expected warming of Trump's coming to power and the Republican victory (the results will be seen in a few days), the warming of the crypto market is conducive to the increase in the perpetual arbitrage yield and scale of BTC and ETH, increasing Ethena's protocol income;

Second, more projects will appear in the Ethena ecosystem after Ethereal, increasing ENA's airdrop income;

Third, the launch of Ethena's self-operated public chain can also bring attention and nominal scenarios such as staking to ENA, but the author expects that this will be launched after more projects have accumulated in the second line.

However, the most important thing for Ethena is that USDE can be accepted by more top CEXs as collateral and trading assets.

Among the top exchanges, Bybit has reached in-depth cooperation with Ethena.

Coinbase has its own USDC to operate, and as a US-based company, considering the complexity of supervision, the possibility of supporting USDE as collateral and stablecoin trading pairs is basically zero.

Among the two major CEXs, Binance and OKX, there is a possibility that OKX will include USDE in stablecoin trading pairs and contract collateral, because it has participated in two rounds of Ethena financing and has a certain consistency in financial interests. However, this possibility is not great, because this move will also bring OKX operating and endorsement risks related to Ethena; compared with OKX, Binance, which has only participated in one round of Ethena investment, is less likely to include USDE in stablecoin trading pairs and collateral, and Binance itself has its own stablecoin projects.

The belief that USDE will become a contract margin asset for major exchanges is also one of the reasons why Eugene is optimistic about Ethena in previous articles, but the author is not optimistic about this.

3. Valuation level: Is the current price of ENA in an undervalued strike zone?

We analyze ENA’s current valuation from two dimensions: qualitative analysis and quantitative comparison.

3.1 Qualitative Analysis

Events that are favorable to the price of ENA tokens and are likely to occur in the next few months include:

The increase in arbitrage returns brought about by the recovery of the crypto market is reflected in the improvement of the protocol revenue expectations, causing the price of ENA to rise and promoting the growth of USDE scale

Including SOL in the underlying assets can attract the attention of SOL ecosystem investors and project parties

The Ethena ecosystem may have more Ethereal-like projects in the next few months, bringing more airdrops to ENA

In the next wave of large amounts of ENA Before unlocking, the project party has the motivation to push up the coin price. One is to promote the upward spiral of business and coin price, and the other is to provide themselves with a higher shipping price.

In addition, judging from Ethena’s performance in more than half a year since its launch, the Ethena project team has very strong business capabilities. It can be said that it is the best among many stablecoin projects in terms of external cooperation expansion, and is more aggressive and efficient than the leading stablecoin project MakerDAO.

The factors that are currently unfavorable to the value of ENA tokens and suppress ENA prices include:

ENA lacks real money and silver income distribution, and is more of a floating pledge scenario (such as using AVS assets to ensure Ethena's multi-chain security) and self-mining

The actual profitability of the Ethena project is not good. In order to open up the market, the huge subsidies implemented have caused the project to suffer serious net losses. This part of the loss is actually borne by ENA token holders

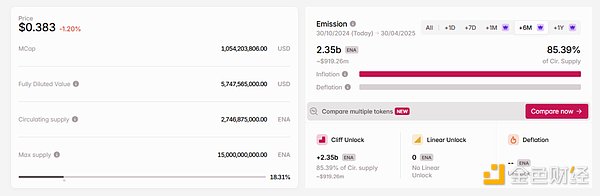

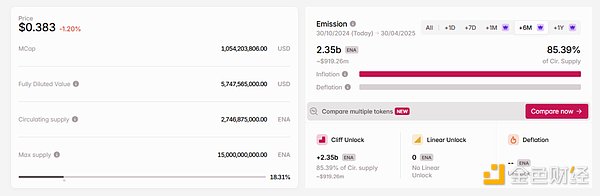

ENA will still face great inflationary pressure in the next six months. On the one hand, it comes from the expenditure of ENA tokens in marketing activities, and on the other hand, it will face the unlocking of the core team and investors after one year of expiration in late March next year. According to tokenomist data, ENA tokens face inflationary pressure of 85.4% of the current circulation in the next 6 months.

Data source: https://tokenomist.ai/

3.2 Quantitative comparison

Ethena's business model is actually no different from other stablecoin projects. Its innovation lies in the use of raised assets, that is, using the raised assets to make profits through perpetual contract arbitrage.

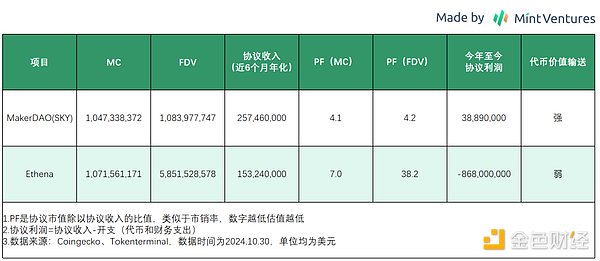

Therefore, we will use MakerDAO (now SKY), the stablecoin project with the largest current market value, as a valuation benchmark for comparison.

It can be seen that compared with the old protocol MakerDAO, Ethena's token ENA is not cost-effective in terms of protocol revenue or profit.

Summary

Although many people call Ethena a very representative innovation project in this round, its core business model is no different from other stablecoin projects. They all raise funds for financial operations and make profits, and strive to promote the use scenarios and acceptance of their own bonds (stablecoins) to reduce their own fundraising costs as much as possible.

From the current stage, Ethena, which is in the early stage of stablecoin promotion, is still in a huge loss stage, and is not a "very profitable project" as many KOLs say. Its valuation is not underestimated compared with the representative stablecoin project MakerDAO.

However, as a new player in this track, Ethena has demonstrated very strong business development capabilities and is more aggressive than other projects. Like many Defi projects in the previous cycle, rapid scale expansion and more project adoption will increase investors' and researchers' optimistic expectations for the project, thereby pushing up the price of the currency. The rising price of the currency will bring higher APY, further pushing up the scale of USDE, forming an upward spiral of the left foot stepping on the right foot.

Then, such projects will eventually face a critical point, and people will begin to realize that the growth of the project is driven by the subsidy of tokens, while the price increase of the additional tokens seems to be supported only by optimistic sentiment and lacks value hooks.

At this point, a game of running fast has begun.

In the end, only a few projects can be reborn from such a downward spiral. The last round of stablecoin star Luna (UST issuer) has been buried, Frax's business has shrunk significantly, and Fei has ceased operations.

As a product with an obvious Lindy effect (the longer it exists, the stronger its vitality), Ethena and its USDE still need more time to verify the stability of its product architecture and its ability to survive after the subsidy reduction.

Anais

Anais